Key details

Fund: Baker Steel Gold Fund

Profile date: March 2020

Manager: Baker Steel Capital Managers

Fund Type: Retail Unlisted Fund

Invests In: Global listed gold and precious metal producers.

Key People: David Baker, Mark Burridge and Trevor Steel

Investment Focus: Global listed gold and precious metal producers.

Risk profile: High. This Fund and gold equities are often more volatile than the overall share market. Proceed with caution.

Affluence Fund Weighting: As at March, the Baker Steel Gold Fund has a weighting of 2.0% in the Affluence Investment Fund portfolio.

What Baker Steel does

David Baker and Trevor Steel founded Baker Steel Capital Managers in 2001. They specialise in investing in natural resources and precious metals and have backgrounds in geology and investment management.

The Baker Steel Gold Fund is an Australian feeder fund into the firms Precious Metals Fund. The Precious Metals Fund invests in a portfolio of globally listed gold and precious metals equities, with a mid to large cap focus. The core of the strategy is to invest in and hold good value precious metal equities. The Fund focuses on gold and precious metal producers that have strong management teams in place, where the investment offers value and above average growth potential. Their research process includes an in-house valuation database which tracks over 500 gold deposits and 200 gold mining companies. This assists in evaluating mining opportunities worldwide.

Why Invest in Gold?

We are not ‘gold bugs’, but we believe there is a case for a small allocation to gold as a portfolio diversifier. It is widely believed that gold does well in a crisis. However, the relationships and correlations between gold and other major asset classes are variable. Sometimes gold can provide an excellent hedge against falling growth asset prices and sometimes it falls in sympathy.

We believe the current environment has been, and remains supportive for gold, because:

- Gold is seen by investors as a store of value, especially in troubled times.

- Low interest and bond rates and expanding global debt levels encourage gold ownershlip.

- Heightened financial market risk and geopolitical tension can increase the demand for gold.

We choose to gain exposure via the Baker Steel Gold Fund. We could achieve a pure exposure to gold by either directly buying physical gold, or through a gold ETF which is essentially a managed fund backed by physical gold. However, our issue with holding gold directly is that it does not produce any return or income. Instead, we believe that an actively managed portfolio of gold producers should give exposure to the benefits of owning gold, plus the potential profits from operating the gold mines.

One problem with our approach is that historically, gold miners have had a poor track record of capital allocation. Often, the sector expands or acquires new assets at boom time prices and then suffers the consequences when the inevitable fall in gold price happens. By investing through the Baker Steel Gold Fund, we seek to limit this risk. The Baker Steel team are precious metal specialists, with a focus on selecting the best capital allocators within the sector.

