Key Details

Fund Manager Profile December 2017

Manager: NAOS Asset Management

Fund: Three LICs, NAOS Emerging Opportunities (NCC), NAOS Small Cap Opportunities (NSC), NAOS Absolute Opportunities (NAC)

Fund Type: Listed Investment Companies

Invests In: Micro and small cap Australian equities

Key People: Sebastian Evans and Ben Rundle

Investment Focus: Micro and small cap Australian equities with a value bias.

Risk profile: High. These LICs invest in small cap equities, and are therefore subject to market drawdowns.

Affluence Fund Weighting: As at December 2017, the Affluence LIC Fund holds NAC and NSC, with a combined holding of 4.7%.

What the Manager does

NAOS Asset Management is a boutique Australian based equities manager. It was founded in 2005 by Sebastian Evans. NAOS currently manage three LICs and one unlisted fund. Total funds under management are around $300 million.

NAOS Asset Management are the investment managers for three LICs:

- NAOS Emerging Opportunities Company Limited (ASX code: NCC).

- Industrial companies with a market cap of $10M to $250M.

- Target 8-12 long positions.

- Emerging and micro-cap companies.

- NAOS Small Cap Opportunities Company Limited (ASX code: NSC).

- This LIC was previously called Contango Microcap Limited. NAOS acquired the management rights from Contango Asset Management in October 2017.

- Industrial companies with a market cap of $100M to $1B.

- Target 10-15 long positions.

- Small-cap companies.

- NAOS Absolute Opportunities Company Limited (ASX code: NAC).

- Industrial companies with a market cap of $400M to $1B+.

- Target 10-15 long positions, and 0-3 short positions.

- Small and mid-cap companies.

They use a long/short portfolio structure although generally with limited use of shorting. NAOS place a primary focus on the generation of absolute returns. They have the flexibility to hold up to 100% cash and can invest in domestic as well as overseas developed markets, although overseas holdings are usually limited.

Their investment strategy focuses on 5 key factors:

- Opportunistic – They seek to invest the best-of-breed value-driven ideas, and to identify the best opportunity set for superior returns. They limit the size of portfolios to ensure a structure that is nimble in order to maximise value.

- Concentrated – They generally hold between 10-30 investments in each portfolio. The maximum position weighting for a single stock is 15% of the Fund.

- Catalyst Driven – They place a primary focus on ideas that have a clear path and timeframe to realising value.

- Fundamental Research Driven – They undertake disciplined, detailed, bottom-up research with a view to building conviction, such that best ideas dominate the portfolio. They gather information from industry experts and unlisted industry participants. The investment team maintains contact with over 500 individual companies per year.

- Focus on Capital Preservation – They use a detailed macro-economic indicator model to manage their top down view for portfolio cash/equity weightings in their portfolios.

Performance History

The following performance history is from NAOS. The performance is before management fees. Numbers for NSC have not been provided, due to the relatively short history since NAOS commenced management.

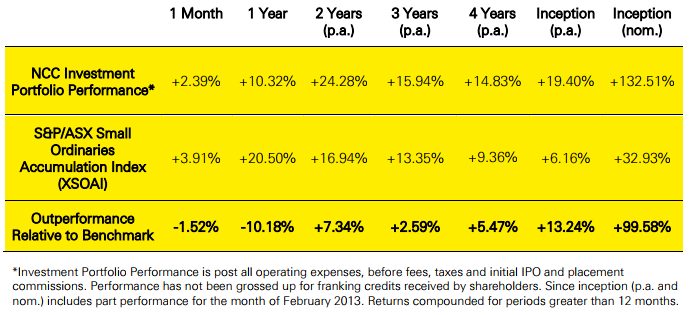

NAOS Emerging Opportunities Company Limited (NCC)

