Hi,

Welcome to our monthly report. April was another volatile month in financial markets. Our cautious approach continued, with higher than average cash holdings and hedging levels in all funds. So far, this has been the correct approach for 2022.

At times like these, when almost every asset class is falling in value, the best you can hope for as an investor is to mimimise your losses. In that respect, April was satisfactory for us, with one fund slightly up, one flat and one slightly down. Still, it gives us no pleasure to be treading water. The good news is that as markets continue to correct, we are starting to see a few opportunities we like.

If inflation is brought under control with fewer interest rate increases than expected, markets may be close to a bottom. On the other hand, persistent inflation may cause central banks to increase rates well above a neutral level, and equity markets could fall a lot further.

Our approach, as always, will be to buy more assets as they get cheaper but keep some dry powder available if markets become dislocated. We have added several new names to Fund portfolios in May as we see value emerging.

If you want to apply online or download application or withdrawal forms for all our funds, go to our website and click “Invest Now”.

The “things we found interesting” section includes job ads, an ARK, the first junk bond ever, and the word game taking the world by storm.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

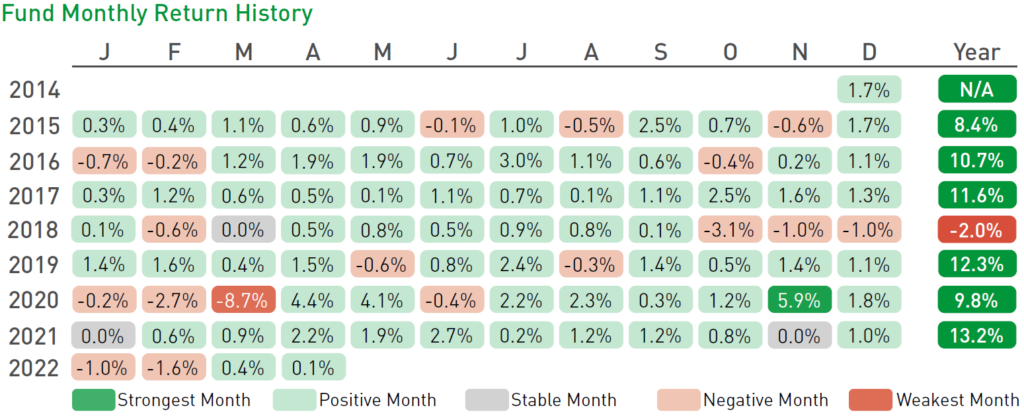

The Affluence Investment Fund returned 0.1% in April. Since commencing in 2014, returns have averaged 8.4% per annum, including distributions of 6.5% per annum.

At month end, 58% of the portfolio was invested in unlisted funds, 14% in the Affluence LIC Fund, 14% in listed investments, 2% in portfolio hedges and 14% in cash.

The cut-off for monthly applications and withdrawals is 25 May.

Affluence LIC Fund

The Affluence LIC Fund was flat in April. Since commencing in 2016, returns have averaged 12.9% per annum, including quarterly distributions of 7.4% per annum.

The average discount to NTA for the portfolio at the end of the month was 13%. The Fund held investments in 29 LICs (71% of the Fund), 5% in portfolio hedges and 24% in cash.

The cut-off for monthly applications (existing clients only) and withdrawals is 31 May.

Affluence Small Company Fund

The Fund returned -0.3% in April. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 9.8% per annum.

The Fund held 8 unlisted funds (53% of the portfolio), 7 LICs (16%) and 6 ASX listed Small Companies (16%). The balance 15% was cash.

Available to existing wholesale clients only. The cut-off for monthly applications and withdrawals is 25 May.

25+ talented fund managers in a single investment

The Affluence Investment Fund provides access to over 25 boutique fund managers in a single investment. These underlying managers all have several things in common. A lot of experience, an accomplished investment track record, and a specialised investment strategy. Plus, they all invest a significant portion of their own money in the strategies they manage.

In these volatile times, it’s good to have a wide variety of talented investment managers in your corner to help navigate market ups and downs. Many of these investment teams are relatively unknown. Quite a few are closed to new investors, or only available to wholesale clients. Almost all of them specifically cap the amount of money they manage, because they understand that one of the biggest barriers to exceptional performance is too much money.

