Year Highlights

Firstly, a massive thank you to all of you who trusted us with your hard-earned capital during the year. It is a responsibility that we never take for granted.

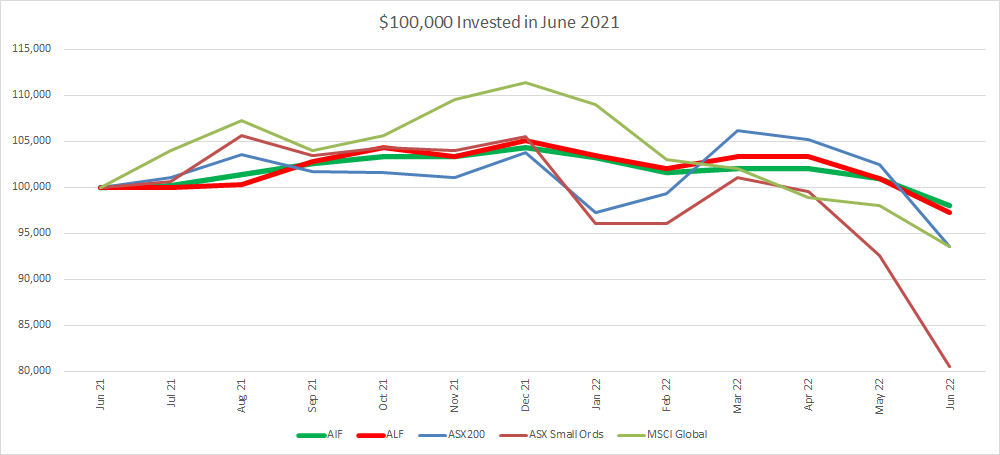

Financial year 2022 (FY22) was a tale of two halves. The 6 months to 31 December 2021 was a continuation of the previous buoyant market behaviour. Investors were happy to use effectively free money to push up the prices of virtually all asset classes. The second half of the year was when investors started to realise that inflation wasn’t “transitory” as had been assumed, but it was in fact becoming very entrenched. This led to global central banks starting the normalisation of interest rates and the withdrawal of monetary support, leading to a global selloff in assets.

The light blue line above is the ASX200 Index (Australian equity market), which shows the selloff towards the end of the year. The light red line is the ASX Small Ords Index. The light green line is the MSCI Global Index (global stocks, in AUD). As you can see, both our funds outperformed the major indices over the turbulent year.

It’s worth remembering that for all our strategies, our focus is always on three things:

- Delivering better than average returns over three years and longer.

- Limiting the impact of market corrections and thus avoiding significant long term capital losses.

- Providing a decent level of regular income, with the option to reinvest and compound returns.

Measuring performance in the midst of a market downturn is never pleasant. Our returns for both funds relative to the major benchmarks are reasonable, and superior to our peer group. But it gives us no great pleasure to deliver a negative return, no matter how bad markets have been.

What is important, however, is that if we can substantially outperform asset markets when they suffer their biggest drawdowns, that gives us a great chance of producing better than average returns over the long run.

