ONovember returns were mixed in November, in a month where equity markets generally fell.

- +0.5% for the Affluence Income Trust (+7.2% over 1 year).

- +1.0% for the Affluence Investment Fund (+13.6% over 1 year).

- -0.1% for the Affluence LIC Fund (+14.7% over 1 year).

- -0.4% for the Affluence Small Company Fund (+16.8% over 1 year).

More details are in our monthly fund reports, which you can access below.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.5% in November and 7.6% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Income Trust November 2025 Report

Affluence Investment Fund

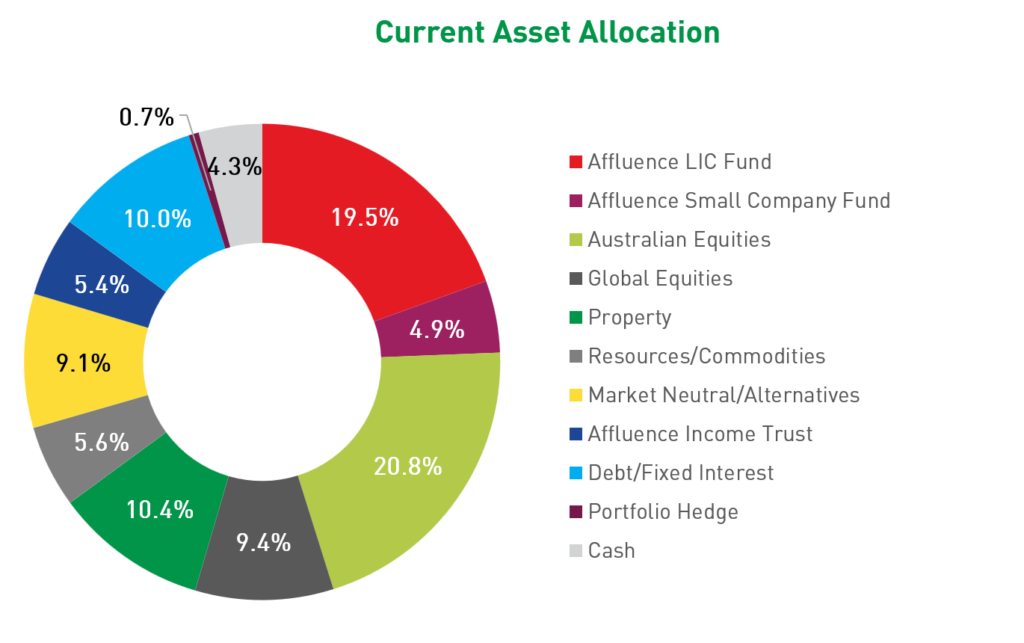

The Affluence Investment Fund returned 1.0% in November and 8.2% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence Investment Fund November 2025 Report

Affluence LIC Fund

The Affluence LIC Fund returned -0.1% in November and 11.4% per annum since commencing. At the end of the month, the average portfolio NTA discount remained near all time highs at around 27%.

Affluence LIC Fund November 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned -0.4% in November and 10.0% per annum since commencing. There’s still exceptional value in many smaller companies.

Affluence Small Company Fund November 2025 Report

Investment Profile

Each month we take a look at an underlying investment in one of our funds. In November, the Affluence Investment Fund allocated some capital to a new unlisted property fund which has acquired a large Brisbane shopping centre and many surrounding properties. The price was attractive, and the strategy provides potential for additional gains. Click below to read more about it.

