December was another good month for our Funds to round out the year. More details are in our monthly fund reports, which you can access below.

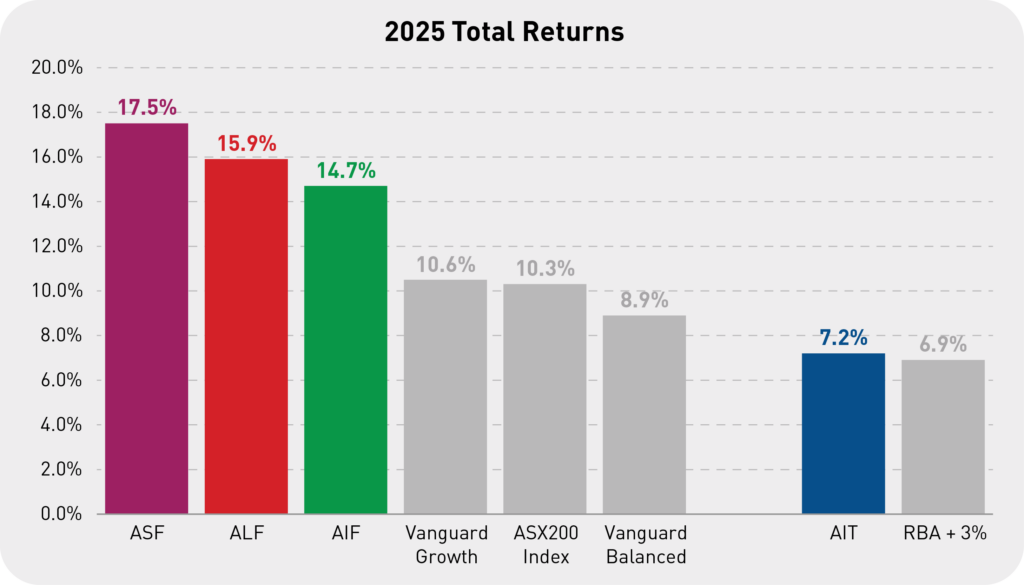

Returns for the 2025 calendar year were very strong across all of our Funds:

In our latest Investor Letter we review fund performance for 2025 and preview how our portfolios are positioned for 2026. We encourage you to read it.

The new year for many is also a time for reflection. We started Affluence in 2015 as we saw an opportunity to offer a better, more diversified and more investor aligned investment solution than what was commonly available from traditional fund managers. We were the first investors in each of our Funds and a significant proportion of our own and extended families wealth is invested in our Funds. We wanted to provide investors with the opportunity to invest differently and access quality, diversified portfolios they may otherwise not have been able to access or that may have been difficult to build on their own.

In 2026 this aim remains the same. We pride ourselves on the high-quality of our products, our long-term performance, strong alignment with our Investors and our desire to continue to provide education and investment related content to our Investors and subscribers.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Annual Investor Letter

In our 2025 Investor Letter, we look at what happened in investment markets, how our Funds performed, how they’re positioned for the road ahead and where we think the opportunities are. It’s everything we would want to know if we were you.

Affluence Funds Returns

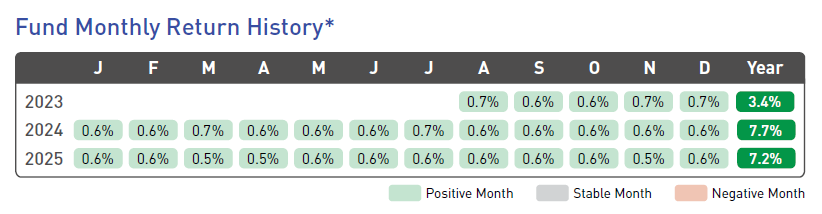

Affluence Income Trust

The Affluence Income Trust returned 0.6% in December and 7.6% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Income Trust December 2025 Report

Affluence Investment Fund

The Affluence Investment Fund returned 1.4% in December and 8.3% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence Investment Fund November 2025 Report

Affluence LIC Fund

The Affluence LIC Fund returned 1.3% in December and 11.4% per annum since commencing. At the end of the month, the average portfolio NTA discount remained near all time highs at around 27%.

Affluence LIC Fund December 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned 1.5% in December and 10.1% per annum since commencing. There’s still exceptional value in many smaller companies.