Market Overview

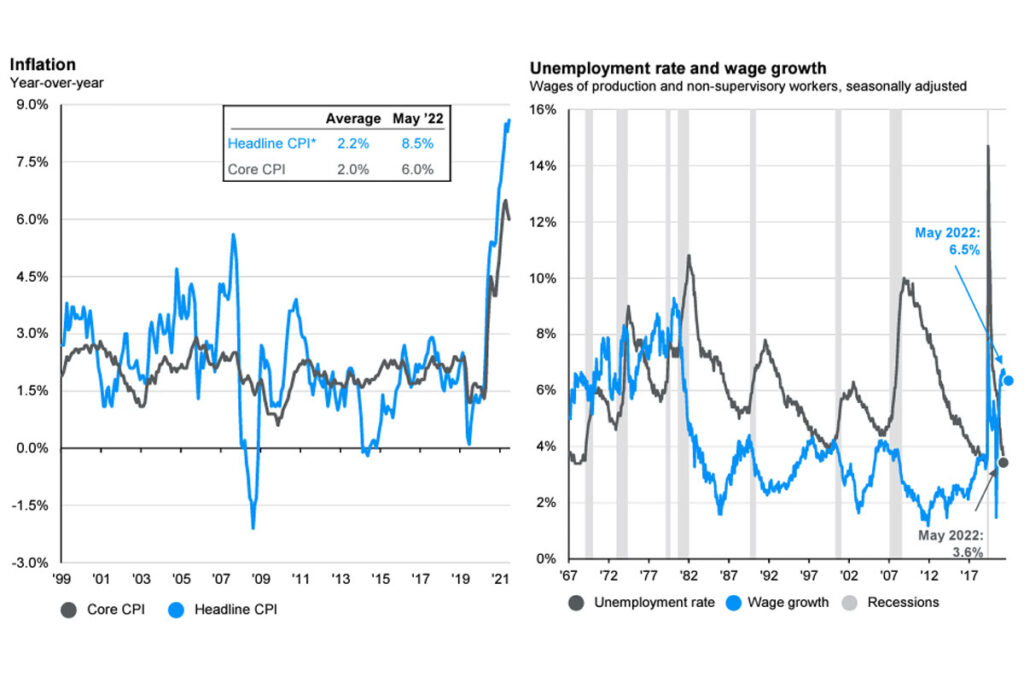

The following chart shows the dramatic increase in US inflation. This has occurred due to ongoing stimulus pumped into the economy since the covid pandemic, near zero interest rates and ongoing monetary policy support, supply shortages across a vast swathe of the economy, and finally the war in Ukraine. This has led to extremely low unemployment rates and high wage growth, all further entrenching the inflationary cycle.

The typical cure for high and increasing inflation is for central banks to increase interest rates. Most developed nations are well on their way to normalising interest rates. This has two negative influences on asset prices. Firstly, higher interest rates lead to a decrease in the multiple of income to determine asset prices. And secondly, higher interest rates should lower demand for products and services, thus decreasing the earnings a company or asset produces. This is why asset prices have been falling over the past 6 months.

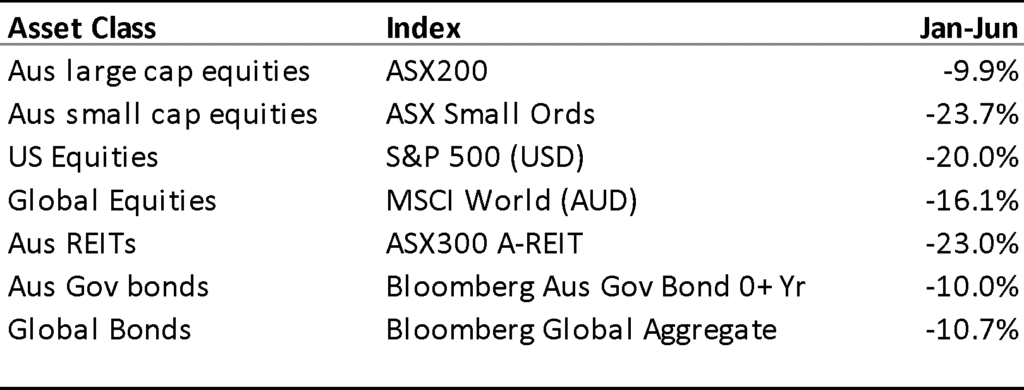

We will be concentrating on the second half events, as this is what will be most topical for most investors. The following table summarises the January to June 2022 returns for a range of asset classes and indices.

What stands out above is how well Australian equities have performed over the last 6 months. The ASX200 Index includes the 200 largest and most liquid companies in Australia. It has performed exceptionally well, falling only 9.9% over the past 6 months. The ASX Small Ords Index is the main index to track the performance of smaller companies. It has faired much worse, falling almost 24% and has seen much more indiscriminate selling regardless of company fundamentals. Global indices have fallen heavily as well, with the tech heavy NASDAQ index (not shown above), falling around 30% to June 2022.

What has been just as concerning to investors is that high grade investment and government bonds have plummeted at the same time as equities (due to rising interest rates). Therefore, even for those investors who may have thought they were relatively conservatively positioned, the falls have been quite substantial.

