Australian and global markets continued their recovery from the Trump Tariff Tantrum in May, and all our Funds delivered positive returns. You can access the latest fund reports below.

We remain somewhat perplexed as to why the current market exuberance is occurring. It doesn’t seem like we should be making new highs, given the uncertain outlook for the economy and company earnings, but we are. This is no better illustrated than the ongoing march higher of CBA shares. CBA is now the most expensive bank in the world. Its dividend yield (including franking credits) is now less than its much lower risk senior secured debt. This would appear to be a mismatch, however it does reflect the current mood of the market.

We’re gearing up for year-end reporting, including sending out tax and investment statements. You can keep up to date with our progress on our 2025 Financial Year Information post on our website. It’s likely that our Affluence Investment Fund, Affluence LIC Fund and Affluence Small Company Fund will pay a higher distribution than normal for June, as we factor in additional investment gains realised during the year. Details of final distributions will be included in June distribution advices, which are expected to be released around 11 July.

Should you wish to invest this month, head to our invest now page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 July.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in May and has delivered 7.7% per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.00% per annum.

Affluence Income Trust May 2025 Report

Affluence Investment Fund

The Affluence Investment Fund returned 1.8% in May. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.8% per annum.

Affluence Investment Fund May 2025 Report

Affluence LIC Fund

The Affluence LIC Fund returned 2.0% in May, and has delivered 10.6% per annum since commencement. At the end of the month, the average portfolio NTA discount remained near all time highs at 28%.

Affluence LIC Fund May 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned 2.2% in May. The Fund has returned 8.7% per annum since inception in 2016, outperforming the ASX Small Ordinaries Index by 1.7% per annum.

Affluence Small Company Fund May 2025 Report

Investment Profile

Each month we take a look at an underlying investment in one of our funds. This month, we profile the Pengana Private Equity Trust. This listed investment trust utilises the management services of Grosvenor Capital Management to invest in a diversified portfolio of global private equity investments. At current prices, we believe it provides potential for strong returns.

Fund In Focus

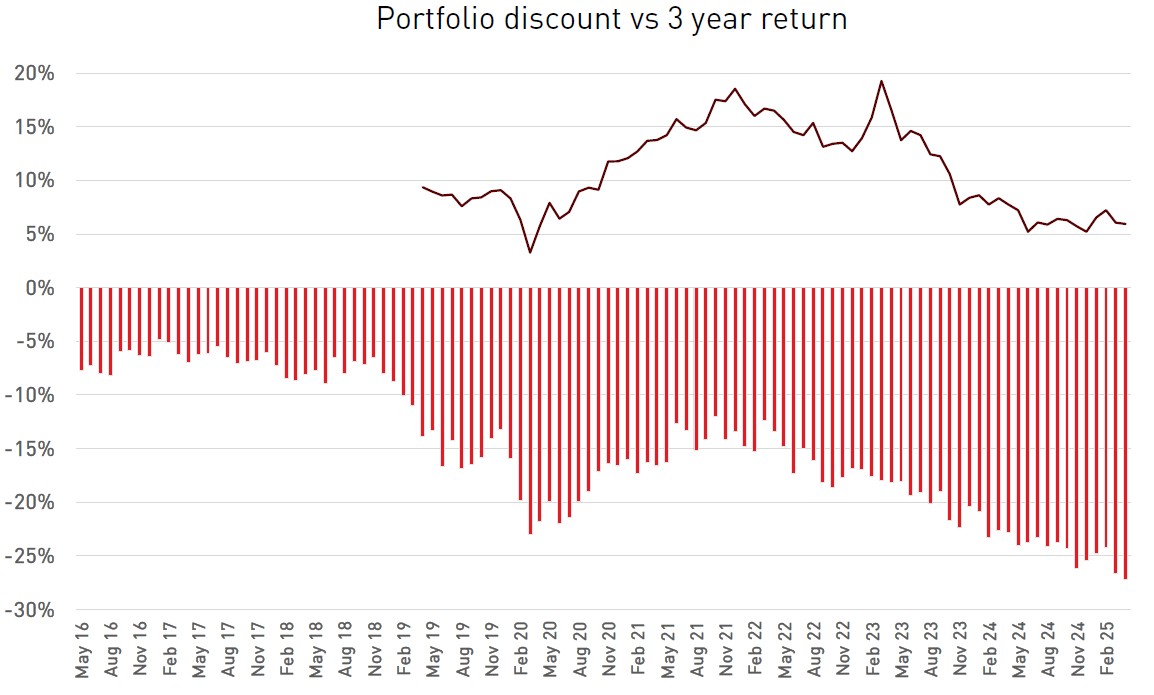

LIC discounts remain near cyclical highs. In the graph below, we’ve tracked average discounts for the Affluence LIC Fund portfolio (red bars) and the average annual return over the 3 previous years.

* Returns are not guaranteed. Past performance is not indicative of future performance.

