Hi,

Welcome to our monthly update. July was a mixed bag for our funds. One up, one flat and one down. Links to the monthly fund reports are below.

For new investors in unlisted funds such as ours, the application process can be a bit of a headache. While a listed share can be bought with a few clicks, unlisted funds require an application form, and a verification process. Of course, we’d like to think our funds are worth the effort, and once you’re an investor, it’s much easier to add more. Still, we’re always on the lookout for ways to make it easier for current and prospective clients to invest with us.

That’s why we’ve made the decision to move our fund registry to Registry Direct. By making this change, we’re hoping we can make the application process easier and quicker. We’re also aiming to make it much simpler for an investor to log on and check/update their investment information.

If you are currently an investor or financial advisor with us, you will be receiving correspondence about the change and an invitation to register over the next couple of months. In the meantime, the video here gives a quick introduction to what you can expect from the Registry Direct online portal.

If you’d like to invest with us this month, applications for the Affluence Investment Fund close on Wednesday 25 August. Investments will be effective 1 September, with confirmations emailed about a week after that. As always, go to our website and click “Invest Now” to apply online or download application or withdrawal forms for all our funds.

If you have any questions or just want to give us some feedback, reply to this email or give us a call.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

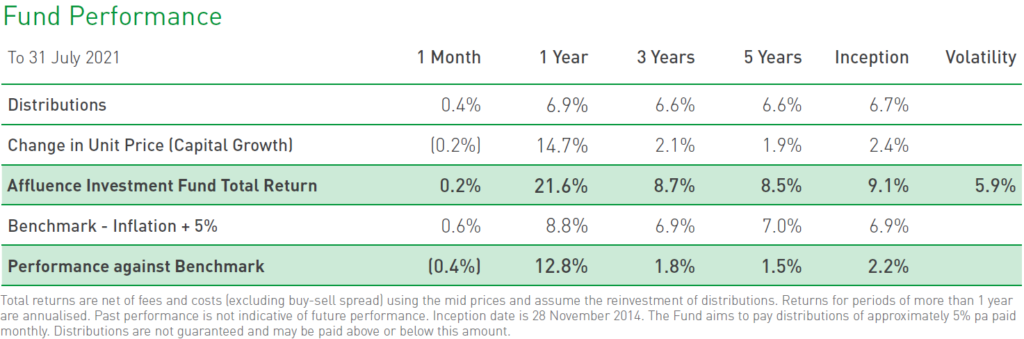

The Affluence Investment Fund returned 0.2% in July. Since inception in 2014, returns have averaged 9.1% per annum, including monthly distributions of 6.7% per annum.At month end, 62% of the portfolio was invested in unlisted funds, 16% in the Affluence LIC Fund, 11% in listed investments, 2% in portfolio hedges and 9% in cash.

Affluence LIC Fund

The Affluence LIC Fund was flat in July. Since commencing in 2016, returns have averaged 14.1% per annum, including quarterly distributions of 7.7% per annum.The average discount to NTA for the Fund portfolio at the end of the month was 13%. At the end of July, the Fund held investments in 28 LICs representing 80% of the Fund, 5% in portfolio hedges and 15% in cash.

Affluence Small Company Fund

The Affluence Small Company Fund returned -0.9% in July. Since commencing in 2016, returns have averaged 10.5% per annum, including quarterly distributions of 6.8% per annum.The Fund holds a range of small cap exposures with a distinct value focus. At the end of July, the Fund held six unlisted funds (53% of the portfolio), five LICs (17%) and nine ASX listed Small Companies (21%). The balance 9% was cash and hedges.

Exclusive access to 25+ talented fund managers

Almost 40% of the underlying funds held by the Affluence Investment Fund are now closed to new investors. This means the Fund provides access to a manager set that is simply impossible to replicate. In addition, around 20% of the portfolio is allocated to funds that are only available to wholesale investors.

With monthly distributions, a focus on investing differently and fees that are totally based on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

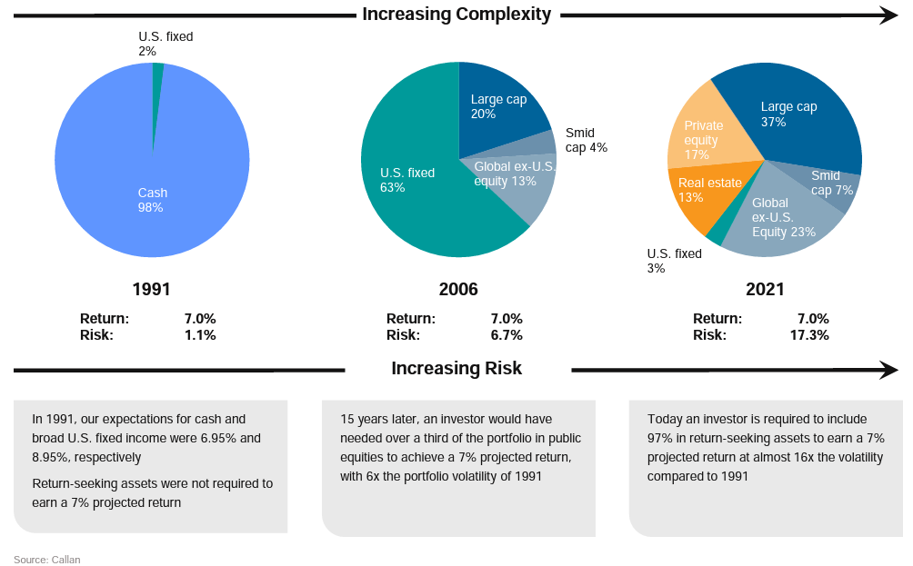

Chart of the month 1.