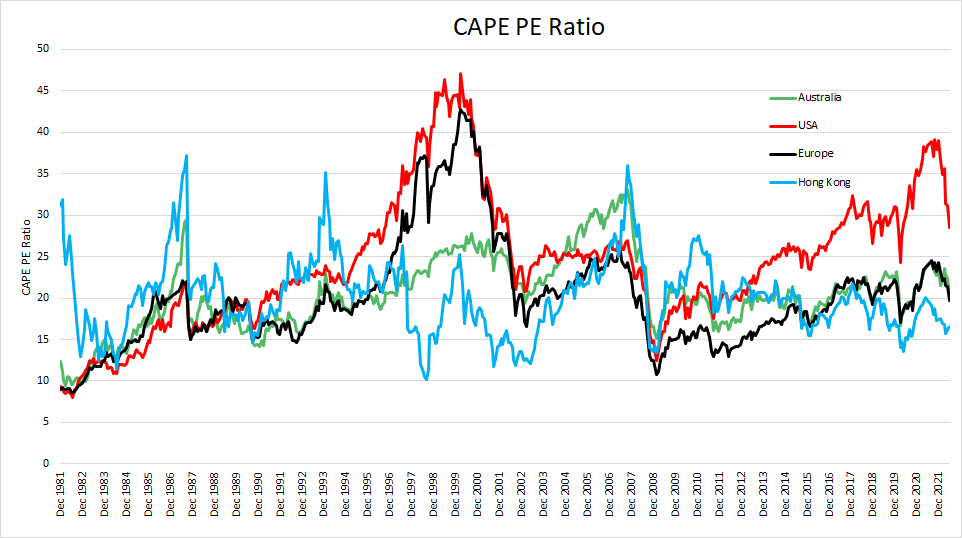

Global markets started 2022 at extreme valuations. On some metrics, US equity valuations were near or at all time highs. One reasonable guide to market valuations that we pay attention to, is the Cape Shiller 10 year PE ratio. This differs from a standard PE ratio, in that it uses the average of the previous 10 years earnings adjusted for inflation. This is intended to normalise for abnormally high or low earnings through market cycles. We believe this is particularly relevant at the moment. as US market profit margins are at all time highs, and likely are not sustainable.

The graph below shows the CAPE PE ratio since 1981 for Australia, the US, Europe and Hong Kong.

Current Market Valuations

At a high level, we would summarise financial conditions as follows.

- Australian equities are around fair value (not expensive and not cheap).

- There are pockets within the Australian market that we believe are very attractive, including small cap equities and some resource sectors.

- US equities are still well above fair value.

- Most other global markets are somewhere between somewhat attractive and fair value. A few look cheap, though certainly not without risk. Examples include the UK and some Asian emerging markets.

- Residential property prices in Australia are falling, led by Sydney and Melbourne. The extent of falls will be dependent on future interest rate rises.

- Commercial property transaction volumes (office buildings, shopping centres and industrial sheds) have reduced dramatically. This is often the first stage before prices fall. Sellers don’t want to be the first to sell at lower prices and buyers get cold feet and decide to wait a bit longer before jumping in.

- Bank term deposit rates have increased dramatically, particularly for longer terms. Some five year term deposit rates are now above 4% per annum.

We have no special insight into what happens from here. The bottom may be near, or there may be further to fall. In either case, it will probably not happen in a straight line.

The maths of investing can be incredibly simple. One of the investment rules that has held over the long term is the higher the price you purchase an asset for today, the lower the future returns will be. Therefore, it makes sense that investing a dollar today is a more attractive option than investing back in December 2021, before the market falls.

Our process, as always, is to increase our market exposure as values fall and reduce market exposure as values increase. While it can be uncomfortable to invest more as values fall, the reality is that true bargains usually only appear when uncertainty is high and investing in that environment usually is uncomfortable. No one knows when markets have reached the bottom, except in hindsight. To us, investing surplus cash cautiously as markets fall, seems logical.

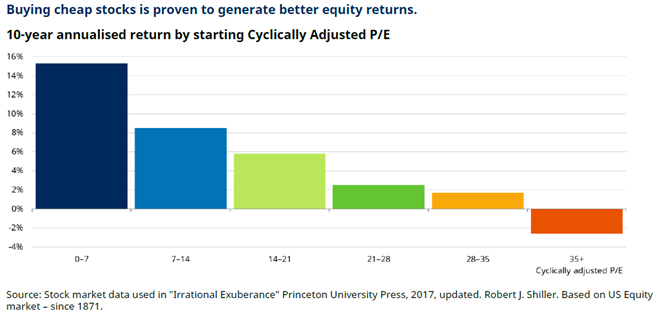

We included the following graph from Schroders in our investor letter last year, and it’s worth reiterating. It is a good reminder of why the price you pay matters over the longer term.

The graph shows the average 10 year total returns from different starting valuations since 1871. The cheaper the starting CAPE, the higher the next ten years returns.