You can clearly see that increasing discounts negatively impact performance. That’s where we find ourselves now. But the opposite is also likely to be true. As discounts narrowed from 2020 to 2022, returns were well above average. We believe there’s good chance that we’ll see a repeat of that situation in coming periods. You can learn more about the Fund from our latest updated presentation, which you can access by clicking below.

Things we found interesting

Chart of the month.

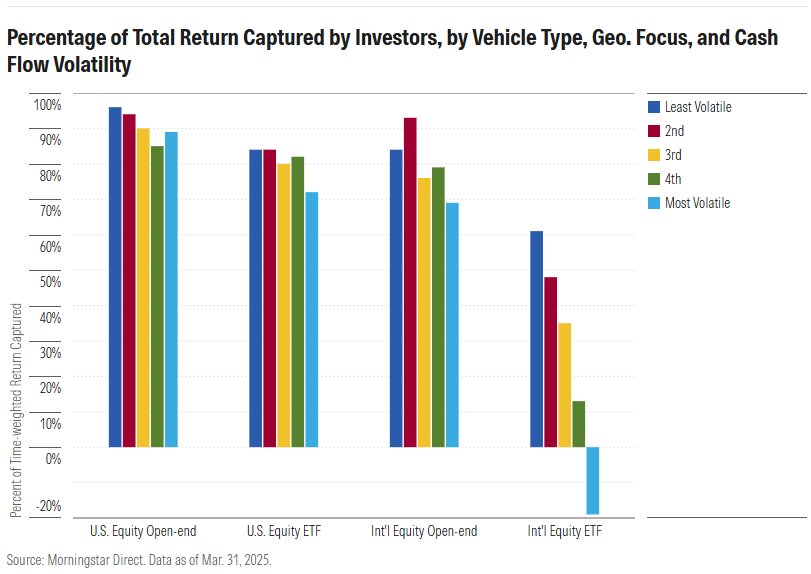

A recent study from Morningstar in the US looked at returns from equity funds themselves vs the returns that investors in those funds received. The results overwhelmingly showed that those funds which had the most trading by investors tended to provide the worst investor returns. The chart below shows the amount of returns from each type of fund “captured” by investors in that group. So, a 100% capture rate would mean investors in those funds received the same return as the fund itself.

Other key takeaways included:

- The negative impact of frequent trading was more pronounced in ETFs than unlisted funds. This suggests that the flexibility of ETFs might tempt investors into detrimental trading behaviours.

- The relationship between high trading activity and poorer investor returns held true even when controlling for different variables, including fund type and geographic focus

- International Funds/ETF’s fared worse than domestic ones. In fact, investors in the most highly traded quintile of international equity ETFs actually had negative returns.

The main conclusion is clear – frequent trading tends to erode investor returns. It’s one of the main reasons we focus on lowering the volatility of returns in all of our funds, and have designated monthly applications and redemptions.

Read the full Morningstar Article

Quote of the month.

“We prefer either tight-knit teams or individual decision makers versus broad decision-making constructs; we want to see clear and accountable decisions.”

“We often like managers that are earlier in their life cycle or have attributes that make them behave like they’re early in their life cycles – an experienced manager who has just hung out a shingle and started a new firm, their assets are low, their motivation is high, their building track record, for example.”

“And the third thing is hyper-awareness of their niche or their core differentiated insight. What do they know that others don’t?”

Sage advice from Jon Eggins, Head of Portfolio Management at Russell Investments. Taken from AFR’s Chanticleer column. Jon started in Russell’s Sydney office in 2003 and now lives in New York. He used to run portfolios of managed funds, and now he oversees a team of portfolio managers. Fair to say he knows a thing or two about picking fund managers.

Financial word of the month.

Price Earnings (or PE) Ratio. A company’s stock price divided by its earnings per share over the previous twelve months. Because earnings can be manipulated in many ways and because past earnings are a poor guide to future profits, a PE ratio is an imprecise and often misleading guide to what the company is worth. A “normalized” PE ratio averages several years’ worth of earnings to arrive at a somewhat more reliable number. A “forward” PE relies on analysts’ expectations of earnings in the coming year to arrive at a nonsensical number.

Source: “The Devil’s Financial Dictionary” by Jason Zweig.

This month in financial history.

In June 1982, it became increasingly clear that Mexico was running out of foreign currency reserves. The country was struggling to meet even the interest payments on its debt. Capital flight intensified, and Mexico’s lenders began to panic. In August, Mexico formally announced that it could no longer meet its debt obligations and was suspending repayments. It owed over $80 billion, much of it to major U.S. and European banks. The crisis triggered a wave of defaults across Latin America, including Brazil and perennial debt defaulter, Argentina. Many banks narrowly avoided collapse, thanks to a series of IMF bailouts and coordinated debt renegotiations.

