Invest Differently

Hi

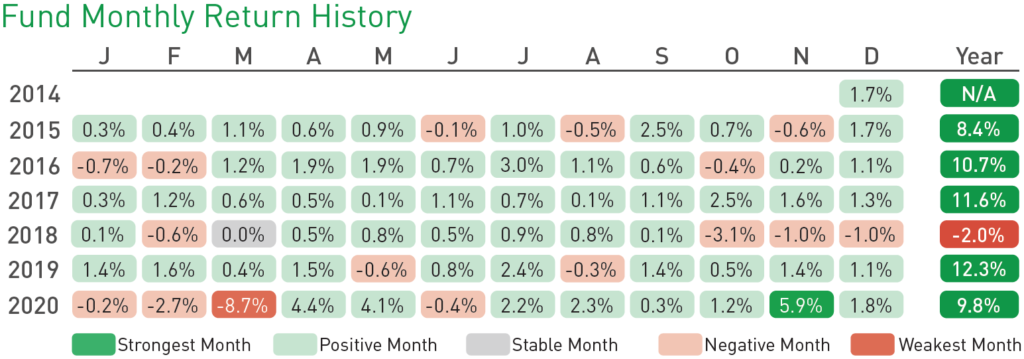

Our three funds achieved returns between 9.8% and 22.9% in 2020. Considering the ASX 200 Index returned just 1.4% including dividends, we’ll mark that down as a solid pass. Monthly reports for all three of our funds are below.

Despite the big recovery from the March lows, it was a wild ride in 2020. Many investors don’t enjoy that sort of thing. It’s the reason we try to make sure our funds can handle the falls better than the market. If you only suffer half (or less) of the pain in the market falls, it’s a lot more comfortable. It also makes it so much easier to recover from, which is just as important.

In the United States, we believe investors have now fully taken leave of their senses. With very limited exceptions, we are avoiding exposure to US stocks wherever we can. We feel the level of over-valuation is now at extremes not seen since the dot com boom of the 1990s. And we think it might end the same way. For US exposed investments, 2021 might be even more tumultuous than 2020. And we want no part of it. Below, in our Other Interesting

Stuff section, we talk more about some of the signs of US valuation extremes that we’re seeing.

Luckily, we don’t see the same craziness playing out here in Australia. Despite tech stocks at silly prices and many of the blue chip stocks in Australia being relatively expensive again, we’re quite positive, for two reasons. Firstly, our recovery from 2020 is likely to be much smoother and quicker than most other places. And secondly, as we’ve talked about repeatedly, all our funds own a range of assets we feel are cheaper than they should be. That doesn’t mean they won’t be affected in a market correction. But it does mean that over a 3-5 year period, prospects for making decent investment returns are very reasonable.

If you’d like to invest with us this month, you’ve got until Monday 25 January to apply for the Affluence Investment Fund or Affluence Small Company Fund. Affluence LIC Fund applications must be completed by Friday 29 January. As always, go to our website and click the “Invest Now” button to apply online or download application/withdrawal forms. If you have any questions, simply reply to this email or give us a call at any time.

Finally, if you use Hub24, and you want to invest with us, we’ve got a favour to ask. Our Affluence Investment Fund is currently approved for the investment menu. We’re due to put it forward for consideration for the Super menu in the next few weeks. If you would like to use our fund on Hub24 super, please reply to this email and let us know how much demand you might have. That will help us speed up the process.

Read on for our monthly Fund reports and other interesting stuff.

Daryl, Greg and the Affluence Team

Affluence Fund Reports & News

Affluence Investment Fund Report

The Fund returned 9.8% in 2020. Since commencing in 2014, returns have averaged 8.5% per annum, including monthly distributions of 6.7% per annum. See

the report for more detail including detailed performance and top holdings. AIF Monthly Report

Affluence LIC Fund Report

The Fund returned 20.2% in 2020. Since commencing in 2016, returns have averaged 12.8% per annum, including quarterly distributions of 7.5% per annum.

See the report for more detail including detailed performance and top holdings.

Affluence Small Company Fund Report

The Fund returned 22.9% in 2020. Since commencing in 2016, returns have averaged 8.7% per annum, including quarterly distributions of 6.0% per annum. See the report for more detail including detailed performance and top holdings.

Waiting for the last dance

Jeremy Grantham, the 82 year old GMO co-founder has declared the US market a fully-fledged epic bubble featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative behavior. Worth a read.

All Weather Fund, Monthly Distributions

The Affluence Investment Fund gives you access to a portfolio of vastly diversified assets and investment styles through a range of exceptional fund managers chosen by us. The result is an all-weather portfolio that can deliver in differing market conditions. Many of the managers in the Affluence Investment Fund are closed to new investors, only available to wholesale clients or have high minimum investment amounts.

The Affluence Investment Fund targets a minimum distribution rate of 5% per annum. Over the life of the Fund, cash distributions have averaged 6.7% per annum. Distributions are paid 10 days after the end of each month, or you can reinvest and receive additional units.

