Hi ,Welcome to our monthly update. Despite Australia and most global stock markets falling last month, all our funds delivered positive returns. Links to the monthly fund reports are below. We’ve also provided a link to our recent guest appearance on the Rules of Investing podcast, which generated a lot of interest and positive feedback.For existing investors, we have now completed the change of registry and you should have received your latest distribution statement from Registry Direct, as well as an invitation to register. This change does not have any impact on the investment strategies or operation of our funds. We did it because we believe it will help improve the service level and make it simpler and easier to deal with your Affluence investment. From now on, you can direct all your enquiries and correspondence directly to us. You can contact us by replying to any email we send you. You can also contact us by: Email: invest@affluence3.wpengine.com Phone: 1300 233 583 or 07 3532 4076 during business hours Fax: 07 3054 7082 Post: GPO Box 112, Brisbane QLD 4001 One of the key benefits of the change is that you can view and manage your holdings via the Registry Direct secure online Investor Portal if you wish. The Portal allows you to update and manage your investment details, view performance, unit balances and transaction history and access statements. This reduces the need for paper forms. Should you wish to use paper forms, these have been updated and you can access these via our website.If you’d like to invest with us this month, applications for the Affluence Investment Fund close on Monday 25 October. Investments will be effective 1 November, with confirmations emailed about a week after that. As always, go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds.Read on to discover some other things we found interesting this month, including options trades, a talented hamster, signs of speculation and the annual wildlife comedy awards.If you have any questions or just want to give us some feedback, reply to this email or give us a call.Regards, and thanks for reading.Daryl, Greg and the Affluence Team.

Affluence Fund Reports

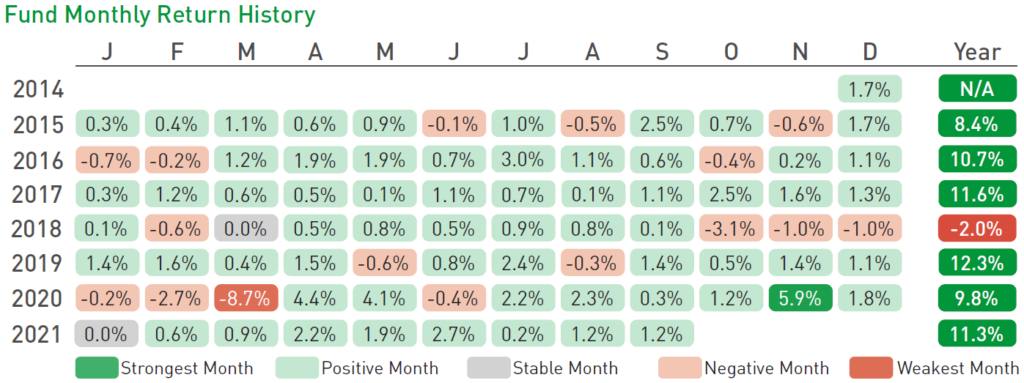

Affluence Investment FundThe Affluence Investment Fund returned 1.2% in September. Since commencing in 2014, returns have averaged 9.3% per annum, including distributions of 6.8% per annum. At month end, 65% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 7% in cash. September 2021 Fund Report

Affluence LIC FundThe Affluence LIC Fund returned 2.4% in September. Since commencing in 2016, returns have averaged 14.2% per annum, including quarterly distributions of 7.7% per annum. The average discount to NTA for the portfolio at the end of the month was 13%. The Fund held investments in 29 LICs (75% of the Fund), 5% in portfolio hedges and 20% in cash. September 2021 Fund Report

The Rules of InvestingIn this episode of The Livewire Rules of Investing podcast, Patrick Poke interviewed Daryl. We took a deep dive into the world of LICs. We covered the basics including some common jargon, how to pick a great LIC and some pitfalls.We also talked about why we started Affluence, what first piqued our interest in LICs and shared some of our favourite LICs in the market today. Access the Podcast and Transcript

Affluence Small Company FundThe Small Company Fund returned 2.7% in September. Since commencing in 2016, returns have averaged 10.9% per annum, including quarterly distributions of 6.9% per annum. The Fund holds a range of small cap exposures with a distinct value focus. At 30 September, the Fund held six unlisted funds (42% of the portfolio), five LICs (15%) and seven ASX listed Small Companies (15%). The balance 28% was cash and hedges. September 2021 Fund Report

Exclusive access to 25+ talented fund managers

Around 40% of the Affluence Investment Fund portfolio is invested in underlying funds that are closed to new investors. This means the Fund provides access to a manager set that is simply impossible to replicate. A further 23% of the portfolio is allocated to funds that are only available to wholesale investors.With monthly distributions, a focus on investing differently and fees based totally on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio. Learn more about the Fund

Things we found interesting

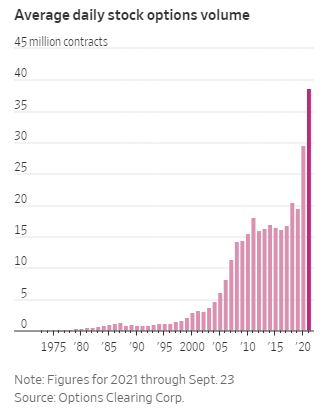

Chart of the month.

