Hi,

January was a tough month for financial markets. In our last few monthly reports, we’ve discussed our concerns that rising inflation would lead to rising interest rates (and potentially lower equity prices). In January, equity markets started to take notice of this risk. The ASX 200 Index fell 6.4%, the ASX Small Ords fell 9%, and in the USA, the tech-heavy Nasdaq fell 9%.

The news was better for Affluence investors, with all three Funds outperforming significantly, though still slightly down for the month. Read more in the latest fund reports below.

Markets have stabilised somewhat since the January falls. However, we remain cautious. We are doubtful that markets have yet priced in the full number of interest rate increases that will be required this year. We expect further volatility during the year as reality sets in. As a result, we continue to hold more cash than usual in all funds.

In other news this month, we explain why we think the worlds largest companies are expensive. We also touch on Pets.com, St Patrick and some really big numbers.

Monthly applications for the Affluence Investment Fund close on 25 February. Investments will be effective 1 March, with confirmations emailed about a week after that. Go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds.

If you have any questions or want to give us some feedback, you can reply to this email or give us a call.

Regards.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned -1.0% in January. Since commencing in 2014, returns have averaged 8.9% per annum, including distributions of 6.6% per annum. At month end, 57% of the portfolio was invested in unlisted funds, 14% in the Affluence LIC Fund, 12% in listed investments, 3% in portfolio hedges and 14% in cash.

The cut-off for monthly applications and withdrawals is 25 February.

Affluence LIC Fund

The Affluence LIC Fund returned -1.6% in January. Since commencing in 2016, returns have averaged 13.5% per annum, including quarterly distributions of 7.5% per annum. The average discount to NTA for the portfolio at the end of the month was 14%. The Fund held investments in 27 LICs (70% of the Fund), 5% in portfolio hedges and 25% in cash.The cut-off for monthly applications (existing clients only) and withdrawals is 28 February.

Affluence Small Company Fund

The Fund returned -2.4% in January, while the ASX Small Ords Index fell by 9.0%. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 10.1% per annum. The Fund held 8 unlisted funds (49% of the portfolio), 7 LICs (17%) and 6 ASX listed Small Companies (19%). The balance 15% was cash and hedges.

Available to existing wholesale clients only. The cut-off for monthly applications and withdrawals is 28 February.

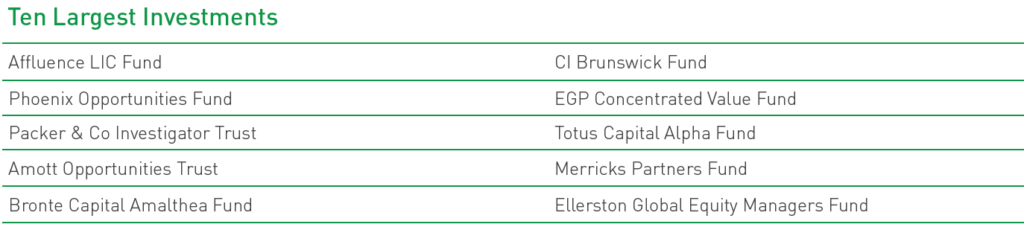

How many of these have you heard of?

The bedrock of the Affluence Investment Fund is 25+ investments with a range of boutique fund managers. These underlying managers all have several things in common. A lot of experience, an accomplished investment track record, and a specialised investment strategy. Plus, they all invest a significant portion of their own money in the strategies they manage.

You may not have heard of many of these funds. Quite a few are closed to new investors, or only available to wholesale clients. Almost all of them specifically cap the amount of money they manage, because they understand that one of the biggest barriers to exceptional performance is too much money.

Through the Affluence Investment Fund, you can access them all, plus more. With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

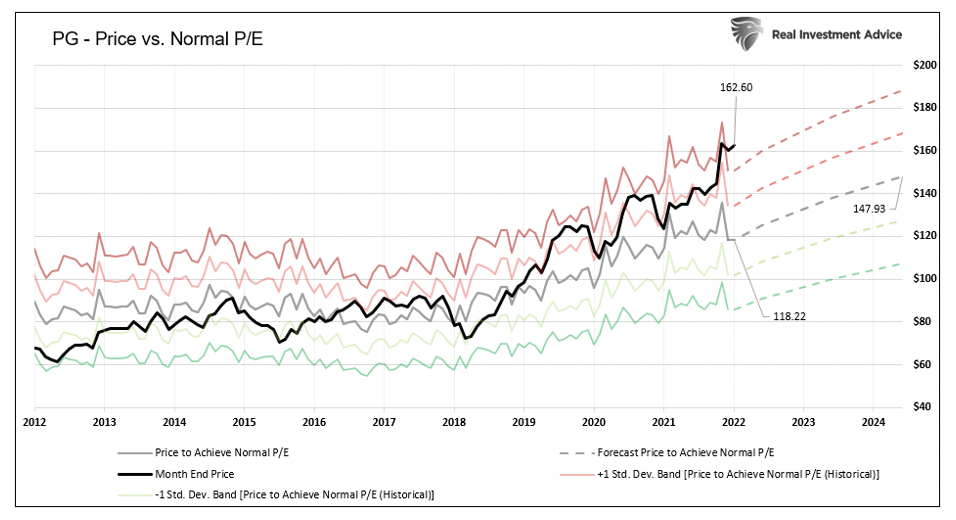

We currently have quite low exposure to many of the largest listed companies, both in Australia and globally. These “blue chip” stocks are widely considered to be high quality. Right now, some are even considered to be “value” stocks. But in our view, most of them are actually quite expensive. More expensive than their growth profiles would suggest is fair.

