Investment performance

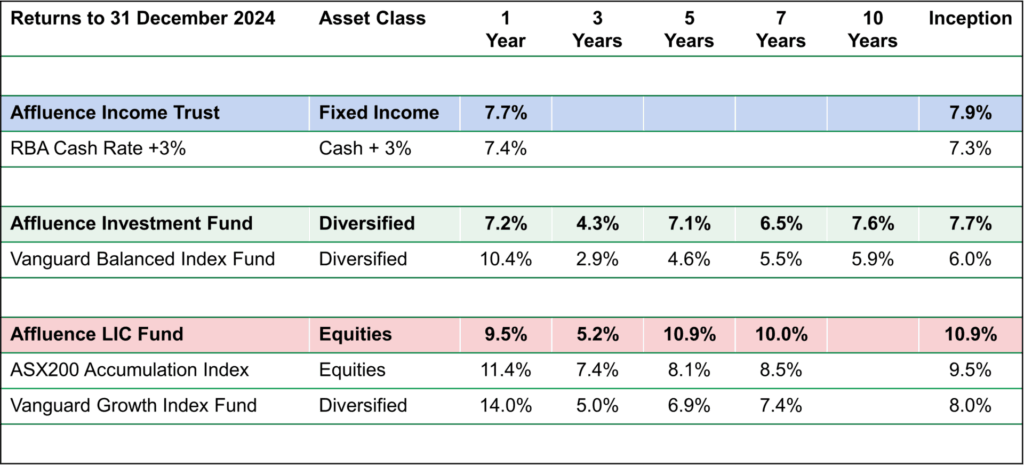

Affluence Fund returns and the relevant benchmarks are shown below.

Our 2024 returns could best be described as solid but not spectacular. Longer-term returns (which is what matters), compare very well with passive alternatives.

The 2024 year was a frustrating one for us. The winners were once again mostly confined to growth stocks, the largest stocks, and speculative investments. Earnings multiples for the largest stocks in each market continued to expand. At the start of the year, they were at levels well beyond what we would consider reasonable. By the end of the year, in an echo of 2021, they were significantly higher. On the flipside, many of our underlying investments, which were cheap at the start of the year, got cheaper. This type of market is, to put it mildly, not friendly to our investment style. To have still delivered reasonable returns in 2024 feels like a win, though not one that we take much joy in.

The most important takeaway from this letter, is that we don’t need much to go right from here. We end the year even more excited about the value embedded in our fund portfolios, than we were at the beginning. This provides us with an excellent starting point for the medium term. If market conditions continue to be unfavourable for us, the 2024 year gives us confidence we can still do ok. If valuing investments based on fundamentals makes any sort of comeback, we could do quite well.

Below, we take a closer look at market conditions, and review the performance and current positioning for each of our Funds.

Market Conditions

Major equity markets performed strongly in 2024, as most economies continued to show surprisingly strong conditions after previous years interest rate rises, and markets rallied again when the US Federal Reserve started cutting official interest rates. US equities were the standout, especially when combined with a falling Australian dollar). This was largely driven by the “Magnificent 7” which now represent a record amount of the S&P 500 Index.

In our June 2024 Investor Letter we discussed the following dominant market themes:

- US equities remain very expensive on most measures.

- The “Magnificent 7” represent a record amount of the S&P 500 Index.

- CBA is the most expensive bank in the world and has accounted for a disproportionate share of the ASX200 Index gains.

- Large cap equities have outperformed small cap equities.

- Growth stocks have outperformed value stocks.

These themes have only strengthened over the past 6 months. Many equity markets have hit new all time highs, and it would appear that historical valuation parameters no longer apply.

