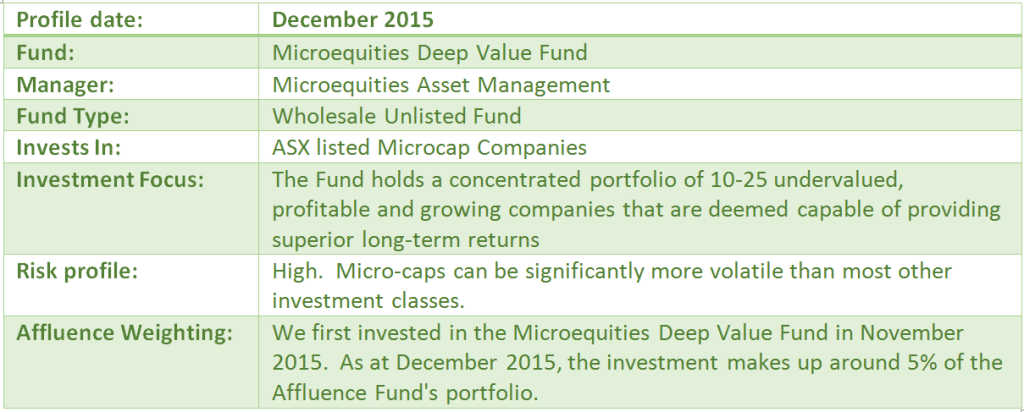

Key Details

Why we like it

Microequities first came to our notice around 2 years ago when we started seriously doing research for the Affluence concept. Right off the bat they showed many of the qualities we admire in a great fund manager. In addition to delivering great returns, they were operating in a specialist area and hold a high-conviction portfolio. The principal, Carlos Gill was substantially invested in the Fund and had a great background both in Australia and overseas. Most importantly, they have shown themselves to be remarkably resilient in market corrections, something that is somewhat unusual in this space.

What the Fund does

As the name indicates, the Fund invests in ASX listed microcaps and has a deep value focus. Microequities is focused on growing companies with a performance track record and an undervalued share price. They use a bottom-up approach to investing. Fundamental analysis of companies is undertaken using various models and key indicators to value companies before consideration of inclusion for investment by the Fund.

The micro-cap sector can provide access to under-researched and/or potential high growth stocks that have not yet been discovered by the investing public. This can lead to larger gains over time if the company grows to a size where larger, institutional investors and researchers may become more interested.

Microequities conduct research that includes information gathering from customers, suppliers, and competitors. As part of the investment process they conduct face to face meetings with company’s senior management to gain insights into the operations of the company’s business units, strategy, and plans. They only invest the Fund in businesses that they understand and that have a historical track record of earnings.

Microequities prefer investments which display some of the following characteristics:

- A well-established business model

- Profitable (on an EBITDA basis) for at least 2 years

- Low, manageable debt or no debt

- High cash flow generation

- High earnings visibility, predictability and disclosure

- In a growing sector with a growth catalyst division, product or service

- A highly competitive advantage or brand name

- A stable management and track record for delivering value to shareholders

- Management with a significant stake in the business

- A reputable board of directors

The Fund is only available to wholesale and sophisticated investors and has a minimum investment amount of $100,000. With a fund like this it is important to understand who the investors are, since large-scale withdrawals in tough times can weigh heavily on Fund performance. The Microequities team seem to have a careful approach to marketing, with funds under management (FUM) building slowly and methodically over a number of years. Withdrawals have been limited to date although the Fund has not yet been tested in a period where there has been a significant market fall.