Fund In Focus

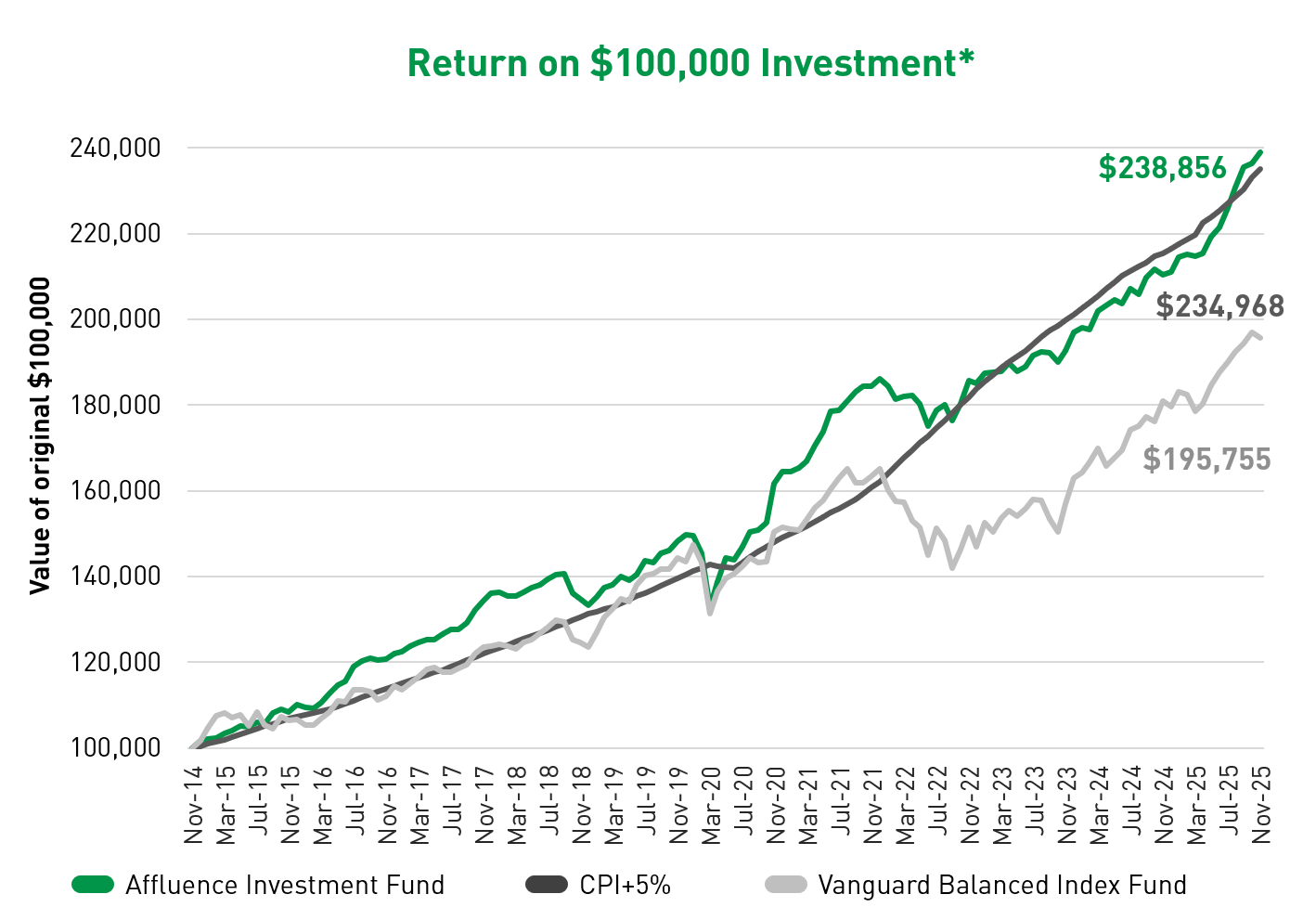

Our Affluence Investment Fund has been quietly delivering results for over ten years.

- Source: Affluence, RBA, Vanguard. Data from commencement of Affluence Investment Fund in November 2014. Returns are not guaranteed. Past performance is not indicative of future performance.

Our investment mandate for the Fund is very wide. We combine a variable allocation to our three specialist funds, with a range of our best investment ideas across all asset classes. The result is an all-weather portfolio that can deliver in differing market conditions, including:

- A blend of defensive and growth assets, with a strong value bias.

- A focus on differentiated investment strategies.

- Access to over 30 underlying managers and thousands of underlying investments.

With monthly distributions and a focus on differentiated investment strategies, the Affluence Investment Fund can be a very useful portfolio diversifier. To find out more, get in touch or head to the Fund page on our website to access all the latest information.

