The FY24 financial year finished in positive territory for most markets. The general trend was that the expensive, most favoured assets at the start of the year got more expensive, while the cheap got cheaper. That’s not great for our investment style, but eventually, value will get recognised, and markets will move in our favour.

Our fund returns for FY24 were:

- +7.4% for the Affluence Income Trust (11 months only)

- +7.8% for the Affluence Investment Fund

- +10.8% for the Affluence LIC Fund

- +5.6% for the Affluence Small Company Fund

Distributions for the year were between 5.3% and 7.0%, with the Affluence Investment Fund and LIC Fund paying special (higher than normal) distributions for June.

Below, you can access all monthly fund reports, as well as a profile of one of our larger Affluence LIC Fund investments.

Our FY24 investor letter, also linked below, takes a look at performance for the year, current portfolios, and where we see value in the years ahead.

The cut-off for applications this month is 31 July for the Affluence LIC Fund and this Thursday, 25 July for all other Affluence funds. Go to our website and click “Invest Now” to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 August.

Thanks for reading and for your continued support. If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Annual Investor Letter

In our review of the 2024 Financial Year, we look at what happened in investment markets, how our Funds performed, how they’re positioned for FY25 and where we think the opportunities are. It’s everything we would want to know if we were you.

Affluence Fund Reports

Affluence Income Trust

The Affluence Income Trust returned 7.4% for FY24 (11 months only). The Fund pays monthly distributions. The current distribution rate is 7.5% per annum.

The cut-off for monthly applications and withdrawals is Thursday 25 July.

Affluence Investment Fund

The Affluence Investment Fund returned 7.8% for FY24. Since commencing, the Fund has returned 7.7% per annum, including monthly distributions of 6.4% per annum.

The cut-off for monthly applications and withdrawals is Thursday 25 July.

Affluence LIC Fund

The Affluence LIC Fund returned 10.8% for FY24. The average NTA discount for the LIC portfolio hit a new high of 25% at the end of the month.

The cut-off for monthly applications and withdrawals is Wednesday 31 July.

Affluence Small Company Fund

The Affluence Small Company Fund returned 5.6% in FY24. Birddog Technology (BDT) and the Samuel Terry Absolute Return Fund were the largest positive contributors in June.

The cut-off for monthly applications and withdrawals is Thursday 25 July.

Investment Profile

Each month we profile an underlying investment of one of our funds. This month, we’ve taken a look at another one of the holdings in the Affluence LIC Fund. Ryder Capital Limited (ASX: RYD) is a listed investment company. RYD has a value focus and invests mostly in smaller ASX listed companies. There’s also another reason we like it right now. Click below to find out more.

Affluence’s go anywhere fund offers 7.5% income and no headaches

That was the heading Livewire Markets went with when they recently promoted our Affluence Income Trust to their readers.

From 2014, when we started Affluence, until early 2022, we had very little fixed income in any of our portfolios. The pitiful yields just weren’t attractive. Now it’s different. Returns of 6-8% are achievable comfortably, provided you do your homework well.

In a Q&A session with Livewire, we explained where we see opportunities in fixed income, and what we’re avoiding. We also explained what makes the Affluence Income Trust unique for anyone seeking fixed income exposure.

Things we found interesting

Financial word of the month.

Value, n:

A source of great confusion, as when journalists write, “The stock lost 20 percent of its value today.” But it didn’t lose 20 percent of its value; it lost 20 percent of its price. The value of the underlying business almost certainly changed much less-if at all. Price is measured moment-to-moment; value, properly understood, unfolds over months and years. As Benjamin Graham taught Warren Buffett: “Price is what you pay, value is what you get.”

Value is what an asset is worth to a sensible buyer with access to all information necessary to appraise it, based on the cash the asset is likely to generate over its life. The value of a stock depends on the cash-producing potential of the underlying business, which barely changes quarterly or monthly, let alone from day to day. The price of a stock, on the other hand, can change thousands of times in a single day, even if the business of the company is utterly unaffected by any of the events that traders are reacting to.

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Peter Lynch Investing Rules.

Peter Lynch is widely regarded as one of the world’s best investors. Between 1977 and 1990, he was the manager of the Magellan Fund at Fidelity Investments. Lynch averaged a 29.2% annual return, consistently more than double the S&P 500 stock market index. During his 13-year tenure, assets under management increased from US$18 million to $14 billion. Here are 15 of his most quoted investing rules (there are more).

- You have to know what you own, and why you own it. If you don’t study companies, you have the same chance of success as you do in a poker game if you bet without looking at your cards.

- Never invest in a company without understanding its finances. The biggest losses come from companies with poor balance sheets. Always look to see if a company is solvent.

- Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling in a panic, you ought to avoid stocks altogether. A decline is a great opportunity to pick up the bargains left behind by investors fleeing the storm in panic.

- Your investor’s edge is not something you get from Wall Street experts. It’s something you already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand.

- The stock market has come to be dominated by a herd of professional investors. Contrary to popular belief, this makes it easier for the amateur investor. You beat the market by ignoring the herd.

