Hi,

Welcome to our monthly report.

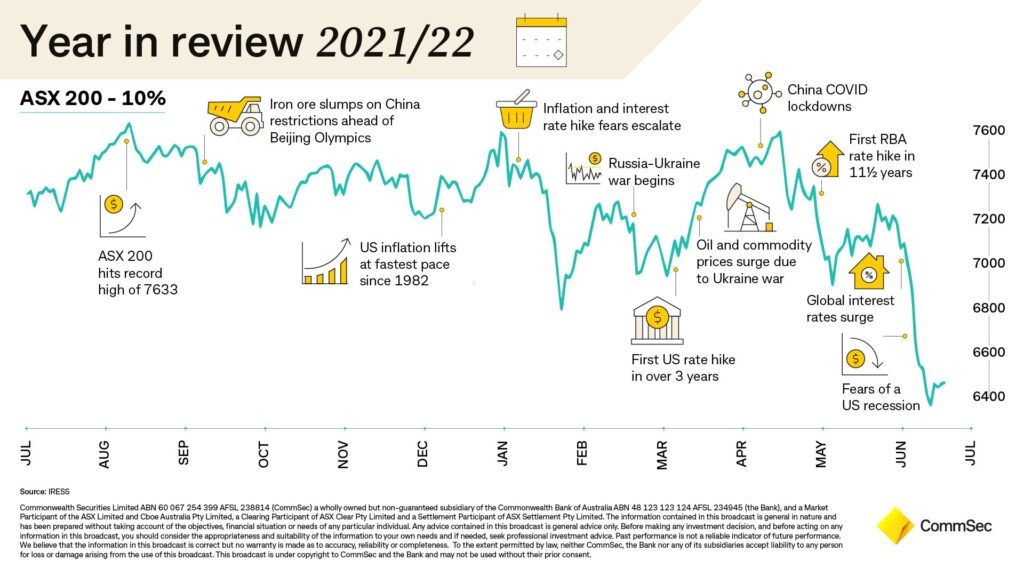

The 2022 financial year was a hectic one in markets. Commsec summed it up well.

Had you invested in the ASX 200 last financial year, you would have lost around 10% before dividends, or 6.5% including dividends. Most other markets around the world did worse (some substantially worse). For the last six months, bonds fell at the same time as stocks, a relatively rare occurrence. This meant there were very few places to hide in the 2022 financial year. Even resource stocks, which were the shining light for most of the year, got smashed in June as the increasing chance of recessions got priced in.

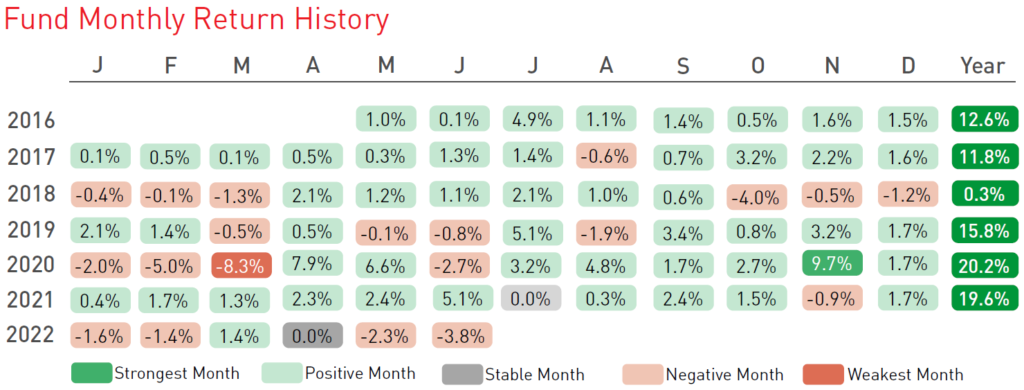

All of our funds were slightly ahead for the year as we headed into June. But in a month when the ASX finally succumbed to selling pressure, and the ASX200 fell almost 9%, the Affluence Funds dipped into negative territory for the financial year. Final returns for FY22 were -2.0% for the Affluence Investment Fund, – 2.8% for the Affluence LIC Fund and -3.8% for the Affluence Small Company Fund.

While we’re seeing many signs of a slowdown, the Australian economy is starting from a position of considerable strength. Wage rises are kicking in, consumers continue to spend, jobs are plentiful and spending on business investment and infrastructure continues to look healthy. While we’re not expecting investment markets to deliver stellar returns over the next year or so, many asset classes have been marked down quite a bit, and the buying is much better. That’s giving us the chance to add to portfolios in a few areas we’re very familiar with, including LICs, resources and small cap value stocks. And while those investments may not rise quickly in the near term, at some point over the next 3-5 years, we think they can be worth a lot more than we are paying for them now.

Below is a link to our annual letter, where we review the year, and our results, in more detail. In August, we’ll be doing a webinar update, covering where we’re seeing the best opportunities, what we’re avoiding, how we’re navigating the markets and how each of our funds is positioned. Further details are below and we’d encourage you to register to watch if you can. We’ll also be sending a recording of the webinar to anyone who is registered, but can’t make it on the day.

