The rise of debt LITs

There are now eight debt focused Listed Investment Trusts (LITs) on the ASX. They have a combined market cap of $4.7 billion. Debt-based LITs are a relatively new product for Australia, with Metrics Credit Partners launching the first for the ASX in October 2017. From that initial raising, the number of managers and the size of the sector has expanded rapidly.

As the name suggests, debt LITs are listed trusts that invest in debt and fixed interest instruments. These instruments include high-grade corporate debt, lower quality global junk bonds and direct loans to borrowers. They range widely in potential returns and the level of risk.

Before the market crisis began in February 2020, the whole sector was sold based on consistent income to investors, with many paying monthly distributions. Different LITs offer higher or lower target returns. It seems that investors did not have a deep understanding of the differences in strategy and the underlying portfolio of each trust. Instead, they viewed all the products as a higher yielding alternative to quality government and corporate bonds. It appears most investors also did not understand the risks to which they were exposed.

Until February, these debt LITs virtually always traded at either their NTA or a small premium to NTA. This made secondary capital raises in the sector very attractive, as most investors had had a positive experience. This led to many follow-on capital raisings after the initial IPO. There is a reasonable argument that the payment of stamping fees to brokers and advisors was a significant factor in raising this capital. As these fees have now been banned, and the whole sector is trading at a discount to NTA, it is difficult to see any new capital raisings in the short to medium term.

Who are these LITs?

The individual LITs invest in very different underlying debt instruments. They vary by debt/borrower quality, underlying asset type, structure, geography and risk profile.

The following table provides a high level of summary of the eight ASX debt LITs.

They all share a common investment objective of producing consistent income for investors, and some level of capital growth. The following table summarises the distribution and total return objectives for each:

In the search for a cash yield, investors and their advisors loved the concept of secure monthly income. Of course, the higher the target yields, the more attractive the opportunity. What people failed to appreciate is that there is no such thing as a free lunch. The LITs above are sorted by their total return objective. Some debt LITs were targeting a return of the RBA cash rate plus 3.5%. Others were targeting returns of 8% plus.

Financial markets are quite good at ensuring there are no risk-free arbitrages most of the time. Therefore, the only way to achieve a higher return is to take more risk. When markets and economies are stable, more risk very often means higher returns. However, when trouble strikes, the consequences of taking that extra risk become apparent.

Performance of LITs

Right now, is an interesting time to assess the performance of these trusts. Until February 2020 all was going swimmingly for this group. They had the full support of the investing public and were mostly performing to expectations.

However, the Coronavirus crisis highlighted two aspects that perhaps the investors did not appreciate. Firstly, just because the trusts invest in fixed interest instruments does not mean that the underlying portfolios can’t fall materially (and potentially more than equity markets). And secondly, as with any other listed security, there is no reason the traded value of the units must equal the underlying NTA. These two factors combined in March to create some significant losses for investors.

We have analysed this performance in two ways.

Underlying Portfolio Performance

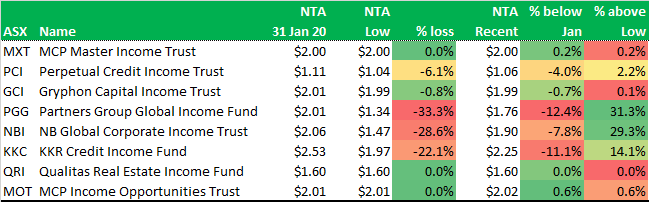

Firstly, we have looked at the underlying portfolio performance of the LITs. This is based on the published NTAs by the managers. For this analysis, we have excluded any distributions paid. However, these are not material to short term returns. We have used the NTA at 31 January 2020, before the crisis hit markets, as a starting point. We have compared this to the lowest published NTA during March and April.

The results highlight to investors the risks in each strategy. The two Metrics vehicles, and those from Gryphon and Qualitas, are conspicuous by the stability of their NTA. This is due to these four trusts investing in direct loans which are mostly not traded on any exchange or formal secondary market. For valuation purposes, if the underlying debts are not in default or the borrower not subject to any known difficulties, the loan continues to be carried at its original cost.

The other four trusts which invest in traded debt securities, and thus their valuations are “marked to market”. The results, particularly for PGG, NBI and KKC at their low point, demonstrate falls in NTA that are in some cases more severe than those suffered by equity markets.

This is why understanding the exact assets being invested in, and the strategy is so important. The fall in NTA of the traded credit funds does not necessarily indicate that they have more risk than the direct loan trusts. It just means that the valuation process is different. For example, we would estimate that the underlying risk profiles of both MOT and KKC are similar. However, the difference in the valuation process could lead investors to believe otherwise.

Share Price Performance

Understanding the underlying portfolio strategy and performance is essential. But what investors experience is the price they can trade the investments for on ASX (share price).

