Hi,

Welcome to our monthly update.

Markets bounced back in July and all of our funds delivered positive returns.

In early August, we hosted our first webinar for quite a while. We hope to do so more regularly in the future. There are links below to a full replay, as well as the presentation. Here’s the summary:

The era of zero interest rates is over. What worked from 2009 until 2021 will not work as well from here.

Inflation is back, and it’s probably here to stay, off and on, for quite a while. We could see successive bouts of inflation → higher interest rates → recession → lower interest rates → inflation in coming years.

Impacts of this new regime include intermittent shortages, faster economic cycles and onshoring of supply.

In this new environment, we like resources, LICs, Aussie small cap shares and value managers.

We are being selective about property, global equities and fixed interest.

We’re mostly avoiding US equities, quality (expensive) large caps and loss making companies.

Returns are improving for cash, fixed interest, cyclicals and value stocks.

Australia will continue to be the best place in the world to live, and one of the best places to invest from, for the next decade.

We are now in an environment where active managers can really shine, and which suits our investment style much better than has been the case for the last few years.

In other exciting news, last month we welcomed Melynda Lander to the team as Head of Investor Relations. Melynda worked with us a few years back in a part-time role, and it’s great to have her back full time. Next time you make contact with us, it’s likely Melynda will be your first point of contact.

Finally, August applications for the Affluence Investment Fund and Affluence Small Company Fund close on Thursday 25 August. Applications for the Affluence LIC Fund close Wednesday 31 August. If you want to apply online or download application or withdrawal forms for any of our funds, go to our website and click “Invest Now”.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased 2.2% in July. Since commencing in 2014, returns have averaged 7.9% per annum, including distributions of 6.6% per annum.

At month end, 56% of the portfolio was invested in unlisted funds, 16% in the Affluence LIC Fund, 15% in listed investments, 1% in portfolio hedges and 12% in cash.

The cut-off for monthly applications and withdrawals is Thursday, 25 August.

Affluence LIC Fund

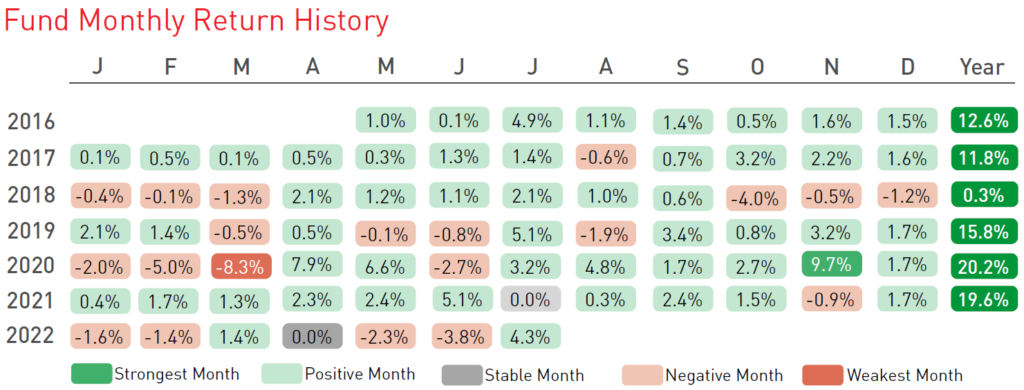

The Affluence LIC Fund increased 4.3% in July. Since commencing in 2016, returns have averaged 12% per annum, including quarterly distributions of 8.3% per annum.

The average discount to NTA for the portfolio at the end of the month was 15%. The Fund held investments in 30 LICs (85% of the Fund), 4% in portfolio hedges and 11% in cash.

The cut-off for monthly applications and withdrawals is Wednesday 31 August.

Affluence Small Company Fund

The Fund increased in 5.2% July. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 9.1% per annum.

The Fund held 9 unlisted funds (59% of the portfolio), 8 LICs (16%) and 7 ASX listed Small Companies (21%). The balance 4% was cash and hedges.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Thursday 25 August.

