Hi,

In August, the ASX200 index fell 0.7% and most global share markets were down 2-3%. Markets were rattled by increasing US 10 year bond yields, and deteriorating economic indicators out of China. August was full year reporting season in Australia, and overall, consumers appear to be withstanding the tougher economic conditions reasonably well, although forward guidance was relatively soft.

The Affluence Investment Fund recorded a positive return for the month. The Affluence LIC Fund was flat, while the Affluence Small Company Fund was slightly negative. You can access the latest Fund reports from the links below.

Each quarter we provide an update on our market view, and how we’re positioned in each of our fund portfolios. This quarter’s presentation is titled “patience is a virtue”. The key theme is that we are finding a significant number of attractively priced opportunities to buy, and we expect that will continue to be the case. A link to the latest presentation is below.

Should you wish to invest this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Monday 25 September. Applications for the Affluence LIC Fund close Friday 29 September. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 0.5% in August. Since commencing over eight years ago in November 2014, the Fund has returned 7.8% per annum, including monthly distributions of 6.5% per annum.

The cut-off for monthly applications and withdrawals is Monday 25 September.

Affluence LIC Fund

The Affluence LIC Fund was flat in August, outperforming the ASX 200 Index which decreased by 0.7%. Since the Fund commenced, returns have averaged 11.0% per annum, including quarterly distributions of 7.9% per annum.

The cut-off for monthly applications and withdrawals is Friday 29 September.

Affluence Small Company Fund

The Affluence Small Company Fund decreased 0.7% in August, outperforming the ASX Small Ords Index which fell 1.3%. Since commencing, returns have averaged 8.9% per annum including quarterly distributions of 6.9% per annum.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Monday 25 September.

Our Performance

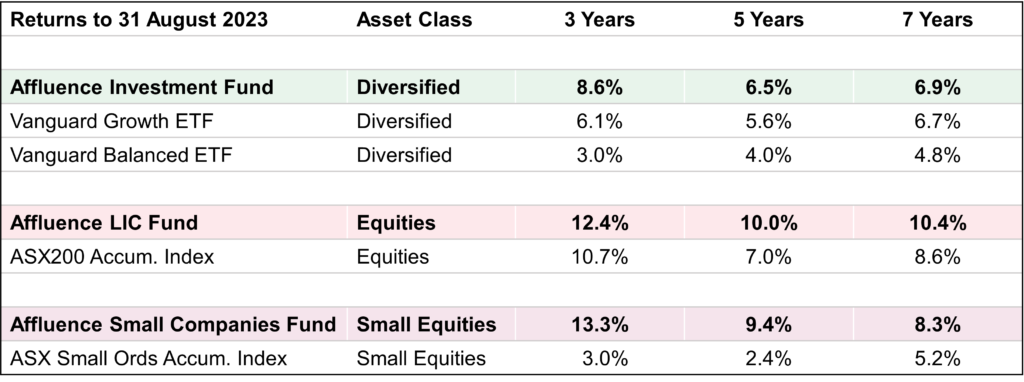

All of our Funds have substantially outperformed their index or passive equivalents over the suggested investment periods of 3 years and longer, with substantially less volatility.

Right now, we’re excited by the value apparent in all of our fund portfolios. If you would like to know more, you can access our latest quarterly presentation below.

Access our latest Presentation

Performance data is calculated assuming the reinvestment of distributions and is expressed net of fees and costs, excluding the buy-sell spread. Performance includes distributions and changes in unit prices, but not franking or other tax credits. Returns for periods over 1 year are annualised. Past performance is not indicative of future performance. Current performance data is available at https://affluencefunds.com.au.

