Key Details

Fund: Ironbank Karara Market Neutral Fund

Manager: Karara Capital

Fund Type: Retail Unlisted Fund

Invests In: Australian REITs and equities using a market neutral strategy.

Key People: Andrew Smith

Investment Focus: The Fund aims to generate absolute returns in line with long term equity returns while targeting a lower risk profile.

Risk profile: Medium. The Fund utilises a market neutral strategy. This means the manager has a very low net exposure to equity markets. This should reduce the effect of major market falls.

Affluence Fund Weighting: As at August 2020, the Ironbark Karara Market Neutral Fund has a weighting of 1.5% of the Affluence Investment Fund portfolio.

What the Karara Market Neutral Fund does

The Ironbark Karara Market Neutral Fund is a collaboration between Ironbark Asset Management and Karara Capital. Ironbark is the Responsible Entity and provides administration and marketing services. Karara Capital is the investment manager, and our focus is on them as they make the buying and selling decisions.

Karara Capital was established in April 2007. They have approximately $3 billion of funds under management. The majority of the FUM is in the successful Australian equities and small cap strategies. In 2016 Karara launched their property securities and market neutral investment strategies when Andrew Smith joined Karara. Andrew has held a number of senior portfolio manager roles, largely in the property sphere.

The Fund aims to generate absolute returns in line with long term equity returns while targeting a lower risk profile. Generating returns that are uncorrelated (i.e. performance doesn’t necessarily rise/fall when equity markets do) and preserving capital are priorities for the Fund. Investment limits include a maximum gross exposure of 200% (combined long and short exposure) and net exposure between -25% and +40%. The Fund asset allocation will be biased towards ASX listed real estate investment trusts (REITs) and other property-related securities, as well as other ASX securities and limited global REITs.

How the Fund aims to make money

The Fund uses four different methods for alpha generation:

- Pairs Trading. One security is purchased long. Another security is sold in an equal proportion short. The manager is trying to match up pairs of securities that have similar characteristics from within similar ASX sectors. They are looking to exploit relative pricing differences between the two stocks, irrespective of the performance of the market as a whole. If the stock purchased long does better than the stock sold short, the Fund makes money. If the opposite occurs, the Fund loses money.

- Fundamental Long. This is the traditional investment method. The manager purchases stocks that they believe are trading below their intrinsic value.

- Fundamental Short. Essentially the opposite of a fundamental long. The manager shorts a security when they think it is trading above its intrinsic value.

- Event Driven. The manager frequently observes special situations whereby mispricing occurs. These can be caused by “events” such as merger and acquisition activity, initial public offerings, equity placements, recapitalisations, Australian de-listings, buybacks, acquisitions & divestments and index rebalancing. These events differ in nature and have varying expected timeframes to play out.

Karara Market Neutral Fund Performance

The Fund has just reached its four year anniversary. We have compared the performance of the Fund to the ASX 200 Index. The manager reports their performance compared to the RBA cash rate. We do not believe this is a valid benchmark.

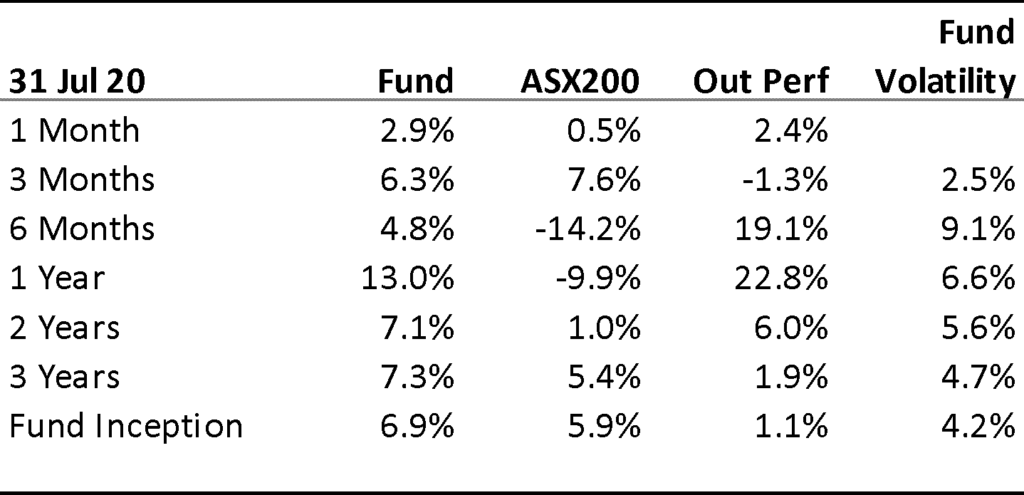

Performance and volatility of returns over various time periods are summarised below.

