More about Affluence

Affluence was founded in 2015 with the aim to provide better investment solutions.

Throughout our years working in the Investment industry we learned several key lessons:

- The average returns delivered to investors by the wealth management industry are not great;

- The larger the fund manager and the more money they manage, the harder it is to beat the averages (around 90% fail to do so after fees);

- Many of the best managers are out of sight, or not able to be accessed by the average investor.

- Alignment between a fund manager and their investors is crucial.

The average outcomes being delivered to investors in Australia are not acceptable. A short term focus results in a lack of awareness of investment cycles and poor decision-making.

Investor returns over the long term have been very poor, particularly after the impact of fund manager fees, personal advice fees and administration costs. Most managed funds do not outperform a fair benchmark, resulting in a worse performance than simply investing in a market index through a low cost ETF or managed fund.

In addition, many investors have very poor diversification, which can result in increased risk. Some investors do achieve adequate diversification, but only by investing in some assets which are almost guaranteed to deliver exceptionally low returns.

There are some fantastic investment funds and managers out there. However, many remain relatively undiscovered or have high minimum application amounts which limit the ability of many to invest with them.

The small number of managers and funds who can outperform over the long term tend to have several characteristics in common. At Affluence, we believe in identifying those managers and combining them in diversified portfolios that have the potential to lead to a much better investment outcome.

We pride ourselves on the quality of our products and alignment with our investors. We co-invest in each of our Funds. We charge no up-front or ongoing fixed fees for managing our Funds. Instead, we charge a performance fee, based on the total positive returns of the Fund.

Read on to learn more about our Investment Philosophy and Process.

Investment Objective and Process

Affluence Funds are focused on Investor outcomes.

All of our Funds target;

- Better than average returns – over 3 years or longer

- Regular Income – at least 5 % per annum, paid monthly or quarterly

- Smoother returns – to help limit the impact of market downturns

To achieve this, we continuously screen potential investment opportunities to unearth what we believe to be some of the best investment funds and managers available in Australia.

We aim to ensure that each fund manager we invest is capable of providing above average long-term returns with lower than average volatility.

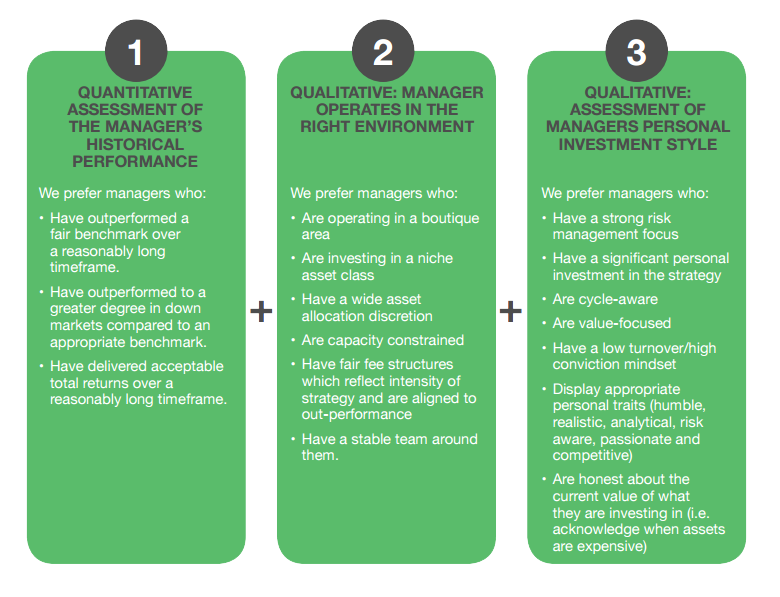

We have a number of key criteria we look for when assessing potential managers and funds. These are outlined below.

Not every manager meets all of these criteria, but they are common to many of the best managers and funds we have reviewed.

Investment Philosophy

Our investment philosophy is designed around these core investment values.

- To achieve better than average results, you must invest differently.

- Value investing can deliver excellent long-term returns.

- Investing in markets where there is less competition makes it easier to achieve above average results.

- Being aware of long-term cycles and seeking to time investments can significantly improve performance.

- A focus on lowering volatility of returns through diversification provides comfort for investors.

- Long-term success requires a long-term focus, which in turn requires patience and discipline.

- We have a strong value and contrarian focus. While our Funds will hold many investments that pursue different strategies, it is likely the portfolio will always have a bias towards value investing.

What It Means For You

Affluence offer four Funds that include access to a diversified mix of quality investment managers and other opportunities. We cast the net very wide – looking across both listed and unlisted funds, those available to everybody and those available only to a select few. Our process reduces over 10,000 investment opportunities available in Australia to a short list of less than 200. From this, we construct portfolios of 20-35 investments for each of our Funds.

You can view these portfolios and receive information on the funds and the managers we invest with as well as regular educational content, by registering as an Affluence Member.

By investing as little as $20,000 in our Affluence Income Trust, Affluence Investment Fund, Affluence LIC Fund or Affluence Small Company Fund you can access all the investments that Fund makes.