Key Details

Profile date: May 2020

Fund: Future Generation Australia Investment Company (ASX: FGX)

Fund Type: Listed Investment Company (LIC)

Invests In: Australian Equities

Investment Focus: A fund of funds that provides access to some outstanding investment managers.

Risk profile: Medium to high. The underlying portfolio includes 20 different Australian equity investment managers who use a variety of different investment styles and strategies. At May 2020, FGX is trading at an attractive discount to NTA, but this can change quickly.

Affluence Fund Weighting: At May 2020, FGX was 6.7% of the Affluence LIC Fund portfolio, making it one of the largest holdings.

What Future Generation Australia does

This LIC has a dual purpose. Firstly, as an investment vehicle and secondly as a philanthropic entity that provides ongoing donations to charities that support children and youth at risk.

As an investment vehicle, FGX provides shareholders with exposure to some exceptional Australian boutique investment managers at no cost. All investment managers provide access to their funds for free or refund any management fees to the LIC. Most service providers also offer their services pro-bono.

As a result of these savings, FGX donates 1.0% of total assets annually to designated charities.

The FGX Investment Case

The investment objective of FGX is to provide shareholders with an increasing stream of fully franked dividends, achieve long term capital growth and preserve shareholder capital. They benchmark their performance against the ASX All Ordinaries Accumulation Index.

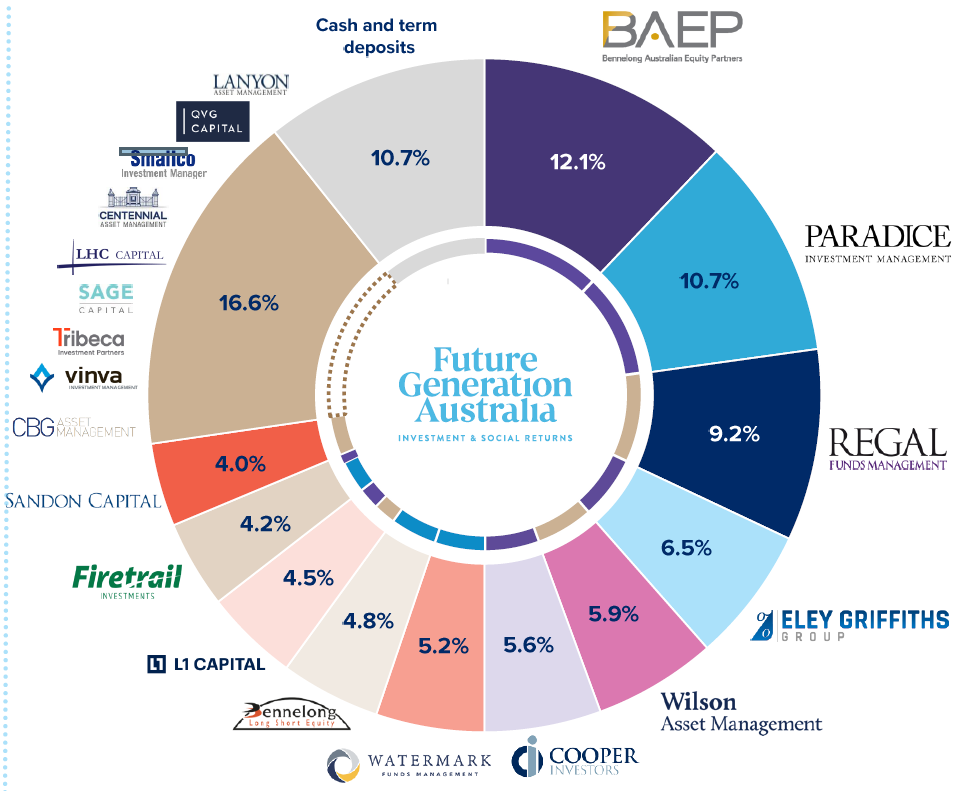

The investment managers they are invested are a roll call of some of Australia’s best equity managers. Funds are currently allocated to 20 managers, making FGX very well diversified by manager, investment style and strategy. The investment managers are grouped into three strategy “buckets”. On 31 March, the allocation was 45.5% to long only funds, 30.5% to absolute bias funds and 13.3% to market neutral funds. The remaining 10.7% was held in cash.

