We were recently asked three questions by Livewire Markets about key events or data that could impact residential property investment in Australia. Here’s our thoughts. A link to the original Livewire article is here.

1. What data point or event in the last month could potentially have the biggest implication on housing, and why?

The Federal budget announcement that deductions for travel costs and certain depreciation allowances will no longer be available to landlords of residential property is a potential game-changer. These changes, combined with other changes to curb foreign buyer demand, are relatively small in terms of their market impact. But make no mistake, this represents a profound shift in thinking and action from the Government.

For over 30 years, Government policy has been very supportive for residential property prices. Now, the Government is signaling for the first time that it will take measures to slow demand for housing. This is an acknowledgment that we have backed ourselves into a corner on residential house prices, and that we must now find ways to stifle future price growth without causing a substantial correction.

It’s a very fine line to walk. A major fall in house prices would be very destabilising for our economy. Labor’s response, changes to negative gearing, is even more profound and would likely have a much larger negative impact on markets.

2. What are some of the potential implications for investors and the wider economy?

The Budget announcement in itself is not going to lead to a material change in tax collected. But we are predicting it will be the start of a subtle shift in investor behaviour. Over the last two years, we’ve seen a reduction in almost all the major factors that have supported housing price growth for the past 30 years. We’re not picking a major crash in prices. But we are certainly entering a period of significantly heightened risk.

The Federal Government through their budget announcements and APRA through implementing tighter controls on bank lending have combined to increase risk. On top of that, it’s likely we have seen the bottom of the interest rate cycle, and in our view rates can only go up from here. We also have very low wage growth, higher stamp duties and harder financing for foreign investors. Lower immigration and a general over-valuation in almost all asset markets are additional risk factors. The negative influences are piling up.

Our greatest collective challenge over the next few years is to walk a fine line of keeping housing prices and debt levels relatively stable, while allowing our economy, wages and incomes to grow. It’s an incredibly difficult balance to get right.

3. What do investors need to watch for in coming months, and why?

Residential property ownership has been heavily supported, some would even say subsidised, over the past 30 years by household debt (mortgages) growing substantially faster than household incomes. Here’s two charts published by the Reserve Bank of Australia which illustrate the point (you can get them free from the RBA website – just search “RBA chart pack”). The first chart shows total growth in credit (loans).

In our view, changes in the total debt can have a disproportionately big impact. You can see from the chart above, that the rate of growth in total loans started falling in early 2008. Even though loan growth never actually went below zero, the impact on our economy was severe.

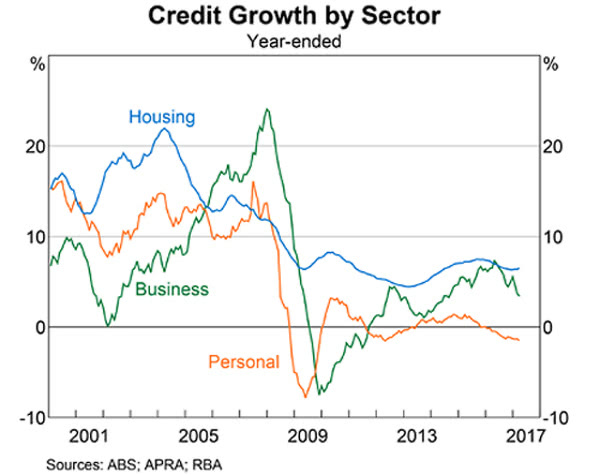

The second graph shows this same data, but broken down by the type of loans (housing, business and personal). This graph suggests that housing debt was much more resilient during and after the GFC. It also shows that continued borrowing for housing over the past few years has been a major contributor to our economy holding up OK.

In the future, it’s likely that any major fall in house prices will be start with a fall in the availability of loans, leading to a reduction in loan growth, or even a contraction. Keep an eye out for a significant fall in the rate of growth in these graphs. Or even better, talk to mortgage brokers regularly about what they’re seeing in the market.

Any major reduction in the availability of loans is likely to be a sign that credit growth is slowing and a decent correction is possible.

Want to know more?

See more of our articles here.

Find out more about us here.

Subscribe to our free monthly newsletter here.

Find out about our Affluence Investment Fund.

Or sign up as an Affluence Member and get access to exclusive investment ideas, profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!