The investment world post 31 December 2021 entered a distinctly different phase, with the realisation that rampant inflation was going to lead to a substantial rise in interest rates. This has impacted most asset classes, however commercial real estate, unlisted property funds and listed Real Estate Investment Trusts (REITs) are some of the more pronounced losers from this change. Property funds and REITs hold illiquid property assets such as office buildings, shopping centres, industrial sheds, residential accommodation or specialised real estate assets such as data centres.

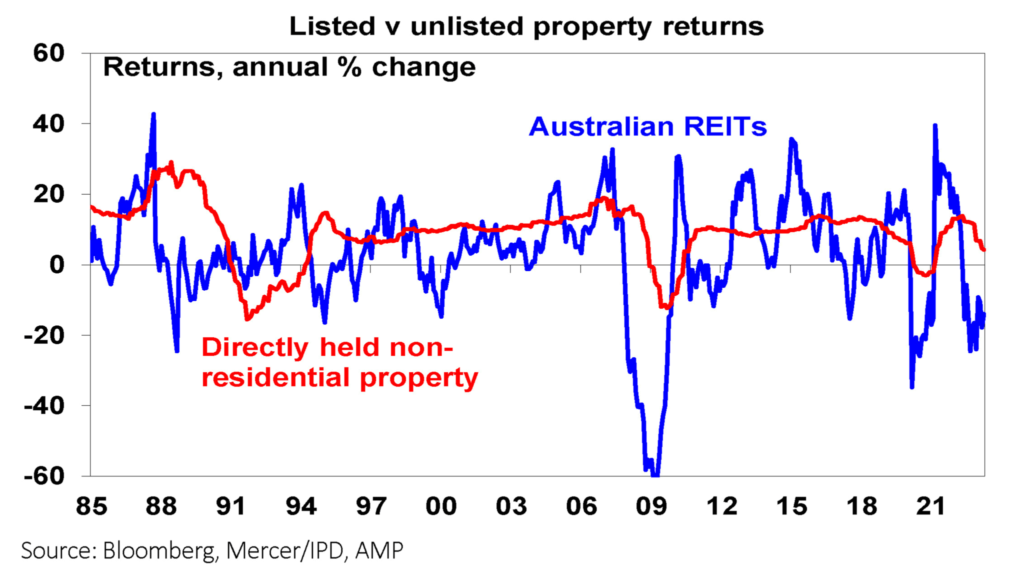

Unlisted property funds offer an advantage over their listed counterparts in that units are usually bought and sold at prices very close to their net tangible assets (NTA). However, they are well known for becoming illiquid during times of market stress, as is happening now both in Australia and globally. There are countless examples over each cycle of investors becoming stuck in a previously liquid fund as many unitholders head for the exit at the same time.

REITs are listed and have closed ended structures. This means that when someone buys or sells REIT units on an exchange, they are trading existing units with other investors. No units are issued or redeemed. Because the market sets the price, REITs can and do trade at substantial discounts and premiums depending on market conditions and investor sentiment. This volatility is the price of liquidity. Like all listed vehicles, REITs are at the mercy of Mr Market.

While some investors find volatility uncomfortable, it does provide the opportunity to substantially outperform if you are able to take advantage of it. In the good times when property values are increasing, investors are chasing attractive distribution yields and the sky is blue, REITs often trade at substantial premiums to their NTA. This can lead to tremendous gains. The NTA increases as property valuers increase the valuations of the assets, while investors pay even greater premiums on these new increased values in the expectation it will all continue forever.

What has happened with REITs?

REIT prices have been in freefall since interest rates started rising in 2022. So why do REITs fall when interest rates rise? There are a few mechanisms at work and they all help to push values down.

The first is similar to all investment assets. The more interest rates increase, the higher the risk free return available to investors. To maintain a similar risk premium, valuation metrics must soften. The main valuation tool for commercial property is known as the capitalisation rate. This is a yield applied to the market income of an asset. The higher the cap rate, the lower the value. Therefore when interest rates increase, cap rates (yields) must eventually increase as well.

