Hi,

Welcome to 2022!

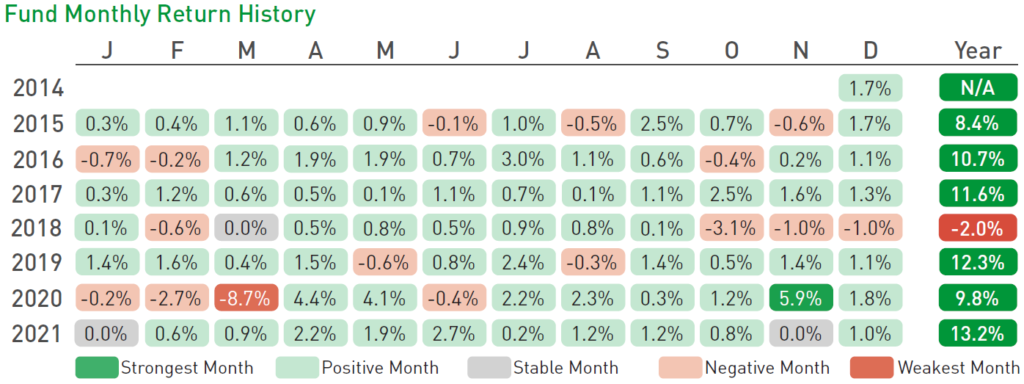

All our funds delivered positive returns in December, capping off a good year and helped by continuing buoyant asset markets. In calendar 2021 the Affluence Investment Fund returned 13.2%, the Affluence LIC Fund 19.6% and the Affluence Small Company Fund 21.0%. Pleasingly, all three Fund returns for the year were well in front of their benchmarks. Read more in the latest fund reports, which you can access below.

Given the very good run in 2021 and current market conditions, we have further reduced our market exposure in all funds. We don’t believe the potential returns on offer are substantial enough to put more capital to work right now. US equity markets remain a whisker away from all time highs, and Australia is within a couple of percent as well. As we have mentioned before, the main driver of markets in recent years has been zero interest rates set by world central banks. We think this is now changing.

All our funds already own a range of assets we feel are cheaper than they should be. That doesn’t mean they won’t be affected in a market correction. But it does mean that over a 3-5 year period, prospects for making decent investment returns continue to be positive. If we do see a correction, we will have the capacity to take advantage of the opportunities that we find. But if markets continue to rally upwards relentlessly, it is likely that our performance will lag. It’s a trade-off we are prepared to make.

If you would like to invest this month, Affluence Investment Fund applications close on 25 January. Investments will be effective 1 February, with confirmations emailed about a week after that. Go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds. If you have any questions or want to give us some feedback, you can reply to this email or give us a call.

Read on to discover some things we found interesting this month, including the increasing dominance of very large companies, the best review of 2021 ever, what might happen next in financial markets, giant penguins and a vodka emergency.

Regards.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 1.0% in December. Since commencing in 2014, returns have averaged 9.2% per annum, including distributions of 6.7% per annum. At month end, 59% of the portfolio was invested in unlisted funds, 14% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 14% in cash.

The cut-off for monthly applications and withdrawals is 25 January.

Affluence LIC Fund

The Affluence LIC Fund returned 1.7% in December. Since commencing in 2016, returns have averaged 14.0% per annum, including quarterly distributions of 7.6% per annum. The average discount to NTA for the portfolio at the end of the month was 13%. The Fund held investments in 26 LICs (72% of the Fund), 4% in portfolio hedges and 24% in cash.

The cut-off for monthly applications (existing clients only) and withdrawals is 31 January.

Affluence Small Company Fund

Our contrarian Fund holds a range of small cap exposures with a distinct value focus. Since commencing in 2016, returns have averaged 10.8% per annum, including distributions of 6.8% per annum. At the end of December, the Fund held 8 unlisted funds (50% of the portfolio), 7 LICs (17%) and 6 ASX listed Small Companies (19%). The balance 14% was cash and hedges.

The cut-off for monthly applications (existing wholesale clients) and withdrawals is 25 January.

Access to over 25 talented fund managers

The Affluence Investment Fund provides access to a manager set that is simply impossible to replicate. Around 36% of the portfolio is in underlying funds that are currently closed to new investors. A further 22% is allocated to funds that are only available to wholesale investors.