Affluence Webinar

Earlier in August as we hosted our latest Affluence webinar. In case you missed it we have included the presentation and link to the recording below.

Affluence LIC Fund reopened to new investors

Listed Investment Companies (LICs) have corrected substantially so far in 2022. The Affluence LIC Fund seeks to invest with some of the LIC managers, while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.With quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to your investment portfolio.

Things we found interesting

Chart of the month.

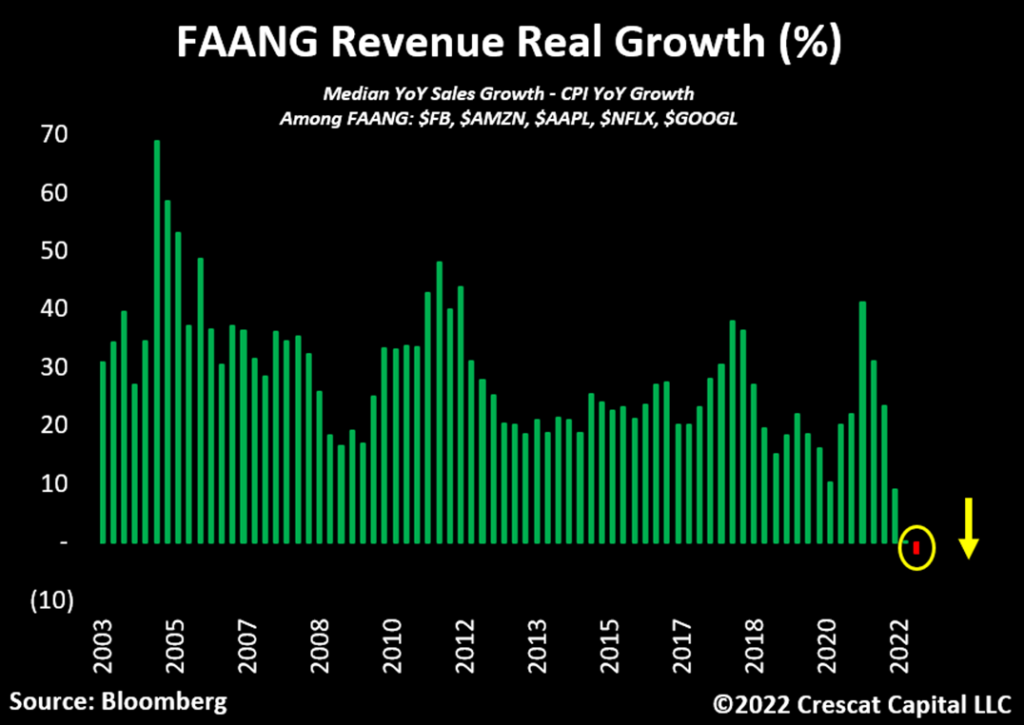

OK, so this was never supposed to happen. Revenue for the FAANG stocks has fallen. Admittedly, the measure used below is real revenue (net of inflation). But still, it’s a surprising development. And if profit margins start to get impacted as well, these stocks could be in for further pain.

Chart of the month 2.