Our thesis for the current market is that it is stuck in a ‘liquidity flywheel’. The concept of a liquidity flywheel was explained very well in an LT-3000 Blog post from July 2020:

“A liquidity flywheel is a situation where inflows into an asset class lead to buying pressure that pushes up prices, leading to favourable apparent return and volatility characteristics in the said asset class. This favourable outcome then attracts yet more inflows, leading to yet more buying, etc. Conversely, poorly performing asset classes with significant downside volatility can lead to investor redemptions, leading to forced selling that contributes to yet further price declines, yielding even worse returns and even greater redemptions, and so on. This process can go on for years, and sometimes even for decades, and is a fundamental contributor – perhaps the most important contributor – to both major asset-class bubbles, as well as asset price busts and secular lows that lead to fire sale prices (which are ‘anti-bubbles’ driven by the same drivers of bubbles in reverse).”

This definition explains how a company such as CBA can reach $160 per share, even though most sell side analysts have a price target closer to $100 per share. It also explains, through ‘anti-bubbles’, how assets such as small cap equities can go from ‘reasonably priced’ to ‘crazy cheap’, in a bull market.

Parts of the market are now genuinely irrational. To stick with the CBA example, Australia’s largest bank is currently trading at 27 times forward earnings. That equates to an earnings yield of 3.7%. Most analysts are forecasting very minimal earnings growth, however even if we assume 3% annual growth, the total expected return would be 6.7% per annum. However, this includes the very heroic assumption that the PE ratio stays at 27 times. If it were to revert to a more traditional 15 times, then CBA would be worth around $90 (which is about what we believe it is worth), and CBA shareholders buying today would suffer considerable losses.

To enjoy the same returns that CBA investors have received over the past few years, from today’s starting point, would require the PE ratio to continue to expand further, when it is already almost double the historical average. To us, expecting this to happen meets the definition of irrational.

Market Returns

One year returns have generally been solid to good. Three year numbers are much more subdued, as the starting point for the three year numbers coincided with the start of the interest rate increasing cycle.

