Fund Performance

| To 30 September 2015 | 3 Months | 6 Months | 1 Year | Inception* |

| Affluence Investment Fund | 3.1% | 4.5% | N/A | 9.4% |

| Target Return (Inflation + 5%)^ | 1.9% | 3.3% | N/A | 6.5% |

| Outperformance | 1.2% | 1.2% | N/A | 2.9% |

* Annualised ^ Inflation data as at June 2015, as September data was not released at the date of this report

The performance of the Affluence Investment Fund for the quarter exceeded that of the ASX200 accumulation index by over 9% and for the past 6 months has exceeded it by over 17%.

The Fund commenced investing on 1 December 2014 with a limited number of initial investments and has continued to be very conservatively placed over the past few months. While the performance for the quarter of 3.1% after all fees and costs was well above our benchmark, what was more pleasing to us was that it substantially exceeded that of the stock market during the recent correction phase. The performance for the quarter exceeded that of the ASX200 accumulation index by over 9% and for the past 6 months has exceeded it by over 17%.

Performance to date is equivalent to a 9.4% annualised return, well ahead of our target returns in what has been a difficult market. While we are not yet fully invested and the return history is relatively short, we are somewhat comforted by these results.

We currently have around 73% of the Fund’s capital invested, with the balance held in cash.

The Cromwell Direct Property Fund investment again performed well during the quarter and was the biggest positive contributor to performance. We saw increases in the value of a number of assets in this fund including one underlying asset which was sold to foreign investors at a significant premium to its most recent valuation.

Fund Investment Portfolio

We have now identified our target initial portfolio, gleaned from over 10,000 funds available in Australia. The pullback in markets over the past 6 months has provided us with a much more attractive entry point into many of these funds.

We will make these additional investments gradually over the next 3 months with the intention of being fully invested in our target funds and managers by the end of the calendar year, subject of course to market conditions. This will result in the Fund being significantly more diversified, holding approximately 25 investments in what we consider to be the best managed funds available in Australia.

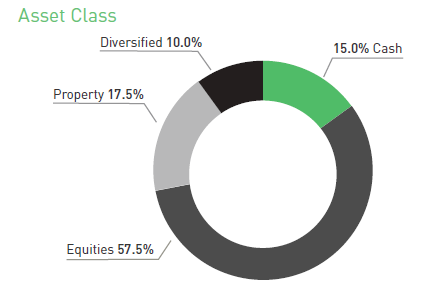

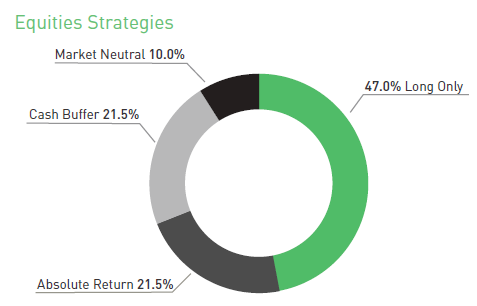

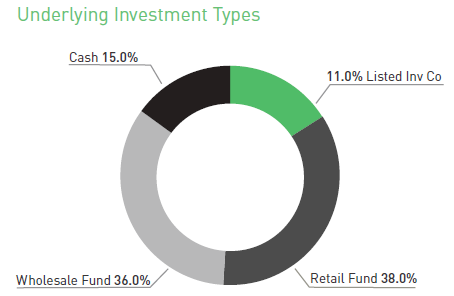

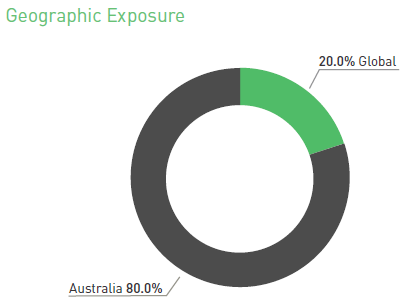

Below are some graphs outlining the expected characteristics of this target portfolio. Importantly, we expect to expand the portfolio over the next 3 months into funds which invest in some offshore equities and a broader range of Australian equities. Many of these underlying funds use strategies designed to cushion returns in market corrections.

Because a number of the funds we invest with are themselves carrying significant amounts of cash, the underlying cash exposure is likely to be higher than noted above. This means the impact of any market correction on our portfolio should be less severe than, say, a portfolio constructed only of listed stocks.

If you would like to know more about the Fund’s portfolio, please contact us.

The portfolio will continually evolve as markets move around and new opportunities present themselves. We will select only those opportunities which we feel are the absolute best for inclusion in the portfolio.