Things we found interesting

Quote of the month.

“If I got this right, we’re smart enough to invent AI, dumb enough to need it, and so stupid we can’t figure out if we did the right thing.”

Comedian Jerry Seinfeld sums up the current situation well.

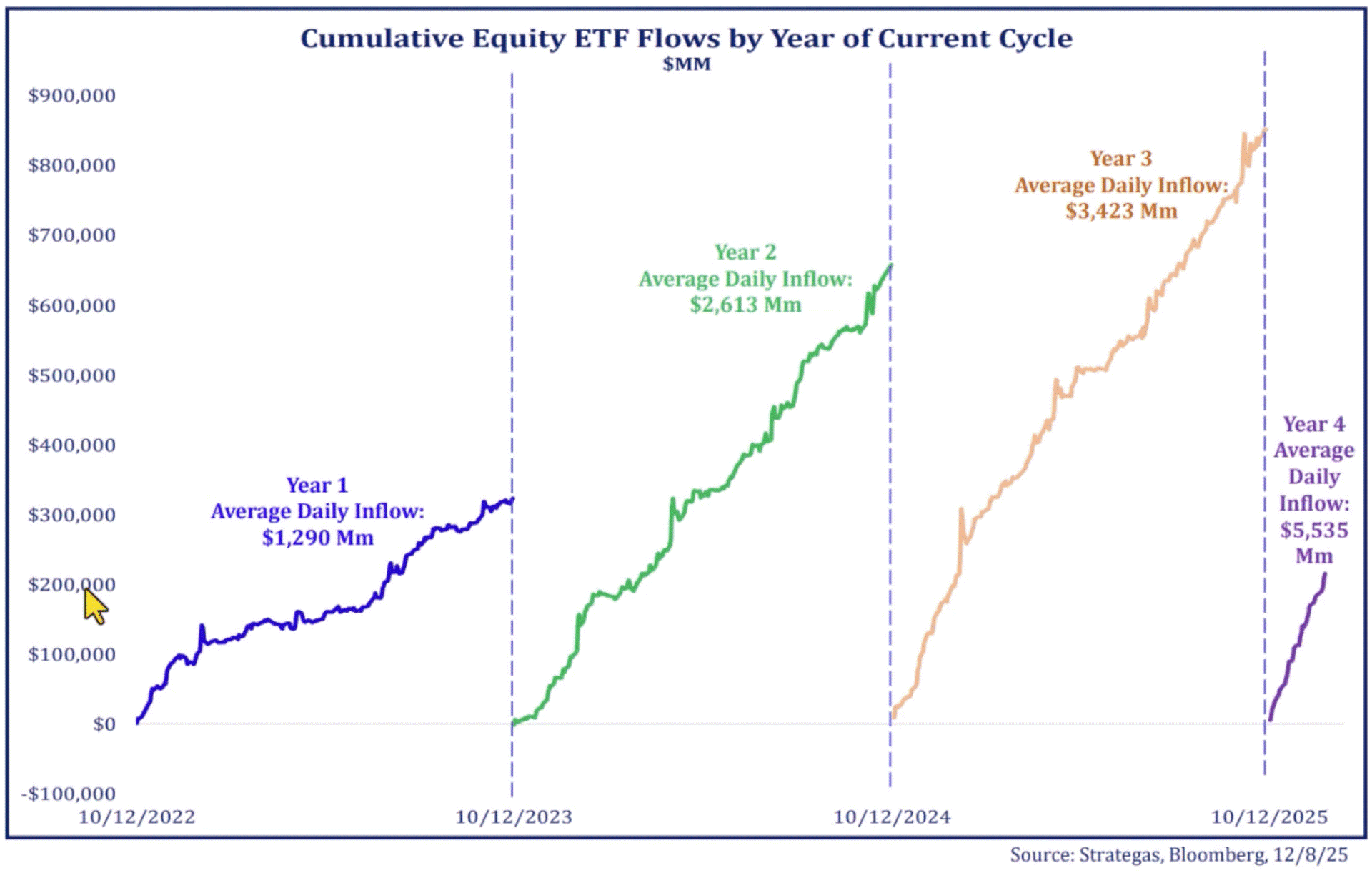

Chart of the month.

