Hi

This month, I’d like to depart slightly from my usual monthly commentary to talk specifically about the Affluence LIC Fund.

The Fund will celebrate its five year anniversary in two months. Given the strong returns it has achieved, it is likely to come on the radar of a wider range of potential investors and advisers at that time, as many people wait to see a five year performance history before committing to a fund. Since commencing in 2016, the Fund has delivered total returns of 12.9% per annum, including quarterly distributions of 7.3% per annum. Those returns have exceeded the Australian stock market (ASX200 including dividends) by 3.6% per annum. Pleasingly, the majority of the outperformance has occurred during periods of market decline, when the Fund has substantially outperformed the Australian stock market.

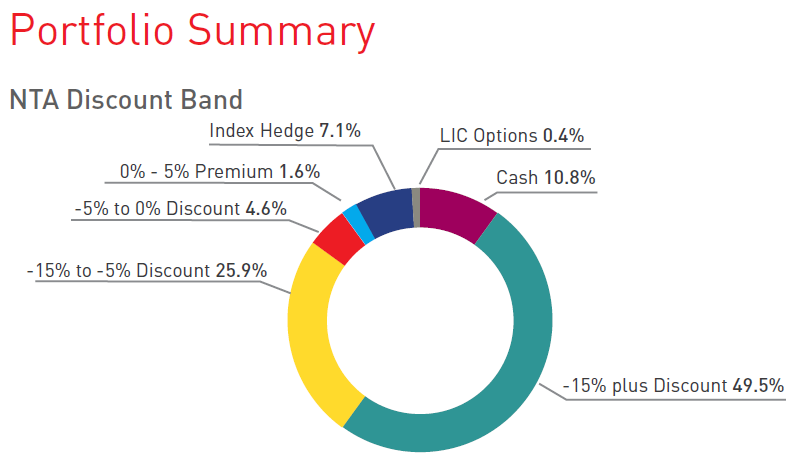

Right now, a well chosen portfolio of LICs still represents a great opportunity, but that won’t last forever. The LICs currently in the Fund portfolio trade at an average 16% discount to the value of their underlying investments, providing an obvious source of additional returns should those discounts narrow to more average levels. In addition, many of these LICs are run by investment managers we rate very highly, meaning the LICs themselves may perform very well.

All of which brings me to my point. Greg and I want to ensure the Fund remains small, in order to allow us the best chance of continuing to deliver good returns well into the future. Once the Fund reaches our target size, we will close it to new investors. Contrary to popular belief, one of the biggest advantages in investment management is less money, not more.

We have no idea how long it will take for this remaining capacity to fill up. Over the last year or two, despite the excellent performance, the Fund has grown quite slowly. That says more about our poor marketing ability, than the attractiveness of the Fund. If that trend continues, it may take some time for the remaining spots to be filled. But these things have a way of escalating quickly once people realise the window of opportunity is closing, so it could well be full in the next few months.

We wanted to make sure that everyone who has an interest in investing alongside us in the Affluence LIC Fund, get’s the chance to do so. If that’s you, here’s what you should do.

To learn more about the Fund, click here for the latest presentation.

To register for The Affluence LIC Fund webinar later this month, click here. I’ll be discussing how the Fund delivered returns of 20% plus in 2020, despite the pandemic, and how we are currently positioned.

If you have not yet invested in the Fund and would like to reserve an allocation, please reply to this email and confirm the amount you wish to invest and the expected timing of your investment (up to 30 June 2021). We’ll do our best to make sure we can accommodate you.

If you’re ready to invest right now, click here to apply or to download the PDS and application forms. The Fund is unlisted. We accept applications and withdrawals monthly, on the last business day of the month.

Finally, to ask us a question directly, you can reply to this email or give us a call during business hours on 1300 233 583.

Now, read on for our usual monthly fund reports and other interesting stuff.

Daryl and the Affluence Team

P.S. Because a lot of the LICs in the Fund ultimately invest in stocks, the Fund is impacted to a degree by movements in the stock market. If you’re not comfortable with that, the Fund may not be for you. In that case, you may wish to consider our Affluence Investment Fund.

Affluence Fund Reports & News

Affluence Investment Fund Report

The Fund returned 0.6% in February. Since commencing in 2014, returns have averaged 8.4% per annum, including monthly distributions of 6.7% per annum. See the report for more including detailed performance and top holdings.

Affluence LIC Fund Report

The Fund returned 1.7% in February. Since commencing in 2016, returns have averaged 12.9% per annum , including quarterly distributions of 7.3% per annum. See the report for more including detailed performance and top holdings.