In June 1994, just 17 months after its launch the SPDR S&P 500 ETF Trust (SPY) reached over USD $1 billion in assets. It was a staggering achievement for a new investment product and signalled the birth of the exchange traded fund industry. Today, SPY remains the largest ETF in the world at over USD $647 billion. In June 2007, Blackstone Group became the first major US private equity firm to go public. Priced at $31 per share, the stock surged to $38 on its debut, reflective of the enthusiasm of the time. However, the GFC was not helpful to Blackstone’s stock price. By the end of 2008, shares had plummeted to under $3, a drop of over 90% from the IPO price. Despite the initial setback, Blackstone’s share price eventually recovered and today it trades at around $140, which is just under a 10% annualised return if you held it since the IPO. Had you been a genius and waited to buy at $3.00 in late 2008, you would have earned 27% per annum.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- The sun accounts for 99.9% of the mass in our solar system. Jupiter is most of the remainder.

- Kangaroos can’t walk backwards. And before you ask, neither can wallabies.

- Great Red Spot on Jupiter is a storm that’s been raging for over 300 years.

- Bananas are very mildly radioactive, due to their potassium content.

- Napoleon was once attacked by a horde of rabbits. *

* This bizarre event occurred during a rabbit hunt organized by Napoleon’s chief of staff. In 1807, shortly after signing the Treaty of Tilsit (which ended hostilities between France and Russia/Prussia), Napoleon wanted to celebrate. As was customary among Europe

an nobility, a grand rabbit hunt was arranged for the occasion. They reportedly released hundreds (or thousands – accounts vary) of rabbits for the hunt. Instead of running away, the rabbits swarmed Napoleon and his men. This was likely because domesticated rabbits had been used and associated humans with food. Napoleon reportedly retreated to his carriage laughing, while his men struggled to fend off the onslaught, thereby proving that contrary to popular belief, he did have a sense of humour.

And finally.

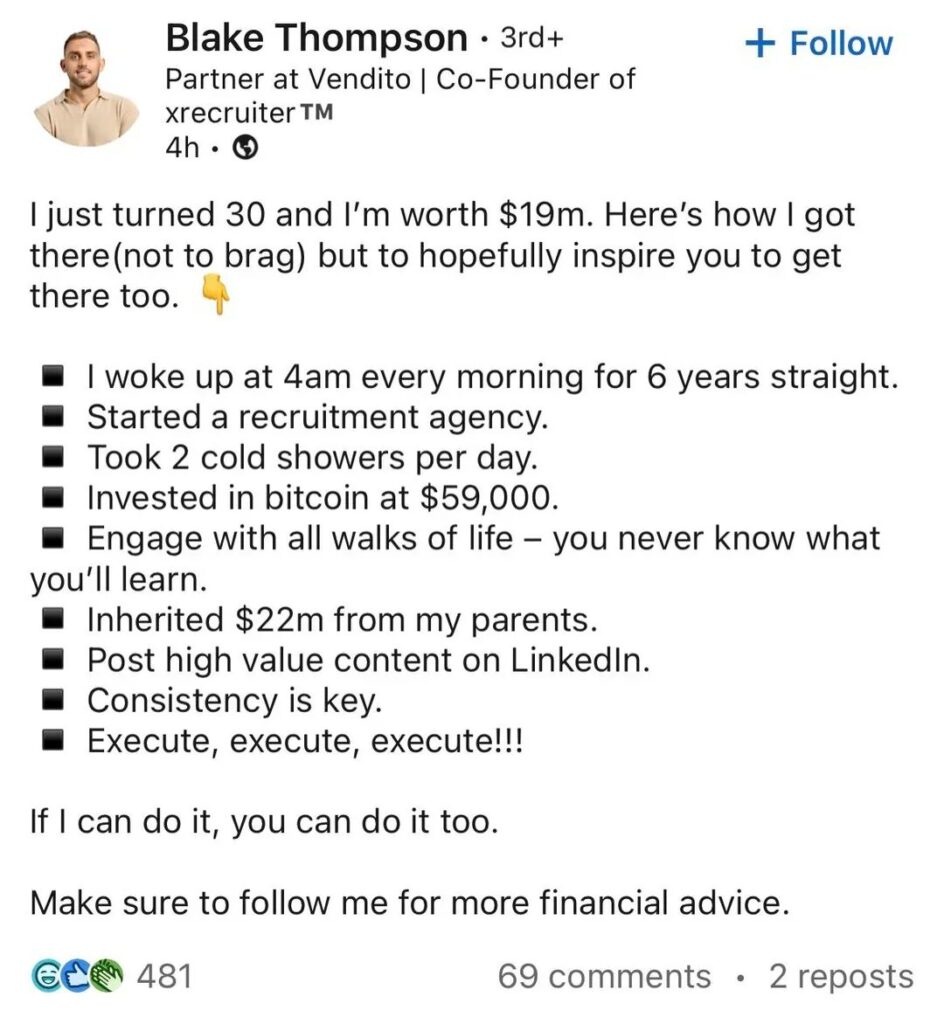

The best thing on LinkedIn this year…

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.