Through the Affluence Investment Fund, you can access them all, plus more. With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

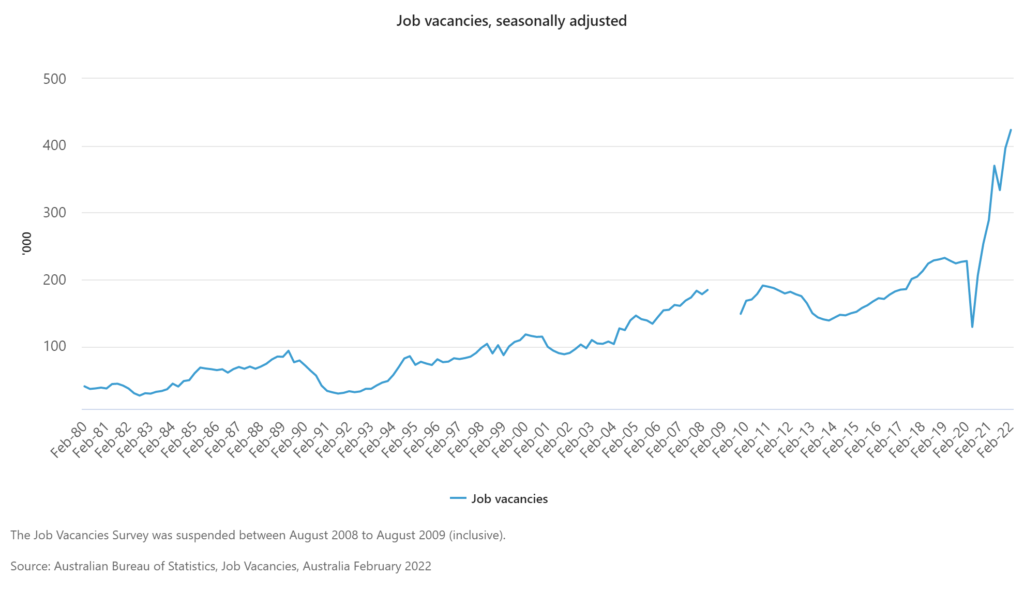

Here are the job vacancies in Australia since 1980. The number of jobs available is breaking all records.

The data only goes to February this year, because Australia has the slowest statistics department in the world. Also possibly the laziest, since it looks like they took a year off in 2008/09. But job ads data since then tells us that there are still plenty of jobs available. There are just under 600,000 unemployed in Australia, so there’s almost a job available for every single person that wants one. That’s never happened. It’s one reason why we think upward pressure will continue on wages. That’s good for employees, but potentially bad for companies.

Chart of the month 2.

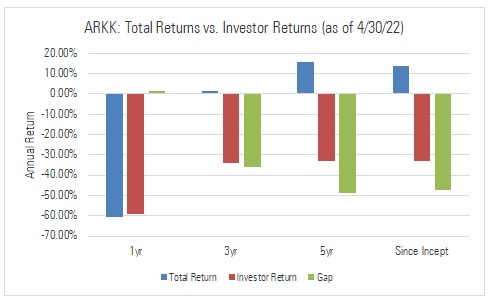

The US listed ARK Innovation ETF is a bellweather for what’s going on in markets right now. ARKK has returned an exceptionally good 13.6% since commencing in 2014. But it’s been a rough ride. The ETF has lost over 60% in the last 12 months, as the high growth innovators fund manager Cathie Wood favours have fallen heavily. But the chart below (apologies for the quality but it’s the best we could find) shows that the experience for the average ARKK investor has been very different to the Fund.

Morningstar analyst Jeffey Ptak has been tracking the performance of ARKK since it commenced, and comparing it to the return of the average ARKK investor. The differences are astounding. Even though ARKK has delivered 13.6%pa since commencing, the average investor dollar in ARKK has lost 33%pa.

How could that be? Well, it all comes down to timing. Much of the money in ARKK was invested after periods of exceptional outperformance. These investor dollars then suffered through the underperforming periods, including the last 12 months. Then investors panicked, and took their money out again. And it’s only gotten worse in May.

