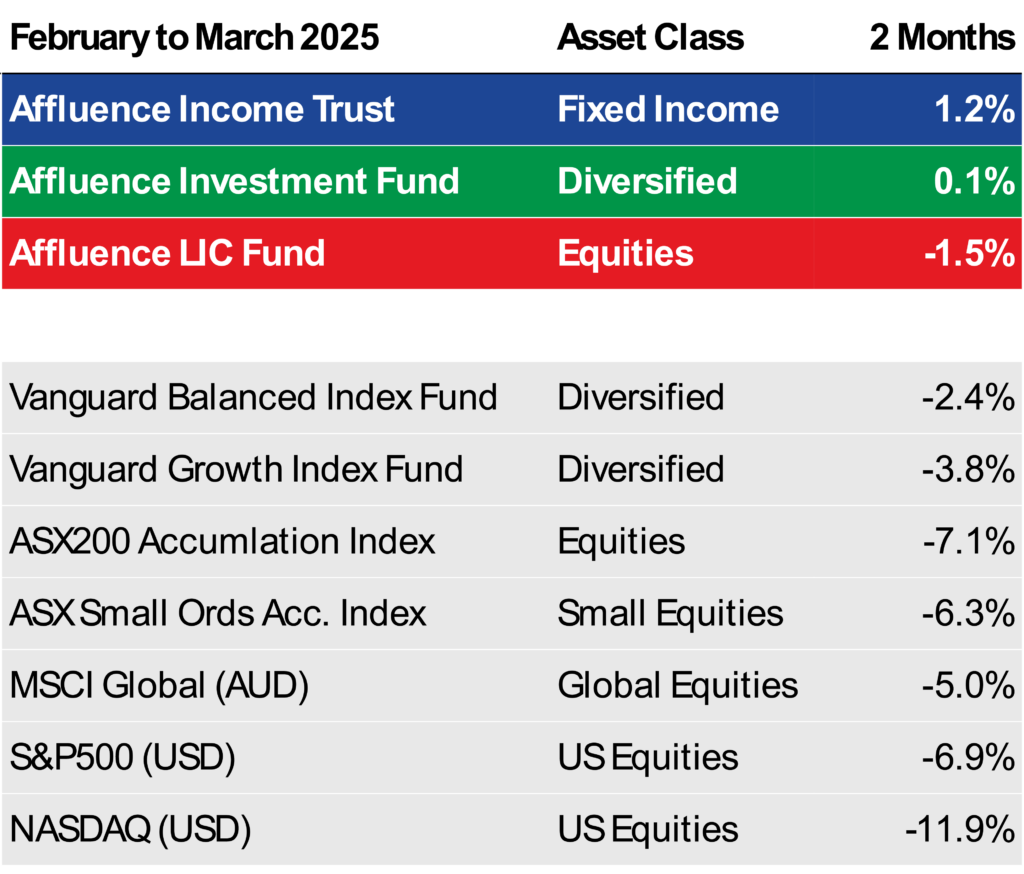

Following the correction in February, markets continued to fall in March, with Trump’s tariffs dominating headlines. Globally, the S&P500 was down 5.6% and the tech heavy NASDAQ down 8.2%. The ASX200 Index fell 3.4%, with Australia (quite rightly) not impacted as much by the tariff announcements from the White House. Our funds all outperformed in March, continuing the resilience shown in February. You can access the latest fund reports below.

Over the past 2 months our funds have behaved as we would expect, shielding investors from the worst of the falls:

So far in April, we’ve seen even more volatility, as markets swung wildly after each new proclamation from the Trump administration. In March and April we have done what we usually do in times of market panic. We realised some profits on our hedges across various funds, and topped up a few holdings that we felt had been unfairly punished. If we can lose less in the downturns, and put a little cash to work at better prices, it leaves us well placed for the eventual recovery.

It may take a few months before markets get back to normal, though it may surprise you to know that as we write this on 15 April, the ASX200 is only down around 1% for the month so far. We’re continuing to monitor the situation closely. We plan for a range of potential scenarios, so we’re prepared for whatever happens, not just guessing and taking the chance we’ll be wrong. In these situations, it’s also comforting to know that because of the way in which we invest, every one of our funds provides investors with access to a wide range of talented, active managers and investment teams. Each of these underlying managers has a huge amount of experience, specialist skills in their area of expertise and has proven in the past to be adept at navigating through difficult markets.

Should you wish to invest this month, head to our invest page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 May.

There’s a lot going on in the investment world right now, so we’ve also included a range of additional content in this edition, including links to a webinar and podcast we participated in last month.