Secondly, commercial property is generally a fairly stable asset class. This leads to property owners using debt against the assets in an effort to improve returns. An increase in interest rates leads to higher interest costs for the debt within the REITs, reducing net profits and returns on equity. Most REITs use some form of hedging to manage future interest costs, but eventually those hedges expire and if interest rates remain high, interest costs will increase over time to current market rates.

Finally, interest rates are normally increased to reduce aggregate demand in the economy. This means less demand for office space, retail shops and industrial accommodation. This puts downward pressure on market rents, which may reduce property income or at least the expected rent growth rate.

Owning REITs at the top of the valuation cycle, especially if they are trading at substantial premiums to NTA, can make for a very scary ride on the way down. Since the start of 2022, investors have been faced with the triple whammy. Valuers marked property valuations down as landlords sold assets for less than they were previously worth, leading to falls in NTA. Gearing magnifies these falls in NTA. Investors then sell off the REITs even further as they fear further downgrades. REIT prices go from a premium to a discount to NTA, or from a small discount to a much bigger one. This can lead to situations where a 10% fall in asset values, through the combination of gearing and premiums falling to discounts, can lead to losses to investors of 30% or more.

Where are REITs now?

From 31 December 2021 to 30 September 2023 the ASX300 A-REIT Index is down 26% excluding distributions, or 20% including distributions, despite fairly modest falls in announced property valuations so far. Most REITs have actually suffered larger losses than the index, as the titan in the sector, Goodman Group, makes up 30% of the index and has performed much better than the average.

There are some very pronounced differences in asset classes. Office REITs and those with a substantial allocation to office properties have been impacted the worst. Covid obviously changed the way we work, and the work from home trend has definitely won favour with employees. It is still too early to make any long term conclusions, but there is now an expectation that the world will need less office space if employees continue to spend a material part of their work time at home. This has led to investors showing more caution towards office REITs, and they are trading at larger discounts to NTA. Retail and shopping centre REITs are in the middle, with concerns over overall valuations and potential rent softening if we do enter a recession or consumer trouble. The least affected are industrial REITs. There has been an explosion in demand for quality industrial sheds as ecommerce and the latest technology distribution centres have been required. This has led to industrial being the unanimous winner amongst fund managers.

Asset values have started being marked down, but we expect they still have a substantial decline left. Our opinion is that the current NTAs based on the 30 June 2023 valuations are still high, and are likely to continue to fall over the next 12-24 months. Our sympathies are with property valuers (coming from someone who used to be a property valuer) as trying to assess values in the current market is very difficult. Similar to the process of valuing any asset class, property valuation is as much art as science. The main method of property valuation is to compare the subject property to recent sales in the market with regards to the main valuation metrics (cap rate, IRR, building rate per square metre, market rents). Normally this is reasonably straightforward. But in a falling market, direct transactions slow down markedly as no-one wants to be the first to sell at a loss. Valuers are stuck in the middle, with many property owners fighting to persuade the valuers they are being too conservative, and buyers pointing to the listed market saying that the reason the discounts to NTA are so big is because the values need to fall further. Normally they are both wrong, and the right answer ends up being somewhere in the middle.

Property valuers generally do an admirable job of assessing the evidence as they see it. Values may continue to fall, but that doesn’t mean their assessment at the date of valuation was wrong. Eventually, as a larger number of transactions start to occur again, the gap between buyers and sellers converge and the market continues to go on its way.

When to buy REITs?

Timing the trough in property values is not as important as trying to estimate where they may end up, and how this compares to the current share price. When you buy a REIT you are essentially buying an interest in the underlying direct property, and this is our main method of assessing value. We will use an example for this purpose.