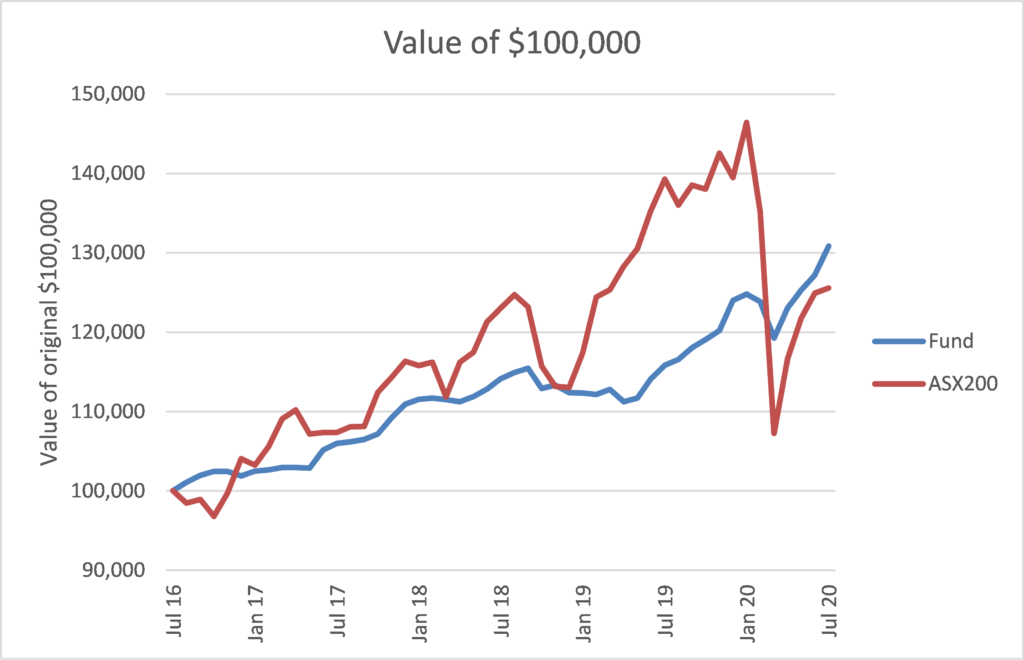

Returns for the Fund and the ASX200 Index since the commencement of the Fund are shown below.

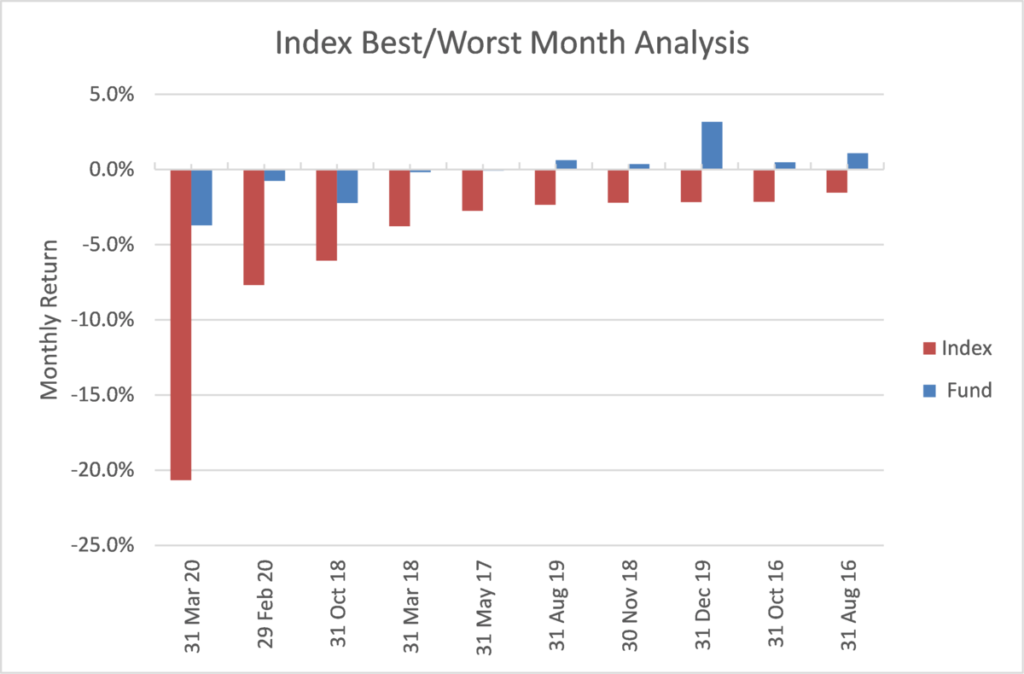

One of the other factors we focus a lot on is the Fund’s performance during months when the index had the largest negative returns.