If you want to apply online or download application or withdrawal forms for any of our funds, go to our website and click “Invest Now”. July applications for the Investment Fund and Small Company funds closed Monday 25 July. Applications for the LIC Fund close Friday 29 July.If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned -2.9% in June. Since commencing in 2014, returns have averaged 7.7% per annum, including distributions of 6.6% per annum.

At month end, 56% of the portfolio was invested in unlisted funds, 16% in the Affluence LIC Fund, 15% in listed investments, 2% in portfolio hedges and 11% in cash.

The cut-off for monthly applications and withdrawals is Monday, 25 July.

Affluence LIC Fund

The Affluence LIC Fund delivered -3.8% in June. Since commencing in 2016, returns have averaged 11.4% per annum, including quarterly distributions of 8.4% per annum.

The average discount to NTA for the portfolio at the end of the month was 17%. The Fund held investments in 33 LICs (86% of the Fund), 4% in portfolio hedges and 10% in cash.

The cut-off for monthly applications and withdrawals is 29 July.

Affluence Small Company Fund

The Fund returned -4.3% in June. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 8.3% per annum.

The Fund held 9 unlisted funds (59% of the portfolio), 8 LICs (17%) and 7 ASX listed Small Companies (21%). The balance 3% was cash and hedges.

Available to wholesale clients only. The cut-off for monthly applications and withdrawals is 25 July.

Affluence Annual Investor Letter

Please click the link below to read our annual letter, where we review the year, and our results in more detail.

Affluence Webinar

In the first half of 2022 markets fell quite a lot. Join us on 9 August as we host our latest Affluence webinar. Find out where we’re seeing the best opportunities, what we’re avoiding, how we’re navigating the markets and how each of our funds is positioned.

Affluence LIC Fund reopened to new investors

Listed Investment Companies (LICs) have corrected substantially so far in 2022. The Affluence LIC Fund seeks to invest with some of the LIC managers, while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.With quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to your investment portfolio.

Things we found interesting

Chart of the month.

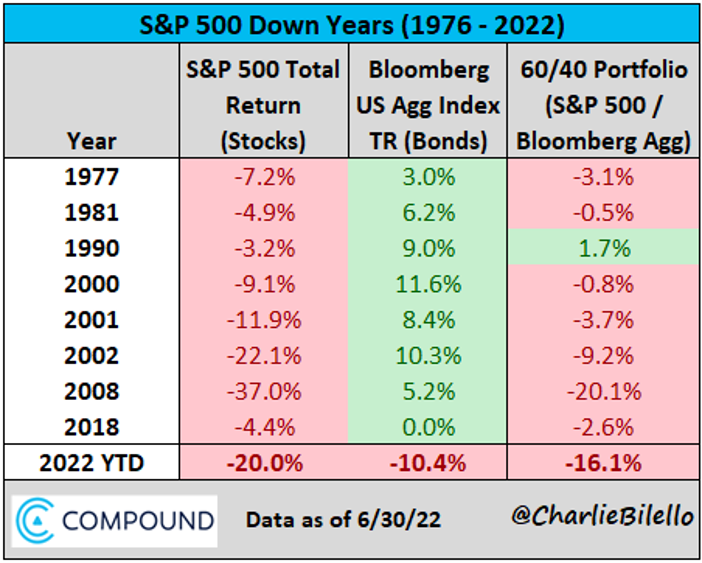

It’s relatively uncommon for both stocks and bonds to lose money at the same time. It’s even more uncommon for it to happen to the degree it has over the first six months of 2022.

The picture was similar, though not quite as bad, in Australia. It’s all down to that combination of persistently higher inflation causing higher actual, and expected interest rates.

Chart of the month 2.

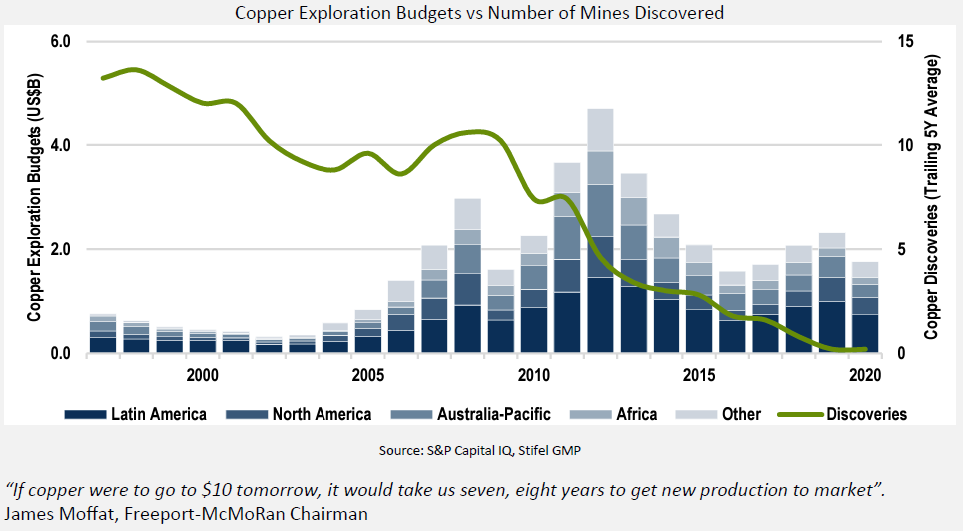

Here’s one example of why we believe commodities and resources stocks can do exceptionally well over the coming years. The graph shows copper exploration budgets compared to new mine discoveries. Put simply, there’s less and less new supply being discovered. And when it is, it’s taking longer and costing more to bring these new sources of supply into production.