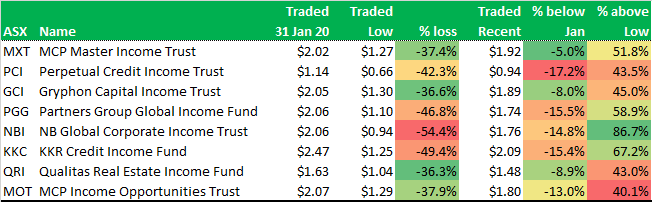

The below table uses the same methodology as the portfolio performance. However, instead of looking at NTA, we use the closing share prices for each LIT. We acknowledge that in most cases, these LITs traded at the low prices very briefly and only on small volumes.

High quality corporate debt versus junk bonds. Private versus traded debt. Stable versus falling NTAs. As it turns out, investors were not too concerned and sold everything indiscriminately. The share prices were a combination of declining NTAs (implied for the private debt vehicles) and a blow out in discounts to NTA.

There was a massive opportunity for investors during the worst of the crisis to purchase these LITs at exceptional prices. They represented outstanding potential risk-adjusted returns, relative to equities. Within our portfolio, we had a holding of less than 3% in these LITs leading into the crisis. During March and April, we increased our holding in them to almost 10%. We believed the risk was low. Their prices implied considerable defaults across the portfolios, which we did not think was justified. As the prices recovered and the discounts to NTA reduced, we sold down our holdings, making excellent returns in only a couple of months.

Lessons for Investors

While the worst of the losses have been reversed as both debt and equity markets have staged dramatic recoveries, all eight of the debt LITs are still trading at discounts to their current NTA. They all remain below their IPO prices to varying degrees.

Perhaps the investors that purchased these LITs at IPO did not fully understand what they were investing in, or the potential drawdown risk to which they were exposed. We are not suggesting that these LITs do not have a place in portfolios. But, investors need to understand the risks. Here are three lessons to bear in mind.

1. Understand the Strategy

These LITs were sold at IPO as a way of generating monthly income, and as an attractive fixed interest yield compared to other cash options. But investors did not necessarily understand how and from what these returns were generated. For example, the KKR Credit Income Fund (KKC) seeks to earn additional returns through investing mainly in non-investment grade credit (aka junk bonds). There is nothing wrong with this strategy. But it comes with increased risks and a higher potential for loss. On the more conservative side, the Perpetual Credit Income Trust (PCI) has a higher allocation to investment-grade credit and seeks to achieve a much more modest return. Investors in these LITs need to be able to distinguish between the various strategies and asset classes that they invest in, and not just view the entire sector as “fixed income” as there are vast differences between them.

2. Discounts to NTA

It is usual for most equity LICs (and LITs) to trade at persistent discounts to NTA. It appears that the strong run that debt LITs had since MXT listed in October 2017 had convinced investors that these vehicles would always trade around NTA. Given the stability in trading prices, it made raising new capital for new and existing LITs much more straightforward as there was no opportunity to purchase the existing LITs cheaper on the market.

The recent crisis appears to have shattered that illusion. All eight LITs now trade at discounts to NTA. Many different factors influence the price a security trades at, compared to its NTA. It is complicated to determine what the “normal” discount might be moving forward. During the crisis, the discount to NTA for some of the LITs blew out beyond 40%. Currently, the majority are trading at a discount of less than 10%. This is, on average, a smaller discount than their equity LIC cousins. This makes sense, given the relative risk/return/distribution profiles.

We should not assume that they will all recover to trade at NTA once markets settle down. There are many equity LICs that trade at constant discounts to NTA, and only a few that trade at NTA or better. However, these LITs have shown little in the way of resilience in a crisis. This is something that must be remembered in the future.

3. The Risks of IPOs

There have been relatively few occasions when it makes sense to purchase an LIC or LIT at IPO, especially if you are likely to be a passive investor. Most times, within the first year after listing, there is an opportunity to purchase the new IPO offering at a lower price than its listing price. However, this was generally not the experience with the debt LITs before February 2020. Until then, they mostly traded at NTA or a small premium, and their NTAs were very stable.

Now that the illusion of debt LITs always trading at NTA has been shattered, it is unlikely they will all revert to around NTA. Combined with the banning of stamping fees for new LIC or LIT capital raises, it is difficult to see any new debt LITs being launched in the foreseeable future. And even if one does come to market, investors would need a strong reason to participate in the IPO while existing LITs continue to trade at a discount.

Conclusion

There are arguments in favour of holding some of these debt LITs in investors portfolios. While they differ markedly in their strategies and risk levels, they mostly meet their core requirement of producing consistent income. It is up to investors to understand the specific asset class that each invests in and realise that the convenience of being a listed security means that at times the traded value can deviate substantially from the underlying NTA.

We hope that was helpful. If so, here are some other things you might like.

Learn more about ASX Listed Investment Trusts.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Affluence LIC Fund.

View the Affluence LIC Fund Portfolio.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.