Happy New Year from all of us at Affluence.

All funds delivered positive returns in December, despite hefty falls on most equity markets. You can access the latest fund reports below.

In our latest Investor Letter we review fund performance in 2024 and examine how our portfolios are positioned for 2025.

Should you wish to invest this month, head to the invest now page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 February.

As always, thanks for reading and for your continued interest in what we do. We wish you all the best for the holiday season and a Happy New Year.

If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

December 2024 Reports

Affluence Income Trust Report

The Affluence Income Trust returned 0.6% in December and has delivered 7.9%per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.5% per annum.

Affluence Investment Fund Report

The Affluence Investment Fund returned 0.4% in December. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.7% per annum.

Affluence LIC Fund Report

The Affluence LIC Fund returned 0.2% in December and has delivered 10.9% per annum since commencement. At the end of the month, the average portfolio NTA discount was close to all time highs at 25%.

Affluence Small Company Fund Report

The Affluence Small Company Fund returned 0.9% in December. The Fund performed reasonably in 2024 with a 12.0% total return, outperforming the ASX Small Ords Index which increased 8.4%.

Investor Letter

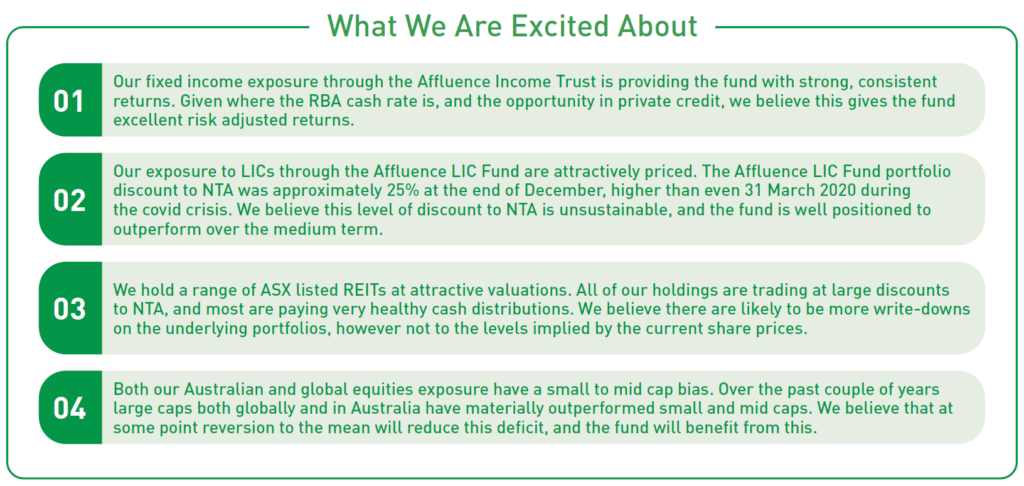

In our review of 2024, we look at what happened in investment markets, how our Funds performed, how they’re positioned for 2025 and where we think the opportunities are. It’s everything we would want to know, if we were you.

Things we found interesting

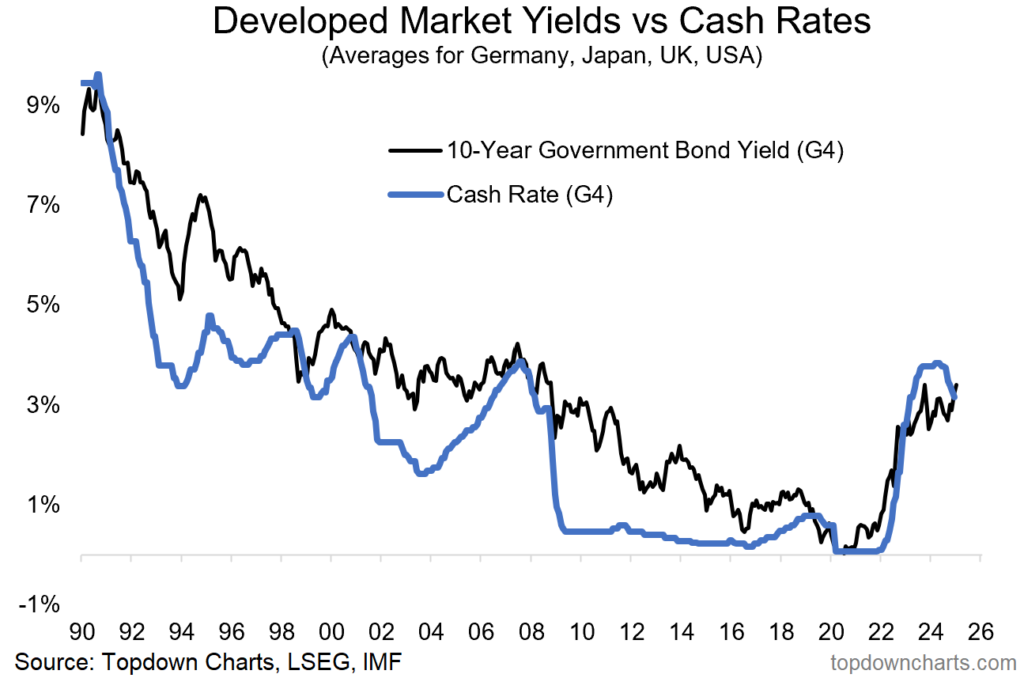

Chart of the Month.

