Key Details

Fund Manager Profile February 2018

Manager: India Avenue Investment Management

Fund: India Avenue Equity Fund

Fund Type: Retail Unlisted Fund

Invests In: Indian equities

Key People: Mugunthan Siva and Aran Nagendra

Investment Focus: Equity fund focused on capturing India’s economic growth and producing alpha through active management in a less efficient market.

Risk profile: High. Emerging market equities can be very volatile.

Affluence Fund Weighting: As at February 2018, the India Avenue Equity Fund was 1% of the Affluence Investment Fund portfolio.

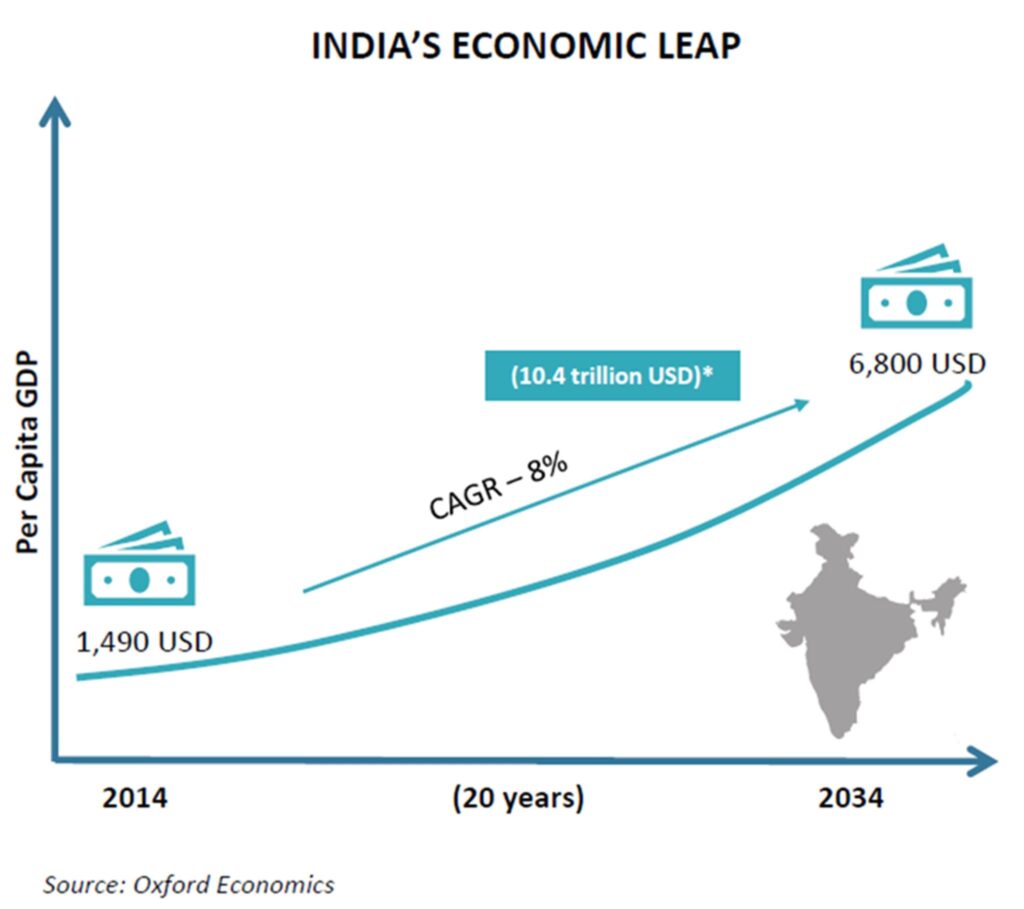

Why India?

India interests us as an investment destination for a number of reasons:

- GDP growth is around 7%pa. India is forecast to be one of the fastest growing economies in the world.

- A huge, growing and relatively young workforce. The working-age population expected to touch 1 billion people by 2030.

- Corporate earnings growth in India has been strong at 13.5% per annum over the past 20 years.

- A strong entrepreneurial culture, creating disruptive new businesses.

- The Modi government continues to fight corruption and modernise the economy.

- Demographic tailwinds, with a substantial expected increase in the middle class.

- A low correlation with Australian equities. For example, unlike Australia, India benefits from low commodity prices.

What the Manager does

India Avenue Investment Management is an India focused specialist based in Sydney, with an office in Mumbai.

The India Avenue Equity Fund’s investment objective is to outperform the MSCI India Index by 3%pa over rolling 3-year periods.