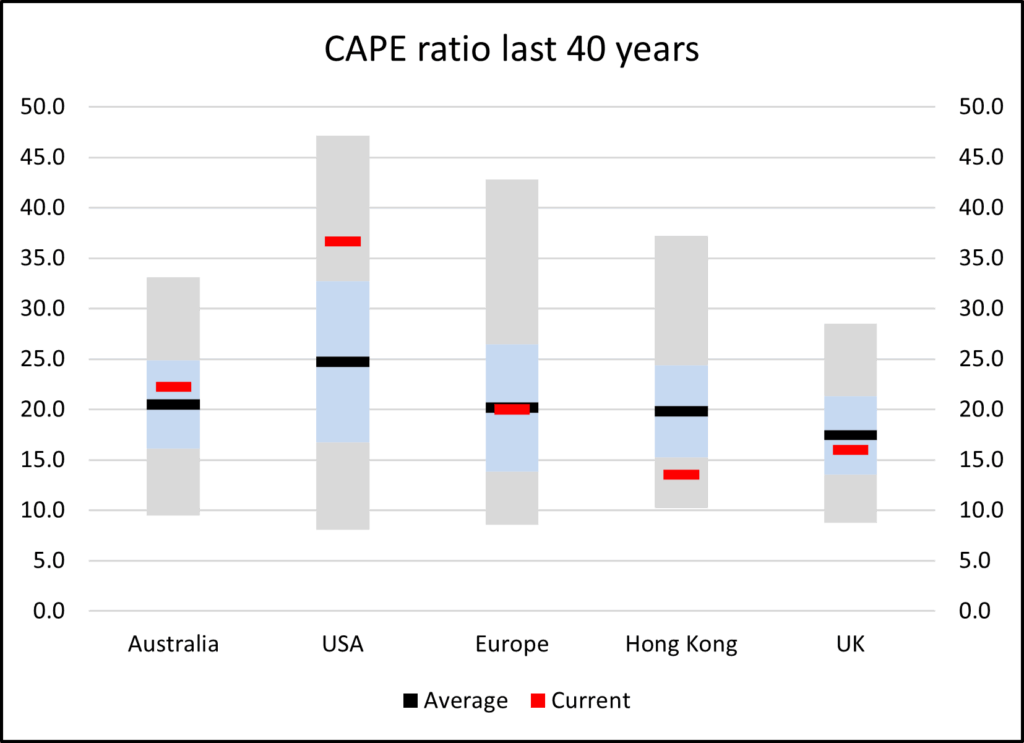

The obvious conclusion from the above chart is that US equities are very expensive. Australian markets are above average. Many global markets offer reasonable value. Hong Kong (and China) seem outright cheap. Major global indices are now 70% weighted to the US, therefore passive global equities we would consider to be expensive.

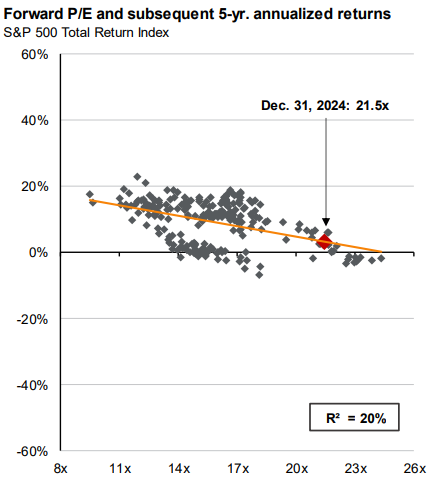

The biggest consideration in buying yesterday’s winners at such expensive valuations, is that you are paying a lot for the privilege. In simple terms, the higher the price you pay today, the lower your future returns are likely to be. The following graph shows historical 5 year returns from different valuation levels (represented by forward PE ratios). Based on history, investors holding US equities from here hopefully don’t have high expectations of future returns.

Affluence LIC Fund

Performance

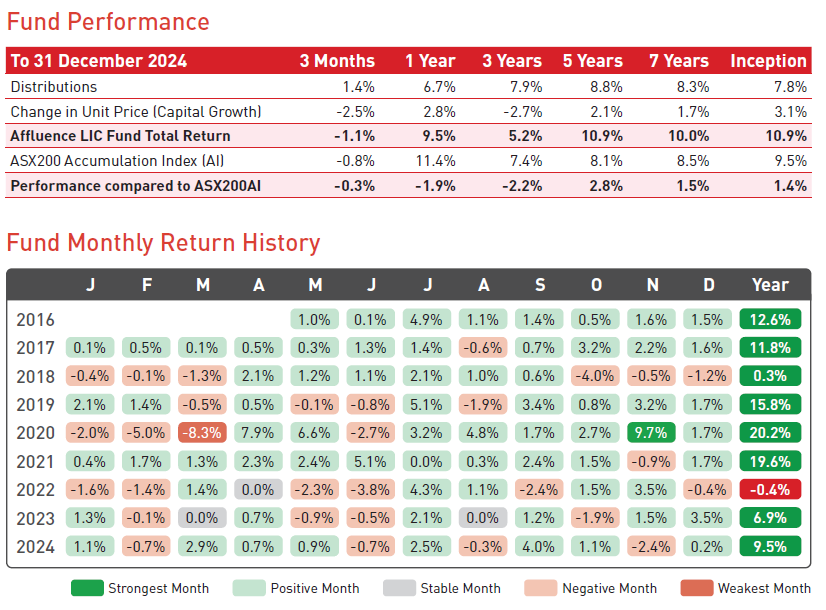

The Affluence LIC Fund has outperformed its benchmark (the ASX200 Index) over five years and longer, with significantly lower volatility.