Affluence Small Company Fund Report

The Fund returned 1.2% in February. Since commencing in 2016, returns have averaged 8.6% per annum , including quarterly distributions of 5.8% per annum. See the report for more including detailed performance and top holdings.

Why interest rates are so important

Back in late 2019, we wrote about the impact of very low (even negative) interest rates, and what the future may hold. Given what happened to markets in February, as long term interest rates rose, much of this is still relevant.

Register for the Affluence LIC Fund Webinar

January 2020 represented the highest monthly close for the ASX200 Index ever. Then a pandemic happened. In the 13 months since that market high, the Affluence LIC Fund returned 23%, while the ASX200 was down 2%.

Join us on 25 March, as we host an Affluence LIC Fund webinar. Find out how we did it, why we still think there’s a window of opportunity to get some exposure to LICS, and how we’re positioned.

We’re aiming for a 30 minute presentation, followed by the chance to ask questions.All registrants will receive a copy of the presentation and a link to access a replay of the webinar, so you may still wish to register even if you can’t attend on the day.

Other Interesting Stuff

Chart of the month.

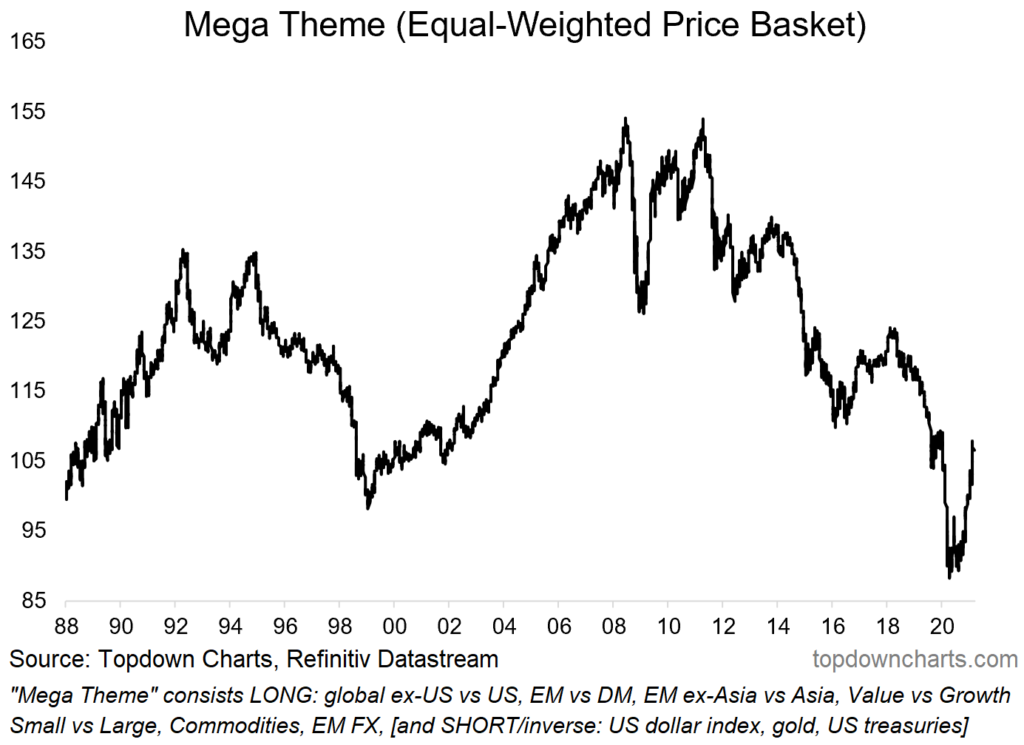

This month, Topdown Charts founder Callum Thomas shows the potential for upside from a group of ‘Mega Themes” which mimic many of the overweight positions in our own Affluence Investment Fund. If indeed this is the start of a rotation back into unloved sectors and markets, there is potentially a lot of money to be made.

The full article explaining the themes in detail is available here. Here’s part of Callums’s summary:

“It is…a good way to highlight how important taking a more nuanced approach to asset allocation will be as the cycle matures. Further to that, it also represents an about face on some of the big themes and trends that worked very well in previous years (i.e. the big secular downtrend for this basket across the last decade) – should we see further follow through to the upside this will be a rude surprise to investors who have extrapolated past performance into eternity. This next decade in many ways promises to be nothing like the past 10 years – so be careful how you anchor your expectations and mental models.”

Quote of the month:

“I’ve been doing this as some kind of chief investment officer since 1978. And this is about the wildest cocktail I’ve ever seen in terms of trying to figure out a roadmap.”

Stanley Druckenmiller, Duquesne Family Office, February 2021.

Stan Druckenmiller is 67 years old, and he’s seen a few investment cycles. He thinks markets are weird out there, and we’re inclined to agree with him.