As one example, the chart below shows the share price of Proctor & Gamble (PG), a conservative and highly regarded consumer staples company with a 180-year track record. PG owns many globally admired consumer brands. In Australia, this includes Gillette, Oral B, Pantene, Olay, Pampers, Vicks and Ambi Pur.

The chart (click on it to see a larger version) compares the actual price of PG (in black) with what that price would be if it were trading at its average historical price earnings ratio (grey). Since mid 2018, two things have happened. One is obvious from the chart, and one is not.

Firstly, the price has run up to be well above what it should be if it was trading at a “normal” P/E ratio. At the end of 2021, PG was trading at $162 per share. This is around 35% above the normal PE ratio price. That may not sound like much, but it represents 4-5 years of average returns. So, if earnings continued growing at the expected rate, but PG traded back to its normal P/E ratio, you might break even on this investment around 2026.

The second problem (that is not so obvious from the chart) is that profit margins for the past few years have grown much quicker than revenues. That trend may be over. One key impact of higher inflation is that it tends to hurt company profit margins, as higher wages and other costs are eventually unable to be fully passed on to customers.

So, anyone buying Proctor & Gamble today may think they are buying an exceptionally high quality global company, with great management and market leading consumer brands. And they are. It’s just that they’re paying a big premium for the privilege, and taking the additional risk that profitability is near a cyclical high. That combination could deliver some very ordinary returns in coming years. Price matters.

The chart is taken from a much more detailed analysis by Michael Lebowitz at Advisor Perspectives, which you can read here.

Quote of the month.

“A portfolio that contains too little risk can make you underperform in a bull market, but no one ever went bust from that; there are far worse fates”

Howard Marks

Kind of how we feel about markets right now.

This day in (financial) history.

In February 2000, online retailer Pets.com listed at $11 per share, valuing the company at $290 million. For the prior year, they had revenues of less than $1 million, after having spent $11 million on advertising. Their tag line was “Pets.com, because pets can’t drive.

“The company was to become the poster child for dot com excess. It was founded in 1998. In 1999, Amazon was an investor in their first round of venture funding, purchasing a significant stake in the company. Disney also invested. Pets.com spent most of the money on large warehouses and shipment infrastructure. They also purchased their biggest online competitor at the time, Petstore.com, for $10.6 million.

The Pets.com mascot, and star of their TV ads, was a sock puppet dog. The sock puppet attained cult status, and the company eventually offered them for sale. Despite the puppet’s success, Pets.com did not do well. The company’s demise was hastened because it lost money on nearly every sale it made. In 1999, it was selling merchandise for approximately one-third the price it paid to obtain the products. It turns out this was not much of a business plan. They did better in 2000, but still they took less in revenue than it cost them to actually buy the products.

On November 6th, 2000 – just 268 days after its IPO, Pets.com entered into a form of liquidation. Eventually, shareholders got 9 cents per share returned to them.

These days, the pets.com website is owned by PetSmart, which operates a large chain of stores in North America. PetSmart bought the website and some other assets of Pets.com in late 2000, having previously offered to buy the whole company for less than it’s cash backing.

In an interesting post script, eventually, the Pets.com concept was successfully realised by Chewy.com. Chewy was also owned by PetSmart for a time, until being floated in 2019. This prompted some comparisons between the two companies. Chewy’s founder, Ryan Cohen, rejected comparisons to Pets.com in 2019, saying “That is an absolute crazy comparison. I think there’s really nothing in common between those two businesses.

“Ryan, who has since left Chewy, was right (sort of). Chewy.com certainly does have sales greater than their cost to buy the goods, so they are at least doing something right. However, from the latest full year numbers available, to early 2021, we can see that Chewy had not yet turned a profit.

Currently, Chewy has a market capitalisation of $20 billion. Which is down from almost $50 billion in mid 2021. Which just goes to prove that history doesn’t repeat, but it does rhyme.

In February 1955, listed company Berkshire Fine Spinning Associates announced that it would acquire Hathaway Manufacturing Company. The combined company was to be called “Berkshire Hathaway Inc.”, and would have 10,000 employees and 14 textile plants.

However, joining forces did not save Berkshire from trouble. Over the next 7 years, Berkshire Hathaway would close 9 of its 14 manufacturing plants as the company’s value shrank by 37%. About then, a relatively unknown fund manager by the name of Warren Buffett began buying stock in Berkshire Hathaway. It was another three years before young Buffett would take control of the company. The rest, as they say, is history.

Vaguely interesting facts.

- Paraskavedekatriaphobia is the fear of Friday the 13th.

- Blood donors in Sweden receive a thank you text when their blood is used.

- According to a Japanese study, looking at cute animal pictures can boost your focus.

- St. Patrick wasn’t Irish. He was born to Roman parents in either Scotland, England, or Wales.

- Ben and Jerry originally wanted to start a bagel company. They ended up in the ice cream business because they couldn’t afford a bagel machine.

Source: mentalfloss.com

And finally…a story and some pictures about really big numbers.

“There are depressing moments. There are dark places. And then there’s being a 31-year-old man carefully stacking Sour Patch Kids on the kitchen counter in a silent apartment at 2:00am.

“Investing is all about the numbers, and in this piece from 2013, Tim Urban puts some visual perspective on really big numbers, with the help of a bunch of lollies.

If you enjoyed this newsletter, forward it to a friend.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.