It’s why we would rather back a great fund manager after they’ve underperformed for a couple of years, than when they’ve had a fantastic run. By the way, we believe that almost none of the stocks currently held by ARKK could be considered cheap, which means the rough trot could continue.

Quote of the month.

“Since I started Third Point 27 years ago, I have seen many investors (including myself) stumble after years of success because they did not adapt their models and frameworks quickly enough as conditions shifted. I have said before that they don’t ring a bell when the rules of the game are changing, but if you listen closely, you can hear a dog whistle. This seems to be such a time to listen for that high-pitched sound.”

US hedge fund manager Dan Loeb, explaining that in financial markets, everything has changed. We agree. What worked best from 2010 to 2021 is unlikely to do so for the next few years at least. The rules of the investment game have changed.

This day in (financial) history.

In May 1568, one of the earliest known junk bonds was issued. The Russia Co. borrowed 4,000 pounds, 8 shillings, and 10 pence from the British exchequer. The interest rate was 13.5%. The company had a monopoly on trade between England and Muscovy (the precursor of Russia). The company repaid the loan not with cash, but with hundreds of tons of cables and rope. No word on what the British exchequer did with it.

Vaguely interesting facts.

- The clothes of a fully-dressed 20th century man had 78 buttons and 24 pockets.

- A butt is a real unit of measurement, for a cask of wine. To be exact, a buttload is about 108 gallons.

- During World War II, the United States began rationing shoes. Citizens were allowed three. What the…

- Nostrils take turns receiving the majority of the air you breathe, which explains why one is usually stuffier than the other.

- The most common last name in each of the US, Canada, UK, Australia and New Zealand is the same. Can you guess what it is? (see below *)

Source: mentalfloss.com

And finally…game of the month.

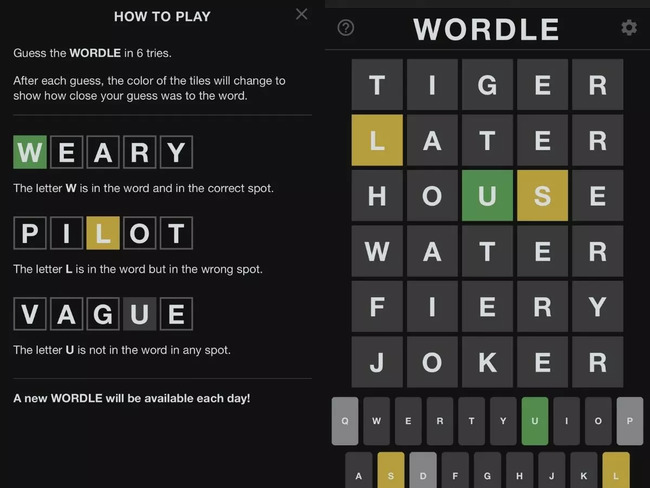

“And so selling…was a way for me to walk away from that. I didn’t want to be paying a lawyer to issue cease and desists on the game that I’m not making money from. It felt like it was all going to get really, really complicated in a way that just [made me] pretty stressed out, truthfully.”Josh WardleWho is Josh Wardle? Well, he invented Wordle. The game has taken the world by storm. If you haven’t tried it, it’s addictive.

You can play it here. The game has a single daily solution, with all players attempting to guess the same word. So if you’ve already solved today’s puzzle, don’t spoil it for your friends.

The game was developed by Josh, who is a Welsh software engineer, with help from his partner, Patak. Josh initially created the game for himself and his family to play, only making it public in October 2021. It went viral by December 2021 and the game was purchased by the New York Times in January 2022. The quote above explains why. The price has not been disclosed, but Wardle has confirmed it was at least $1 million

The game is nearly identical to the 1955 pen and paper game, Jotto. There’s now a bunch of spinoffs including versions for fans of Star Wars, Taylor Swift, Maths and Disney. This article has links to a bunch of them.

* The most common surname in each of the US, Canada, UK, Australia and New Zealand is Smith. Also, bonus content, in Ireland it’s Murphy. More here.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.