The most striking element of performance is how much better the Fund has performed through the recent market turmoil. This is the reason for including market-neutral funds within a portfolio. The Fund suffered a much smaller drawdown in February and March 2020 and recovered very quickly afterwards.

In contrast, the period from January 2019 to January 2020 shows the potential cost of these strategies. When markets rally strongly, market neutral strategies can not be expected to keep up.

This is another reason it fits well into the Affluence Investment Fund, as we like investments to contribute at different times.

Not surprisingly, the Fund has a reasonably low beta to the ASX200 Index of only 0.2 since inception. Beta is a measure of the Fund’s volatility in relation to the overall market. A beta of 0.2 implies that the Fund’s movements have historically been about 20% of the index’s movements.

Why we like the Karara Market Neutral Fund

Our market neutral/alternatives portfolio has struggled over the past 3 years. However, the Karara Market Neutral Fund has been one of the standout performers. It has achieved its objective of producing reasonable absolute returns regardless of market conditions.

We have known and followed Andrew Smith for many years. We have always been impressed with his property securities knowledge and skills. In addition, he and his small team have the benefit of being able to tap into the idea generation and skillset of the greater Karara investment team.

Performance has exceeded the ASX200 since inception, with much lower volatility. In traditional market neutral style, the Fund has underperformed in strongly rising markets. It has more than made up for it in the recent correction.

Potential risks

An important part of our investment process is understanding what might go wrong. Here are some of the key risks for this Fund:

Low cash rates

Market neutral strategies typically hold up to 100% of the fund’s NAV as cash. This is because of the way shorting works. If I have $100 and I buy $100 of shares I now have $0. However, if I then borrow and “sell short” $100 of shares, I receive the proceeds of $100, and now have exposure to $200 or shares ($100 long and $100 short) and $100 of cash in the bank. For this reason, historically these strategies have received a substantial benefit of receiving interest on the cash at bank. Back when cash rates were at 5% plus, this fell straight to their overall returns. Today, interest rates are closer to zero, therefore reducing returns from this source significantly. This factor needs to be considered when assessing historical performance over longer periods when cash rates were higher.

Net exposure

Market neutral means different things to different managers. Strictly speaking, it refers to a strategy where there is zero market exposure. This Fund has the ability to adjust net exposure between -25% and +40%. Typically, Karara has operated the Fund between 5-15% net exposure. An increase in net exposure will typically result in the Fund being more influenced by market movements.

In addition, market-neutral does not mean low risk. With this strategy, there is the possibility of losing on both sides. For example, if the stock that is bought long falls, and the stock that was sold short rises, then essentially you lose twice. Some market-neutral funds also employ additional gearing, which can amplify this risk.

Key man risk

Andrew Smith is the portfolio manager and the primary reason for us investing in the Fund. Should he no longer manage the Fund, we would likely redeem our investment. Should a change in personnel lead to a decision by the manager to wind up the Fund, the portfolio could be sold over a short period, and capital returned to investors.

Conclusion

The Ironbark Karara Market Neutral Fund provides the Affluence Investment Fund with access to a well-performing alternative strategy. The benefits of these sort of funds in a diversified portfolio were demonstrated this year. The Fund substantially outperformed during a major market correction.

We hope that was helpful. If so, here are some other things you might like.

Learn more about this manager.

See more of our articles.

Visit the Affluence Members page to see more Fund Manager and LIC profiles.

Find out about our Affluence Investment Fund.

View the Affluence Investment Fund Portfolio.

Disclaimer

This content was prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence 475940 (Affluence) to enable investors in Affluence funds to understand an underlying investment in one or more Affluence funds in more detail. It is not an investment recommendation. Prospective investors are not to construe the contents of this article as tax, legal or investment advice. Neither the information nor any opinion expressed constitutes an offer by Affluence, its subsidiaries, associates or any of their respective officers, employees, agents or advisers to buy or sell any financial products nor the provision of any financial product advice or service.

The content was prepared without considering your objectives, financial situation or needs. In deciding whether to acquire or continue to hold an investment in any financial product, you should consider the relevant disclosure documents for that product which are available from the product provider. Disclosure documents for Affluence funds are available here. Affluence recommends you consult your professional adviser to determine whether a particular financial product meets your objectives, financial situation or needs before making any decision to invest.