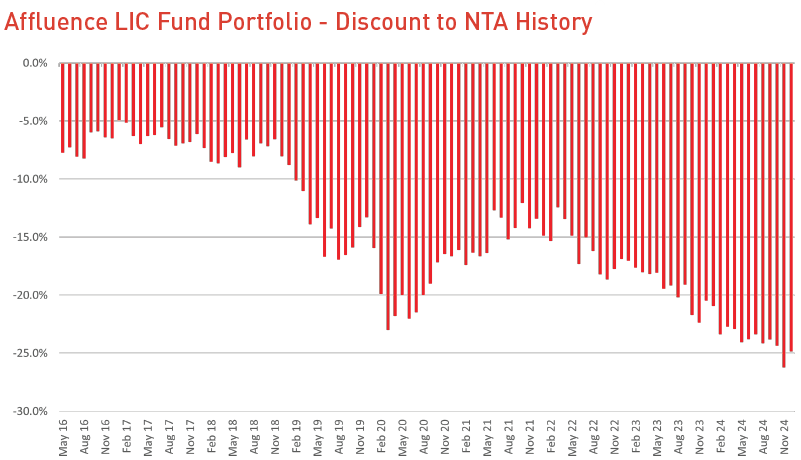

For 2024, the Fund returned 9.5%, compared to 11.4% for the ASX200 Index. The significant increase in discounts to NTA throughout the year more than explains the gap. The average discount to NTA for the portfolio increased from 20% at 31 December 2023 to 25% at 31 December 2024.

The increase in the portfolio discount over three years has been starker, increasing from 13% to 25%. While we are disappointed to lag the index, we are quite pleased to have kept up as well as we have, given the market dynamics.

The largest positive contributors to the 2024 returns were:

- Salter Brothers Emerging Companies (SB2).

- Ryder Capital (RYD).

- Hearts & Minds (HM1).

- Thorney Opportunities (TOP).

- Lion Selection Group (LSX).

The largest negative contributor was our market hedges. In our view, both the Australian and US markets were materially overvalued for much of 2024. The fact that they ended the year even more expensive does not change our process. It is an unfortunate reality of investing in a bull market, that being risk aware is a losing strategy in the short term. There will come a time when investors are rewarded for managing risk, but this has certainly not been the case recently.

Discounts

As the below chart shows, discounts have been consistently increasing from mid-2022. While this has obviously been a headwind to performance over this period, we find this incredibly exciting as we look forward.

Affluence LIC Fund positioning

Given the range of excellent opportunities on offer, we are relatively fully invested. The key features of the portfolio that differentiate it from the ASX200 are as follows:

- Limited exposure to ASX 20 stocks. The portfolio has minimal exposure to the big four banks, large iron ore miners and other large cap Australian equities. We believe there are much more attractive opportunities outside this sector.

- Access to Australian small cap stocks. Small and microcap stocks have substantially underperformed larger stocks. This will change at some point. We have continued to increase the Funds exposure to these areas, at very attractive valuations.

- For the first time in the history of the Fund, it has a reasonable exposure to REITs. We have invested in a number of compelling opportunities where the securities are trading well below NTA.

- Resource equities have had a tough year. We are invested in a number of LICs that have substantial exposure to resources and resource equities.

We believe the current portfolio discount of 25% is unsustainable in the medium term. There are many LICs that are currently under pressure to deal with sustained discounts, and the continuing trend of windups, mergers and structural changes will continue to increase pressure on the remaining LICs.

We are excited about the prospects for the Fund over the next few years.

