Hi,

Welcome to our monthly update, a little later than usual. Another financial year has come to a close and it’s been a good one for us, helped by buoyant markets. All three funds delivered strong positive returns in June. Links to the monthly fund reports are below. The Affluence Investment Fund delivered a total return of 24% for the year, despite being quite conservatively positioned a lot of the time. The Affluence LIC Fund delivered 43% and the Small Company Fund 49%.

We encourage existing and potential new investors to read our Annual Investor Letter below. As well as a review of the 2021 financial year, we’ve outlined how our fund portfolios are positioned, given the current environment.

The Affluence LIC Fund and Small Company Fund are now only available to existing Affluence investors. But if you’ve not yet invested with us it’s not all bad news. The Affluence Investment Fund includes allocations to our LIC Fund and various smaller company funds, among many other things.

If you are invested with us, you should by now have received your June distribution statements. We’re hoping to get annual investment statements emailed out this week. We expect annual tax statements to be sent out during August. Updated information can be found here.

If you’d like to invest with us this month, applications for the Affluence Investment Fund close Friday, 23 July. Investments will be effective 1 August, with confirmations emailed about a week after that. As always, go to our website and click the “Invest Now” button to apply online or download application or withdrawal forms for all our funds.

And among the things we found interesting this month, we look at market cycles, bubbles, who owns the car companies and a fascinating interview with the guy who decides Olympic sports.

If you have any questions or just want to give us some feedback, reply to this email or give us a call.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

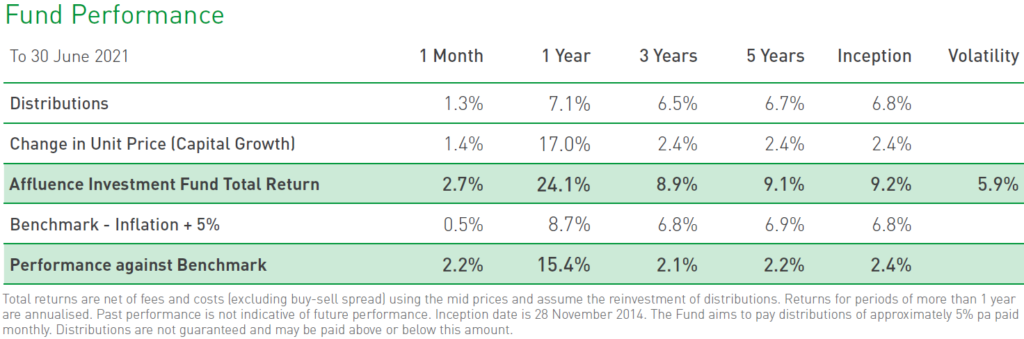

The Affluence Investment Fund returned 2.7% in June and 24.1% for the financial year as Australian and global markets continued to hit new highs. Since inception in 2014, returns have averaged 9.2% per annum, including monthly distributions of 6.8% per annum.

At month end, 61% of the portfolio was invested in unlisted funds, 17% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 10% in cash.

Affluence LIC Fund

The Affluence LIC Fund returned 5.1% in June and 43.2% for the 2021 financial year as LICs finished the year off well. Since commencing in 2016, returns have averaged 14.4% per annum, including quarterly distributions of 7.9% per annum.

The average discount to NTA for the Fund portfolio at the end of the month was 13%. At the end of June, the Fund held investments in 22 LICs representing 77% of the Fund, 5% in portfolio hedges and 18% in cash.

Affluence Small Company Fund

The Affluence Small Company Fund returned 4.9% in June and 49.2% for the 2021 financial year. Since commencing in 2016, returns have averaged 10.8% per annum, including quarterly distributions of 7.0% per annum.

The Fund holds a range of small cap exposures with a distinct value focus. At June 30, the Fund held six unlisted funds (55% of the portfolio), five LICs (17%) and eight ASX listed Small Companies (19%). The balance 9% was cash and hedges.

Annual Investor Letter

We review the 2021 financial year for our two main funds. We look at performance in detail and review each of the portfolios. We also give our take on the investment environment, explain why we’re still upbeat despite most markets being expensive and highlight where we see opportunities.

Exclusive access to 25+ talented fund managers

Almost 40% of the underlying funds held by the Affluence Investment Fund are now closed to new investors. This means the Fund provides access to a manager set that is simply impossible to replicate. In addition, around 20% of the portfolio is allocated to funds that are only available to wholesale investors.