- In the short term, there is no correlation between the success of a company’s operations and the success of its stock. In the long term, there is a 100% correlation between the success of the company and the success of the stock.

- Long shots almost always miss the mark.

- Owning stock is like having children – don’t get involved with more than you can handle. If you can’t find any companies that you think are attractive, put your money in the bank until you discover some.

- Avoid hot stocks in hot sectors. Great companies in cold, non-growth industries are consistent big winners.

- With small companies, you’re better off to wait until they turn a profit before you invest.

- If you invest $1,000 in a stock, all you can lose is $1,000, but you stand to gain $10,000 or even $50,000 over the time you’re patient. You need to find a few good stocks to make a lifetime of investing worthwhile. Time is on your side when you own shares of superior companies.

- In every industry and every region, the observant amateur can find great growth companies long before the professionals have discovered them.

- There is always something to worry about. Avoid weekend thinking and ignore the latest dire predictions of newscasters. Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.

- Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.

- If you study 10 companies, you’ll find one for which the story is better than expected. If you study 50, you’ll find five. There are always pleasant surprises to be found in the stock market.

Strange jobs that no longer exist.

AI is apparently going to make all of us redundant. In recognition of this trend, each month we’re profiling a strange job that no longer exists. This month…

Knocker Uppers

In the days before alarm clocks, people used to hire others to wake them up in the morning. It may not seem complicated, but it was quite an essential job in the 1800s, and continued to as late the the 1960’s in some parts of Britain.

These human alarm clocks or “Knocker Uppers” would often use long poles to tap on the windows of their employers. Other aides included soft hammers, rattles and even shooting peas at the glass of their windows.

It may seem like an unnecessary job, but people back then needed to wake up at odd times sometimes too, particularly where people worked shifts, or in London where dockers kept unusual hours, ruled by tides.

This all begs the question – how did the Knocker Uppers wake up? Turns out, most of them slept during the day, waking at about four in the afternoon to go about their work.

Source: historydefined.net

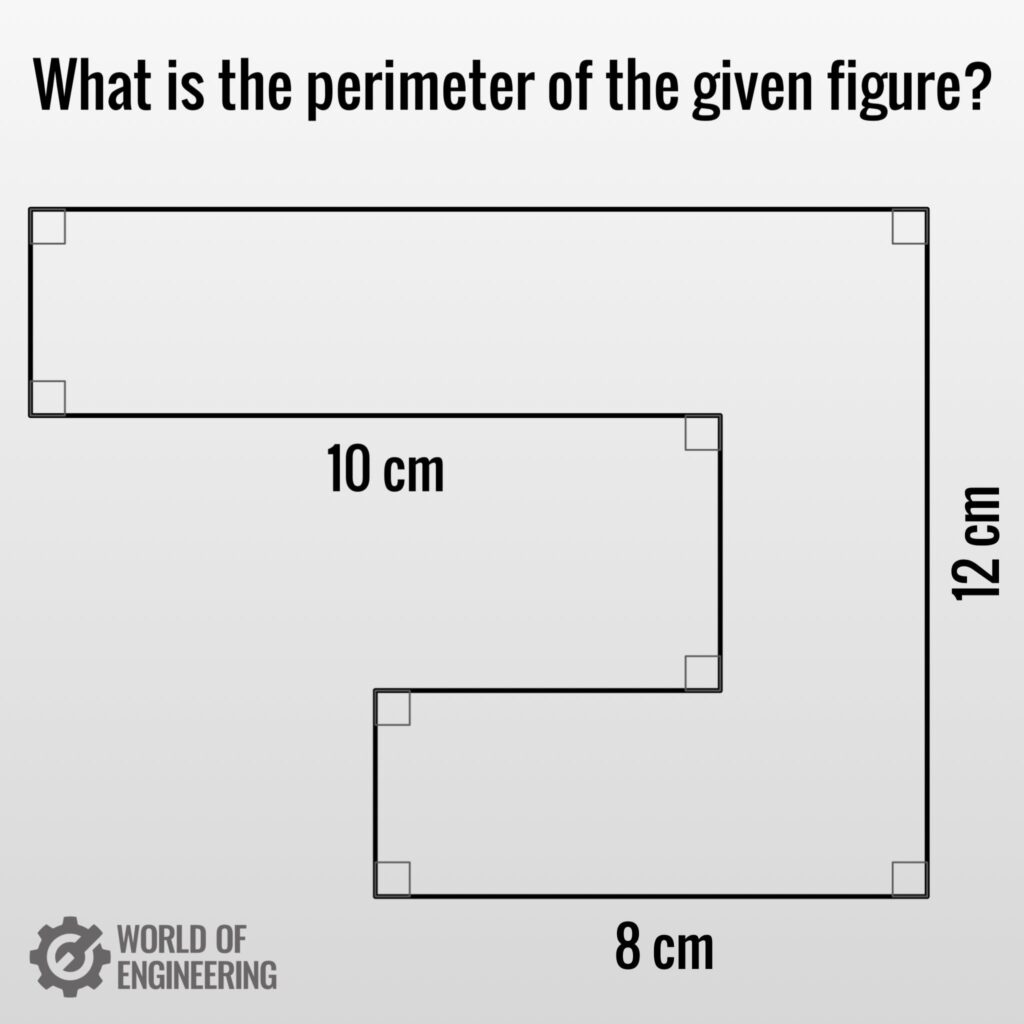

Brain Teaser

This one is quite tough!

