Hi,

Happy New Year. We hope you’ve had a great start to 2023.

December was a tough month for markets to round out a tough year. Despite that, our three funds did relatively well, to end the year almost flat. As always, detailed fund reports can be accessed below.

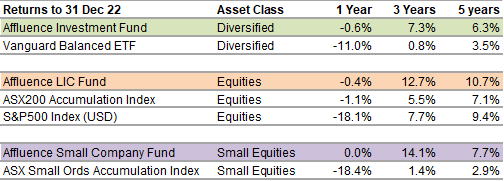

Looking over longer periods, here is our performance for all three funds vs an equivalent index or ETF.

Below is a link to our 2022 investor letter, where we look at what happened in investment markets, how our Funds performed, and how they’re positioned for 2023.

In other news, we’ve been working on a project to refresh and update our website for quite some time. In December, thanks to a big effort from Melynda and the team at Web 3, we finally launched it. Feedback is welcome. Don’t be shy.

Keep reading to learn about some other things we found interesting this month, including earnings forecasts, office occupancy, the Salad Oil Scandal and Galileo’s middle finger.

Should you wish to invest this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Wednesday 25 January. Applications for the Affluence LIC Fund close Tuesday 31 January. Go to our (new) website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund decreased by 0.3% in December. Since commencing over eight years ago in November 2014, the Fund has returned 7.9% per annum, including monthly distributions of 6.5% per annum.

At month end, 60% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 12% in listed investments, 1% in portfolio hedges and 11% in cash.

The cut-off for monthly applications and withdrawals is Wednesday 25 January.

Affluence LIC Fund

The Affluence LIC Fund decreased by 0.4% in December. Since the fund commenced over 6 years ago, returns have averaged 11.7% per annum, including quarterly distributions of 8.2% per annum.

The average discount to NTA for the portfolio at the end of the month was approximately 17.3%. The Fund held investments in 27 LICs (72% of the Fund), 3% in portfolio hedges and 25% in cash.

The cut-off for monthly applications and withdrawals is Tuesday 31 January.

Affluence Small Company Fund

The Affluence Small Company Fund decreased by 1.0% in December. Since commencing in 2016, returns have averaged 9.1% per annum.

The Fund held 8 unlisted funds (57% of the portfolio), 8 LICs (15%) and 7 ASX listed Small Companies (23%). The balance 4% was cash and hedges.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Wednesday 25 January.

Annual Investor Letter

In our review of 2022, we look at what happened in investment markets, how our Funds performed, and how they’re positioned for 2023.

Things we found interesting

Chart of the month.

This chart shows 2022 growth in earnings per share for listed companies in various markets, plus current forecasts for 2023 and 2024.

The forecasts for the US seem overly optimistic, given higher interest rates and the slowdown/recession that many of the economic leading indicators tell us is on the way. Forecasts for Australia seem much more reasonable.

Chart of the month 2.