Baker Steel Gold Fund Performance

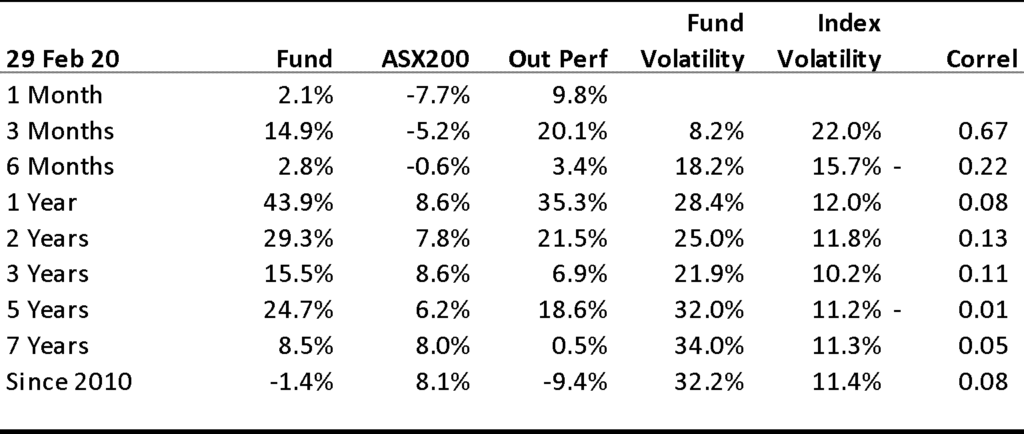

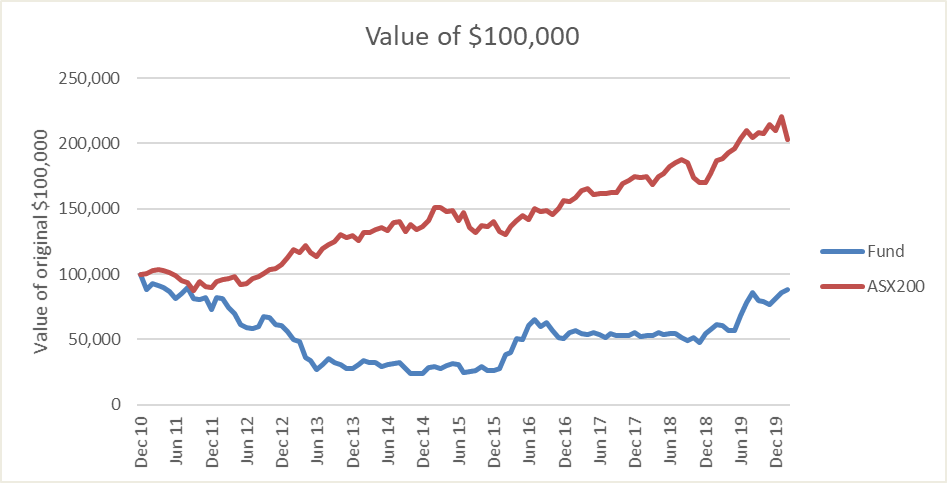

The following graphs show the performance of the Fund versus the ASX 200 since 2010. Note that the ASX 200 is not the correct index to assess the performance of the manager. However, since we invest in this fund as a portfolio diversifier, we find it useful to evaluate the Funds’ performance against the ASX 200 as it has the most influence over the Affluence Investment Fund returns.

We don’t expect always to be invested in gold, or at least not with the same allocation. We first invested in the Baker Steel Gold Fund in late 2015, which was a low point for both gold and gold producers. From that date until February 2020, the investment has returned over 33% per annum. This makes it one of the best performing investments in the Affluence Investment Fund.

It is evident from the above that the past five years has been an exceptional time for investing in gold and gold producers. This was preceded by a long period of abysmal returns for the sector. The Fund has also demonstrated over time that it has much higher volatility than the ASX 200 Index. Over long periods it has no correlation with ASX200 returns.

The above graph shows that while returns can be very high over short periods, it lagged significantly from 2010 to 2015.

Why we like the Baker Steel Gold Fund

Gold has been sought as a store of wealth for centuries. Its rarity continues its appeal, especially during and following times of crisis. As mentioned earlier, we prefer to get exposure to gold through producers rather than holding physical gold, as it hopefully produces income over a cycle from the minim activities.

Baker Steel are specialist managers who we believe are very well qualified to manage this strategy. Their performance has substantially exceeded their benchmark, the FTSE Gold Miners Index (AUD) since inception.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for the Baker Steel Gold Fund:

1. Commodity Price

Ultimately gold is a commodity. Therefore, a producer or investor will be impacted by the price of the commodity. Unlike a company that producers goods or services that can be differentiated, gold prices are somewhat unpredictable, being driven as much by human emotion as by fundamentals. Gold can rise quickly, making money fast for those who have exposure to it. However, all investments are cyclical, and the opposite is also true at some point. We prefer to own gold when fundamentals are strong (such as in late 2015, following a period of inferior returns) and also when growth asset valuations are very high. At other times, we may have no exposure at all.

2. Gold producer quality

There has been a lot of value destroyed in the sector by poor capital allocation decisions by company management. While this is a risk with investing in any equities, it appears to be amplified with gold producers. Baker Steel manages this risk well by assessing management skill as a critical component of their research.

3. Volatility and unpredictability

Gold prices can change relatively quickly. Gold equities can be even more volatile. We seek to minimise these risks by limiting the amount of the portfolio exposed to gold prices, and by doing so only in circumstances where we feel there is absolute or relative value. This tends to occur after a period of poor returns (such as in 2015) when we think growth assets are particularly overvalued or after a period of market dislocation, where demand for “safe haven” assets lingers.

Conclusion

The Baker Steel Gold Fund has been a strong performer for the Affluence Investment Fund. At times when equities and other growth assets have struggled, this Fund has tended to help by producing positive returns. However, investing in any commodity is more unpredictable than most other types of investments, and this must be considered when making buy and sell decisions.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager Profiles.

Find out about our Affluence Investment Fund.

View the Affluence Investment Fund Portfolio.

Disclaimer

This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.