Hi,

Welcome to our monthly update. All funds delivered positive returns in August. Links to the monthly fund reports are below.

It’s been an extremely busy time for us in the past few weeks. We’re continuing to work towards our change of registry providers, and existing investors can expect to hear more from us on that in the next month. We’re also planning a revamp of our website. If you have any feedback about our current website, or you have any other suggestions for change, we would be happy to hear from you. Just reply to this email and let us know.

Finally, we’re also preparing for new rules that come into force for financial products in early October. Known as product design and distribution obligations, the changes are meant to make it easier for prospective investors to understand whether a particular investment product might be suitable for them. There are two obvious changes you might notice from next month onwards as a result of these new rules. Firstly, new documents, called Target Market Determinations, or TMDs will be made available online for most investment products. Secondly, if you are applying to invest in a product, and aren’t using a financial advisor, you may notice a few additional questions during the application process. These questions are designed to help us fund managers make sure that those applying for a product are within the “target market” that the product was intended for.

Read on to discover some other things we found interesting this month, including profit margins, the unluckiest investor in the world, McDonalds ice cream machines and Lego.

If you’d like to invest with us this month, applications for the Affluence Investment Fund close on Friday 24 September. Investments will be effective 1 October, with confirmations emailed about a week after that. As always, go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds.

If you have any questions or just want to give us some feedback, reply to this email or give us a call.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

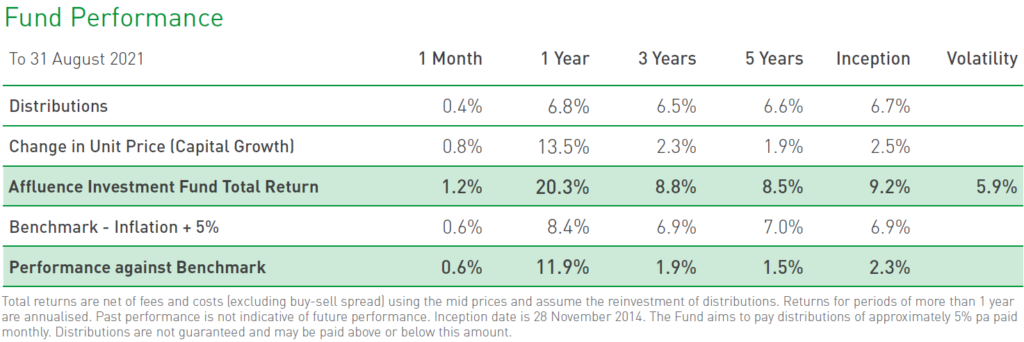

Affluence Investment Fund

The Affluence Investment Fund returned 1.2% in August. Since commencing in 2014, returns have averaged 9.2% per annum, including monthly distributions of 6.7% per annum.At month end, 64% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 8% in cash.

Affluence LIC Fund

The Affluence LIC Fund returned 0.3% in August. Since commencing in 2016, returns have averaged 13.9% per annum, including quarterly distributions of 7.6% per annum.The average discount to NTA for the portfolio at the end of the month was 13%. The Fund investments included 26 LICs (80% of the Fund), 5% in portfolio hedges and 15% in cash.

Affluence Small Company Fund

The Small Company Fund returned 1.4% in August. Since commencing in 2016, returns have averaged 10.6% per annum, including quarterly distributions of 6.7% per annum.The Fund hold a range of small cap exposures with a distinct value focus. At August 31, the Fund held six unlisted funds (53% of the portfolio), five LICs (17%) and eight ASX listed Small Companies (19%). The balance 11% was cash and hedges.

Exclusive access to 25+ talented fund managers

Almost 40% of the underlying funds held by the Affluence Investment Fund are now closed to new investors. This means the Fund provides access to a manager set that is simply impossible to replicate. In addition, around 20% of the portfolio is allocated to funds that are only available to wholesale investors.

With monthly distributions, a focus on investing differently and fees that are totally based on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

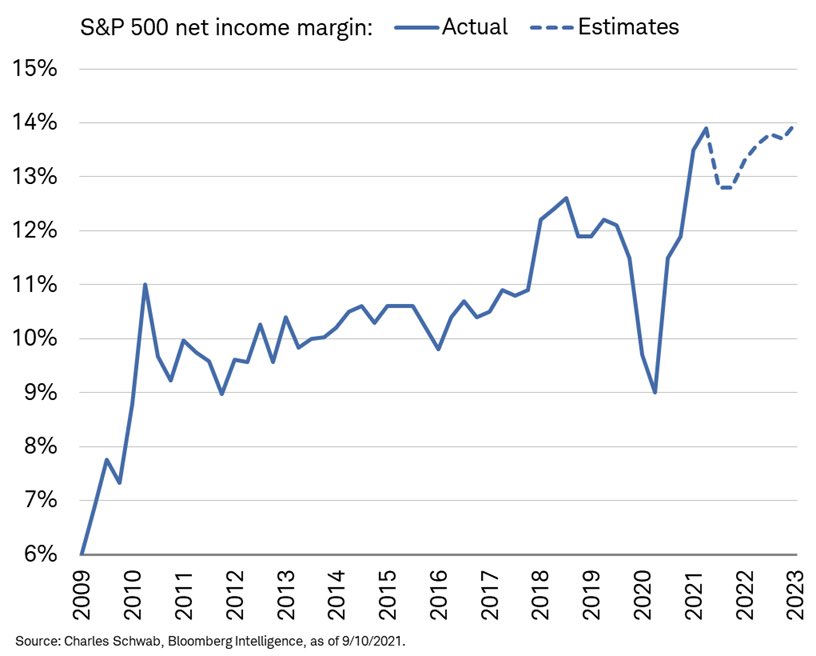

Chart of the month 1.

