Hi,

Welcome to our monthly report. In financial markets, May was a repeat of April. And once again, each of our Funds delivered results that were better than markets. June so far has seen continued falls around the world.

At times like these, we often get asked whether it’s a good time to invest. We don’t try to predict where markets may go because we recognise that we have no idea. Nor does anyone else. But there are broadly two ways this can play out. We’re either at the start of what will eventually become a recession. In this case, markets will probably fall further and take quite a while to recover. The other possibility is that it’s not as bad as people fear, and markets will bottom sometime soon. Given that markets are undoubtedly quite a bit cheaper than they were six months ago, it could make sense to put some more cash to work if you have some. Since there’s no guarantees that markets won’t fall further, it also makes sense to hold a bit back in reserve, just in case.

The good news is that as markets continue to correct, we’re seeing more and more opportunities that we like. So much so, that we’ve decided to reopen our Affluence LIC Fund and Small Company Fund to new investors again, effective immediately. We’re seeing signs of stressed pricing for some LIC’s and we want to be ready to take advantage of it. As at 20th June, our Affluence LIC Fund Portfolio is showing an average 18% discount to NTA. And the ASX 200 is around 15% cheaper than it was late last year, so there’s much better value in those NTA’s as well. In smaller companies, the value is even more stark. The ASX Small Ords is down around 25% from it’s highs, and we’re seeing a wide range of attractive investments in the sector.

If you want to apply online or download application or withdrawal forms for any of our funds, go to the Invest page of our website. If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

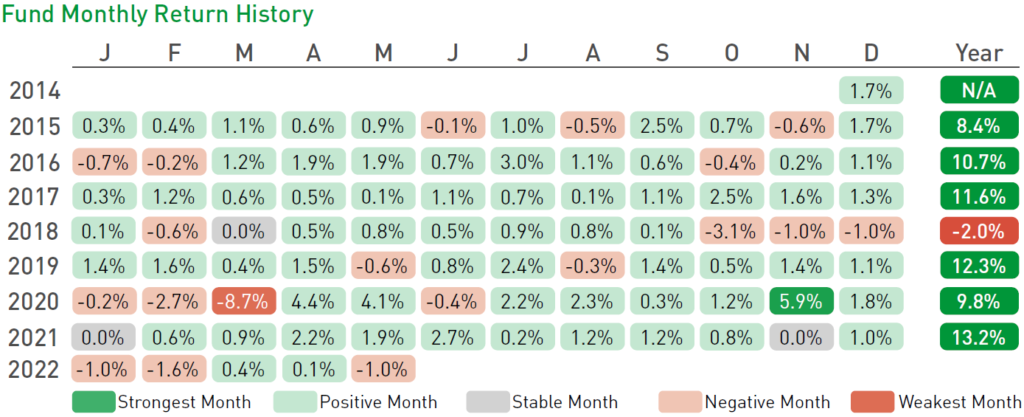

The Affluence Investment Fund returned -1.0% in May. Since commencing in 2014, returns have averaged 8.2% per annum, including distributions of 6.5% per annum.

At month end, 57% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 15% in listed investments, 2% in portfolio hedges and 11% in cash.

The cut-off for monthly applications and withdrawals is this Friday, 24 June.

Affluence LIC Fund

The Affluence LIC Fund delivered -2.3% in May. Since commencing in 2016, returns have averaged 12.3% per annum, including quarterly distributions of 7.3% per annum.

The average discount to NTA for the portfolio at the end of the month was 15%. The Fund held investments in 32 LICs (77% of the Fund), 4% in portfolio hedges and 19% in cash.

The cut-off for monthly applications and withdrawals is 30 June.

Affluence Small Company Fund

The Fund returned -2.5% in May. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 9.2% per annum.

The Fund held 8 unlisted funds (52% of the portfolio), 8 LICs (17%) and 6 ASX listed Small Companies (17%). The balance 13% was cash.

Available to wholesale clients only. The cut-off for monthly applications and withdrawals is 24 June.

25+ talented fund managers in a single investment

The Affluence Investment Fund provides access to over 25 boutique fund managers in a single investment. These underlying managers all have several things in common. A lot of experience, an accomplished investment track record, and a specialised investment strategy. Plus, they all invest a significant portion of their own money in the strategies they manage.