Stanley was born into a middle class suburban family. After graduating university, he began his financial career in 1977 as an oil analyst at a bank. He became head of the bank’s equity research group after one year and in 1981, he founded his own firm, Duquesne Capital Management.

In 1988, he was hired by George Soros to run the Quantum Fund. He also continued to run Duquesne Capital during this period. In 1992, he and Soros famously “broke the Bank of England” when they shorted the British pound. Stanley left Soros in 2000 to concentrate full time on Duquesne Capital, after taking losses in technology stocks.

Duquesne Capital reportedly posted average annuals return of 30% per annum for 30 years, without any money-losing year. In 2009, Druckenmiller was the most charitable man in America, giving to foundations that support medical research, education, and anti-poverty.

In 2010, Druckenmiller announced he was closing the Duquesne Capital hedge fund, telling investors he had been worn down by the stress of trying to maintain one of the best trading records in the industry while managing an enormous amount of capital. His funds were down for about 5% for the 2010 year when he announced his retirement, but ultimately closed with a small gain. Since then, he has concentrated on managing his own family money, via the Duquesne Family Office.

Livewire markets recently profiled Stan Druckenmiller. You can view that profile here. The article includes some great quotes, his current portfolio positioning and a link to a recent video interview with Goldman Sachs.

SPAC update:

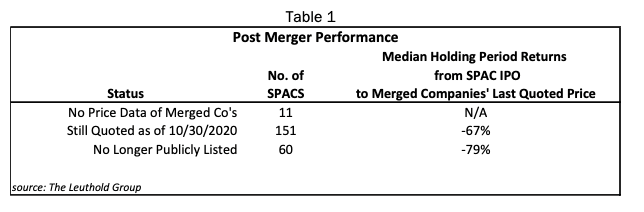

Last month, we told you about the US SPAC market, and how crazy valuations were. Since then, it has only gotten crazier.

If you recall, SPACs are a form of IPO. Essentially they are listed as cashboxes and then “merge” with an unlisted company/companies. The fees are outrageous, with a recent calculation suggesting only around 67 cents in every dollar raised goes to acquiring the target company, with 33% of IPO money disappearing in fees, costs and free carry for the promoters/managers.

More recently we came across this analysis of pre-2019 SPACs. How has this batch gone? Not great. Of those still quoted, the average SPAC is down 67% from the IPO price! Those no longer listed are down an average of 79%. Ouch..

Did you know:

Australia is moving north by 7cm every year. It is the fastest moving land mass on earth.

Nearly 10% of the revenue of the nation of Tuvalu comes from its control of the .tv internet domain.

In Warsaw’s Gruba Kaska water plant there are eight clams with sensors attached to their shells. If the clams close because they don’t like the taste of the water, the city’s supply is automatically shut off.

The P68 Dulcimer was invented 20 years ago. You’ve probably never heard that name, but I bet you’ve owned one. It’s better known as the iPod. Developing and launching the iPod in 2001 took just 41 weeks, from the very first meeting (no team, no prototype, no design, and apparently no proper name) to iPods shipping to customers.

This month in financial history:

In 2000, the NASDAQ Composite Index closed above 5,000 for the first time, delivering a 25% return a mere 48 trading days after breaking through the 4,000 barrier. Famed technical analyst Ralph Acampora predicted that the NASDAQ would hit 6000 in 12 to 18 months. One year after his prediction, the NASDAQ sat at 2,053, having lost 59%.

In 1834, six farm labourers from Tolpuddle in Dorset, England were sentenced to be transported to Australia for forming a trade union.

And finally:

The recent past does not determine the future. But many people invest like this…

Media and Presentations

AFR journalist Tony Featherstone completed “the survival guide to income investing” recently. We were featured as an LIC specialist. AFR subscribers can read the article here.

We regularly present to investment groups on various topics including our Affluence Funds, how we choose great fund managers, LICs and the investment environment.

If you would like to meet with us or have us speak with your investment group, get in touch.

Are you an Affluence Member?

We’ve spent hundreds of hours looking for Australia’s best Fund Managers and LICs.

Click below to register as an Affluence Member and see the results of all our hard work! Access our Affluence Fund portfolios and profiles of managers we invest with.

Thinking about Investing with us?

If you would like to learn more about our Funds, or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below. Alternatively, click on the ‘contact us’ button, fill out the contact form on our website and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors in any Affluence Fund should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contain important notices and disclaimers and important information about the relevant offer.As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. The value of your investment will go up and down over time, returns from each fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that there is always the chance that you could lose money on an investment. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers and potential investors are encouraged to obtain independent expert advice before any investment decision.The Morningstar Rating™ is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision. © 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.