Ever since the pandemic hit, the volume of options traded on global exchanges, much of it by ordinary investors, has increased dramatically. It is a strategy that has worked well in a market that always goes up. In fact, because of the way options work, it has probably been one of the reasons markets have continued to go up.

Just add it to the list of speculative forces driving global markets, the US in particular.

Quote of the month.

“October. This is one of the particularly dangerous months to speculate in stocks in. The others are July, January, September, April, November, May, March, June, December, August and February.”

Mark Twain. Poor old Mark lost money in the 1800’s on an engraving process, on a magnetic telegraph, on a steam pulley, on the Fredonia Watch Company and on railroad stocks. He also turned down the chance to buy into Bell Telephone, even though he had one of the nation’s first residential phones.

Sign of the Times.

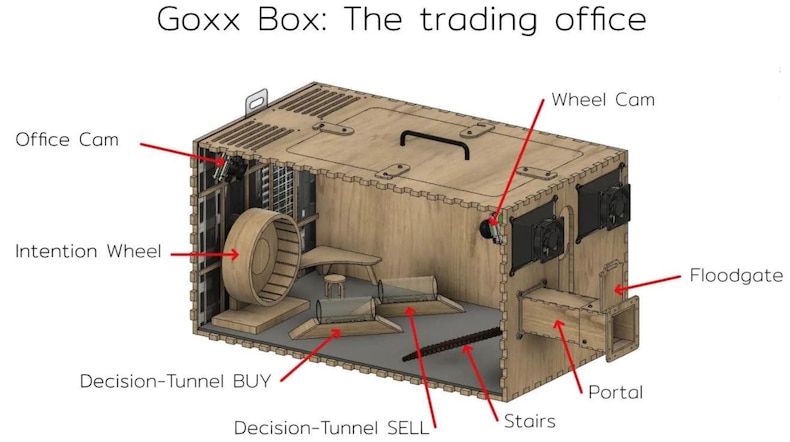

This is the Goxx Box.

What is a Goxx Box? Glad you asked. It sounds like a Dr Seuss book, but it is in fact the home office of Mr Goxx. Mr Goxx is a German hamster that trades in cryptocurrencies. Mr. Goxx has been trading crypto since June, so he’s a professional now.

Mr. Goxx’s caretaker/ business partner built the Goxx Box as an attachment to its larger home. The box allows Mr Goxx to perform various exercises that then execute specific cryptocurrency trades. First, Goxx runs on the “intention wheel” to pick which one of about 30 cryptocurrencies to trade. Then he runs through one of two “decision tunnels” that trigger either a buy or sell trade of the chosen currency. The trades are then executed automatically.

The hamster can apparently enter its office whenever it wants to make trades. Mr. Goxx’s unidentified caretaker provided 390 Euros in initial capital, but there is no word on the profit sharing arrangements between the two. When we last looked, he was up 19% since June. That’s better than us! It’s also better than Warren Buffett, Cathie Wood, and the ASX 200. But for reasons that should be obvious, we don’t recommend outsourcing your investment management to a hamster.You can watch Mr Goxx in action here.

Sign of the Times 2, 3 and 4.

The Australian Financial Review recently reported on a survey of Selfwealth clients. Just 7 per cent said they use a professional financial adviser. A resounding 44 per cent base their decisions off gut feel. What could possibly go wrong with that.

And in other news, Banksy’s self destructing painting has just sold for the second time. The piece, “Love is in the Bin,” originally sold at auction in 2018 for about $1.4 million at Sotheby’s London in a viral stunt. The bottom half of the canvas of “Girl With Balloon,” began to shred as soon as the gavel hit, sealing the original sale. And would you care to take a guess at the sale price this time? Around $25m, or roughly 18x what it initially sold for, before it was half-shredded.

Finally, there are reportedly now enough empty apartments in China to house 90 million people. That’s more than 3x the population of Australia. More importantly, it’s around 6.5% of the population of China.

This month in (financial) history.

“This is the longest period of practically uninterrupted rise in security prices in our history. The rise was more rapid than has ever been seen, and its speculative attraction influenced a larger part of the public than ever before. The psychological illusion upon which it was based, though not essentially new, has been stronger and more widespread than has ever been the case in this country in the past.

This illusion is summed up in the phrase ‘the new era’. The phrase itself is not new. Every period of speculation rediscovers it. During every preceding period of stock speculation and subsequent collapse business conditions have been discussed in the same unrealistic fashion as in recent years. There has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have been changed, that old economic principles have been abrogated, that the country has entered upon a period of unprecedentedly easy and rapid expansion, that all economic problems have been solved, that industry has suddenly become more efficient than it ever was before, that prosperity has become universal, that production and trade have been growing at an exceptionally high and permanently accelerating rate, that business profits are destined to grow faster and without limit, and that the expansion of credit can have no end.”

Taken from The Business Week, November 2, 1929.

Media & Presentations.

Last month, we spoke with Livewire (again) about how to use LICs for income and three we liked. You can read all about it here.

And finally…

Around this time every year, we get to see the annual wildlife comedy awards finalists. You can view them all here. Enjoy.

Got a question?

If you would like to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluence3.wpengine.com | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.