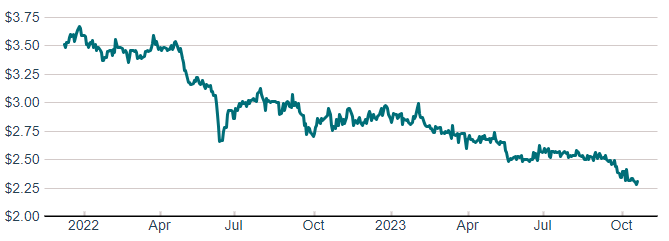

The Dexus Convenience Retail REIT (ASX: DXC) holds a portfolio of service stations around Australia. The tenant quality is excellent with the major tenants being Chevron and 7-Eleven. The weighted average lease expiry is solid at 9.7 years, and it is appropriately geared at 32% (more on this later). As at 30 June 2023 the NTA of DXC was $3.75 based on current property valuations, with a portfolio cap rate of 6.10%. As at 29 September 2023 the trading price was $2.34, a 38% discount to the 30 June NTA. Adjusting for gearing and other balance sheet assets and liabilities, the discount to NTA of 38% translates to an implied discount to the property values of 25%. Therefore for the NTA to fall to the share price of $2.34, all other things being equal, the 6.1% portfolio cap rate at 30 June 2023 must rise to an 8.2% cap rate. In our opinion, this is attractively priced real estate. Could it get cheaper? Of course. When markets become irrational and unanchored (on the way up and on the way down) there is no limit to how cheap or expensive prices can get. However, we do believe the market reaction is overdone for these assets. Based on the distribution guidance for 2024, the distribution yield at the share price is 8.8%.

Source: Dexus.com (ASX: DXC Share Price 8 Dec 2021 – 18 October 2023)

What else to consider?

Unfortunately listed REITs have proven in the past to be relatively poor capital managers. The smart choice would seem to be to issue new capital when prices are high and, if possible, to undertake buy backs when prices are low and the share price is trading at a discount to NTA. In REIT land unfortunately, this rarely happens.

Other than the property values, two of the most important factors to assess before investing in a REIT are the gearing level (and where it may end up) and the managers capital allocation ability. How likely it is that the REIT manager will raise equity? If we felt is was likely, we would probably not be buyers at the moment. Contrary to market consensus, there is nothing wrong with gearing levels of 40-50% at the bottom of the valuation cycle, providing the property income is sufficient to service the debt.

When looking at whether it’s a good time a buy REITs, there are many other things to consider as well. Some of the more important factors include:

- Debt hedging levels. Most REIT managers have hedges in place to manage their interest costs for the next 1-2 years. They will eventually wind off, and this can substantially impact future profits.

- Distributions and cash flow. You should never buy a REIT (or any asset) purely on a distribution yield. But it is important to confirm that the distribution is being paid from profits, and there is sufficient cash flow to pay for upcoming property capital works and tenant lease incentives.

- Asset quality. In tougher economic times when vacancy levels increase, asset quality becomes more important. Those owners stuck with lower quality or poorly located assets are often the ones who bear the brunt of price falls.

Conclusion

We believe it is very likely property values will continue to fall. Given current discounts to NTA available in the REIT market, there are limited reasons why investors would choose to own unlisted property funds or directly owned assets. If you are buying unlisted funds or direct assets at NTA (or at a premium if you are paying stamp duty and manager acquisition costs) then it is likely putting you behind from the start.

Neither are we saying that now is the time to go all-in on REITs. We have started nibbling around the edges where we believe the look through asset values and other factors are sufficiently attractive. We continue to research and watch those REITs that meet our criteria. We don’t know exactly where the bottom will be, but as soon as investors believe the worst is behind us, REITs might start to recover very quickly.

We hope that was helpful.

If so, here are some other things you might like.

See more of our articles.

Find out about our Funds.

You can also sign up to receive our monthly eNews at the bottom of this page. It includes Fund updates, investments ideas and other things we find interesting.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.