Things we found interesting

Chart of the month: Soft landing

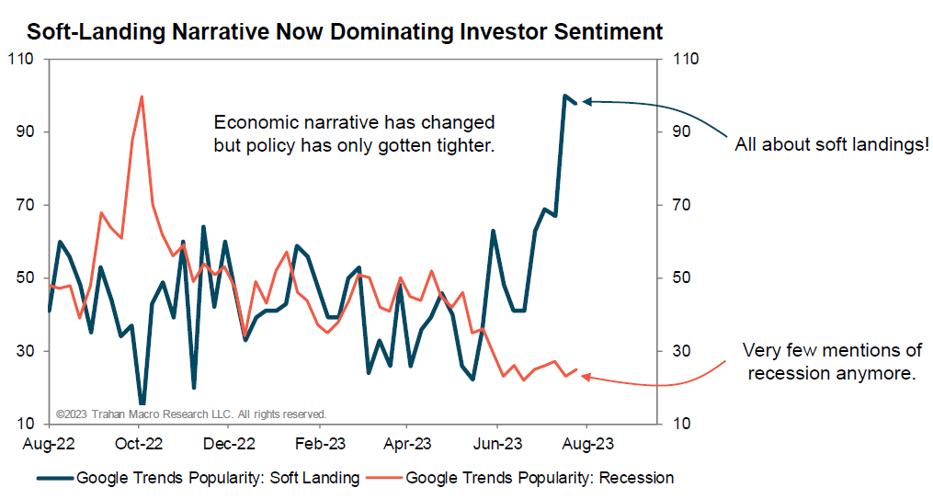

We pay attention to measures of investor sentiment, particularly at extremes. Below we can see an example of how there is now almost 100% agreement that there will be no recession, AKA, a soft landing.

This is the exact opposite to the prevailing view last October, when almost everybody expected a recession imminently. Consensus is often wrong at key turning points. When almost everybody thinks the same thing, we pay attention! It’s one more reason we’re happy to own some extra cash, and a range of investments that seem, to us, cheaper than average.

This month in financial history.

In September 1837, luxury brand Tiffany & Co. (first named Tiffany & Young) was founded by Charles Lewis Tiffany and Teddy Young in New York City. The store was originally marketed as a “stationery and fancy goods emporium”.

In September 1889, video games company Nintendo was born, though of course video games had not yet been invented back then. Nintendo Koppai was founded by craftsman Fusajiro Yamauchi and originally produced handmade Hanafuda playing cards. By 1953, Nintendo Koppai had become the first Japanese company to successfully mass-produce plastic playing cards. Its success led to the company going public in 1962. A year later, the name was shortened to Nintendo Co. Ltd. It wasn’t until 1977 that Nintendo launched its first home video game machines, the TV Game 15 and TV Game 6. But their big breaks came with the release of games Donkey Kong in 1981 and Super Mario Bros. in 1985. For the next several decades, Nintendo had hit after hit, with both games and gaming systems, and the company is now worth over $80 billion.

Quote of the month:

“We don’t have enough lithium, cobalt, nickel, or copper – these are all scarce resources. We live in a world now of fairly regular shortages – we call it whack-a-mole in America. We are not going to be rolling in commodities ever again. That era has gone.”

GMO Founder Jeremy Grantham, speaking to an Australian audience at Livewire Live from his home in Boston earlier this month.

Grantham pointed out that he no longer actively manages investor money for GMO, the company he co-founded. In fact, he hasn’t done so for 15 years. These days, his focus is primarily investing the $1 billion + in his family’s charitable foundation. Surprisingly, given Grantham is well known as a value investor, the vast majority of his foundation money is invested in early stage venture capital. This gives Jeremy privileged insights into the major trends and structural issues the world faces, and how new companies are going about solving them. A summary of the full interview with Grantham can be found here.

Vaguely interesting facts.

Lobsters’ bladders are in their heads.

Some spiders recycle damaged webs by eating them.

The first item ever sold on eBay was a broken laser pointer.

There are more registered real estate agents in the US than there are homes for sale.

Despite being less than 4km apart, the larger of the two Diomede Islands is one day ahead of its smaller neighbour.*

Source: mentalfloss.com, wikipedia.com.

* The two Diomede islands are located in the Bering Strait between mainland Alaska and Siberia. They sit on either side of the International Date Line. Because of this, the islands are sometimes called Tomorrow Island (Big Diomede) and Yesterday Island (Little Diomede). Big Diomede is located on the Russian side while Little Diomede is on the US side. Due to locally defined time zones, the time difference is not exactly one day. Big Diomede is only 21 hours ahead of Little Diomede (20 in summer). Big Diomede is now inhabited only by military units, after Russia established a military base there in 1948 and relocated the indigenous population to mainland Russia. Little Diomede has an Inupiat population of just over 100 people in a village on the west side of the island with a school, a post office and a store. The ice bridge that forms between the two islands in winter makes it possible, although illegal, to walk the short distance between them and ‘travel through time’.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.