Copper is a key industrial metal. But it’s also at the heart of the long term trend towards electrification. Irrespective of whether we have a global recession or not, demand for copper and other battery metals is likely to increase substantially over the medium to long term. We’re not economists, but we’re pretty sure that when supply is shrinking and demand is increasing, the price will eventually go up. Possibly by a lot.

This month in (financial) history.

In July 1852, giant US bank Wells Fargo & Co was founded in San Francisco to support miners in the gold rush. Henry Wells and William Fargo started out purchasing gold dust from miners in exchange for paper bank drafts. By 1858, they had expanded with a delivery service, transporting letters, packages and gold nuggets on their fleet of branded wagons. Its stagecoach lines eventually covered over 3,000 miles of western US, and in 1888 became the first coast-to-coast express company. In the 20th century, the company spun off its delivery segment and began growing as a local, then regional, then national bank.

In July 1995, Spyglass became the first-ever publicly traded internet software company. Spyglass licensed the early internet browser, Mosaic. The stock was up more than 200% on its first day of trading. Just months before the Spyglass IPO, Netscape Communications had released its Netscape Navigator browser.

Microsoft quickly recognised the value in web browser software and licensed Mosaic as the basis for its Internet Explorer browser. The deal between Microsoft and Spyglass stipulated that Spyglass would receive a base quarterly fee for the Mosaic license plus a royalty from Microsoft’s Internet Explorer revenue. Microsoft then bundled Internet Explorer and provided it as a free add-on for it’s Windows 95 software. Thus, since it made no direct revenues on Internet Explorer, Microsoft paid only the minimum quarterly fee to Spyglass. In 1997, Spyglass threatened Microsoft with a contractual audit, and Microsoft eventually settled the dispute for $8 million. In March 2000, OpenTV acquired Spyglass at almost the exact peak in the dot-com bubble in a stock swap deal worth $2.5 billion.

And finally, in July 1997, the corporate assets of ZZZZ Best Co (pronounced “zee best”) are sold at bankruptcy auction for $62,000. Less than four months earlier, the company had a stock-market value of roughly $300 million, and the stock had more than quadrupled since in initial public offering in 1986. ZZZZ Best was supposedly a carpet-cleaning company, founded by 21-year-old whiz kid Barry Minkow while he was still at high school. But it turned out ZZZZ Best had virtually no customers, revenues or assets. Minkow had set up an elaborate system of phantom offices and phony account records. At one point, he even bribed a building owner to pretend in the presence of an auditor that ZZZZ Best was cleaning his carpets. These days, ZZZZ Best survives only as a case study for auditing students.

Minkow eventually served five years in prison for his crimes. But that’s not the end of the story. After being released from jail, Barry became a pastor and fraud investigator in San Diego, and spoke at churches and schools about ethics! This came to an end in 2011, when he admitted to helping deliberately drive down the stock price of homebuilder Lennar and was ordered back to prison for five more years. Three years later, Minkow admitted to defrauding his own church and was sentenced to an additional five years behind bars. The 2018 US film, Con Man, is based on Minkow’s life. Barry makes an appearance in the film.

Vaguely interesting facts.

Cicadas have been known to confuse the roar of power tools for mating calls and sometimes swarm people mowing their lawn.

IKEA uses about 1 percent of the world’s timber every year, making it (probably) the largest consumer of wood on earth.

Chewing gum boosts concentration by increasing the flow of oxygen to regions of the brain responsible for attention.

In 19th-century Ireland, locals carved jack-o’-lanterns out of turnips instead of pumpkins.

Bacon fat was used to make explosives during World War II. *

Source: mentalfloss.com

* During World War II, The American Fat Salvage Committee was created (we are not making this up) to urge housewives to save all the excess fat left over from cooking and donate it to the army to help them produce explosives.Housewives were directed to strain the left over fats and store them. Once a pound or more was collected, it could be handed over to any one of 250,000 participating butchers, meat dealers or frozen food plants who would then turn the fat over to the army. The donor would get four cents a pound for the fat. One pound of fat supposedly contained enough glycerin to make about a pound of explosives. To popularize the message, Disney created a film in 1942 called “Out of the Frying Pan and into the Firing Line”. It starred Minnie Mouse and her dog, Pluto, and you can see it here:

And finally…we’ll let you into a secret.

Fast food company KFC is on Twitter. No surprise there.

The observant among you will notice that while they have approximately 1.6 million followers on Twitter, they only follow 11 people. And if you research a bit further, you will discover that those 11 people include the 5 spice girls, and 6 guys named Herb. And there you have it. The 11 Herbs and Spices are a secret no more.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.