This chart (from Callan via Arnott Capital) sums up the current dilemma of every investor quite nicely. It shows the asset mix required to achieve a 7% annual return, based on expected long term returns from each asset class. It’s based on US returns, but the story for Australian investors is similar.

Way back in 1991, all you needed to do to get a decent return was to own bonds. Minimal risk. By 2006, the picture had changed a bit for US investors. You required almost 40% of your portfolio in stocks to achieve 7%. For Australian investors it wasn’t that bad – you could almost still get 7% from cash and bonds.

Fast forward to 2021 and the picture is drastically different for everybody. With cash and bonds earning close to zero, you need almost all your portfolio in growth assets to achieve an expected 7% return. That’s much riskier.

Of course, this analysis only looks at traditional asset classes. Luckily for us, we have other options. They include:

- Finding sectors and assets that are cheaper than average, providing potential for above market returns.

- Investing in alternative assets, where returns are less directly impacted by market movements.

- Alternative investment strategies (generally with lower market exposure).

- Investing with managers we strongly believe can outperform markets.

- Reducing market exposure through selective hedging.

Our funds use a blend of all these strategies to provide a decent shot at beating markets, while managing the level of risk.

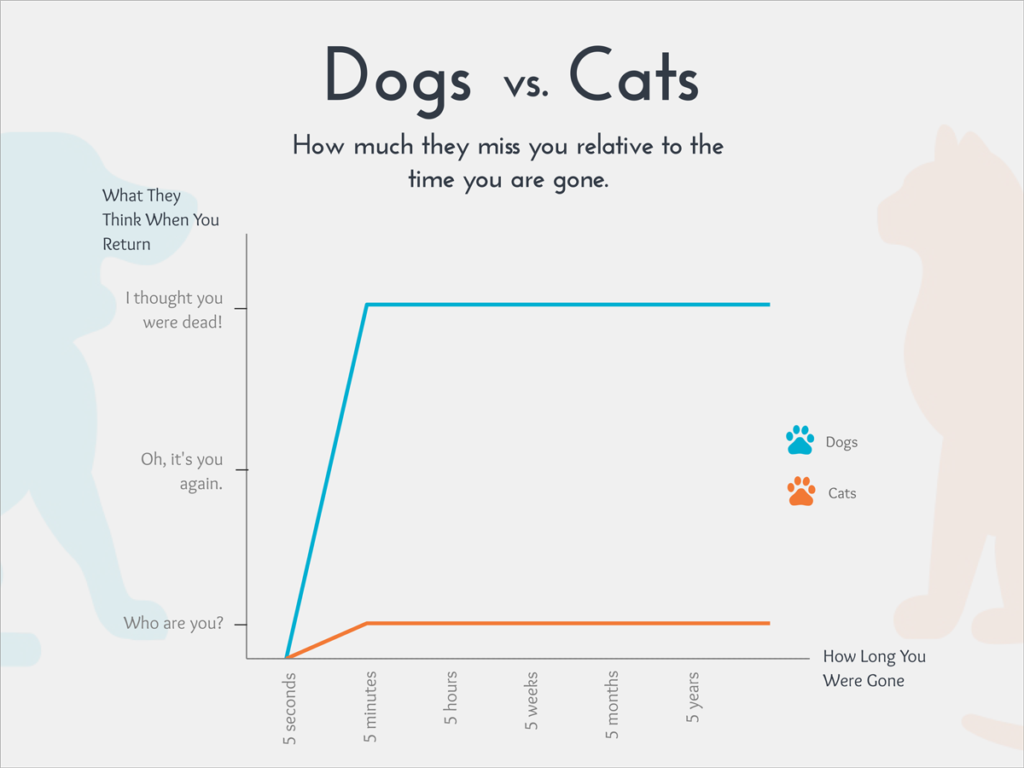

Chart of the month 2.

We all know this one is true…

Quote of the month.

It’s not often we quote an economist. It’s not because we don’t like them. We just don’t have much faith in their ability to predict the future. And even if they get that right, markets don’t always react the way you expect them to. But this month we’re making an exception.

“As time goes on, I get more and more convinced that the right method of investment is to put large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is mistake to think that one limits one’s risk by spreading too much between enterprises about which one knows little and has no reason for special confidence.”