Performance History

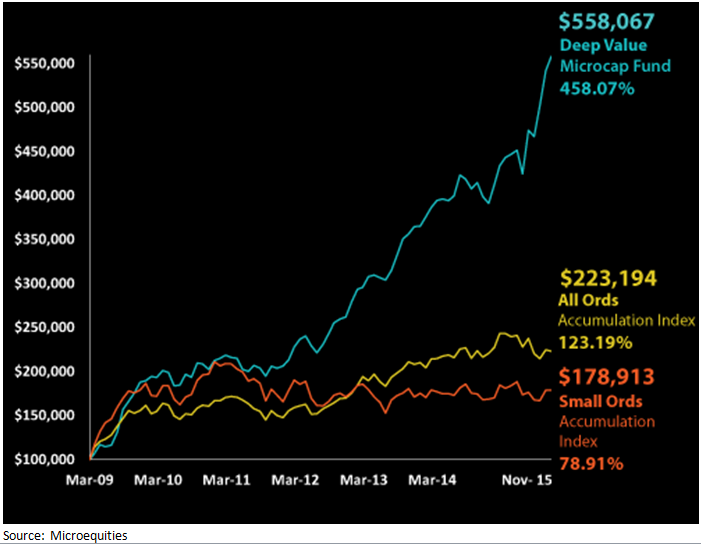

Over the period since March 2009, the Fund has delivered average compound returns of 29% per annum. During this period the All Ords accumulation has delivered 12.6% per annum. When looking at the performance history for funds, in addition to being comfortable with the ability of the manager and the asset class they invest in to deliver above average returns in the future, we focus most heavily on how the Fund has performed in difficult periods. This is particularly important at times like these, when a long period of good market returns potentially increases the chances of a correction in the future.

Some key results we find impressive over the 81-month history of the Fund are:

- There have been 56 positive months and 26 negative months. During this same period the market has had 50 positive months and 30 negative months.

- The average median returns in negative months have been better than the market by a reasonable margin.

- The worst monthly return of -7.5% is about the same as the worst market return during that period.

Funds such as these are traditionally more volatile (or at least as volatile) as the underlying market and it is unusual for a small and micro-cap manager to outperform in this manner.

Potential Risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Here are our top 3 risks for the Fund

1. Market corrections can really hurt

While starting in March 2009 was a stroke of genius from a market timing point of view, it means the fund and the management team have never been fully tested in a big market correction. While it has been resilient to date, the nature of many small and micro-cap funds is that they will survive ok until serious selling pressure emerges, perhaps in a major market correction. At that point, they have a habit of falling off a cliff all at once, perhaps due to factors such as one or two key shareholders who are forced sellers. Their deep value focus can help to mitigate this, but if markets get bad enough, there is no respect for intrinsic value.

For this reason, we are cautious in our investment allocation towards this Fund, despite the exceptional performance to date.

2. Growth in FUM may impact future performance

The Microequities team is clearly starting to get noticed. FUM has continued to build progressively but is now stating to grow at a much quicker pace. As sometimes happens in these cases, the team is keen to continue to grow FUM and appears to be leaning towards increasing capacity constraints above what has previously been indicated. They have also flagged the potential to expand into other strategies (e.g. global micro-caps) which may result in reduced focus on the main fund and distraction for key staff.

While the Microequities team does not expect this to impact performance, we have seen it happen enough times before to be cautious and we expect to monitor these factors carefully.

3. Concentrated Portfolio

The Fund generally has a very concentrated portfolio. The top 5 stocks can be 40% or more of the funds’ investments. This can greatly assist to deliver above-average returns, but can also result in significant downside risk if one or two major investments do not work out as planned. And in this space, there are always some investments that don’t work out as planned.

The team generally scale into positions over time, meaning their largest holdings may have been built over a long period. This can give them a great insight into the business and how it works, and mitigate the risk somewhat. However, if one or more companies in the portfolio underperform significantly at the same time, it can severely affect Fund returns.

Conclusion

A great manager with skin in the game, operating in a niche market and doing it well. Despite the risks inherent in small and micro-cap stocks, we are very happy to have an allocation of around 5% of our portfolio to this Fund.

Disclaimer: This article is prepared by Affluence Funds Management Pty Ltd ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service. The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.