This activist manager has delivered good returns through a quite different strategy. They predominantly invest in small-medium ASX listed stocks trading at a discount to assessed valuation. They then attempt to work proactively with management and boards of those companies to help realise value. If they’re not getting the results they believe are appropriate, they are prepared to try more unconventional and even hostile approaches to get the job done.

Key Details

Profile date: April 2016

Manager: Sandon Capital

Fund: Sandon Capital Activist Fund/Sandon Capital Investments Limited (ASX: SNC)

Fund Type: Wholesale Unlisted Fund/Listed Investment Company (LIC)

Invests In: ASX listed small and medium companies

Investment Focus: Sandon Capital runs both an unlisted wholesale fund and a listed investment company. Both seek to deliver attractive investment returns using a combination of activist investment strategies and a ‘deep-value’ investment philosophy.

Risk profile: High. The combination of a small and medium company portfolio and a fairly concentrated portfolio can mean returns are significantly more volatile than most other investment classes.

Affluence Fund Weighting: As at April 2016, the Affluence Fund holds investments in both the unlisted wholesale fund and the listed investment company. The combined investment makes up around 3% of the Affluence Fund’s portfolio.

What the Manager does

Sandon Capital is a Sydney-based activist investment firm. They devise and implement active engagement strategies that seek to unlock value inherent in listed companies in their investment portfolios. Sandon Capital is the investment manager of both the ASX-listed Sandon Capital Investments Limited and the Sandon Capital Activist Fund, an unlisted wholesale fund. They also run a second unlisted fund and provide corporate advisory services to select wholesale clients. The key manager is Gabriel Radzyminski, who is ably supported by Campbell Morgan. Both have significant experience in financial analysis and investing over many years.

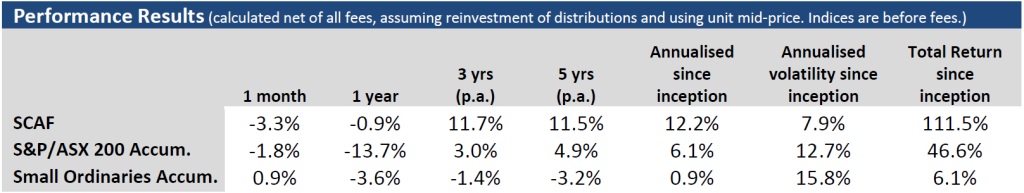

Performance History

Over the period from September 2009 to February 2016, the Fund has delivered average compound returns of 12.2% per annum. During this period the Small Ords accumulation index (an index of small to medium ASX listed companies) has delivered just 0.9% per annum. When looking at the performance history for funds, in addition to being comfortable with the ability of the manager and the asset class they invest in to deliver above average returns in the future, we focus most heavily on how the Fund has performed in difficult periods. Some key results we find impressive over the 78 month history of the Fund are:

- Volatility (or variability of returns) has been 7.9%, almost half that of the Small Ords index

- The Fund holds a significant amount of cash – usually 15-20% of the total portfolio, which reduces volatility and enables additional stocks to be bought on market corrections.

- There have been 55 positive months and only 23 negative months.

- The average median returns in negative months have been better than the market by a reasonable margin.

- The worst monthly return of -4.9% is about the same as the worst market return during that period.

Funds such as these are traditionally more volatile (or at least as volatile) as the underlying market and it is unusual for a small and micro-cap manager to outperform in this manner.

Performance of the LIC has been less impressive, due to a combination of a shorter period of operation and the fact that the LIC generally trades at a discount to NTA value. Nonetheless, both the Fund and the LIC portfolios are run in a very similar fashion and returns from both should be similar over the long term. On balance, we would probably be buyers of the LIC where we see a combination of an appropriate discount and reasonable market value. For more on how we assess LIC value, you can download our LIC guide here.

Why we like it

One of the ways we believe we can get diversification is by holding funds exposed to the stock market, but which pursue strategies which are independent of the main stocks (i.e. the index). The Sandon Capital Activist Fund is just such a vehicle. Because Sandon Capital is an activist shareholder, their returns have been less correlated to the ASX market than most other equity funds.

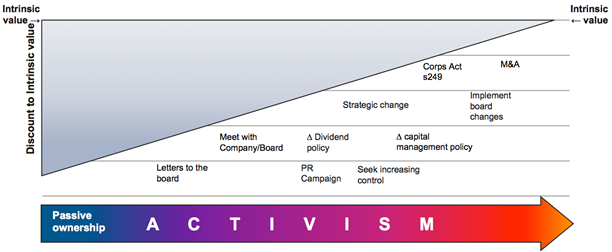

We are also fans of the activist investment strategy. This can best be summed up by the graph below, sourced from Sandon Capital.

Such a strategy is commonplace in US but still quite rare in Australia. In essence, they seek to unlock value in companies through encouraging, and if required forcing, management and boards to take actions to improve shareholder returns.

Returns to date have been very good. The combination of above market returns and below market volatility is one we find exciting.

Both key investment staff have substantial (for them) holdings in the Fund and/or the LIC.

Potential risks

1. Concentration risk.

Both the Fund and the LIC hold a small number of stocks in relatively smaller companies. This can lead to significant volatility in returns, both positive and negative.

2. Execution risk

Sandon Capital might not always be able to do what they set out to do. In some cases, companies will vigorously resist attempts to restore value and there are no guarantees the strategies Sandon Capital employ will work in all cases. In this case, the shares of that particular investment may not rise, or may even fall in value.

3. Key man risk

Gabriel is the key investment manager, although ably assisted by Cameron. Should it be required, investments could mostly be liquidated over a period of time, although a few of the larger investments may require significant periods of time to fully realise.

4. Market risk

Many of the stocks Sandon Capital own are smaller companies, as they are required to be able to take a meaningful position to effect change. Because they are value stocks many of these hold up well, but in a major market correction, commonsense can go out the window and stocks like these can trade at values far removed from reality.

5. Structure risk

LICs can trade at a discount or premium to underlying net asset value (NTA). This presents both risk and opportunity. Sandon Capital recently did a capital raising (issued shares) in the LIC at a discount to NTA value. This type of transaction can be dilutive to investors who can’t/don’t participate. On the other hand, you can always enter/exit the unlisted fund at NTA value, but is less liquid (only monthly unit pricing) and normally requires a $250,000 minimum investment which is outside the range of many investors.

Conclusion

Sandon Capital is a very good manager with a very different strategy and skin in the game. They are operating in a niche market and seem to be doing it well. They are well respected by a number of other people in the industry we think highly of. Despite the risks inherent in smaller stocks and the concentrated portfolio, we are very happy to have a long-term allocation of up to 5% of our portfolio to this manager.

Disclaimer: This article has been prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service. The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.