John Maynard Keynes, in a letter written August 15th, 1934.

Amazing fact.

Scientists estimate that during their heyday, around 20,000 Tyrannosaurus Rexes lived at any one time. Were you able to go back in time, a T. Rex would have been on average 25km from you. They hung around for a long time too, with an estimated 127,000 generations of the dinosaur living and dying in total.

This month in (financial) history.

August 15/16, 1945: Stock markets closed to celebrate the end of WW2.

August 1971: Alarmed at inflation, which was running at roughly 4.5% per annum, US President Richard Nixon declared a 90-day freeze on wages and prices. In response, the stock market soared by 3.8%. However, the freeze would not work. By 1975 inflation was running at over 11%. After a slight drop in the late 70s it hit 13% in 1980.

August 13, 1998: As Russia struggled economically, it put capital controls on the ruble, attempting to limit the currency’s decline. Russia’s stock market fell on the news, and at that point was down 75% since the start of 1998. Short term interest rates in Russia hit 200%. The panic was hurting one hedge fund in particular, who had investment assets leveraged at 25 to 1, much of which was used to bet heavily on Russian bonds. And it got worse. Russia would default on its bonds 4 days later. The hedge fund was Long Term Capital Management. Over the following five weeks, all equity in Long Term Capital Management (LTCM) would evaporate, leading to one of the biggest bailouts in corporate history.

LTCM was initially very successful. However, in 1998, investor capital all but disappeared in less than four months. Because many of the largest banks in the world had financed LTCM, it was feared outright failure could invoke a chain reaction in numerous markets, causing catastrophic losses to cascade through the financial system. LTCM tried, and failed to raise more money on its own, and it became clear it was running out of options.

On September 23, 1998, Goldman Sachs and Berkshire Hathaway offered to buy out the fund’s partners for a fraction of what the stake had been worth at the start of the year, and to inject enough funds to pay out the creditors. Warren Buffett gave LTCM less than one hour to accept the offer, but the time lapsed before a deal could be worked out.

Seeing no options left, and in stark contrast to how things are done these days, the Federal Reserve Bank of New York organised a bailout by the major creditors. No public money was injected or put directly at risk. The companies involved in providing support to LTCM were also those that stood to lose from its failure.

In 2007 Warren Buffett spoke about LTCM, and the folly of debt, during a talk to MBA students at the University of Florida. Here’s his comments on the investment team at LTCM. Pay attention.

“The whole story is really fascinating because…if you take the 16 of them, they probably have as high an average IQ as any 16 people working together in one business in the country…an incredible amount of intellect in that room. Now you combine that with the fact that those 16 had had extensive experience in the field they were operating in…in aggregate, the 16 had probably had 350 or 400 years of experience doing exactly what they were doing. And then you throw in the third factor that most of them had virtually all of their very substantial net worth in the business. So they had their own money up. Hundreds and hundreds of millions of dollars of their own money up. Super high intellect, working in a field they knew. And essentially, they went broke.

And that to me is fascinating…to make money they didn’t have and didn’t need, they risked what they did have and did need, and that’s foolish. Doesn’t make any difference what your IQ is. If you risk something that is important to you for something that is unimportant to you, it just does not make any sense. I don’t care whether the odds are 100 to one that you succeed or 1,000 to one that you succeed….you can name any sum you want but it doesn’t do anything for me on the upside and I think the downside is fairly clear. So I’m not interested in that kind of a game. And yet people do it financially without thinking about it very much.

There was a great book…“You Only Have to Get Rich Once.” Now that seems pretty fundamental, doesn’t it? If you’ve got $100 million at the start of the year, and…you’re going to make 10% if you’re unleveraged, and 20% if you’re leveraged, 99 times out of 100. What difference does it make at the end of the year whether you’ve got $110 million or $120 million? It makes no difference at all…It makes absolutely no difference. It makes no difference to your family. It makes no difference to anything. And yet the downside, particularly in managing other people’s money, is not only losing all your money, but it’s disgrace and humiliation, and facing friends whose money you’ve lost and everything. I just can’t imagine an equation that that makes sense for. And yet 16 guys with very high IQs who are very decent people, entered into that game…I think it’s madness.

“By the way, eventually the assets of LTCM were all sold. And the creditors themselves did not lose money from being involved in the transaction.

After helping unwind LTCM, founder John Meriwether launched a new hedge fund, JWM Partners. By December 1999, it was reported they had raised $250 million for a fund that would continue many of LTCM’s strategies – this time, using less leverage. Unfortunately, during the credit crisis of 2008, JWM Partners was hit with a 44% loss from September 2007 to February 2009 in its Relative Value Opportunity II fund. JWM was shut down in July 2009. Quite amazingly, Meriwether then launched a third hedge fund in 2010, using a similar investment strategy to LTCM. No word on how that worked out, but he did apparently raise over $100 million.

And finally…if aliens visited Sydney

Got a question?

If you would like to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluence3.wpengine.com | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.