Affluence Income Trust

Performance

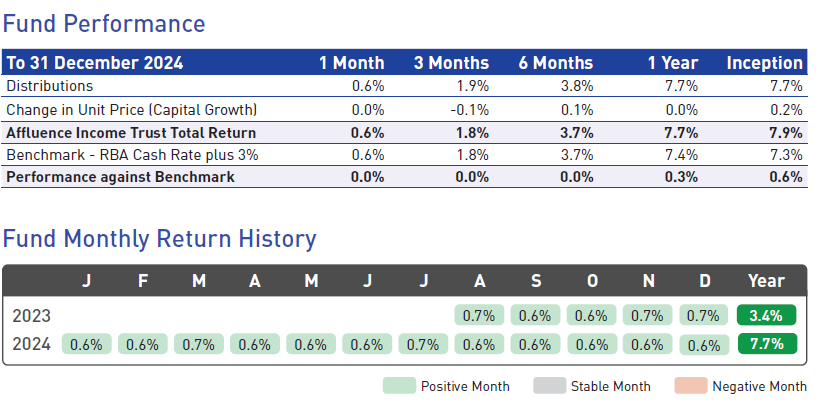

The Affluence Income Trust celebrated its first full year in 2024. Returns were ahead of the benchmark (RBA cash rate plus 3%) at 7.7%. Monthly returns were consistent and the fund paid monthly distributions equal to 7.5 cents per unit.

Affluence Income Trust Positioning

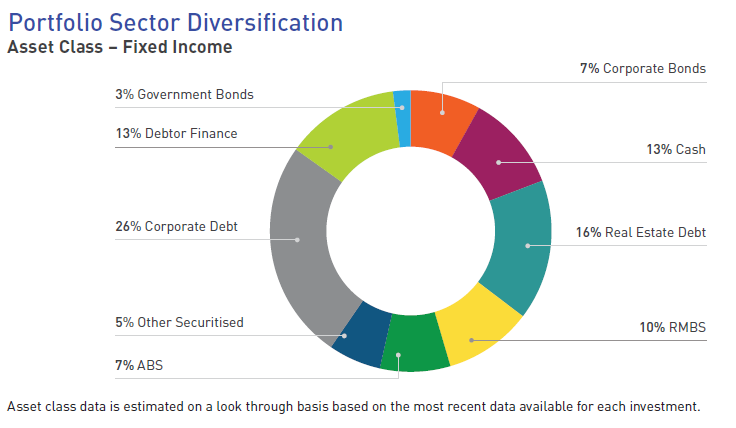

The Fund has a very flexible investment mandate within the fixed income asset class. Importantly, this allows us to take advantage of what we believe to be the best risk adjusted investment opportunities within this asset class at any given time. This is very rare in the fixed income sector, with most funds constrained to investing in a single sub sector.

The Fund portfolio currently includes a range of investments chosen by us, including access to many exceptional fixed income specialists normally only directly available to wholesale and institutional clients. For most individual investors, it would be very difficult to build such a diversified portfolio of fixed income assets.

At 31 December 2024 the Fund had exposure to 19 different investments across a wide range of sub-sectors, with approximately 50% by value invested in funds that are only available to wholesale and institutional investors. The look through diversification of the portfolio was as follows:

We have built out the portfolio across an excellent range of managers and sub-sectors. We believe the Fund offers very attractive returns, within a significantly less risky asset class. The economy is at the top of the interest rate cycle and there is pressure on the economy and borrowers in general. However, the Fund is very well diversified and we are confident we can achieve the benchmark returns into the future.

