Key Details

Fund Profile date: August 2019

Manager: Unibail Rodamco Westfield

Fund: Unibail Rodamco Westfield (ASX: URW)

Fund Type: Listed REIT

Invests In: Premium Global Shopping Centres

Investment Focus: One of the premier global shopping centre owners in the world.

Risk profile: Medium. We believe URW is very attractively priced and is being valued on a retail armageddon scenario. While the death of shopping centres is one potential scenario, we think it is not the most likely outcome. Therefore, URW is currently well below fair value.

Affluence Fund Weighting: As of July 2019, Unibail Rodamco Westfield was 2.1% of the Affluence Investment Fund portfolio.

What the Manager does

Most Australian investors had likely not heard or did not know much about Unibail-Rodamco before they made an offer to take over Westfield Corporation in June 2018. Unibail-Rodamco was itself formed by the merger of Unibail and Rodamco Europe in 2007 and was one of the leading listed commercial property companies in Continental Europe.

Westfield was the outcome of a reorganisation in June 2014. That transaction resultes in all the Westfield US and international shopping centres being owned by Westfield Corporation. All the Westfield Australian and NZ centres owned by Scentre Group. Therefore, when Unibail-Rodamco merged with Westfield Corporation, it added a predominantly US portfolio of assets to a European portfolio of assets.

URWs main listing is in Europe. It also trades in Australia via chess depositary interests (CDIs), where 20 CDIs are equivalent to 1 URW euro share. The CDI structure is relatively common. Rights afforded to the CDIs are very similar to the rights afforded to the actual shares.

Today the group owns some of the premier shopping centres in the world. In their own words:

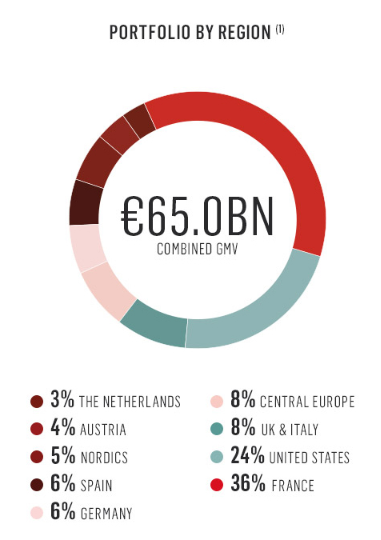

“Unibail-Rodamco-Westfield specialises in owning, developing and managing premier retail assets (shopping centres and airports) in the most dynamic cities in Europe and the United States, the most prestigious office buildings and major convention & exhibition venues in the Paris region. The Group’s portfolio was valued at €65.0 billion as at June 30, 2019.”

Many of the centres are in global gateway cities, such as London, Paris, Berlin, Milan, New York and Los Angeles. The following summarises the portfolio by region:

Some REIT commentators believe the current loan to value ratio of 37.5% is too high for the group. We remain very comfortable with the balance sheet. In fact, from an Australian perspective, the debt statistics are incredible. The group currently pays an average all up interest rate of just 1.6%. It has an average remaining debt term of 8 years. In addition, the group has available undrawn credit lines of €9.2 billion.

They plan to use the proceeds of a planned disposal program and some of these credit lines to fund a very substantial development pipeline.

Recent Performance

Since merging with Westfield Corporation, the share price has plummeted, which was what initially gained our interest. This is partly a global story, as retail REITS all over the world have moved from trading at a premium to their NTA a few years ago to now trading at sometimes very significant discounts.

Part of this change is very rational and understandable, as the Amazon effect and internet shopping has and continues to disrupt the retail landscape. This is resulting in a substantial number of retailer bankruptcies, fewer tenants, more vacancies and softer trading conditions. And all of this could get worse. In the US, where Amazon is most dominant, some lower grade centres have become completely obsolete and are now empty and derelict.

However, in our opinion, this is not the future for the URW portfolio. While there are a small percentage of secondary and struggling assets in the portfolio (as there is in any large property portfolio), the vast majority of assets are what URW call Flagship assets. These large centres dominate their catchment area and are destination experiences. URW are continually evolving these assets with the times, for example, reducing the amount of floor space dedicated to fashion and increasing the level of experiential tenants, services, food and dining.

Valuation

As with any investment, we believe the largest source of investment risk is price. There is now a real bifurcation between listed and unlisted shopping centre investors. Direct (unlisted) institutional investors are happy to own retail assets at book value, whereas listed REIT investors are currently only prepared to pay much less. In many cases, listed REITs are trading at 40%+ discounts to book value.

We believe part of this price dislocation is due to the increasingly short term investment horizons of many professional REIT investors. They are much more interested in what will make money in the next three months, rather than what is the best priced investment over the medium to long term. Therefore, prices for industrial property owners have skyrocketed to eye-watering levels well above property fundamentals (industrial being the current fashionable asset class with the growing demand from e-retailers). Retail REITs, however, are seen as structurally challenged, with low growth. Therefore, listed REIT investors are prepared to be overweight industrial REITs, because the prices have been going up, and underweight retail REITs, because they haven’t. There is no consideration given to relative value.