As always, thanks for reading and for your continued interest in what we do.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

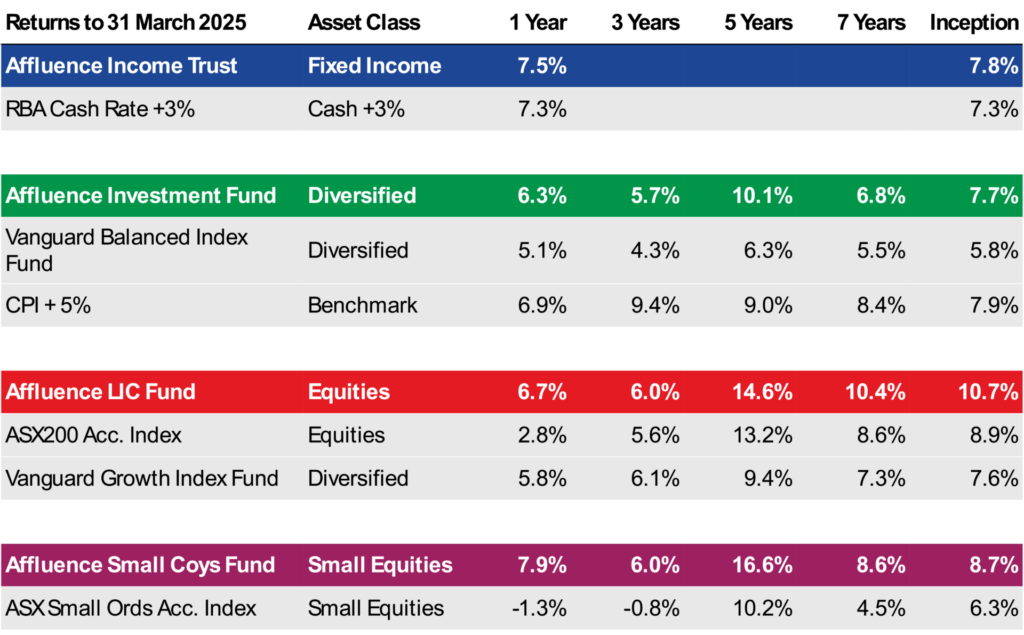

Affluence Funds Returns

Performance can change quickly – particularly in times of market stress. One of our key focus areas is generating smoother returns to help limit the impact of market downturns.

We’ve done that consistently now for more than ten years, through a range of different market corrections.

March 2025 Reports

Affluence Income Trust Report

The Affluence Income Trust returned 0.5% in March and has delivered 7.8% per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.25% per annum.

Affluence Investment Fund Report

The Affluence Investment Fund returned -0.2% in March. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.7% per annum.

Affluence LIC Fund Report

The Affluence LIC Fund decreased 1.9% in March, and has delivered 10.7% per annum since commencement. At the end of the month, the average portfolio NTA discount made new all time highs at 26%.

Affluence Small Company Fund Report

The Affluence Small Company Fund decreased 1.6% in March, outperforming the ASX Small Ords Index which fell 3.6%. The Fund has beaten the ASX Small Ords Index by 2.4% per annum since inception.

Investment Profile

Each month we take a look at an underlying investment in one of our funds. This month, we profile the Pzena Global Focused Value Fund. It uses a deep value investment strategy to invest in 40-60 global stocks located mainly in developed markets. At current prices, we believe it provides potential for strong returns.

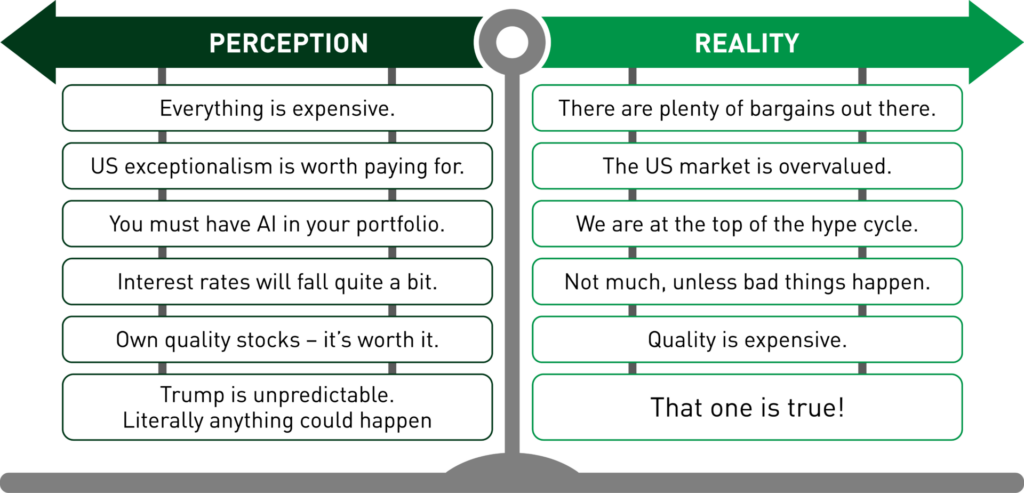

Time to be a contrarian

In mid March, we presented a short (10 minute) webinar for Investment Markets. The topic? Why now is the time to be a contrarian. We talked about why we believe we are going through a major secular turning point in markets, and how we’re positioned to benefit in our Affluence Investment Fund. You can access the Webinar and Presentation below.