The manager currently employs two Indian based equity managers. Each provides stock recommendations and portfolios. These ideas are then implemented by India Avenue directly. This means investment management and research is undertaken by local specialists. Trading and governance are undertaken by India Avenue in Australia. This is further enhanced by India Avenue having full-time employees in Mumbai. This provides additional oversight of external managers and monitoring of local market conditions.

The key investment team includes Mugunthan Siva and Aran Nagendra, who both worked together at ANZ and ING. During this time, they ran a very similar strategy and structure to the current fund.

Most emerging market funds only research and own the largest companies listed in India. This Fund seeks to own medium and smaller equities as well. They also have a bias towards companies where revenue is generated from the local economy. This is where they believe there will be the greatest earnings growth, which should translate into higher returns. Most other fund managers focus on large global companies listed in India that may generate revenue worldwide.

The Fund typically holds 40-70 stocks, out of a universe of the top 1,000 companies. Their investment style is typically GARP (growth at a reasonable price). This means they will consider a stock with high P/E ratio if it is supported by high earnings growth. The strategy is typically currency unhedged.

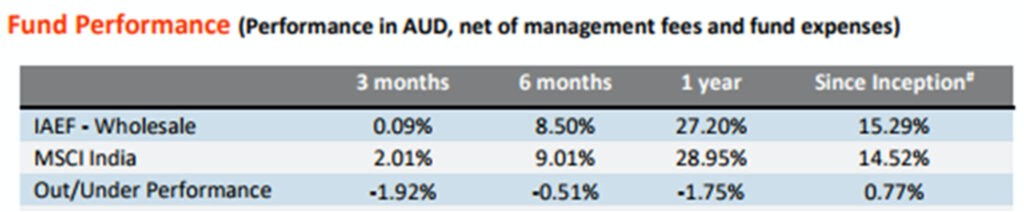

Performance History

The Fund has only been running since September 2016, so the performance history is limited.

However, the underlying investment advisers (based in India) have long track records in the local market.

Being an Emerging Market economy, we don’t expect returns to be delivered smoothly. There will undoubtedly be times when the Indian market (and this Fund) will be subject to substantial falls in value. However, given the potential benefits from the ongoing development of India, we believe there is a very strong investment case for this strategy.

Why we like it

The combination of local Indian equity specialists, managed by a dedicated team that has a presence in both Australia and India is appealing. We believe this is a superior approach rather than a western equity manager trying to stock pick from a different continent. Or a global manager concentrating on only the largest stocks.

The key investment staff have extensive experience in running this strategy successfully.

We like the focus, with some larger stocks coupled with access to small and mid-cap equities.

We also like exposure to the exciting India story, which we view as a long-term positive.

Potential risks

We spend a significant amount of time thinking about what could go wrong for each investment we make. Outside of normal equity market risks, here are our top risks for this Fund:

Emerging market risk

There are additional risks when investing in any global equities market. These are heightened when investing in emerging countries. Emerging equity markets and currencies can be very volatile, and sensitive to capital inflows and outflows from foreign investors. Emerging markets can also have additional sovereign risks.

To take on this additional level of risk, we need to be comfortable that we are likely to receive higher returns from these types of investments.

Small and mid-cap bias

There is potential for large performance variances compared to the index. India Avenue target small and mid-cap stocks that they believe are likely to outperform. This introduces the risk of potential additional volatility, on top of an already volatile emerging market asset class. While this is an additional risk, we believe the potential benefits are worth it.

Key person risk

The strategy is reliant on the key portfolio managers experience in Indian markets, coupled with the experience of the underlying managers. We would need to consider whether to continue to hold the investment if one of these groups were no longer involved.

Valuation risk

India is not a cheap market. Strong historic earnings growth and a well understood potential combined to deliver relatively high price/earnings ratios, particularly for an emerging market.

Conclusion

India no doubt has an exciting future, but there are likely to be some bumps along the way. Given this, we expect to maintain a smaller position size in our portfolio for this strategy (less than 2.5%).

This is a Fund that really needs the mindset of investing for the long term. And we believe over the long term it will be able to deliver excellent returns.

We hope that was helpful. If so, here’s some other things you might like.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager Profiles.

Find out about ourAffluence Investment Fund.

View theAffluence Investment Fund Portfolio.

Disclaimer

This article was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) to enable investors in the Affluence Investment Fund to understand the underlying investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.