Hi,

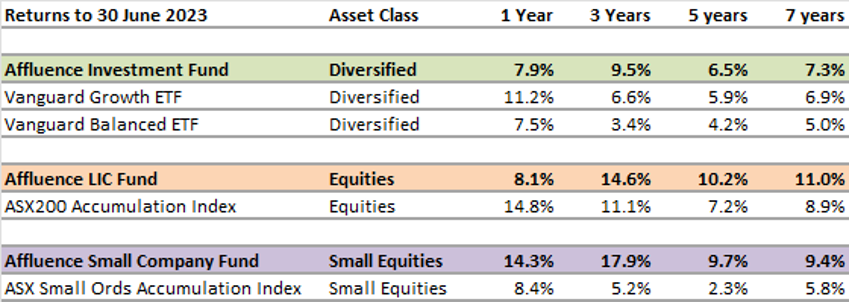

The FY23 financial year finished in positive territory for most markets. The ASX 200 Index was up 14.8% and the ASX Small Ords up 8.4%. Our results for the year, as set out in the table below, were solid, though not spectacular. Over our preferred investment periods of 3 years and longer, each of our funds have clearly added value, compared to relevant indices or ETFs.

A key lesson for the last year is that markets can always surprise you. Most equity markets have delivered above average returns, while economic conditions have continued to deteriorate, and interest rates have risen substantially and consistently. As the year has progressed, we have continued to position portfolios more conservatively. As we outlined in our webinar update and presentation from last month’s enews, we think reality will set in as the year rolls on.

You can access June Fund reports from the links below. We’re in the process of finalising year-end reporting, including investor tax statements. You can keep up to date with our progress here. We’ve also included an update on year end distributions, including more detail on how we determine whether to pay a higher amount in June each year.

Across all our Funds, we’re excited about the return potential over the next 2-3 years. For example, within one or more of our Funds, we own:

- A wide range of unlisted funds run by specialist managers that have delivered impressive long term results.

- A group of unlisted fixed interest funds and other debt focused investments yielding 8%+.

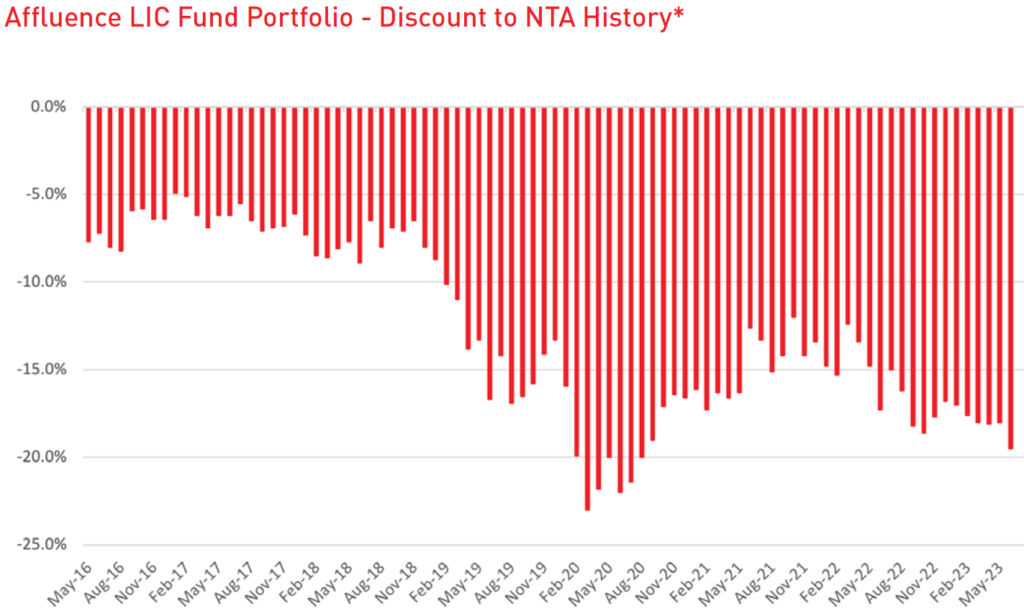

- A portfolio of LICs we estimate were trading at an average 20% NTA discount at 30 June. The only time it has been higher, was for a few months at the height of the COVID panic.

- An assortment of ASX listed REITs bought on good yields, and at 30%+ discounts to valuations.

- A variety of small-cap value funds and stocks, trading at prices we regard as exceptionally cheap.

