Markets were volatile in October, taking a breather after some strong previous months. Equity indexes were lower both in Australia and globally. Despite that, all of our funds delivered positive returns. Fund reports can be accessed below.

This big news so far in November is of course the Trump election victory in the US. We do not normally worry too much about the impact of geopolitics on markets. However, this change of presidency, and the resulting republican majority in both the house and senate, significantly increase market risk. So far, the reaction has been positive. But the Trump agenda includes a range of things that have the potential to work either exceptionally well, or very badly. Policies include making the US Government much smaller, significantly increasing fossil fuel production, ongoing tax cuts and increasing tariffs. Potential risks include a resurgence of inflation (very likely in our view), and the US debt burden moving to a level at which it becomes unsustainable. Markets will be impacted in unpredictable ways, and it will be important to be appropriately diversified.

In other news this month, we released our annual LIC predictions, coinciding with the Melbourne Cup. The link to the article is below. This year, our picks include three small cap focused LICs. Also below, we take a closer look at a listed real estate investment trust we like and explain why.

Should you wish to invest this month, head to our website to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 December.

Thanks for your continued support. If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

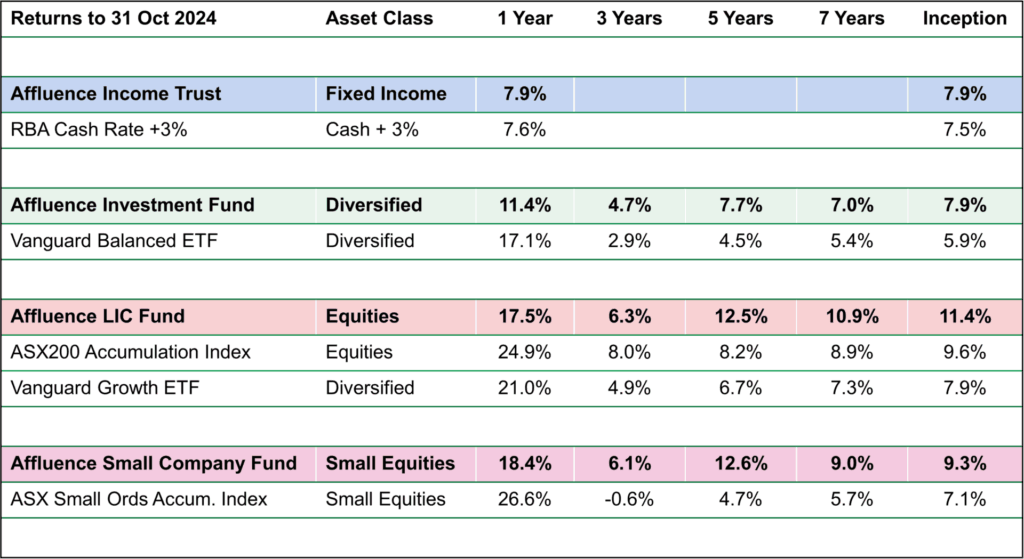

Affluence Fund Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in October and has delivered 7.9% per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.5% per annum

The cut-off for monthly applications and withdrawals is Monday 25 November.

Affluence Investment Fund

The Affluence Investment Fund returned 0.9% in October. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.9% per annum.

The cut-off for monthly applications and withdrawals is Monday 25 November.

Affluence LIC Fund

The Affluence LIC Fund returned 1.1% in October and has delivered 11.4% per annum since commencement. At the end of the month, the average portfolio NTA discount remained high at 24%.

The cut-off for monthly applications and withdrawals is Friday 29 November.

Affluence Small Company Fund

The Affluence Small Company Fund returned 0.9% in October. The largest positive contributors were ASX listed Lark Distilling (LRK), PPK Group (PPK) and Lion Selection Group (LSX).

The cut-off for monthly applications and withdrawals is Monday 25 November.

Investment Profile

This month, we’ve taken a look at an ASX listed REIT that’s in two of our fund portfolios.

It’s small and mostly owns office properties in Perth. It’s a classic contrarian investment. Other investors are chasing shiny new asset classes such as data centres and paying above net asset value to buy them at low yields. We are much happier to get paid a healthy distribution on less popular property that we can buy at a large discount, and wait until the market wakes up to the inherent value.