With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

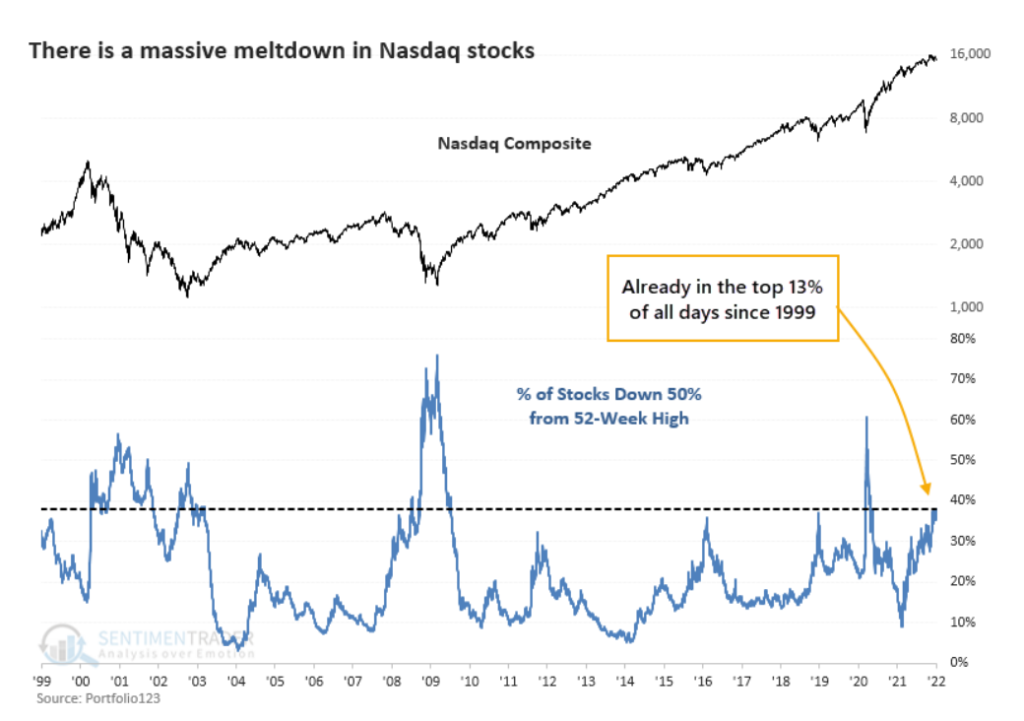

The chart below is a bit complex, but it shows an interesting situation brewing in the tech heavy Nasdaq Index. According to research from Sundial Capital, as of early January, nearly 40% of companies in the Nasdaq Index were trading at less than half their 52-week highs. Many more constituents are showing losses, but less than 50%. In fact, the entire index is being propped up by a few mega-cap tech stocks.

When this has happened previously, it hasn’t been a good sign for growth stocks. As one fund manager recently said, “…we are wary of times when the generals lead but the soldiers don’t follow.” We’ll continue to stick strongly to our value bias for now.

Quote of the month.

“The “market” as referred to via conventional indices, is increasingly dominated by a small group of six large US companies – Alphabet (was Google), Amazon, Apple, Meta Platforms (was Facebook), Microsoft and Tesla.

Last year, this group, which trades on an average P/E of about 36x (triple that of our portfolio) returned an average of 41%/47% (in US$/A$) and now has a combined market capitalisation of US$11.5 trillion – more than any stock market outside the US, including Shanghai, Tokyo or London (as at 31 December 2021).

Three of these companies – Apple, Microsoft and Alphabet were each individually worth more than all listed Australian businesses combined.”

Platinum monthly report, 10 January 2022.

Quote of the month 2.

“It feels a lot like the early 1970s, when we had the Nifty Fifty stocks: The broad market was being held up by around 50 large cap stocks, like IBM or Xerox. These companies were seen as the best of the best, they were not being impacted by inflation because of their pricing power, and every money manager sheltered there.

Their valuations rose to crazy levels. In the end, the rise in labor costs broke their back and the bubble burst.

“Louis Gave, of Gavkal Research, discussing current markets. This is taken from a recent interview about what might happen in markets over the next few years. It’s an excellent summary, and seems like the most likely way, in fact probably the best way, that this could all play out (with the exception of the view on Chinese debt, which we have no idea about).

The full interview is available here.

The year that was…2021.

“Science could not make up its mind about masks, especially in restaurants. Should everybody in the restaurant wear them? Should only the staff wear them? Should people who are standing up wear them, but not people who are sitting down, which would seem to suggest that the virus can also enter our bodies via our butts?

We still don’t know, and we can’t wait to find out what the Science will come up with for us next. Anyway, our point is not that 2021 was massively better than 2020. Our point is that at least it was different. A variant, so to speak. And like any year, it had both highs and lows.

“Taken from the best review of 2021 there will ever be, courtesy of Dave Barry. The whole thing, which is quite a long read, is here.

This day in (financial) history.

January 1956. The Ford Motor Company, had its IPO on 17 January 1956. The company was founded by Henry Ford in 1903. Initially, Ford was entirely owned by Henry Ford and a small group of local investors.

In 1919, Henry Ford bought out the investors and until 1956, all stock in the company was owned by members of the Ford family, the Edison Institute and the Ford Foundation. But after Henry Ford’s death in 1947, the Ford family and Ford Foundation decided to raise money by going public. We’re not sure Henry would have agreed with that move.

January 1974. Several Arab gulf nations doubled the price of their oil exports overnight, leading to recessions, inflation and the formation of OPEC. It also meant big changes, as nations moved to reduce their dependence on imported oil through various means.

January 2009. Zimbabwe unveils the 100 trillion dollar banknote. It would be the highest denomination banknote in the history of money. By the end of February 2009 it was worth 31 cents in U.S. dollars.

Amazing facts.

OK, maybe they’re not amazing. But you can still enthrall your friends at parties with these at-least-vaguely-interesting facts:

- Sphenopalatine ganglioneuralgia is the medical term for ice cream headaches.

- Alexander Graham Bell, who invented the telephone in 1876, suggested answering calls with “ahoy.”

- Scientists think that the largest blue whales probably weigh up to twice as much as the largest dinosaur that ever lived.

- Bones found at Seymour Island indicate that 37 to 40 million years ago, penguins were 6 feet tall and weighed over 100kg. But they still couldn’t walk properly.

- Citizens of the Soviet Union began celebrating the end of World War II as soon as it was announced. Less than 24 hours later, the entire country was out of vodka.

Source: mentalfloss.com

And finally…just for laughs.

The annual Australia Day lamb ad has just dropped. Here it is.

If you enjoyed this newsletter, forward it to a friend.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.