Virtually all of the property assets in the URW were independently assessed by professional property valuers as at 30 June 2019. While it was acknowledged that shopping centre sales were somewhat limited in both Europe and the US, valuers are still well aware of the challenging landscape and assess values based on current conditions. Therefore, we have some confidence that the NTA of the portfolio is “real”, based on current market conditions and transactions. However, even in today’s ultra-low interest rate world, we would not contemplate owning URW if it was trading NTA. Future returns at that price would quite likely be low. At that price, we don’t believe we would be adequately compensated for the risk of a changing retail landscape.

Luckily, right now, URW is trading nowhere near its underlying asset value. Based on the price we have been purchasing URW, some key financial metrics are as follows:

- The discount to NTA is over 40% for some of the best shopping centres in the world. Based on the current debt profile, this discount to NTA translates into buying the direct shopping centre assets at close to a 25% discount to their recently assessed value.

- Based on URWs most recent guidance, which seems reasonable, the trading price reflects a 9.8% yield on earnings. Given the quality of the portfolio and current market conditions, we believe this is very good. High earning yields can sometimes be a trap for declining future earnings. However, in their most recent results, rental growth was still 4-5% per annum for the Flagship assets.

- The development pipeline presents an opportunity to continue to grow earnings, mostly by expanding existing centres. The team has been doing this successfully for a long time.

- URW forecast an underlying growth projection for their earnings of 5-7% per annum between 2019 and 2023. While we’re not quite that bullish, even earnings growth of 2-3% per annum will deliver very attractive medium-term returns from our starting price.

- Based on dividend guidance, the current dividend yield is 8.8%. This is not entirely cash, as there is a 15-30% withholding tax. However, providing investors can utilise the associated tax credit, the effective yield is still very good.

Why we like it

We have been, and continue to be, cautious of commercial property valuations. They have continued to increase since the GFC on the back of declining long-term interest rates. This has been a very long property cycle, and there does not appear to be any slowing down in sight as investors are attracted to the supposedly “defensive” nature of the asset class.

From these starting valuations, we don’t necessarily agree that property is overly defensive right now. However, we love buying at a discount, especially a big discount. And we believe a 40% discount is pretty big. We like URW for the following reasons:

- Irreplaceable portfolio – While many property owners often claim their portfolios are irreplaceable, we believe for URW it is an apt description. The assets URW own don’t often come up for sale, and certainly not in large volumes. Owning some of the best retail assets in both Europe and the US make URW one of the leading retail owners in the world.

- Excellent managers – Westfield were always known as excellent asset managers, continually being at the forefront of retail evolution. We believe URW management also have these skills, and they are as well placed as any owner to navigate the challenges in the sector ahead.

- Paid to wait – At a 10% earnings yield, and almost 9% dividend yield, we don’t need much to happen to generate an acceptable return.

Potential risks

Outside of normal equity market risks, here are our top risks for this Fund:

- Retail Armageddon

There is a risk that the Amazon effect and online retailing completely disrupt shopping centres, and they become mostly obsolete. In this scenario, it would likely mean that consumers shop online for virtually all their needs, with no desire to “experience“ a retail destination. If this was to occur, the value of the assets might well be much lower. We don’t believe this is the likely outcome, especially considering the premium nature of the portfolio. The structural change happening in retailing is expected to impact lower grade centres much more heavily. There are already examples of secondary centres where rents and values have fallen dramatically, destroying value for investors. Given URWs flagship portfolio and continued evolvement of their retail strategy, they are well placed to manage this risk. - Rising Interest Rates

While higher interest rates would negatively affect the price of virtually all financial assets, property prices are especially sensitive to these changes. If there were a significant increase in long term rates, the underlying value of the assets would likely decrease unless it coudl be offset by higher rental growth. This would lead to a reduction in value of URW units. - Currency changes

As with any global investment, the value will be dependent on currency movements. With property in Europe (Euro), the UK (British pound) and the US (USD), the overall currency effect is complex. As Australian investors, the risk is a material appreciation of the AUD, as this would effectively decrease the value of the assets.

Conclusion

We believe it is not often that you get to own some of the world’s best shopping centres at such a substantial discount. Usually, owning premium property assets means accepting low earnings and dividend yields. In this case, we expect to receive virtually all our required return through these yields. In addition, we get a free option on the recovery of the reputation of retail assets.

We hope that was helpful. If so, here are some other things you might like.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager Profiles.

Find out about our Affluence Investment Fund.

View the Affluence Investment Fund Portfolio.

Disclaimer:

This Fund Profile as dated August 2019. It was prepared by Affluence Funds Management Limited (Affluence) to enable investors in the Affluence Investment Fund to understand the investments of the Fund in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content has been prepared without taking into account your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Affluence recommends you consult your professional adviser before making any decision to invest.