Inflows into ETFs have risen incredibly fast during the past few years, as this chart shows.

Most of this money ends up buying the largest stocks. It’s also passive, which means it’s not research driven, but buys a whole market, index or sector without any meaningful fundamental analysis. It’s the main reason that fundamental overvaluation is skewed heavily towards the largest stocks, sectors and markets.

Flows have continued to go to these areas, driven by reinvestment of dividends, buybacks, statutory contributions (super in Australia) and, most notably, gearing. We’re not against passive investing. It’s proven to be very successful over a long period. But if you wanted to diversify, you would invest at least part of your portfolio in the opposite part of the market. Think active managers investing in value stocks, smaller stocks or using differentiated or specialised investment strategies.

Quote of the month 2.

W“ASIC is investigating First Mutual Private Equity Pty Ltd…due to concerns that they may have allegedly raised up to $131 million in investor funds and that ASIC’s investigation indicates that around $80 million has allegedly been spent on gambling, with no actual investment activity found. At present, around $7.1 million of total assets of the funds invested have been identified.”

ASIC media release, 17 December 2025. How does this happen! Our regulator clearly needs more resourcing to enable situations like this to be detected much, much sooner. The First Mutual website (which as of 17 December was still active) shows consistent returns across multiple funds of 20-30% per annum. Based on that alone, we would classify it as almost certainly a fraud and it should have been detected much earlier.

Chart of the month 2

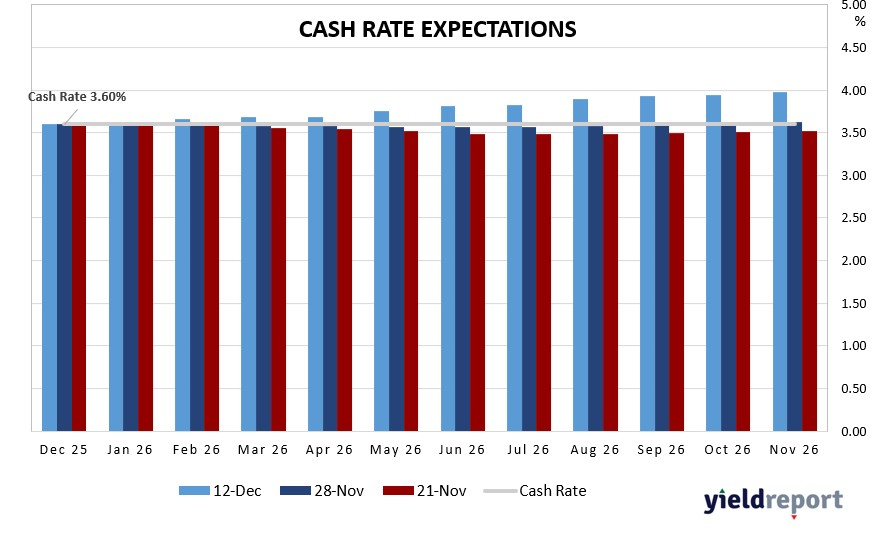

Something important has happened to Australian interest rate expectations in the past month.

Markets have flipped between late November and now. Previously, a further cut in rates was expected in 2026. Now, the next 12 months is expected to see a rise (or two). That represents an important shift in market sentiment.

What actually happens will depend greatly on how inflation plays out over the next few months.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- In the Philippines, there’s an island inside a lake on an island inside a lake on an island.

- Cows moo in regional accents influenced by their environment and herd interactions.

- Bubble wrap was originally invented as plastic wallpaper.

- Snails have anywhere from 1,000 to over 20,000 teeth.

- A horse can actually generate up to 15 horsepower. *

* James Watt defined 1 horsepower as the work of lifting 33,000 pounds one foot in one minute. It was devised as a measure to show how much stronger his steam engines were than horses. A real horse can sustain about three quarters of a horsepower, and a draft horse around 1 hp consistently. But a horse can produce a peak of nearly 15 hp in short bursts.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.