Answer at the bottom of this enews.

Vaguely interesting facts.

- Grocery seller Costco has started selling gold bars online, and in select stores (though not in Australia yet). Apparently, they’re a big hit and sell out quite quickly.

- In a 2004 episode of Sesame Street, Cookie Monster revealed that before he started eating cookies, his name was Sid.

- Depending on the breed, dogs’ sense of smell is between 10,000 and 100,000 times stronger than ours.

- Sloths can move three times faster in water than they can on land. Which is still not very fast.

- Morton’s toe is when your second toe is longer than your big toe.

Sources: mentalfloss, wikipedia.

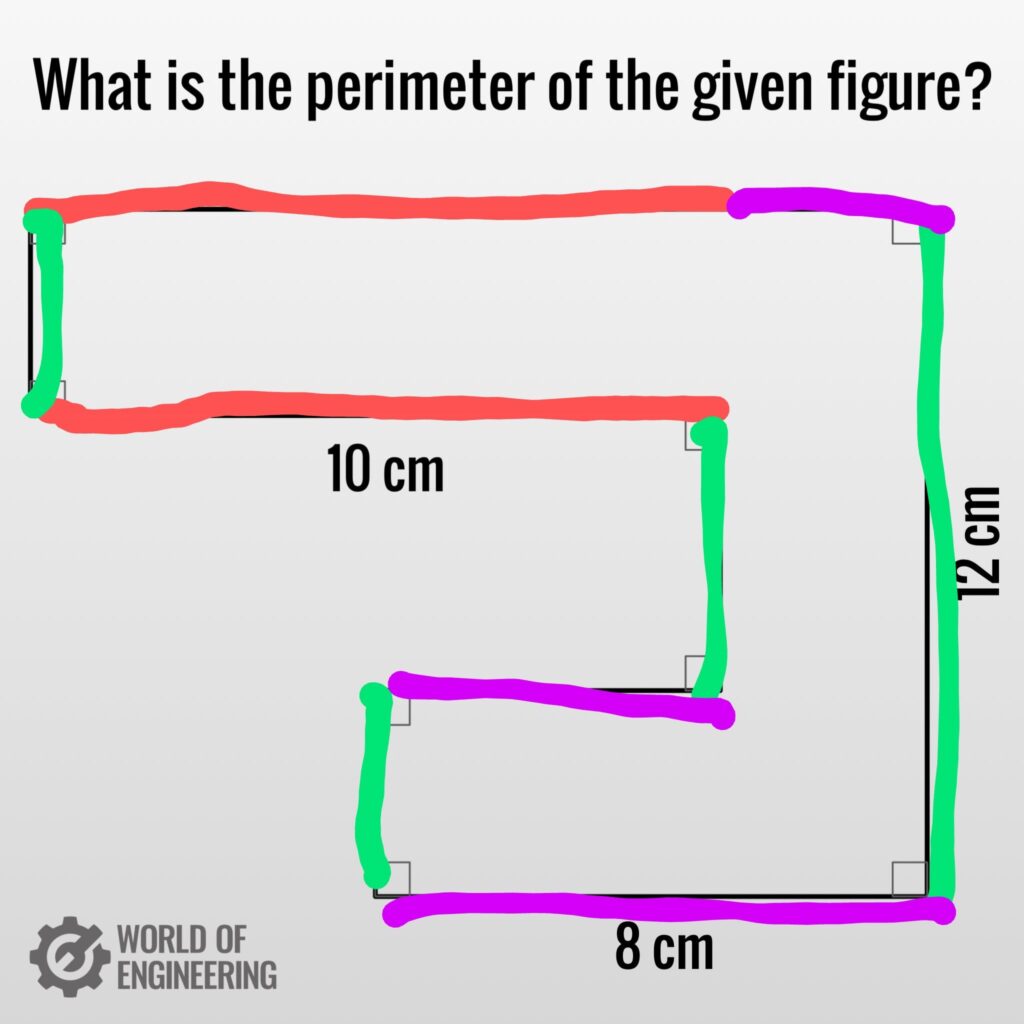

Brain Teaser Answer:

The trick is to build up the answer, based on what you already know.

The perimeter is the total length of all the sides. The answer can be worked out by extrapolating the length of the sides you do know, to their opposites, as shown below.

So:

- The total of the red lines is 20 (10 + 10).

- The total of the green lines is 24 (12 + 12).

- The total of the purple lines is 16 (8 + 8).

Therefore the total perimeter is 60 (20+24+16).

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.