So rather than seeing falling values as just a bad thing, realise that falling prices provide investors the opportunity to increase their future returns.

Which Fund is right for you?

We are often asked by new investors which of our funds they should invest in. We’re not allowed to give personal investment advice, so it’s a question we can’t answer directly. Instead, we prefer to deal with this issue by highlighting the expected return and risk profiles for each of our funds. It’s then up to you to decide (along with your advisor if you have one) where you allocate your investment capital. This is likely to be heavily influenced by your return expectations and your risk tolerance.

The Affluence Investment Fund targets a return of inflation plus 5%. Of course, we’ve managed to do a bit better than this so far, but nothing is ever guaranteed. In addition, this Fund aims to pay monthly distributions and perform much better than stock markets, particularly the ASX200, when markets fall. In both risk and returns, this Fund sits somewhere well above cash and bonds but below equity markets.

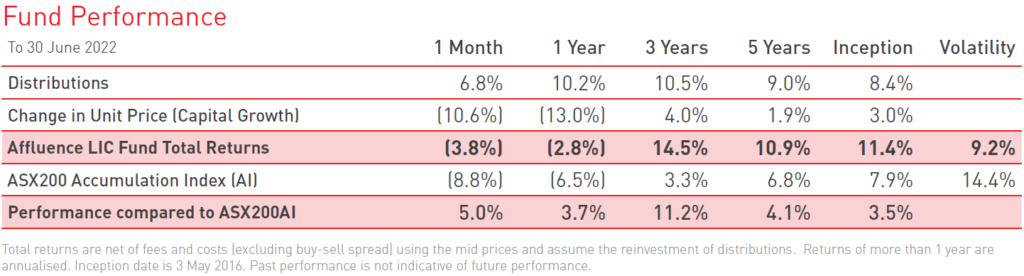

The Affluence LIC Fund targets equity-like returns. We aim to beat the ASX200 Accumulation Index returns with less volatility. And while we have done that to date, you should assess the LIC Fund as having a similar risk/reward profile to an equity fund.

Finally, our Affluence Small Company Fund targets the potentially higher returns available from smaller companies. It has the highest potential returns, and the highest risk, of all our funds. Currently, this fund is only available to wholesale and sophisticated investors, though we hope to be able to change that in time. If you’d like to learn more about this fund, or to register your interest should it be available to all investors in the future, contact us and let us know.

In assessing our Funds, it also helps to look at the current investment portfolio and the performance history. Below, we look at the FY22 performance and current positioning for the Affluence Investment Fund and Affluence LIC Fund. Because the Affluence LIC Fund generally represents 15-20% of the Affluence Investment portfolio, we encourage Investment Fund unitholders to read both sections.

Affluence LIC Fund

FY22 Review

The Affluence LIC Fund has continued to outperform its benchmark (ASX200 Index) over all periods, with significantly lower volatility.

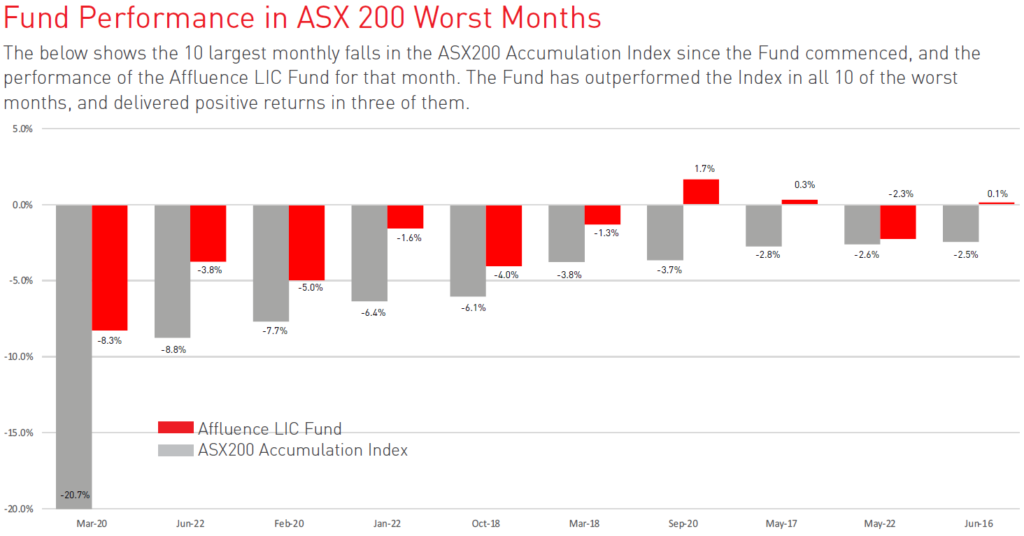

During the past six months there were two months that were some of the biggest falls for the benchmark since the Fund began. Pleasingly, we managed to limit the falls during these months.