How to select fund managers and build a portfolio

March was a busy month. We were also a guest on Rask Invest. We talked about a range of topics, including:

- An overview of Affluence Funds Management

- Special Situations and Small Cap Value

- Portfolio Construction 101

- Adapting Asset Allocation Over Time

- Strategic vs Tactical Allocation Explained

- Value vs Growth Style Bias

- How to Assess Value and Avoid Value Traps

- Global Outlook & Contrarian View

- Market Sentiment and “Smart Money” Behaviour

- Fund Manager Selection Framework

- Manager Due Diligence Process

- Fund Structure Preferences

- Views on Portfolio Concentration

- When to Sell or Redeem a Manager

Things we found interesting

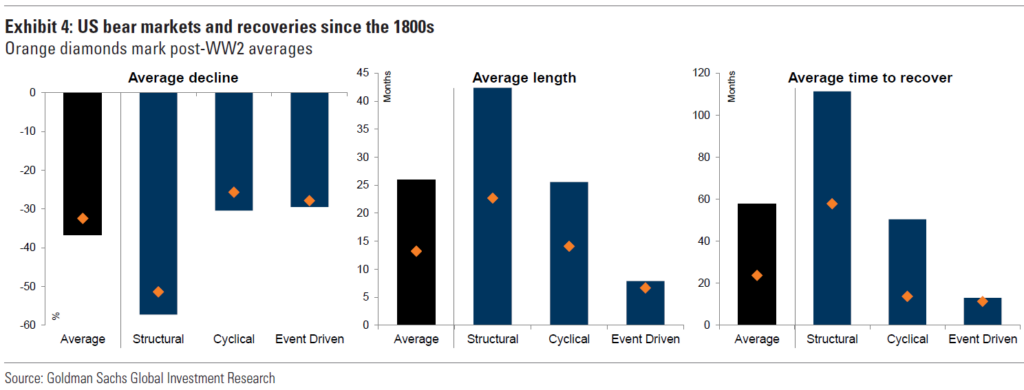

Chart of the Month.

Goldman Sachs recently took a look at what happened in bear markets in the US since the 1880’s. Here’s the results.

The good news is that (at least in Australia) we’re not yet in a bear market, using the standard definition of a 20% fall. The other good news is that so far it’s been an event driven correction. These have tended to have the shortest length and the quickest recovery periods. The bad news is that at the time, it’s hard to know whether an event driven drawdown will morph into a cyclical bear market. For those of you interested, the full paper that this graph came from, titled “Bear Market Anatomy – the path and shape of the bear market

Financial word of the month.

Regression to the mean.

The tendency of above-average results to be followed by below-average results and for unusually bad outcomes to be followed by extremely good ones; the most powerful force in financial physics. The great value investor Benjamin Graham liked to call regression to the mean “the law of compensation” (from the Latin compensare, to weigh against, or to swing in the other direction).

It is difficult to predict exactly when, or by how much, events will regress to the3 mean; but sooner or later, in any field where luck plays a role, they always do. The inevitability of regression to the mean is denied by corporate executives, analysts, and investors-who become euphoric at the top (when they should instead grow more conservative in anticipation of the corning decline) and pessimistic at the bottom (when they should rather become more aggressive in expectation of the impending recovery). At the peak, corporate managers spend wildly on expansion, analysts project current growth rates into the distant future, and investors pay reckless prices to join the party. At the bottom, companies shut down operations that offer no immediate payoff, analysts assume business will continue to wither, and investors conclude that the Apocalypse is upon us. The crowd thus gambles that extreme events will keep getting more extreme, rather than moving in the opposite direction. By ignoring regression to the mean instead of expecting it, the crowd ends up making the effects of regression even more severe. Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Scientists say that the best time to take a nap is between 2pm and 3pm.

- The sound of the roaring lion over the MGM movie logo is actually a tiger.

- Thomas Edison nicknamed two of his kids Dot and Dash, after the Morse code signals.

- Mars surface shifts in a different way than Earth, resulting in volcanoes up to 100 times bigger.

- A cat’s ability to see well at night is due to its tapetum lucidum, a structure that reflects visible light back through the cat’s retina. *

Source: Mentalfloss.

* It’s also what causes cats eyes to glow in the dark. Cats can see normally with as little as 15% of light that humans would need. But, they can’t make out sharp lines and angles. Everything looks a bit fuzzy to them.

And finally, life in the year 2030…

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters on our Insights Page