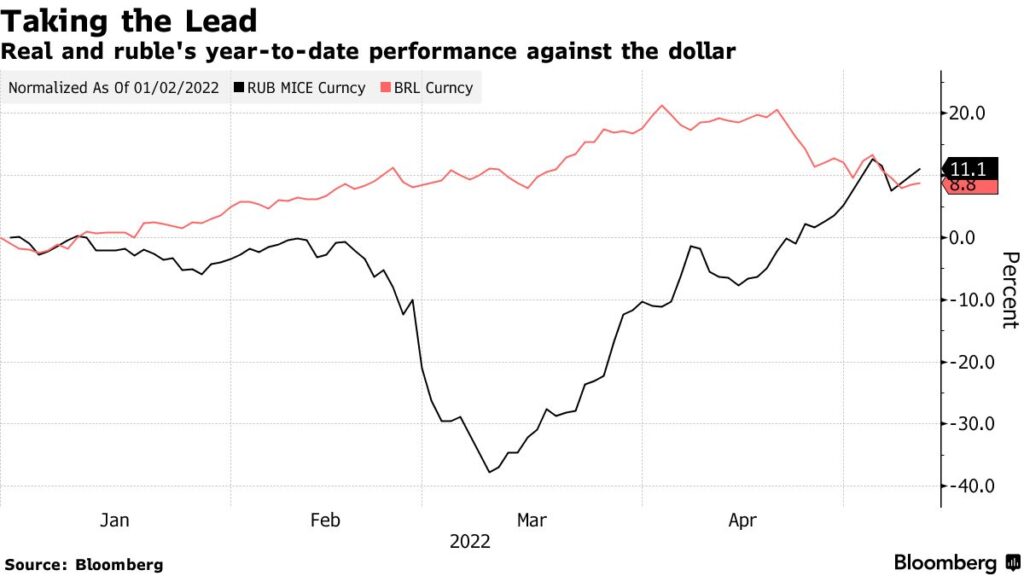

Back in February this year, US President Biden came into the Whitehouse Rose Garden and said Russia’s currency, the Ruble, will be turned into rubble.

Here’s a chart of the Ruble against the US dollar for the first half of 2022. Not only did it rebound strongly (along with the Brazilian Real), it became the best performing currency in the first half of 2022.

The lesson? Markets can always surprise you. Especially when “everyone” agrees what will happen next. It’s why we diversify.

Quotes of the month.

“As I look back now, it’s obvious that studying history and philosophy was much better preparation for stock market than studying statistics…those who are trained to rigidly quantify everything are at a huge disadvantage.”

Peter Lynch.

“Every investor wants to know whether central banks are prepared to cause a recession in order to force inflation down. Surely, officials are bluffing, right? But think about it from the central banker’s perspective. Yes, a recession would be bad: people would lose their jobs, and it could take a while to recover. But recessions happen all the time and they rarely ruin any central banker’s reputation. Some, such as Paul Volcker, are even celebrated for their “toughness” in the face of economic pain. And if a recession happens now, the authorities can blame Putin or say it was the only way to tame the inflation monster. Runaway inflation, on the other hand, would leave a darker legacy. Jerome Powell, Christine Lagarde and others would be joining Arthur Burns on university syllabuses for the semester on “historical monetary failures”. In 40 years’ time, economists would still be discussing how they “let the 1970s happen again”. No central banker wants to become a case-study in how to fail.”

Dario Perkins from TS Lombard, on why Central Banks might continue to drive interest rates higher.

This month in (financial) history.

In August 1998, the Russian government devalued the ruble and declared a moratorium on paying its foreign debt. What’s that saying about history repeating? Back in 1998 the Russian stance caused a slide in the bond market and eventually, the collapse of the giant hedge fund Long-Term Capital Management.

In August 1896, three intrepid explorers named Skookum Jim, Tagish Charlie and Jim Carmack were scrabbling for gold. Their location was Rabbit Creek, a tributary of the Klondike River near Skagway, Alaska. They suddenly came up with a pan chock full of gold nuggets and the Alaska Gold Rush was on!

Vaguely interesting facts.

- The Karni Mata Temple in Deshnoke, India, is home to 20,000 rats. The rodents are believed to be descended from an incarnation of the Hindu goddess Durga.

- The distinctive smell of old books comes from chemicals like benzaldehyde, furfural, and acetic acid. All are byproducts of decomposition.

- The Truman Show Delusion is a mental condition marked by a patient’s belief that they are the star of an imaginary reality show.

- Newborn babies have nearly 100 more bones than full-grown adults.

- It is illegal to own only one guinea pig in Switzerland. *

Source: mentalfloss.com

* They get lonely, apparently.And finally…Just in case you were wondering.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.