What Conditions Suit Different Equity Investment Strategies?

As a follow on our explanation of the different equity investment strategies, this article gives examples of each type of strategy, and the conditions they may perform well in. Each of the different equities strategies perform better in different market conditions. At Affluence, we believe that an equity portfolio diversified by investment strategy will produce superior risk-adjusted returns over the medium to long-term.

As a reminder, we break down the types of equities strategies into four categories:

- Long Only

- Cash Buffer

- Absolute Return

- Market Neutral

To illustrate each type of strategy, for each category we have used one of our existing Fund holdings so show the characteristics of each strategy.

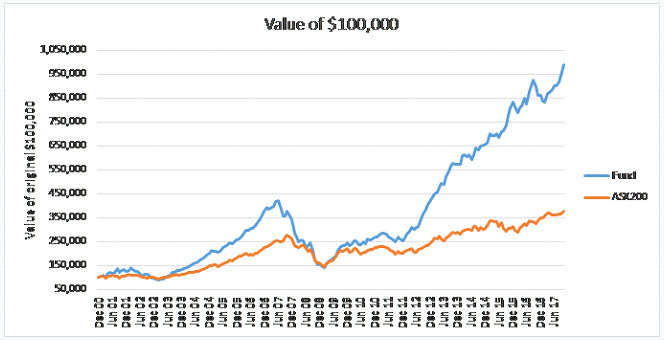

Long Only

The Smallco Investment Fund is an example of a long only fund. We believe Smallco is one of the very best equity managers in Australia, and this fund has delivered returns of 14.6% per annum since inception over 16 years ago. There is no doubt that they are very impressive returns (more than 6% above the ASX 200 over the same period), and most investors would be ecstatic to have received this. However, if you had been an investor between 2007 and 2009, you might not have been so relaxed. During the GFC this fund fell over 60% (note the sharp decline in the graph below). Being long only, there was no protection from falling share prices and the fund investments got caught up in the panic selling that occurred. Over time, the fund more than recovered these losses and continues to perform well. While we hold many long only fund investments, we also like to include other strategies in our portfolios to reduce volatility and draw downs.

Cash Buffer

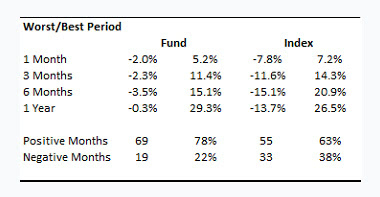

The Lanyon Australian Value Fund has held on average a cash balance of around 50% since inception over 7 years ago. Even with this level of cash, the fund has outperformed the ASX 200 by almost 5% since inception. The benefit of such a high cash holding is reduced volatility (since inception the fund has had volatility of returns of 5.0% per annum compared to the ASX 200 of 11.5%), and much shallower drawdowns during market declines.

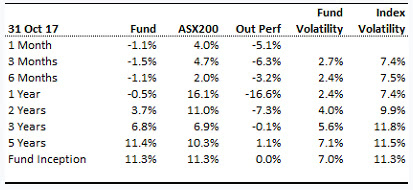

The following table compares the best and worst periods for both the Lanyon Australian Value Fund and the ASX 200 since the fund’s inception:

As can be seen above, the difference is quite staggering. Since June 2010, the ASX 200 has experienced a worst 6 months of -15.1%. In comparison, the worst 6 months for the fund is -3.5%, a very impressive achievement.

Such high levels of cash can be a drag in rapidly increasing markets. Over the past 12 months to 31 October 2017 the ASX 200 has increased by 16.1%. In comparison, the Lanyon fund has only increased by 7.4%. This is expected, and a very small price to pay for superior risk adjusted returns over the medium to long term, and vastly smaller declines during the tough periods.

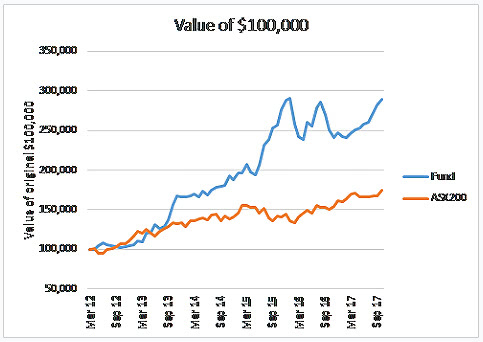

Absolute Return

Absolute return means different things to different people. These strategies generally try to achieve positive returns regardless of market conditions. They may also involve the fund holding long and short positions. One of our absolute return funds is the Totus Capital Alpha Fund. This is one of our more exciting, and unpredictable investments. At times the fund runs more than 300% gross exposure, implying quite a lot of leverage.

Returns have been impressive, but it’s been quite a rollercoaster ride! Since inception over 5 years ago the Totus Fund has outperformed the ASX 200 by over 10% per annum. As can be seen above, the cost of this massive outperformance is higher volatility and more erratic returns. We generally hold smaller allocations to more volatile funds. Holding them in your portfolio can definitely add alpha and improve overall portfolio returns.

Market Neutral

One of our core market neutral holdings in the Watermark Market Neutral Trust. This fund holds generally equal long and short positions, so that it is “market neutral” to the greater share market movements. The following is a summary of the fund returns since inception:

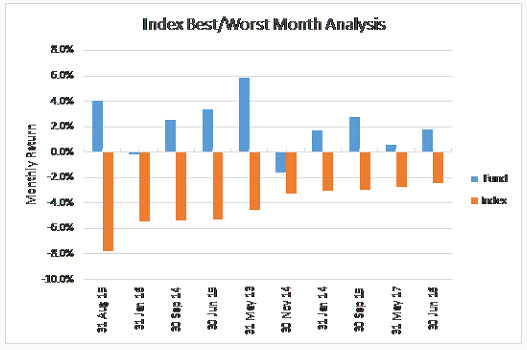

While this strategy has struggled to keep up with the market over the past couple of years, over the longer term it has produced similar returns with lower volatility. However, what we really like about market neutral strategies is summarised in the following:

The above shows the 10 worst months of the ASX 200 index since the fund’s inception (orange bars), and how the Watermark Market Neutral Trust performed on those months (blue bars). When the market goes down there is a real possibility this strategy may go up, or at least down by less.

There is no Miracle Strategy

There is no one strategy that is going to outperform all the time! There is no such thing as a free lunch. The potential for strong increases from long only strategies comes with the possibility of large draw downs. And the potential downside protection afforded by market neutral strategies comes with the cost of possible under performance during strong market periods.

So which strategy should you choose? For our portfolios we like to choose them all. We have found that as each of the different equity investment strategies each perform better in different market conditions, combining them together in one portfolio reduces volatility, market draw downs, and increases risk adjusted returns.

We hope that was helpful. If so, here’s some other things you might like.

See more of our articles.

Find out all about us.

Subscribe to our free monthly Affluence newsletter.

Find out about our Affluence Investment Fund.

Or become an Affluence Member and get access to exclusive investment ideas, profiles of some of Australia’s best fund managers and full details of our Affluence investment portfolios.

Invest Differently!