In these volatile times, it’s good to have a wide variety of talented investment managers in your corner to help navigate market ups and downs. Many of these investment teams are relatively unknown. Quite a few are closed to new investors, or only available to wholesale clients. Almost all of them specifically cap the amount of money they manage, because they understand that one of the biggest barriers to exceptional performance is too much money.

Through the Affluence Investment Fund, you can access them all, plus more. With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

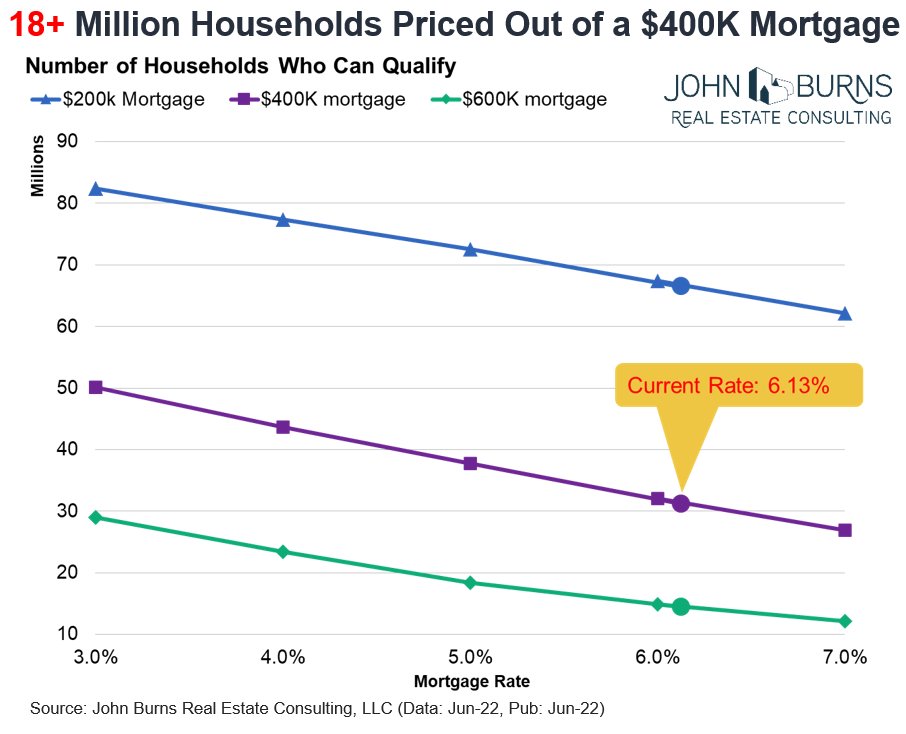

The following chart contains US data. The mortgage market works slightly differently there, and the reaction is more extreme for now, but the story will eventually be similar in Australia. The chart shows how many US households can afford mortgages at different interest rates.

If we focus on the $400,000 mortgage, we can see that at the 3% interest rate that was prevalent in January this year, roughly 50 million US households could qualify. Earlier this month, with mortgage rates at 6.13%, just 32 million households would make the cut. That’s a 36% fall in homebuyers who qualify. And since the amount available for buyers to borrow is the key determinant of house prices, it seems house prices must almost certainly fall.

Luckily in Australia, we’ve seen house prices rise by 20-30% in the past 2 years. So unless you bought during that period, you’re likely to have quite a big valuation buffer. Still, falling house prices are probably now the number 2 economic risk for Australia, after inflation.

Chart of the month 2.