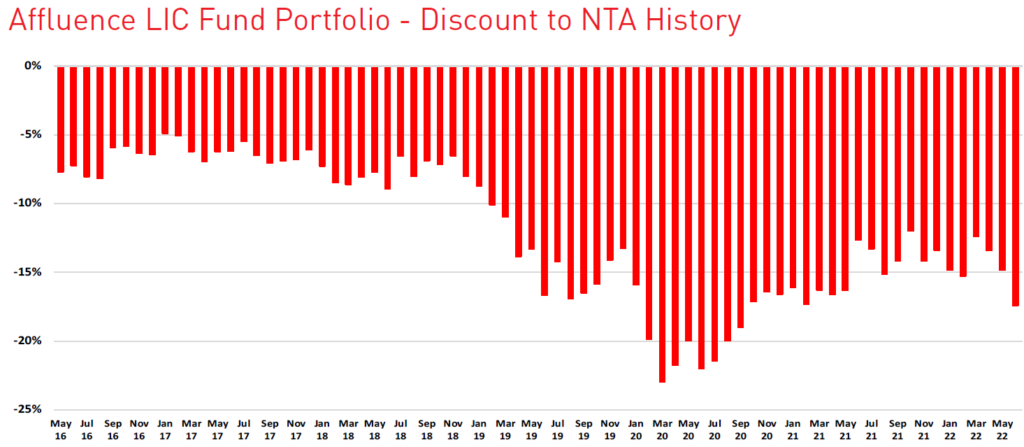

After starting to normalise post March 2020, discounts to NTA have increased back to well above average. This gives us confidence that there is still further value on offer from our discount capture strategy.

Current Positioning

The Fund entered 2022 with almost 25% cash and high levels of hedging. We started the year very uncomfortable about equity valuations. Fast forward to the end of June 2022 and we have spent a considerable amount, to reduce our cash level to 9.7%. We have sold all our ASX 200 Index hedges and now only hold some hedges against the S&P500 to reduce our exposure on our global LICs.

The portfolio has changed quite substantially since 31 December 2022. Significant additions include:

Australian Equity Performance Fund (AEG). Market neutral fund. Proposed transaction with WAM Leaders (WLE) which if it completes should see the Fund receive value greater than NTA.

Ellerston Asian Investments (EAI). Has fallen more than 30% below its highs on the back of falling Asian markets and discount expansion. We have accumulated a large position as we believe there is reasonable value in the underlying portfolio, and the manager stated in their last annual report that if they could not eliminate the discount to NTA they would change the capital structure.

Debt LITs. We have not held any of the debt LITs since the Covid induced sell off and recovery in 2020. Over the past couple of months these LITs have sold off as much as equity LICs. While prices have somewhat recovered, there were some excellent opportunities in June to purchase debt LITs at 10-20% discounts to NTA. In some cases, the NTA was also at a discounts to the repayment value fot he underlying loans. At 30 June we held almost 6% of the portfolio in debt LITs.

Fallen angels. As markets fell, we took the opportunity to add a number of LICs to the portfolio that previously traded at significant premiums to NTA. These included Hearts & Minds (HM1), Touch Ventures (TVL), WAM Strategic (WAR) and Ophir High Conviction Fund (OPH). OPH was subsequently sold for a profit.

The average discount to NTA at 30 June 2022 was approximately 17%, which we believe to be quite attractive. There are a number of holdings that are likely to be forced to undertake corporate restructures to eliminate the discount to NTA over the next couple of years. Whatever happens with markets over this period, we believe we can add significant value through our discount capture strategy.

LIC Fund Reopened

We closed the Affluence LIC Fund to new investors in June 2021, due to limited opportunities to deploy capital. Given the recent market falls and increase in discounts to NTA, we have reopened the Fund to new investors. We are seeing additional opportunities at present, and we will continue to accept applications from new investors for as long as we believe we can continue to purchase LICs at sensible prices.

