“All of the old methods of analyzing markets have given way to deciphering what the Fed or ECB will do next.”

Richard Russell, author of market newsletter Dow Theory Letters for over 50 years, who passed away aged 91 in November 2015.

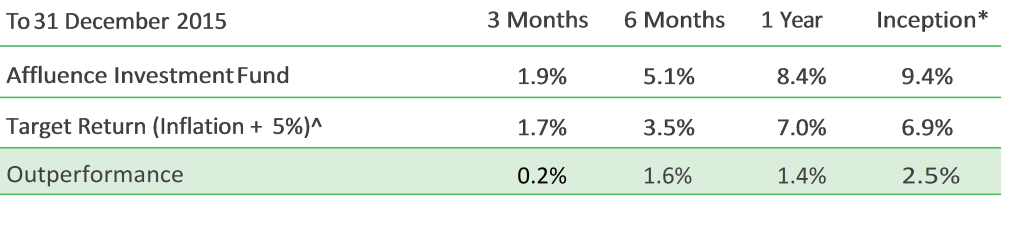

The Affluence Investment Fund returned 1.7% for the month of December 2015 and 1.9% for the quarter, exceeding our target return in what was another volatile period for stock markets worldwide.

Despite a difficult investing climate, the Fund has delivered total returns of 8.4% over the past year and 9.4% per annum since commencement in December 2014. Both figures have exceeded our target returns. We also carried substantial cash for most of the year, which significantly reduced the volatility of these returns.

The key contributors to performance over the past year have been our investments in unlisted property funds. These returned around 12% with very little debt attached. Our worst investment this year was our small allocation to commodities, which lost 7%.

Most pleasingly, the Fund outperformed most when markets were sluggish or falling. This is the essence of what we are trying to achieve – consistent, positive returns without the ups and downs experienced by the markets in general. If you can substantially limit the damage in the bad times, you remain much better placed to deliver over the long term.

While 1 year is a short time in, we are confident in the strategy and the ability of the underlying managers we have chosen to continue to do the job in what is proving to be a tricky investing period.

As at 31 December we have largely completed our portfolio implementation and consider the Fund to be reasonably well diversified. The Fund is invested in 9 managed funds accounting for 68% of the portfolio and 13 listed investment companies comprise a further 12%. We held approximately 20% cash as a buffer against further market falls.

We will continue to invest in funds which give us access to the quality investments, but in ways we believe will prove to be less volatile than average. Many of these underlying funds use strategies designed to cushion returns in market corrections.

The portfolio will continually evolve as markets move around and new opportunities present themselves. We will select only those opportunities which we feel are the absolute best for inclusion in the portfolio.

Because a number of the funds we invest with are themselves carrying significant amounts of cash, the underlying cash exposure is likely to be higher than noted above. This means the impact of any market correction on our portfolio should be less severe than, say, a portfolio constructed only of listed stocks.

If you would like to know more about the Fund’s portfolio, please contact us at any time. Affluence members and Fund investors can view the Fund’s full portfolio here.

Not yet an Affluence Member? Gohereto register. Get access to our monthly newsletter and premium content including full portfolio details and profiles of fund managers we invest with. Take charge of your financial future!