All our funds delivered positive returns in January, in what was a good month for most assest classes. You can access the latest fund reports below.

The big debate in Australian financial markets for the past few weeks has been what the Reserve Bank of Australia will do with interest rates at its February meeting. As we write this, markets are factoring in a 90%+ chance of a 0.25% cut to rates. By the time this hits your inbox, we’ll all know the outcome. Regardless of what that is, it seems that interest rates in Australia are on the way down this year. That can be good for markets, as cash is forced off the sidelines by investors seeking higher yields.

Should you wish to invest this month, head to our Invest Now page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 March.

As always, thanks for reading and for your continued interest in what we do.

If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

January 2025 Reports

Affluence Income Trust Report

The Affluence Income Trust returned 0.6% in January and has delivered 7.8% per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.5% per annum.

Affluence Investment Fund Report

The Affluence Investment Fund returned 1.7% in January. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.8% per annum.

Affluence LIC Fund Report

The Affluence LIC Fund returned 2.2% in January and has delivered 11.1% per annum since commencement. At the end of the month, the average portfolio NTA discount remained close to all time highs at 25%.

Affluence Small Company Fund Report

The Affluence Small Company Fund returned 0.4% in January, as the portfolio took a breather after a relatively strong year in 2024. The Fund has beaten the ASX Small Ords Index by 2% per annum since inception.

Investment Profile

Each month we take a look at an underlying investment in one of our funds. This month, we profile the West Street European Private Credit Fund, which is part of the Affluence Income Trust portfolio. This investment strategy is very different to other Affluence Income Trust investments and is thus complimentary to the portfolio. It provides the potential for double digit returns, with a relatively low risk profile.

Things we found interesting

Chart of the Month.

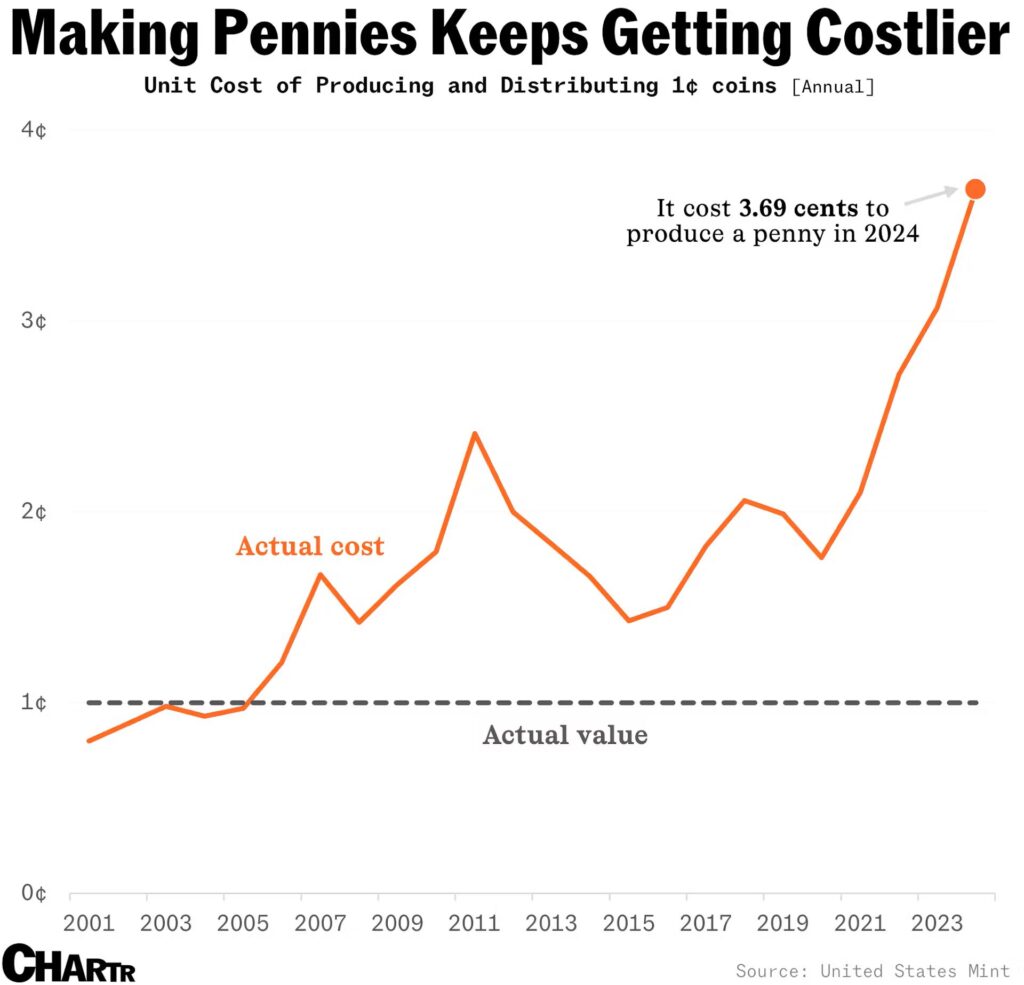

In the good old US of A, they still use one cent coins. Goodness knows why.

In 2024, the cost of producing one US penny (1 cent coin) reached 3.69 cents. Yes, that’s right. It costs over three times as much to produce a penny as it is worth.

Quote (and article) of the month

“Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race ‘looking out for its best interests’, as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.”

Nassim Nicholas Taleb, The Black Swan This quote begins the best article we read last month – from Perpetual’s investment team. In it, they explain the concentration risk focused on one area: Australian residential property. This is not a bearish property piece. Rather, it’s about risk management. It demonstrates how far and wide the tentacles of residential property are spread throughout our Australian markets. Thanks to reader Michael W for sending this through to us.

Financial word of the month.

Risk.

A stock, bond or other tradable financial interest in a risky asset.

From the Latin securitas, meaning safety. However, an investment security does not ensure that anyone will behave well, least of all the person who owns it.

Among the early uses of security in English, dating back to at least the fifteenth century, was the meaning of property pledged by a person to ensure his or her good behaviour or fulfilment of an obligation. Even today, accused criminals must post security to obtain a bail bond. By the seventeenth century, that meaning had extended to the document in which a debtor promised to repay an obligation – originally a bond. Later, by analogy, it was extended to stocks and other instruments as well. Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Before settling on the Seven Dwarfs we know today, Disney also considered Chesty, Tubby, Burpy, Deafy, Wheezy, and Awful.

- Pigeons can be trained to distinguish between the paintings of Pablo Picasso and those of Claude Monet.

- St. Patrick wasn’t Irish: He was born to Roman parents in either Scotland, England, or Wales.

- The space between your eyebrows is called a glabella.

- Humans are the only animals with chins. *

Source: Mentalfloss.

And finally…

Two farmers are watching the sunset on their tractor and having a chat.

The first says, “I keep hearing on the radio, TV, read in the papers about the stock market. But I still have no idea what it is. Do you know?”

The second farmer replies, “How should I explain this to you… Let’s say you buy some eggs for your farm. These eggs hatch and now you have chicks. These chicks grow up to be hens that lay more eggs, out of which you get more chicks that grow up to be hens and so on and so forth. Eventually, your farm is full of them. Then, one day a big flood ravages your land and takes all of them downstream. Then you sit and think to yourself: ducks… I should have gotten ducks. That’s what the stock market is like.”

Thanks for reading. If you enjoyed this newsletter, share it with a friend.

If you are that friend, you can subscribe below and see previous newsletters on our insights page.