Affluence Investment Fund

Performance

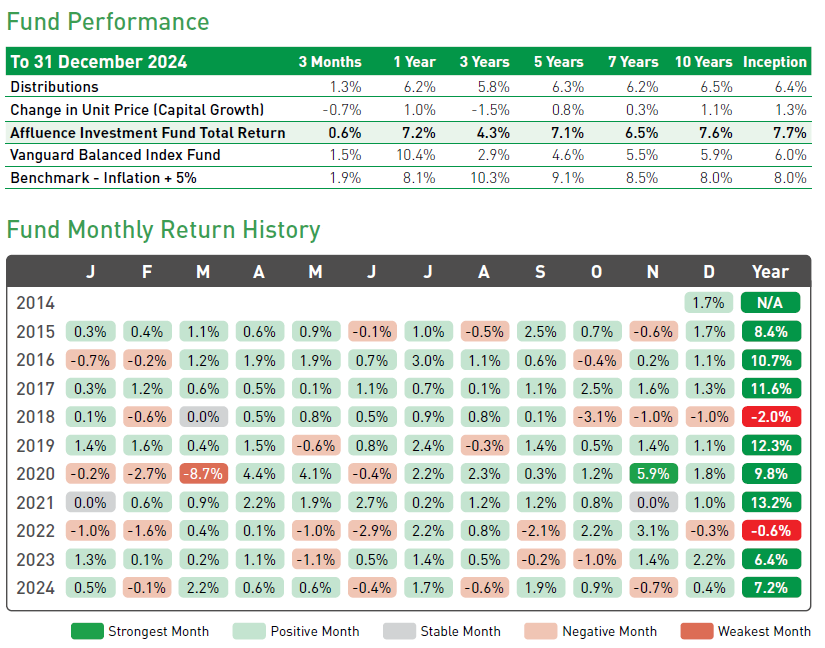

The Affluence Investment Fund had a reasonable 2024, returning 7.2%. While the Fund underperformed the passive alternative over 12 months, it remains well in front over the suggested minimum investment period of 3 years and longer. We believe the current portfolio shows significantly more potential than historic returns would suggest.

The main headwinds over the past 12 months (and really the past 3 years) have not changed. These include:

- Being risk aware in a bull market has lowered overall returns.

- Mean reversion as a strategy has not worked (yet).

Our process is to invest in assets that are cheaper than average (and therefore should offer higher long term returns) and sell assets that are more expensive than average (and therefore should offer lower long term returns). This has not happened. Assets that have been expensive (and by definition popular) have continued to become more expensive. Likewise, assets that were cheap have become cheaper. There is only so far an rubber band can stretch, but this has been frustrating all the same.

Affluence Investment Fund Positioning

It is impossible to build a portfolio that can navigate market downturns and then keep up with aggressive market rallies. Investing is always a balance between offence and defence. Our job is to ensure we strike the right balance to achieve our return target over the medium to long term. In doing this, we seek to limit the downside relative to the major asset markets and then recover those losses more quickly.

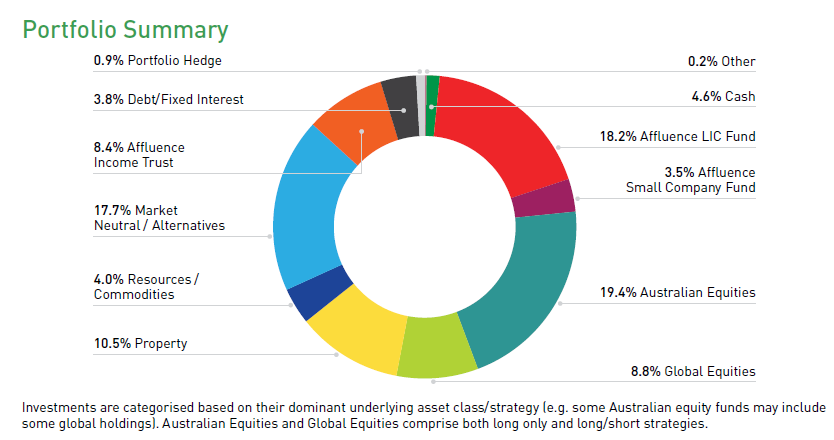

At 31 December 2024, the Fund portfolio looked like this.

We see value in all the areas discussed above. Importantly, this fund provides investors with access to each of our three specialist funds, along with many other boutique managers. Many of the underlying managers are closed to new investors, meaning they are not able to be accessed directly.

In essence, the Affluence Investment Fund provides a combination of all our best ideas and exceptional diversification. In coming periods, we expect the Fund to benefit from its exposure to LICs, small-cap equities, property and fixed income, along with a raft of differentiated strategies with the potential to make money in differing market conditions.

Thank you

Thank you to all of you who trusted us with your hard earned capital during the year. It is a responsibility that we never take for granted. We look forward to continuing our search for exciting investment opportunities in the coming years.

More reading

If you found that helpful, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see Fund portfolios and download our guides.

Find out about our Funds.