Affluence Small Company Fund December 2025 Report

Fund In Focus

Are you looking for an investment option that targets consistent, regular income, but without the risk associated with stock markets? Our Affluence Income Trust might be worth a look.

The Fund aims to provide you with:

- A minimum distribution equal to the RBA Cash Rate plus 3% per annum, paid monthly.

- Preservation of capital over rolling 3 year periods after payment of distributions.

- Access to a highly diversified portfolio of fixed income assets, with a focus on maximising returns with low volatility.

Returns since inception have averaged 7.6% per annum, above the benchmark of the RBA cash rate plus 3%.

The Affluence Income Trust invests in a highly diversified fixed income portfolio, with a focus on maximising returns with low volatility. The Fund has a flexible investment mandate. This allows us to take advantage of what we believe to be the best risk adjusted investment opportunities within the fixed income asset class at any given time.

We aim for the portfolio to be highly diversified within the fixed income asset class by sub-sector, underlying manager, investment strategy, credit risk, liquidity, and investment structure.

The Fund is designed for use as up to a Core Component of an investment portfolio for those investors seeking Income and Capital Preservation with a one year or longer investment timeframe, a Low risk/return profile and needing access to capital Monthly or less often.

You can learn more about the Fund from the Fund Page on our website which you can access by clicking below or let us know if you would like us to call you to discuss the Fund in more detail.

Things we found interesting

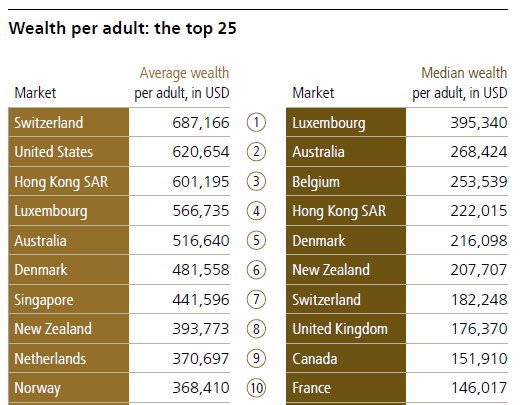

Chart of the month.

Whether it’s average wealth, or median wealth, Australia continues to be one of the top 5 in the world when it comes to wealth per adult, based on this UBS data from 56 countries:

We prefer looking at median. Average figures are often skewed upwards by relatively few individuals with disproportionately high wealth, while median figures tend to offer a keener insight into wealth levels in the middle of the scale.

Could you stay invested?

We often talk about volatility, and how it’s important to understand when investing. Here’s an example of why.

The best performing unlisted investment for the Affluence Investment Fund in 2025 returned 118% for the year. The fund in question operates in the resources space and has delivered average returns of 18.4% per annum since it began almost 15 years ago. That is an exceptionally good long term track record. But (there’s always a but), that performance has come with a large amount of volatility.

For example:

- There have been almost as many months with negative returns as positive.

- This fund has lost more than 10% in a single month 11 times since it began.

- Multiple times, the Fund has had falls of 20%, 30% and once over 50%, before recovering.

- Volatility, which measures fluctuations in returns, has been 27%. That’s more than double the ASX200 Index.

Could you have stayed invested through all of that? Could you have added to the investment after it fell? Some of the best times to invest in this fund over it’s 15 year history were after it had fallen by 20% or more, which has happened every couple of years on average. Seven of the twelve times we have added to this investment were at prices lower than the previous investment.