Something weird is happening with interest rates.

Cash rates in many countries (though not Australia yet), are falling. But yields on longer term bonds (in this case, 10 year bonds), are rising. That’s quite unusual. It reflects a tug of war going on at the moment between bond investors and Governments. Many countries, including the four in the chart above, are running large budget deficits. Those deficits are showing no signs of reducing, and they’re certainly not turning into surpluses. And their debt, as a percentage of GDP, is getting to the point where bond investors are starting to wonder whether they need a risk premium to reflect those higher deficits and debt levels, particularly for longer term bonds.

We have seen periods in the past, where long term bonds have traded at 1-2% premiums to cash rates. Could we see this again? It’s possible. Which makes it tricky to invest in long term bonds right now for those nations with high debt to GDP ratios. Taking the so called “duration risk” associated with 10 year US treasuries, and other similar bonds, is a difficult call to make. A 1% change in yields for a 10 year bond means the holder makes, or loses, up to 10% of the Bond’s value. Not what most people expect from supposedly “risk free” investments. In Australia, the situation is much more benign. While we’re not exactly balancing the books, Australia’s Federal Government debt levels are not yet a concern. So if we measure risk by looking at the potential range of outcomes that are possible (both good and bad), we would consider Australian 10 year Government bonds to be much less riskier than their US counterparts right now.

Totally worth it.

The oldest bond in the world turned 400 years old last month, and it’s still paying interest. A flood in the Netherlands in 1624 smashed a dyke in the river Lek, near Utrecht and necessitated raising 23,000 carolus guilders to finance repairs. One of the bonds sold to raise that money was a 1,200-guilder bond sold on December 10, 1624, by Hoogheemraadschap Lekdijk Bovendams (a Dutch water board). The buyer was Ellsjen Jorisdochter, a wealthy woman in Amsterdam. The bond promised the water board would pay out 2.5%pa interest to the bondholder. Forever.

Though the original water board no longer exists, its assets and liabilities (including the 1624 bond) have been passed on to its successor organisations. The bond originally held by Ellsjen was also passed down through the generations. In 1938, one of her descendants sold the bond to the New York Stock Exchange, which still owns it today. Due to the effects of 400 years of inflation and currency changes, the bond only pays out about 13 Euros of interest per year.

Where to dig for share value in 2025

Tim Boreham takes a look at where to find value in 2025 in this Herald Sun article. He spoke with our own Greg Lander and others. The results? Small caps, REITs and LICs are looking good in 2025. We agree.

Financial word of the month.

Security.

A stock, bond or other tradable financial interest in a risky asset. From the Latin securitas, meaning safety. However, an investment security does not ensure that anyone will behave well, least of all the person who owns it.

Among the early uses of security in English, dating back to at least the fifteenth century, was the meaning of property pledged by a person to ensure his or her good behaviour or fulfilment of an obligation. Even today, accused criminals must post security to obtain a bail bond. By the seventeenth century, that meaning had extended to the document in which a debtor promised to repay an obligation – originally a bond. Later, by analogy, it was extended to stocks and other instruments as well. Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Foreign Accent Syndrome is a rare side effect of brain trauma where patients speak their native language in a foreign dialect.

- Blockbuster Video once had 371 stores in Australia alone. Now there is just one left in the entire world.

- The US state of Wyoming covers 25 million hectares, but it contains only 2 escalators.

- Ravens hold grudges for up to a month when they feel they’ve been treated unfairly.

- Google was originally called BackRub.*

Source: mentalfloss *

It was 1996 when Google co-founders Larry Page and Sergey Brin first started experimenting with search engines. They called their invention BackRub because the program analysed the web’s “back links” to understand how important a website was. In 1997, the search engine started to gain some traction and Page and Brin decided they needed a better name. They held a brainstorming session, where a graduate student at Stanford University suggested the word “Googolplex”. Page countered with “Googol”, which is the digit 1 followed by 100 zeroes. The grad student checked to see if the domain name was taken, but accidentally searched for “google.com” instead of “googol.com.” Page liked Google even better, and registered the domain name on September 15, 1997.

And finally…

Thanks for reading. If you enjoyed this newsletter, share it with a friend.

If you are that friend, you can subscribe and see previous newsletters on our insights page.