Affluence LIC Cup

Here we go again, the eighth running of the Affluence LIC Melbourne Cup! As always, we’ve forensically analysed the entire Listed Investment Company market and the results are in.

Things we found interesting

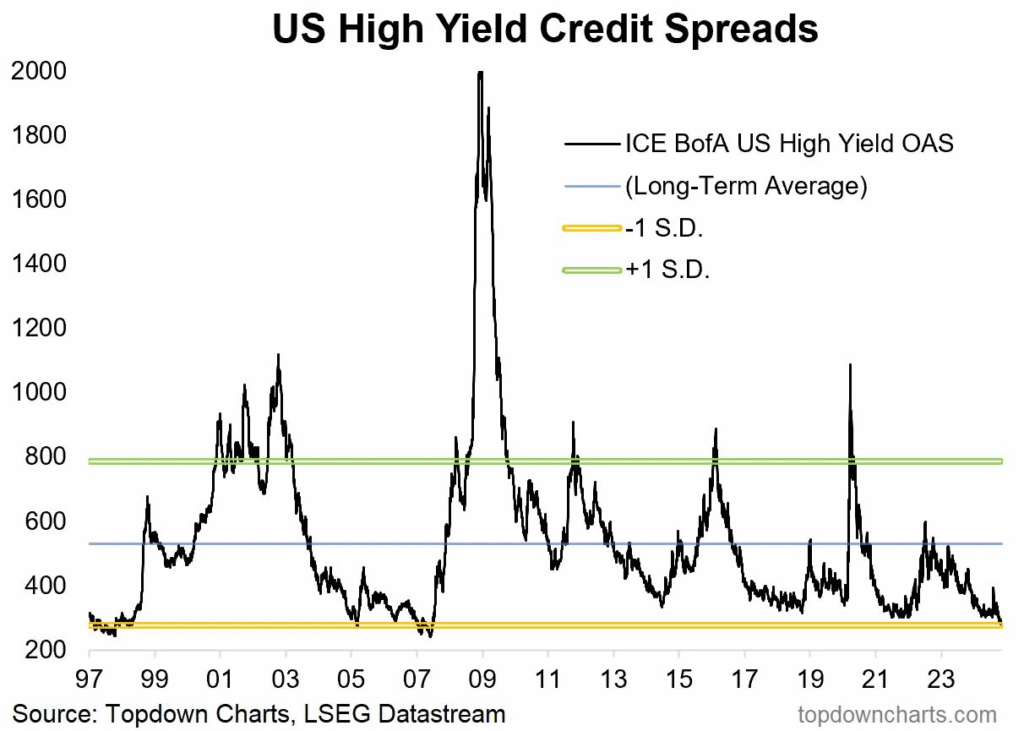

Chart of the month.This month’s chart comes from Topdown Charts. In the US, credit spreads on high yield bonds are back to levels last seen in 2007 and 1999.

The chart shows the difference between the yield for lower rated corporate bonds and US Government bonds with the same maturity. This indicates the risk premium that investors are demanding for taking the extra credit risk attached to high yield bonds.

We very rarely own high yield bonds. In our view, the best time to do so is when credit spreads spike to very high levels. At that point, you are being well rewarded for taking on the extra risk. The worst time to own this type of debt? When spreads are at their lowest…like now. Our Affluence Income Trust currently has no exposure to US high yield bonds.

Financial word of the month.

Top-down.

Basing analytical or investing judgments on macroeconomic, geopolitical, or other forces that affect a company or a market from the outside. An investment firm whose top-down views turn out to be even temporarily profitable may be able to buy its employees Mercedes convertibles that they can all drive with the top down to remind themselves of their success.

If the firm’s clients heed all its future top-down forecasts too credulously, however, they may end up having to rebuild their wealth all over again, from the bottom up.

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Strange jobs that no longer exist.

AI is apparently going to make all of us redundant. In recognition of this trend, each month we’re profiling a strange job that no longer exists. This month… Human Computer

There was a time when organisations hired people to perform calculations now handled by computers. During the 19th century, scientists and governments were beginning to collect reams of data that needed to be processed, particularly in astronomy, navigation and surveying. So they began breaking their calculations down into tiny basic math problems and hiring gangs of people to solve them.