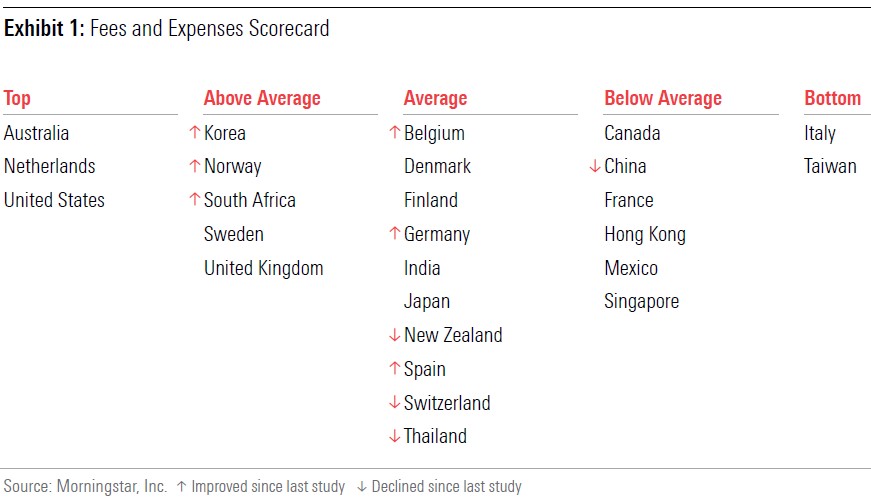

This month we bust the myth that Australia has high investment fees. A recent study by Morningstar, which looked at global investment fees in 26 countries, came to the opposite conclusion. Australia was one of the top three countries in terms of having the lowest investment fees per dollar invested. Neighbours New Zealand were middle of the pack.

That doesn’t mean our industry can’t do better. There are still way too many large fund managers charging high fixed fees for products which are unlikely to outperform markets over the long term. But at least investors are getting a good deal on average, relative to most other countries. The full report is available here.

Quote of the month.

“It’s not a ‘tech sell-off.’ It is a massive repricing of abstraction. We had a bubble in dreams.”

Peter Atwater

As just one example, the entire market cap of cryptocurrencies around the world has fallen from nearly $3 trillion at the start of the year, to less than $1 trillion now. The losses have been enormous. The pain has been borne primarily by younger investors, many of whom have had investment experiences that will scar them for many years to come. We feel for them. It’s probably better to learn harsh investing lessons at a young age, while you’re still got time to recover. But the sheer volume of losses, and the collective emotional toll are extraordinary.

This day in (financial) history.

June 1969: The New York Stock Exchange allocates $7.5 million for a computer systems upgrade. At the time, it is so far behind on its paperwork that it has to close each Wednesday so that clerks can process trades. No word on what sort of computing power $7.5m got you in 1969, but our guess is not much by today’s standards.

June 1988: Dell Computers had its IPO, valuing the company at $85 million. Dell’s stock would be one of the best performing stocks through the 90s tech bubble, averaging an annual gain of 97% from 1990-2000. At its peak on March 22nd, 2000, the company was worth $100 billion. After the tech bust, the company would be taken private in 2016 in a $23 billion deal.

Vaguely interesting facts.

The verb “unfriend” first appeared in 1659.

Paraskavedekatriaphobia is the fear of Friday the 13th, not be to confused with… Pentheraphobia, which is the intense and disproportionate fear of your mother-in-law.

The Crooked Forest in Poland is home to hundreds of pine trees curved at a 90° angle. See more here.

On a rainy day in 1816, writers Mary Shelley, Percy Shelley, Lord Byron, and John Polidori were stuck inside. So they challenged each other to a scary story-writing contest. Mary, who was 18 at the time, came up with the idea for Frankenstein. It was published two years later.

Source: mentalfloss.com

And finally…how the internet has changed.

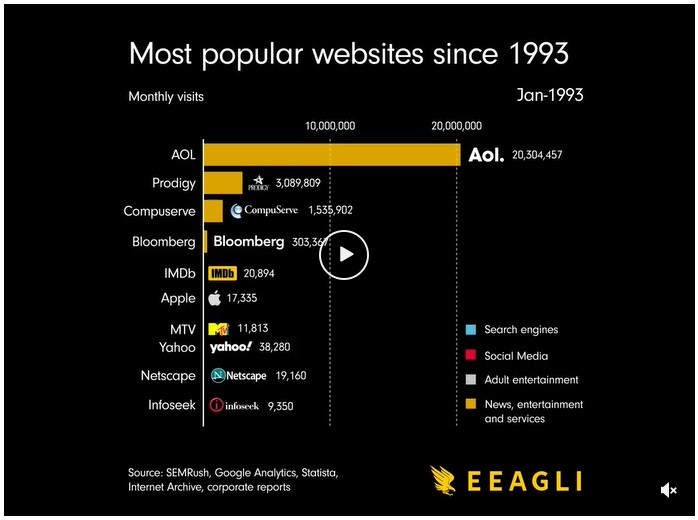

These were the ten most popular websites in 1993.

The current number one (Google), didn’t even make the list until 2001, and only overtook Yahoo for the number one spot in 2006. You can see an animated visualisation showing how the top ten has changed between 1993 and 2022 here.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.