Affluence Investment Fund

FY22 Review

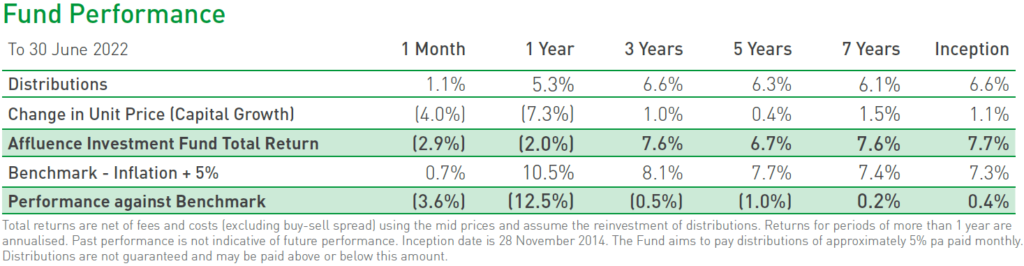

The Affluence Investment Fund underperformed its real return target (inflation plus 5% per annum) in FY22 and is also behind over 3 and 5 years.

We did not make it easy for ourselves in adopting an inflation-based benchmark. The June 2022 inflation numbers have not yet been released, however the 12 month inflation rate to 31 March 2022 was 5.1%. The Reserve Bank of Australia has forecast that they expect inflation to reach 7% per annum by the December quarter. If this proves correct (and its entirely possible it may be even higher) than our return benchmark will continue to increase.

Our long term return of 7.7% remains adequate, however it has obviously been largely affected by the last 6 months market ructions. Perhaps surprisingly, the Fund has also achieved better returns than the ASX200 since commencing.

As at June 2022, the Fund continues to hold a 5 star rating from Morningstar. In addition, it was the highest returning fund in its Morningstar Category (Multisector – Flexible) over 3 and 5 years.

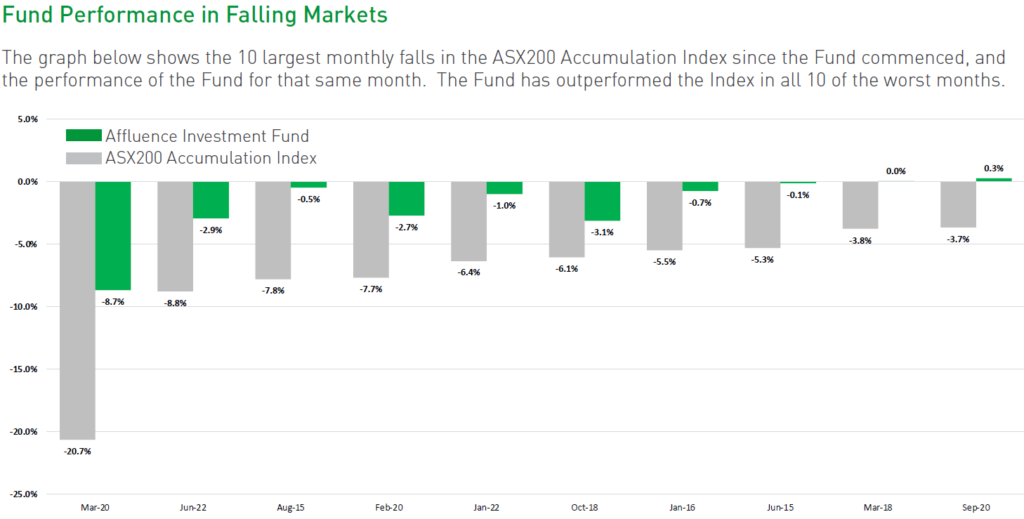

The other factor we consider alongside our long term returns is the risk realised in achieving those returns. More particularly, how the Fund has performed at times when the ASX has fallen. As with the LIC Fund, we can see that a lot of the outperformance has come in times of market turmoil.

We believe that if we can substantially outperform asset markets when they suffer their biggest drawdowns, that gives us a great chance of producing better than average returns over the long run.

Current Positioning

The reason we started the Affluence Investment Fund was to bring together two key ideas:

- Invest with exceptional asset managers across all asset classes.

- Ensure portfolio diversification by asset class, strategy, and investment manager.

