There are now over 80 ASX Listed Investment Companies (LIC’s) available to choose from. Through LICs you can access many different managers, asset classes, geographies and investment strategies.

At Affluence, we recently undertook a year-long project to assess the best LIC’s in the market.

Here’s some of the things we found to be most important.

Are you investing for the right reasons?

Choosing an LIC is a personal decision and will be heavily influenced by your personal circumstances, investing philosophy and portfolio goals.

Before you invest, make sure you understand the strategy the LIC uses and the type of underlying assets you will be getting exposure to. Do you understand and like that investment strategy? Would you be happy to directly own the types of assets the LIC owns?

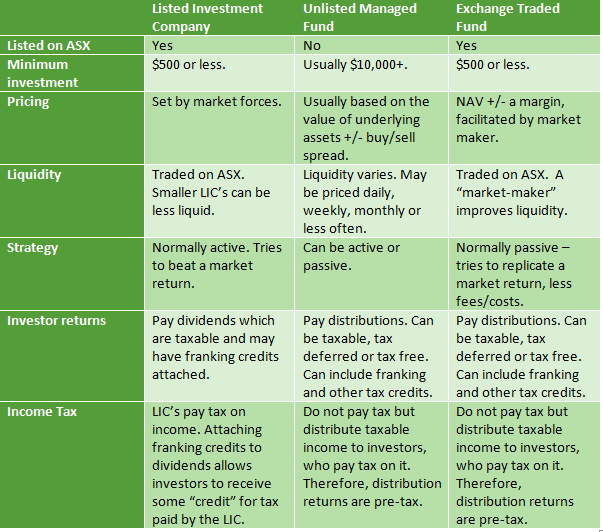

LICs compared to other types of pooled investments

There are many differences between LICs, Managed Funds and Exchange Traded Funds.

Assessing Investment Manager Performance

It is said that historical performance is no guide to the future. While that is true – historical performance can be a great indicator of the potential for future performance, provided it is looked at in the right way.

Portfolio performance should be assessed on an annualised basis, after all fees to the manager and costs, but before tax. Most LIC managers publish this data. This result should then be compared to an appropriate benchmark.

The longer the period you have data for, the better. Good managers can have bad periods and asset prices move in cycles, so you should never assume the last 1 or 2 years’ performance will be repeated. Your aim is to understand how well the manager has performed, relative to the market they are investing in.

Volatility

Depending on your risk tolerance, it may also be important for you to understand volatility, or how much the performance of the LIC has varied over time.

Look at a chart of the LIC’s share price against an appropriate benchmark (e.g. ASX200 index). Focus on times when the market has corrected. Did the LIC move down more, less or about the same as the benchmark? Some LICs may outperform over the long term, but underperform in negative markets. If you are uncomfortable with that, you may be susceptible to selling at the worst possible time.

Other important factors

Some other factors which we have found useful include the fund managers (how long have they been involved, do they have substantial personal holdings in the LIC and/or a stake in the management company), capital raising history, liquidity of the underlying investments, size and liquidity of the LIC, options on issue, level of borrowings and other investment alternatives from the same manager.

On the other hand, we believe some things matter a lot less than most people think. These include distribution yields (they have virtually no impact on investment performance), earnings (look at portfolio performance instead), the Board/Directors (the fund managers are the key individuals) and fees (much less important than other costs).

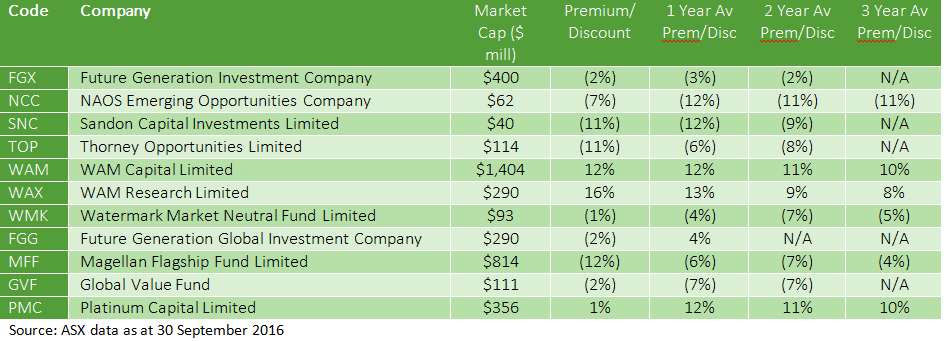

Some LICs that pass our quality test

Here’s a few LICs that we currently believe have strong potential to deliver above market returns.

Buying at the right price

Having looked at the quality of an LIC and determined that you would like to own it, the next part is making sure you buy at the right price. You can do this by answering four questions:

- Is the underlying market the LIC invests in trading at a fair value?

- What is the current Net Tangible Asset value (NTA) per share?

- How does the current ASX buy price compare to the NTA?

- What price are you happy to pay, relative to the NTA?

NTA per Share

ASX requires the NTA per share (calculated by dividing the value of all the investments the LIC holds by the number of shares on issue) to be published by all LICs at least monthly. Sometimes an LIC will publish more than one NTA. We believe the most appropriate value is the NTA before tax on unrealised gains/losses. This includes an allowance for tax on current year earnings and realised capital gains, but before any unrealised gains on the remaining investment portfolio.

Market movements since the last NTA date will need to be considered. For example, if the LIC invests in ASX stocks and the ASX has fallen 5% since the date of the last NTA calculation, it is likely the NTA of the LIC will also have fallen during this period. It may be difficult to know with certainty the exact NTA between reporting dates, but you should be able to make a reasonable estimate based on what the LIC invests in.

Discount/Premium to NTA

Once you know the NTA per share and the Share Price, the discount or premium is calculated by subtracting the current share price from the NTA, and dividing the result by the NTA. A positive number is a premium. A negative number is a discount. For example, if the buy price is $0.90 and the NTA is $1.00, the discount is 10%.

What is the right price to pay?

There is no one rule which determines the right price to pay. Of course, we prefer to buy LICs at a discount to NTA but there are a whole range of factors to consider.

We believe the most important factor is the current premium/discount, compared to the average for that LIC . A price below the long-term average discount/premium to NTA can be a good indicator of value.

Other factors which impact our preferred buy price are historical performance, size, liquidity of underlying assets, portfolio concentration, overall market value and the prices of other similar LICs.

Summary

Like all investments, it’s best to do your homework before buying any LIC.

Try to buy only quality funds with proven managers who have performed well in the past.

Buy those LIC’s holding assets you like and using an investment strategy you understand, with an appropriate structure in place.

Most importantly, buy at the best possible price you can, relative to the NTA per share.

Want to know more? Affluence have published a detailed guide on how we review, assess and invest in LICs.

You can download the Affluence Listed Investment Company Guide by completing the form below. You’ll need to provide us with your name and email address so we can contact you in the future. Don’t worry – we rarely send out more than a couple of emails per month. You can unsubscribe at any time. And we never provide your details to any third-party marketers.

Take care and all the best with your investing endeavours.