This chart shows a little appreciated feature of market cycles, changing profit margins.

As each economic cycle plays out, companies on average can tend to become more and more profitable. This helps increase earnings growth through a cycle, but also masks the risk that when profitability reverts to more normal levels, earnings rates will reduce.

It’s a key reason we’re so concerned about valuations of US stocks. Because it’s possible, in fact very likely, that any future correction involves a fall in revenues, profit margins, and PE multiples. The combination of all three creates a much bigger negative impact on share prices.

Quote of the month.

“I’ve never been rich, but I’ve never been hungry, either.”

Ronald Wayne, possibly the unluckiest investor, ever.

You’ve probably never heard of Ron Wayne, but you probably have heard of his one-time business partners. Ron co-founded Apple as a partnership with Steve Wozniak and Steve Jobs. He was invited to invest in the company by Jobs, after he helped to diplomatically sort out a minor disagreement between the two Steve’s. He accepted the offer, and bought in.

However, Ron was quite a bit older than the other two. Having previously had a business failure, he became concerned that if it didn’t go that well, he would again be in financial trouble. So, twelve days after buying in, he sold his 10% share of the new company back to Jobs and Wozniak for US$800. One year later, he accepted a final US$1,500 to forfeit any potential future claims against the newly incorporated Apple. Today, Apple is the largest listed company in the world. Even allowing for dilution from capital raisings prior to the Apple IPO, it’s fair to say that the initial 10% stake would be worth a LOT today.

Ron has said over the years that he does not regret selling his share of Apple. “I beleived it would be successful, but at the same time there would be significant bumps along the way and I couldn’t risk it. I had already had a rather unfortunate business experience before. I was getting too old and those two were whirlwinds. It was like having a tiger by the tail and I couldn’t keep up with these guys.” He has also said “What can I say? You make a decision based on your understanding of the circumstances, and you live with it.”

But that’s not the end of the story. In the early 1990s, Ron sold the original Apple contract paper, signed in 1976 by Jobs, Wozniak, and himself, for US$500. Ron Wayne has stated that he does regret that sale. With good reason. In 2011, the purchaser re-sold the contract for $1.6 million.

You can hear Ron tell the story in his own words here.

Media & Presentations.

Last month, we spoke with AFR journalist Tony Featherstone on whether there’s still value in LICs. The article is available here for AFR subscribers.

We also ventured out to Toowoomba in August to present to a very knowledgeable investor group. Our talk was titled “The world is nuts…and other interesting stuff”. You can download a copy of the presentation here.

Solving a first world problem.

Smart tech engineer Rashiq Zahid figured that McDonalds customers were getting tired of schlepping all the way to their local Maccas for dessert, only to discover the ice cream machine was broken. If you’ve ever done a late night Maccas run, you will know the feeling.

Rashiq, enterprising man that he was, decided to do something about it. So he worked out a way to access McDonald’s systems via the online ordering functionality and now knows in real time which McDonald’s locations have a broken ice cream machine. Don’t believe us? Head on over to https://mcbroken.com/. The bad news? It only covers US stores (for now).

This month in (financial) history.

On September 15, 2008, the financial crisis hit markets hard. Lehman Brothers started the day trading at $3.65 and closed at $0.19 a share, down 95%. Lehman filed for Bankruptcy later that day. The bank had been around for more than 150 years, but had become over leveraged and clients were rapidly pulling out assets from the firm in the panic.

Insurance behemoth AIG shares started trading that same day at $12.14. They closed at $5 a share, down 60%, as their exposures from underwriting subprime insurance bonds via credit default swaps started to become apparent. AIG would be bailed out the next day, which resulted in the U.S. government owning 80% of AIG. The initial loan amount was $85 billion and was to be repaid with interest. The debt eventually grew to an estimated $182 billion. By late 2012, the loan was repaid in full and the government had received $22.7 billion in interest.

Stock markets were down about 30% from their highs by the time of the Lehman bankruptcy and AIG bailout. But the worst of the financial crisis was still to unfold. Markets would fall another 30%+ before the lows in March 2009.

Meanwhile, in September 1997, just 24 years ago, google.com was first registered as a domain name.

On September 16, 1920, JP Morgan Bank in New York was bombed. The explosion occurred just before noon, caused by a horse-drawn carriage packed with explosives. 40 people were killed and 130 injured by the blast. The bombing seemed to have no effect on stocks on the day, as the Dow Jones Industrial Average finished up 0.92% on the 16th and up 1.49% the following day. The bomber has never been identified.

And finally, in September 1884. Britain ended its policy of penal transportation to New South Wales.

And finally…

If you liked that, here’s a longer cartoon about Lego.

Got a question?

If you would like to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluence3.wpengine.com | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.