These two principles have been the cornerstone of the Affluence Investment Fund since its commencement in 2014. At 30 June 2022, the Fund was invested in over 30 unlisted funds, in addition to a range of listed investments. We are constantly surprised by how many fantastic asset managers are available in Australia once you look beneath the surface of the dominant large (and mostly underperforming) asset managers. Each of our managers does something different to others. And we continue to believe each can produce better than average risk adjusted returns over a complete market cycle.

Having been running for over 7 years, the Fund now has an additional feature that sets it apart from other similar funds. Almost 40% of the underlying investments are closed to new investors or are only available to wholesale investors.

As with all our strategies, we focus heavily on trying to ensure the portfolio can withstand large market corrections adequately. We use four main tools to help us achieve this:

- Predominantly choosing managers who are less volatile than the market and who have a good chance of outperforming in market drawdowns.

- Portfolio diversification by asset class, investment strategy and investment style.

- The ability to carry variable cash, depending on market valuations and opportunities.

- The use of index hedges at times when we believe markets are overvalued.

It is impossible to build a portfolio that can consistently achieve our benchmark returns and completely eliminate periods of negative performance. Investing is always a balance between offence and defence. Our job is to ensure we strike the right balance to achieve our return target over the medium to long term. In doing this, we seek to limit the downside relative to the major asset markets and then recover those losses more quickly.

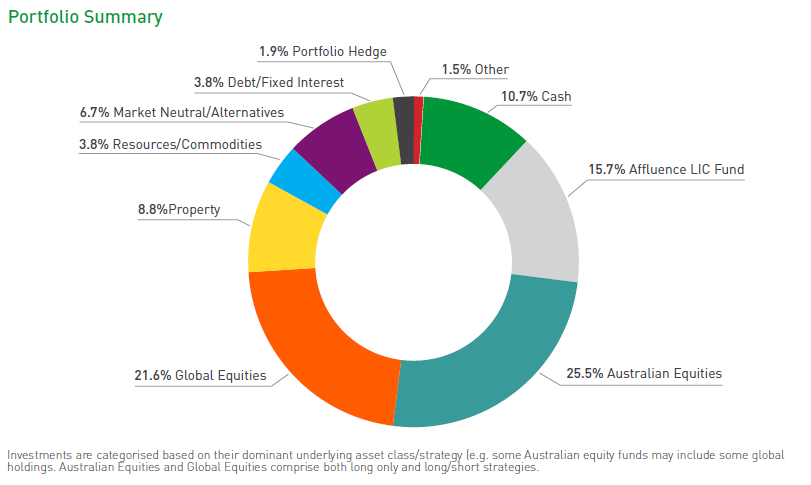

At 30 June 2022, the Fund portfolio looked like this.

This graph categorises each underlying fund investment based on the predominant asset class. But many of our managers have discretion to invest across multiple asset classes. The Australian Equities component includes, for example, some underlying funds that invest mainly in ASX stocks, but where the manager may also invest in global equities.

Within the portfolio allocation, there are also some distinct tilts within each of the asset classes that you should be aware of:

- Our Australian equities portfolio includes an above average allocation to a range of value focused small cap managers. Australian small cap value strategies have by far the most exciting return prospects for us right now.

- The global equities sector is almost exclusively made up of long/short or value focused managers. Many of these have exposures to unloved and undervalued stocks. We’ve also got a small allocation to emerging markets, where we continue to see the prospect for good returns.

- Our property allocation is predominantly a collection of listed investments trading at attractive discounts to underlying portfolio value.

- Our alternatives portfolio includes allocations to several managers that are either market neutral or where returns are not dependent on equity markets.

- Our resource/commodity exposures are just under 4% and include exposure to global gold miners and small cap resources players. We also have a reasonable amount of indirect resources exposure, including oil, uranium, and copper, through other funds. Many of these have exciting return prospects from here.

In addition to the 30 different underlying managers in the portfolio, we continue to identify new managers that excite us. While the level of turnover in underlying funds is not high, you should expect us to continue to gradually tweak the investments as markets change and opportunities come and go.

We have no idea whether we are at the bottom of the current correction. But we are comfortable we’ve put together a portfolio that allows us to feel very optimistic about future return prospects. It also gives us the comfort of knowing your (and our) investment capital is in the hands of nearly 30 different investment teams. We trust them not only to deliver good long term results but also to do the right thing by their investors. After all, almost all of them, like us, are long term investors in the funds they manage.

Thank you for your support in FY22. We love what we do, and we look forward to continuing our search for exciting investment opportunities in the coming years.

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Funds.