The list of managers and asset allocation as at 31 March is shown below.

FGX Performance

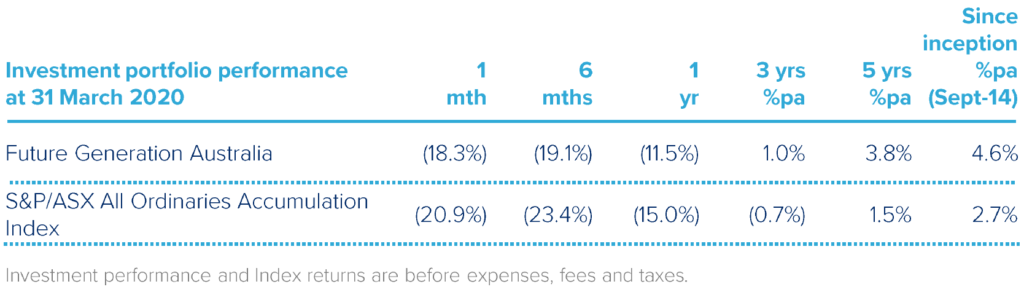

The performance disclosure of LICs is not straightforward and sometimes controversial. The company provides a performance comparison of the underlying portfolio each month. However, the devil is in the detail. Here is the performance as disclosed by FGX.

As stated in the footnote, the performance numbers are before expenses, fees and taxes. They also exclude the impact of any changes in share price, dilution from options being exercised and any capital raisings. Therefore, they may differ substantially from the returns an individual shareholder receives.

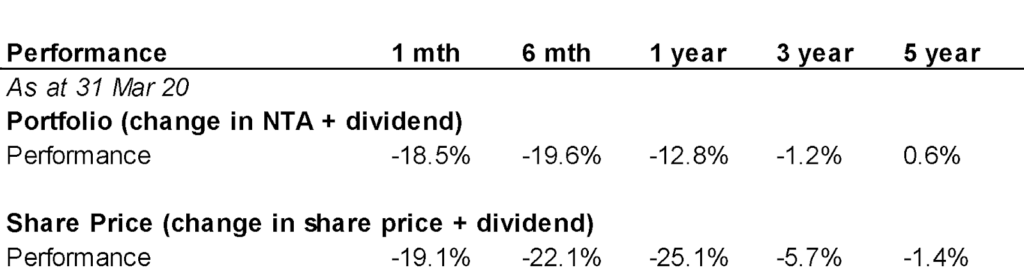

We track the portfolio performance and share price performance for most LICs. Based on our Affluence data, the FGX portfolio returns (change in NTA plus dividends) and shareholder returns (change in share price plus dividends) are shown below. Our analysis excludes franking credits. As LICs are tax-paying entities, this does make the Affluence performance numbers a little lower. However, we would argue that an LIC is an inferior structure compared to a Listed Investment Trust for just that reason.

Our underlying portfolio returns are lower than the company’s disclosure. The majority of this likely due to fees and taxes. While we consider performance to date to be slightly disappointing, the struggle of active managers compared to passive strategies over the past five years has been very well documented. In the current environment, stock selection will be more critical than ever, and top tier active managers should be able to outperform substantially.

The return to shareholders has been worse than the portfolio return. This is mostly due to the current discount to NTA.