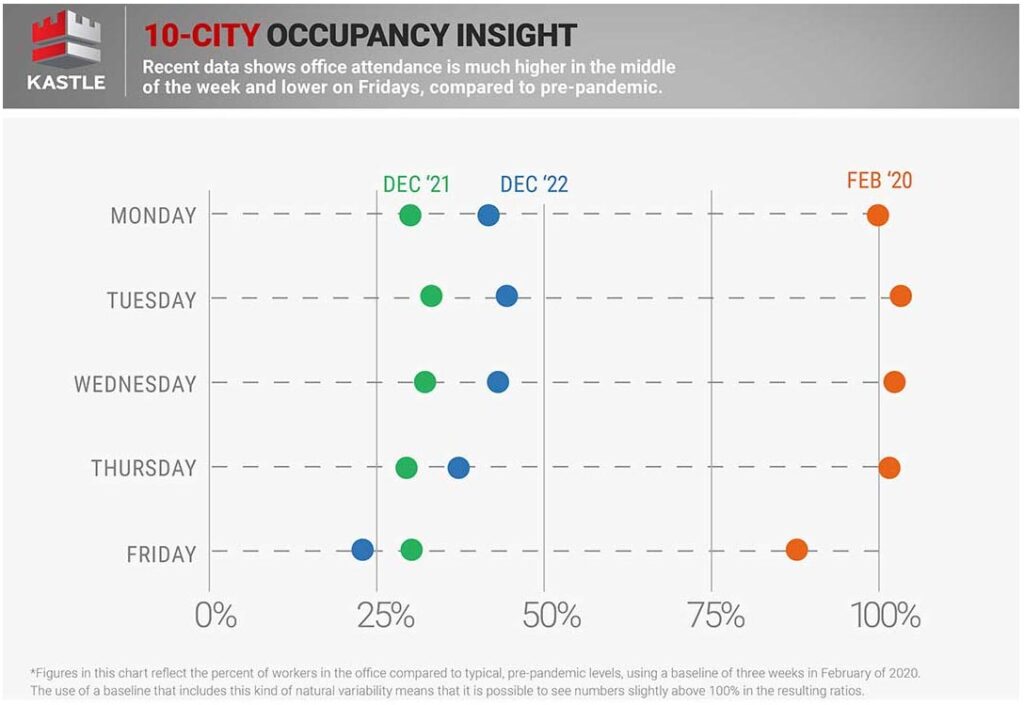

Here we can see the impact that the work from home trend has had on office occupancy.

This is US data, using pre-pandemic occupancy as a baseline. We can see that there are somewhere between one quarter and half the number of people in offices on a typical workday than there were in February 2020. Predictably, Fridays have the lowest office attendance record. There has been some improvement over the past year, but it feels like it will take a long, long time for the number to get back to early 2020 levels. Trends in Australia are similar, although occupancy rates have recovered more here than in the US.

On the plus side, all this working from home is definitely saving us some time. A report out of the Federal Reserve Bank of New York estimates that working from home saves 60 million hours every day that otherwise would have been spent on commuting.

This month in (financial) history.

On this day in 1963, American Express subsidiary American Express Warehousing declared bankruptcy after inspectors exposed a fraud scheme orchestrated by commodities trader and con man Anthony De Angelis.

De Angelis and his company Allied Crude Vegetable Oil company obtained a contract with federal program Food for Peace, which was in charge of selling excess U.S. food stocks to poor countries. De Angelis posted 1.8 billion pounds of soybean oil as collateral for $180 million in loans. In reality, Allied had only about 110 million pounds of oil. Allied would trick inspectors in multiple ways, including filling cargo ships mostly with sea water and floating a few feet of salad oil on top. When inspectors audited Allied’s facilities, the company would transfer the same oil stock from tank to tank to fool the inspectors while entertaining them during lunch.

The Salad Oil Scandal was only exposed when there was a problem with the Russian soybean market, and soybean prices fell drastically as a result. The lenders attempted to cash in the supposed 1.8 billion pounds of Soybean oil, only to discover they were a few hundred million pounds short.

The Salad Oil Scandal drove the American Express stock price down from $60 to $35. An opportunist investor swooped in and invested about 25% of his assets at the time into American Express shares, which were back up 150% within four years. That investor was none other than Warren Buffett.

Vaguely interesting facts.

Foreign Accent Syndrome is a rare side effect of brain trauma. Affected patients still speak their native language, but in a foreign dialect.

Ravens in captivity can learn to talk better than parrots. Intelligence tests rate them at a similar level to chimpanzees and dolphins.

A British man changed his name to Tim Pppppppppprice to make it harder for telemarketers to pronounce.

Galileo’s middle finger is on display at the Museo Galileo in Florence, Italy.

We have no idea why. The world’s entire spider population weighs around 25 million tonnes. *

Source: mentalfloss.com, wikipedia.com.

* Bonus fact. It has been estimated that the world’s spiders consume somewhere between 400 and 800 million tonnes of biomass each year consisting almost entirely of creepy crawlies, plus a few lizards, snakes, frogs and bats. That’s around twice the combined weight of all the world’s adults.

And finally…

How common are dogs with human names? Or humans with dog names? Glad you asked. The Washington Post explored the names of 61,000 dogs available for adoption on the Petfinder website and compared them with baby names stretching back to 1880. If your name is Emily, you’re almost certainly human. Rover? 100% dog. Jack? See below.

Now we know what you’re thinking. You really wish you could test out your name and see the results. As always, we’re here to help. You can do it here.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.