“There was once a time, perhaps, when unprecedented things happened only occasionally. In today’s financial markets, unprecedented things are commonplace. The Queen in Lewis Carroll’s ‘[Alice] Through the Looking-Glass’ would sometimes believe as many as six impossible things before breakfast. She is probably working in the bond markets now, where believing anything less than twelve impossible things before breakfast is for wimps.”

Tim F Price, PFP Wealth Management

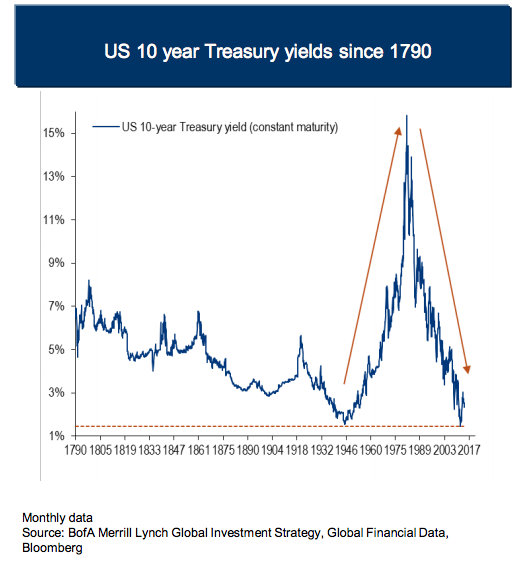

We read a lot of market information and commentary here at Affluence. Much of what is out there is mundane, boring even. Tim Price, luckily for us, is not and his regular articles normally also contain a hint of humour to help get us through the day. The quote above from Tim has rather succinctly summed up the current problem with Bond markets worldwide. The picture below, courtesy of ftalphaville and others, also perfectly explains the situation.

We are, to put it mildly, in interesting times. Bonds around the world are trading at never before seen yields in most cases. The only other time we have come close, at the end of World War 2, was followed by an unbelievable spike in yields for the next 40 years. You have been warned! There are two important takeaways from the current situation.

Firstly, bonds such as US Treasuries (promises to pay issued by the US Government), are supposed to offer risk free returns, although Bond guru Bill Gross in recent years has referred to them as delivering “return free risk”. The supposedly risk free characteristic of Government bonds means the price of every other traded investment on the planet is referenced back to yields on government bonds such as US Treasuries.

In theory, an investment’s return should be the sum of the required investor return due to an investments’ specific risk characteristics, plus the risk free rate. Thus if the risk free rate today is 4% lower than it was 8 years ago, it therefore follows that every investment on the planet, at least in theory, should carry a total return 4% lower than it was 8 years ago. In many cases that is what has occurred. Certainly, for example for term deposits.

And that is why, in a nutshell, almost every investment on the planet is trading at a relatively high value. Not because world economies are going well. Not because profits are growing at a great pace. But because the key reference point, risk free bonds, are trading at (almost) never before seen low yields.

It is a huge global financial experiment that may well continue to go on for years. We have no idea how it will turn out, but it will end at some time in the future and may end very badly. In any event, we must recognise when evaluating any investment in this environment that there is a very good chance bond yields will be substantially higher in the next few years than they are now, and we must factor that risk into our assessment of value.

The second problem with bonds is, in our opinion, you would have to be quite mad to invest in most of them at today’s yields. Income of less than 3%, locked in for years into the future are not attractive. You could argue that the trend for yields in the past 30 years has been down and therefore bond values can still go up if yields fall further. But that, to us, sounds like the greater fool theory at work. We do not like to own any investment that requires the continuation of an unhealthy trend to make a reasonable return.

The bond conundrum also gives rise to a related problem. How do you properly diversify your portfolio if the one thing that has been used successfully for the past 40 years to protect you against falling stock markets, is no longer an attractive proposition?

The answer is not an easy one, and investment professionals the world over are currently struggling with it. Our answer is to make sure we are a careful investor in stocks – via a few managers who are still able to find quality companies at reasonable prices in an overpriced market. Such stocks should go down less than the market if it corrects. Combine this with some cash, some property and other assets which don’t necessarily move together with stocks and maybe a little bit of portfolio insurance to help cushion any big corrections, and you have a combination that should get us through pretty much anything. Which is good, because pretty much anything could come our way in this environment!