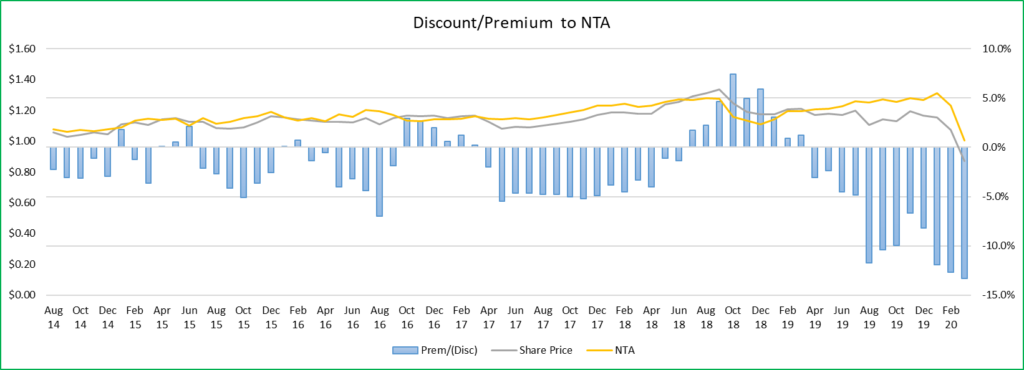

At the end of March 2020, the discount to NTA was over 13%, which is its highest ever. This discount, combined with the recent market falls, has wiped out all returns since the IPO over five years ago.

The Opportunity

The portfolio includes an impressive line-up of investment managers. It is exceptionally well diversified by manager, investment style and strategy. As all the underlying managers rebate their fees, the only cost for investors is the 1% donation to the designated charities. This is far cheaper than investing directly with the managers.

While we like the concept of this LIC, we have not always held FGX in the Affluence LIC Fund portfolio. Over time, the position size has fluctuated from 0% to almost 10%, depending on the level of discount and availability of other opportunities.

For example, we held FGX in early 2018 and started trimming in mid-2018 as the discount reduced towards par, and then moved to a premium to NTA. By mid-2019 we had exited entirely. We started buying again in late 2019 and have continued to add to the position.

We don’t believe that the correct approach to investing in LICs is just to buy a couple you like and then forget about them, even for something as high quality as FGX. Between mid-2018 and now, FGX has gone from a more than 5% premium to an almost 15% discount to NTA. Whatever the actual underlying portfolio has done during that period, the shareholders have done 20% worse.

Conversely, buying at today’s elevated discounts, particularly after a decent correction, provides value on two fronts. We believe now is an opportune time to be invested. Over time, if the consistency of returns and franked dividend payments continue, we believe there is a good probability of FGX returning to trade at par.

Potential risks

Here are our top three risks for the Future Generations Australia LIC.

1. Asset Allocation

If the ASX continued to rally strongly, it is unlikely the underlying FGX portfolio would be able to keep up with the market. While we believe in the ability of the active managers to add alpha (outperform), FGX currently has an allocation of 13.3% to market neutral funds and 10.7% to cash. These allocations will make FGX more likely to outperform the ASX if volatility stays high or if markets trend down. But in a strongly rising environment, this combined 24% will likely cause FGX performance to lag.

2. Persistent Discounts

If any LIC trades at a substantial discount for an extended period, then it may well come onto the radar of activist investors. They may agitate for a wind-up or some other type of corporate action to close the discount. FGX is very widely held, and the chance of co-ordinated investor action thus lower. Balancing this, the WAM asset management group behind FGX command a loyal investor base. WAM have shown themselves to be adept at maintaining discounts within reasonable limits in the past.

3. Manager Performance

We have a high degree of confidence in the underlying managers. But it is possible that as a group, they may underperform for long periods. The performance will also be impacted by the choices of the FGX Investment Committee, who decide when and how funds are invested.

Conclusion

FGX is one of the highest quality LICs in the Australian market, boasting an impressive line-up of investment managers. Given that it is currently trading at a record high NTA discount, we believe this is a very compelling investment.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Affluence LIC Fund.

View the Affluence LIC Fund Portfolio.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.