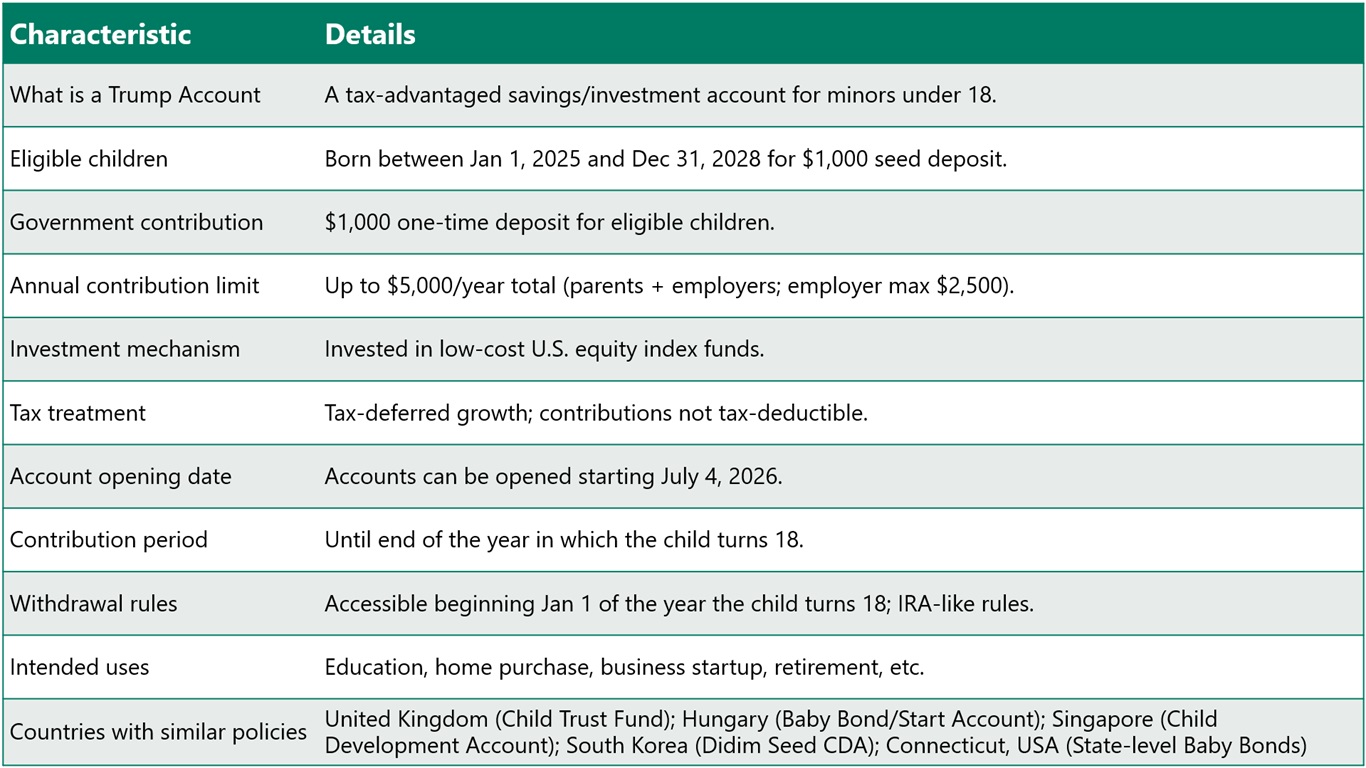

The best idea Trump has ever had

The One Big Beautiful Bill includes the creation of Trump Accounts. No, it’s not a new type of cryptocurrency. It’s a tax‑advantaged, long‑term investment account that will be created for children under 18. Accounts can be opened starting July 4, 2026. They are designed to help families build savings for a child’s future such as education, a first home or starting a business using tax‑deferred investment growth. Best of all, the Government will make a $1,000 contribution for every eligible child.

Here’s the details:

It is a great idea, and one Australian politicians would do well to give some thought to. In our case, we already have vehicles like the future fund, large superannuation funds and the ATO that could assist in tracking and managing the money, so it should be very easy to do.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Spaghetto is the singular form of spaghetti.

- Before erasers, people used breadcrumbs to remove pencil marks.

- The Eiffel Tower can grow over 6 inches in summer due to metal expansion.

- The coast of Alaska is more than double the length of every other US State combined.

- Cleopatra lived closer to the moon landing than to the construction of the Great Pyramid. *

* Cleopatra VII, the last active ruler of ancient Egypt, died in 30 BC. By then, Rome was rising, Egyptian pyramids were old news, and Julius Caesar was a household name.

The Great Pyramid of Giza was completed around 2560 BC, during Egypt’s Old Kingdom. That’s over 2,500 years before Cleopatra’s birth. The Apollo 11 moon landing happened in 1969, which is just under 2,000 years after her death.

That means Cleopatra (who wore eyeliner, spoke multiple languages, was of Greek descent and sparred with both Caesar and Mark Antony), was separated by more time from the building of the pyramids than we are from her. By Cleopatra’s era, the pyramids were already ancient ruins, just like they are to us. She probably visited the pyramids just like modern tourists do, but without the selfie.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.