- Some exposure to mid-small resources companies at prices we think are at, or very close to cyclical lows.

In addition, we’re overweight cash, giving us firepower for later in the year.

Should you wish to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Tuesday 25 July. Applications for the Affluence LIC Fund close Monday 31 July. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased by 0.5% in June. Since commencing over eight years ago in November 2014, the Fund has returned 7.7% per annum, including monthly distributions of 6.4% per annum.

At month end, 59% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 1% in the Affluence Small Company Fund, 12% in listed investments, 2% in portfolio hedges and 12% in cash.

The cut-off for monthly applications and withdrawals is Tuesday 25 July.

Affluence LIC Fund

The Affluence LIC Fund decreased by 0.5% in June, as tax loss selling temporarily impacted the LIC market. Since the Fund commenced over seven years ago, returns have averaged 10.9% per annum, including quarterly distributions of 8.0% per annum.

The average discount to NTA for the portfolio at the end of the month was approximately 20%.The Fund held investments in 34 LICs (76% of the Fund), 3% in portfolio hedges and 21% in cash.

The cut-off for monthly applications and withdrawals is Monday 31 July.

Affluence Small Company Fund

The Affluence Small Company Fund increased by 1.3% in June.

Since commencing in 2016, returns have averaged 9.1% per annum including quarterly distributions of 6.8% per annum.

The Fund held 8 unlisted funds (43% of the portfolio), 11 LICs (18%) and 10 ASX listed Small Companies (27%). The balance 13% was cash.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Tuesday 25 July.

Invest Differently

The current portfolio of the Affluence LIC Fund has an average discount to net asset value of 20%. The only time it has been higher was during the COVID crunch of 2020.

*Discounts estimated by Affluence. The Affluence LIC Fund portfolio varies from month to month.The Affluence LIC Fund seeks to invest with some of the best LIC managers while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.

With quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to your investment portfolio.

Things we found interesting

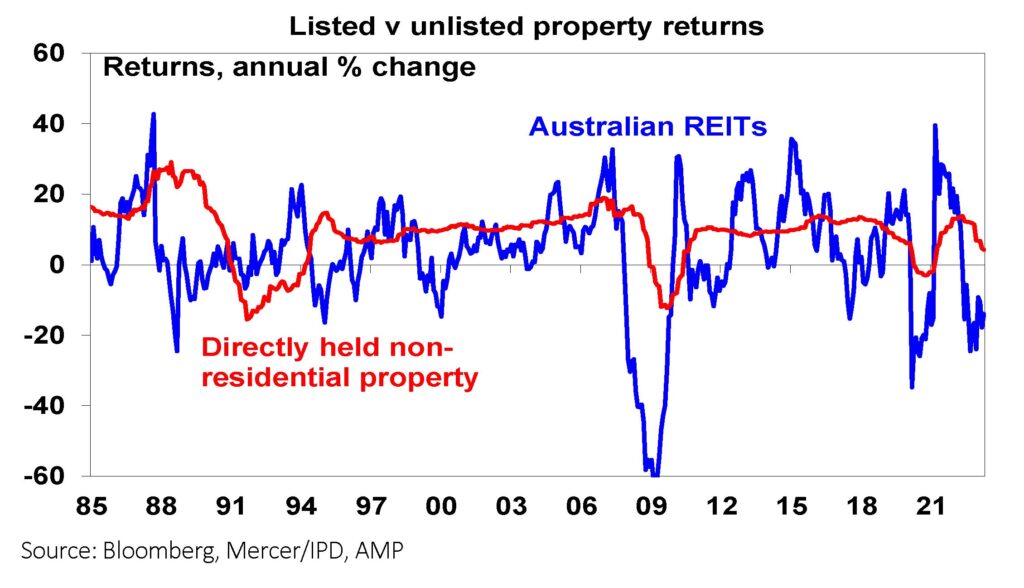

Chart of the month: Listed vs Unlisted Property

Back in 2015, between 15-20% of the Affluence Investment Fund portfolio was unlisted property funds. Right now, we hold almost no unlisted property, with the bulk of the current 11% property allocation in listed property. This chart, showing long term annual returns for listed and unlisted property helps explain why.