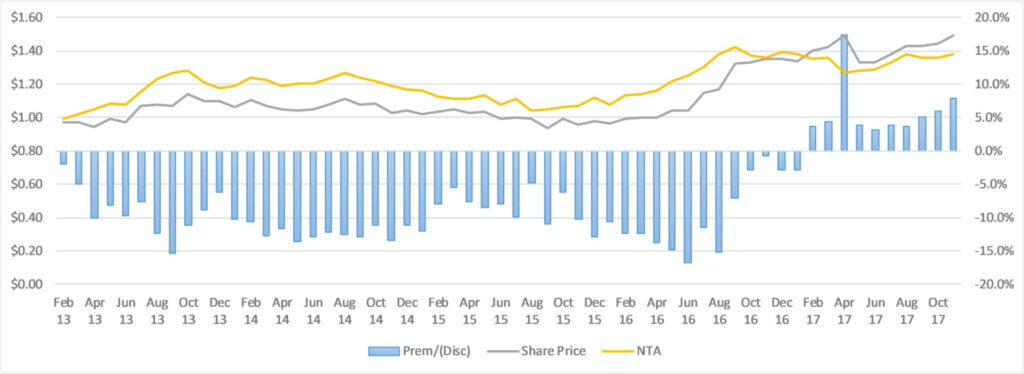

Even allowing for the performance numbers being gross of fees, performance to date has been strong. The second graph shows when the LIC has traded at a premium/discount to NTA.

It unsurprisingly traded at a sustained discount in its early life. NAOS as a manager was not well known, the vehicle was small, and it had a limited track record. The past year has seen this reversed, and it has consistently traded at a premium to NTA.

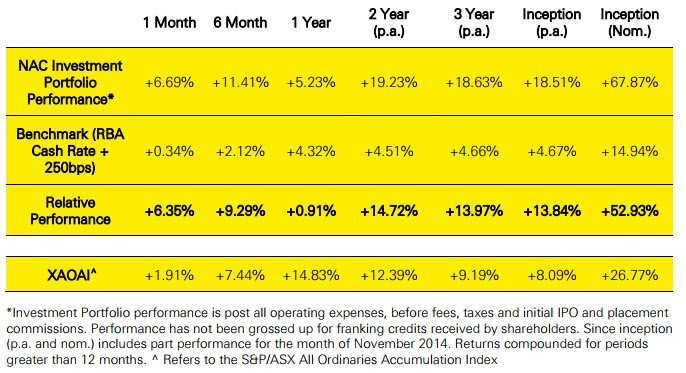

NAOS Absolute Opportunities Company Limited (NAC)

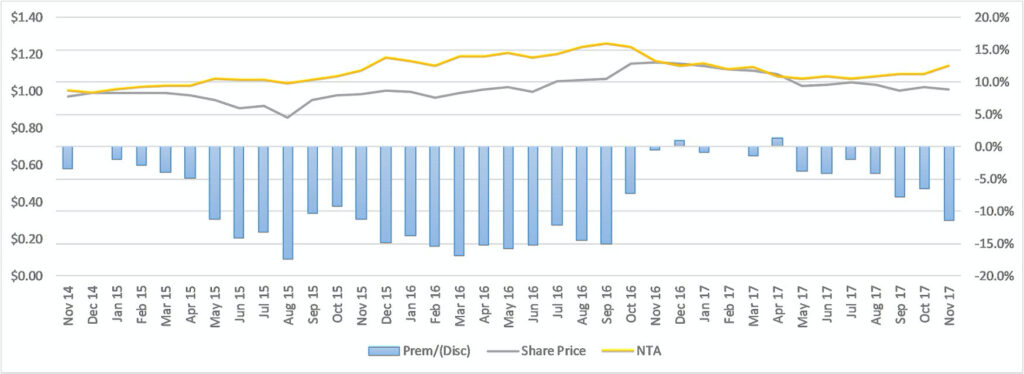

Again, allowing for the performance numbers being gross of fees, performance to date has been good. This vehicle does not have as long a track record as NCC, and has not quite performed as well. However, unlike NCC, this LIC is trading at an attractive discount to NTA, as can be seen below.

Why we like these LICs

NAOS has the potential to outperform as an asset manager and their investment strategy is quite unique compared to the other LICs. As at mid-December 2017, NCC is trading at a 10% premium to NTA, while NAC and NSC are both trading at a circa 10% discount to NTA. NCC is perhaps more attractive from a pure investment strategy point of view. The small market cap band allows more scope for mispricing to be found, it has the best track record and it has the smallest capacity. However, we don’t believe a 20% difference in premium/discount is warranted. The Affluence LIC Fund is currently invested in both NAC and NSC as we believe we are getting access to an excellent manager at an attractive discount to NTA.

Disclaimer: This article is prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in Affluence Funds to understand the underlying investments of the Funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service. The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.