With monthly distributions, a focus on investing differently and fees that are totally based on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month 1.

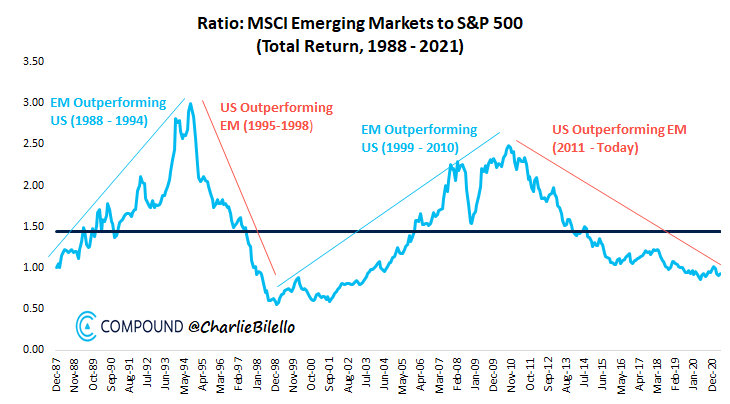

It’s always worth remembering that markets move in cycles. Sometimes, when a trend has been in place for many years, it seems like its going to continue forever. And then markets price that in. And then it’s a big surprise when that trend reverses.

Here’s one example – Emerging Market performance vs the US S&P 500, since 1988.

Chart of the month 2.

You may be surprised to know that just 14 car companies own a combined 64 brands.

Hyundai and Kia are owned by the same company. The decidedly un-racy Volkswagen owns Lamborghini, Porsche and Bugatti. And BMW owns Rolls Royce. And then, there’s the complicated Renault/Nissan/Mitsubishi Alliance. Renault has a 43.4% voting stake in Nissan. Nissan holds a 15% non-voting stake in Renault and a 34% stake in Mitsubishi Motors.

Confusing? You bet.

Alan Kohler interviews…us.

We’ve spoken with Alan a few times over the years. We always enjoy the experience. He’s a straight shooter, and not afraid to jump right in and ask the hard questions.

In this session, we covered why our LIC Fund has had such a great time of it, our performance fee structure, the tools we use to reduce volatility in the Affluence Investment Fund and why we’re excited about our small companies fund, even though it underperformed the index for the first four years of it’s life.

Here’s the podcast and the interview transcript.

Quotes of the month.

“We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances.

“Fed Chairman Jerome Powell, leader of the most influential central bank in the world. What could possibly go wrong?

And a short selling specialist explains the three ways that bubbles can be painful for investment managers.

“This is a bubble. Bubbles make market participants look stupid.

i. If you participate in the bubble you will – like other participants – implode on the way down. You will look stupid in a crowd after the bubble. Being stupid in a crowd has limited career risk, but it is still stupid.

ii. If you do not participate in a bubble you will underperform on the way up, your returns will be lousy, and your clients will leave you. As a money manager your perfectly good business will disappear, and you will look stupid. Moreover, you will look uniquely stupid and thus be the subject of derision.

iii. If you fight the bubble, your shorts will roll you over, you will lose frightening amounts of money and you will look stupid because you are stupid.

“John Hempton, Bronte Capital.

Which brings to mind another quote from the world’s most recognisable ten year old.

“You’re damned if you do, and you’re damned if you don’t”

Bart Simpson.

Amazing fact.

Moderna’s mRNA vaccine, which has a reported 90+ percent efficacy rate, had been designed by January 13, 2020. This was just two days after the genetic sequence had been made public. It took all of one weekend, before China had even acknowledged that the disease could be transmitted from human to human. It was done more than a week before the first confirmed case in the United States. By the time the first American death was announced a month later, the vaccine had already been manufactured and shipped for the beginning of its Phase I clinical trial.

From the NY Time magazine article, “We Had the Vaccine the Whole Time.”

This month in (financial) history.

July 1773: Jonathan’s Coffee House, where brokers have met for decades to smoke, drink, and trade stocks and bonds, gets a new and more grandiose name, the London Stock Exchange.

21 July 1873: Jesse James and his notorious gang of outlaws staged the world’s first robbery of a moving train.

And finally…

Given Brisbane’s brand new status as host of the 2032 Olympics, here’s how Olympic sports are decided. It’s less complicated than you might think.

Got a question?

If you would like to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.