ASX listed property trusts, or AREITs, have been marked down heavily in the last year and a half. Having sold most of our unlisted property years ago, we’ve been buying listed property in the last few months. Investors are trying to anticipate the level of adjustment required to property valuations, off the back of rises in interest rates and a possible recession. What tends to happen in these situations is that listed property values adjust very quickly, and almost always overestimate the actual amount by which the property asset values will fall. This usually takes a couple of years to fully play out, as transactions occur at lower values and markets reset themselves. In most cases, AREIT share prices begin rising well before the underlying property assets values have stopped falling. Being able to have the flexibility to switch between listed and unlisted exposure to an asset class can provide great opportunities to add extra value over the cycle.

Right now, the Affluence Investment Fund portfolio of listed property investments is trading at an average discount well north of 30%. As the chart above shows, in the past, AREITs have tended to have one or two very good years following such periods.

This month in financial history.

In July 1988, Australia changed its financial year for tax purposes from the calendar year to the current format with the financial year starting in July and ending in June. The decision was apparently made to better align with the agricultural and business cycles of the country. Australian Governments had long had a 30 June financial year end. Victoria was the first to adopt this in 1870, with the other states following, and the Federal Government finally getting around to it in 1901. The reason for the change by Governments was for convenience, as it was apparently difficult for Parliaments to meet in November and December to pass a budget.

Quote of the month:

“Bill Ackman once said to me that value investing in a classic sense is like watching paint dry…but he brings a hair blower. I thought, well, that’s a good definition of activism

“Famous value investor Seth Klarman explains activist investing, with the help of famous activist Bill Ackman. The quote comes from this 1.5 hour long podcast. Seth Klarman rarely gives interviews, so it’s a rare glimpse into how one of the world’s best value investors thinks.

Vaguely interesting facts.

Sleeping through summer is called estivation. Who would do that? Apparently some earthworms, frogs, bees, snails, salamanders, tortoises, and crocodiles.

Tsutomu Yamaguchi was in Hiroshima for work when the first A-bomb hit, made it home to Nagasaki for the second, and lived to be 93.

A recent study has found that New York City is sinking by 1-2mm per year under the collective weight of all of its buildings.

Many people are either right or left eared and right or left eyed, in the same way we’re right or left handed.

The Guinness Book of World Records was conceived by the manager of the Guinness Brewery. *

Source: mentalfloss.com, wikipedia.com.

* The inspiration for the Guinness Book of World Records can be traced to November 1951, when Sir Hugh Beaver, managing director of the Guinness Brewery, was on a hunting trip in Ireland. There, he and his mates argued about the fastest game bird in Europe. When they failed to find an answer in any reference book, Sir Hugh had his brilliant idea. Beaver realised that no official record existed for the answer, and the same applied to many other arguments and debates, including perhaps a few over a pint of Guinness.

Beaver recruited journalist brothers, Norris and Ross McWhirter, to amass records and publish it into a book. The creation of the first book took “thirteen and a half 90 hour weeks,” which included weekends and bank holidays. It was published in 1955, at 198 pages long. It was initially made as a promotional item. Guinness distributed 1,000 copies to bars throughout Ireland and the UK who sold Guinness. However, the book was so popular that Beaver set the brothers to work on a new edition. It went straight to the top of the British best sellers list by Christmas of that year. By 1966, the book had sold over 1.5 million copies, in many different countries. It eventually spawned a TV series, The Record Breakers, which aired for 29 years from 1972.

The Guinness beer company and Guinness World Records are no longer officially linked. Guinness owner Diego sold the book company to a Canadian entrepreneur in 2001.

And since we’re sure you’re wondering, the fastest game bird in Europe is the golden plover.

And finally…Chat GPT

We got lazy this month. So we asked ChatGPT to find us some funny jokes with an investing or money theme. This is what it came up with. We think ChatGPT has a way to go yet.

- Why did the investor bring a ladder to the bank? To check their balance!

- What do you call an investor who’s always happy? A stock optimist!

- Why did the banker switch careers to become a chef? Because they knew how to make a lot of dough!

- Why did the stock market break up with its girlfriend? Because it couldn’t commit to a stable relationship!

- What’s an investor’s favorite type of music? Cash-flow!

- Why did the coin go to school? It wanted to get some cents!

- How do you make a small fortune in the stock market? Start with a large fortune!

- What do you call a rich elf? Welfy!

- Why did the financial analyst bring a ladder to the presentation? To show the company’s profits were going up!

- How do investors stay cool during market volatility? They keep their assets in the shade!

Then we gave Google a go. This is slightly better.

- With inflation at 7.5%, you lose half your money in 9 years. The only way to outperform that consistently, that I have found, is crypto. Just this year I’ve already lost half my money.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.