Human computers were meticulous and detail-obsessed number crunchers. The work wasn’t always hard, though it required precision and an ability to focus for long hours. Everything electronic calculators can do now, they had to do by hand. They used tables, graphs, mechanical adding machines, and their minds. One human computer would be responsible for thousands of calculations per day.

The profession became obsolete with the invention of the electronic computer in the 1970s.

Source: historydefined.net

RBA Inflation Adjustor

Have you ever wondered what impact inflation has had on a historical price? Well, wonder no more. The RBA has an inflation adjustor, which you can find here.

The tool calculates the change in cost of purchasing something over a period of time going back to 1970. For example, it shows that an item costing $10 in 1970 is equivalent to $26.93 in 1980, $58.71 in 1990 and $137.52 in 2023.

If 1970 is not far enough back for you, the Bank of England has an inflation calculator on their website that goes back to 1209!

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- In Haddon Township, New Jersey, it is illegal to flirt.

- LEGO has an underground vault in the little Danish town of Billund, with one of every set ever made.

- In 1777, Frederick the Great issued an official statement urging his subjects to drink beer in the morning instead of coffee.

- An avocado never ripens on the tree, so farmers can use trees as a way to store and keep avocados fresh for up to seven months.

- At a 2007 auction, actor Nicolas Cage spent $276,000 on a Tyrannosaurus bataar skull, outbidding fellow movie star Leonardo DiCaprio. *

* What the actor did not know was that the skull had been stolen from Mongolia’s Gobi Desert. When he was contacted by the Department of Homeland Security about the matter in 2014, he quickly agreed to hand the item over so that it could be returned.

Source: mentalfloss

And finally…

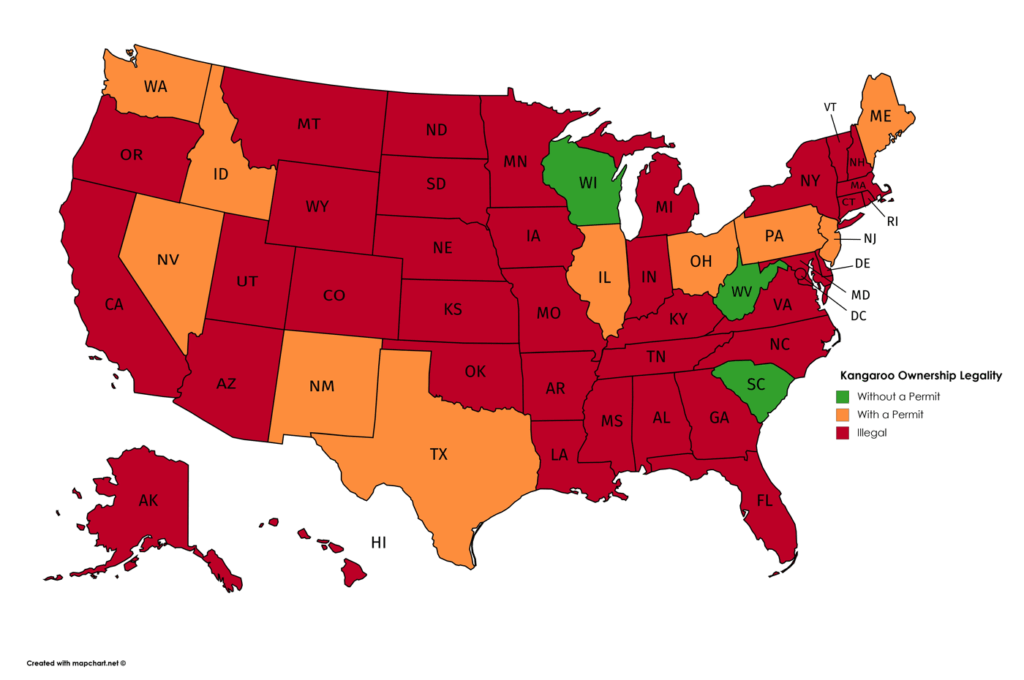

Oh no, not another chart of US states! It’s ok, this one has nothing to do with the election. It shows the US states in which you can own a kangaroo!

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.