Returns shown above exclude franking credits received from investments and passed through in full at the end of each tax year. These have typically averaged 0.4% to 0.5% per annum.

Other Interesting Stuff

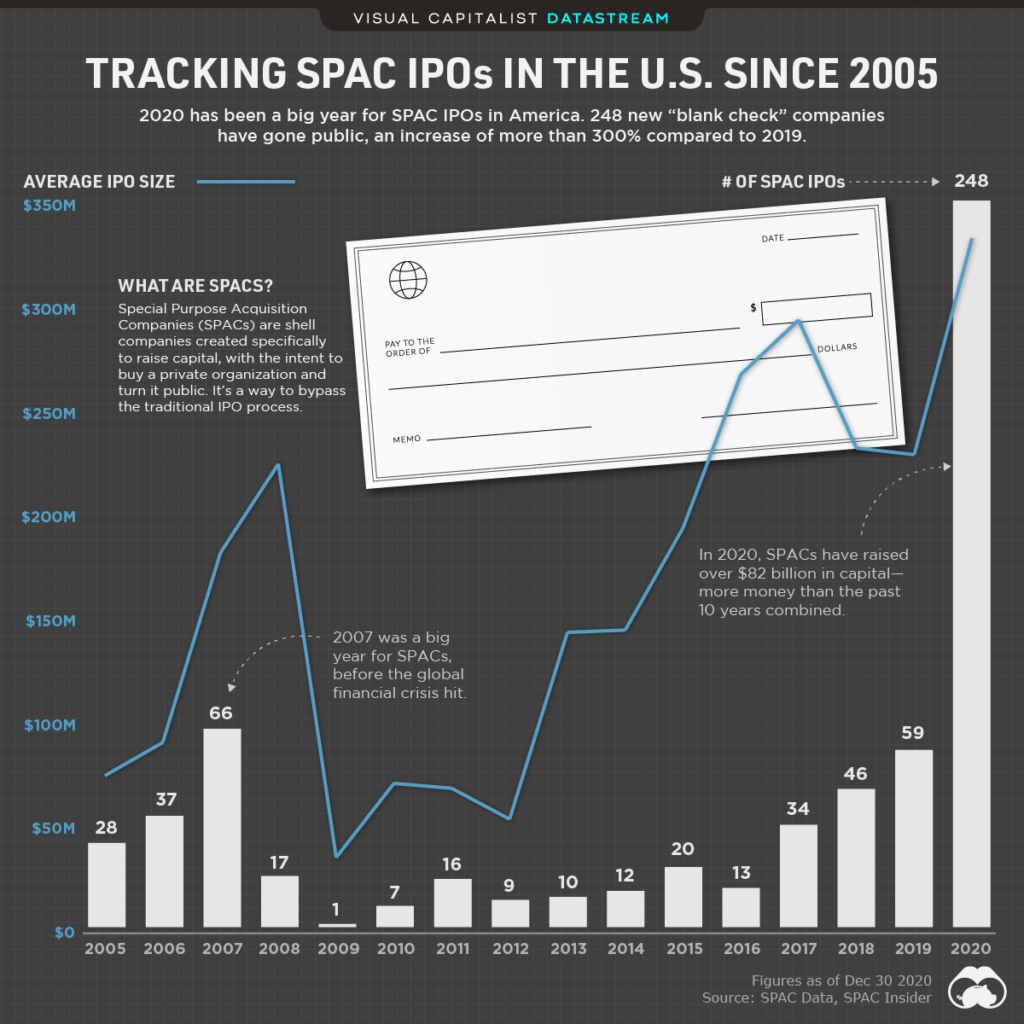

Chart of the month.Here’s one example of why we think the US market is crazily overheated right now. There has been a boom in Special Purpose Acquisition Companies (SPACs). SPACs are shell companies created and listed with the sole intent to raise capital and buy all or part of a private company or companies. They are a form of LIC, with ultimately a more concentrated portfolio than the average LIC here in Australia.

In 2020, 248 new SPACs went public, an increase of more than 300% from 2019. They raised approximately $82 billion. That’s more than the previous 10 years combined. And the average SPAC is now trading at a 20% premium to the value of it’s (probably already overvalued) assets.

As one way of comparing the sentiment and valuations of the US market to Australia, let’s compare the SPAC boom in the US, to our own LIC sector here in Australia. Several things stand out.

- Many LICs are trading at a discount to asset value here in Australia. Almost none are trading at greater than the average 20% SPAC premium. Our Affluence LIC Fund portfolio is trading at an average discount of approximately 15%.

- LICs generally provide more certainty and more diversification than SPACs. Plus franking credits.

- The valuation of underlying equities held by LICs is much more sensible than the equities held/to be acquired by SPACs.

As a further example of the divergence in values, let’s consider a series of three ASX listed LICs held by all of our funds, that invest in US private equity (unlisted companies). This is a similar, albeit more diversified investment strategy than that being pursued by the SPAC cohort in the US. In our case, the three ASX listed funds together provide access to investments in over 100 US private companies via a range of proven, specialist private equity managers. On average those three LICs are trading at over a 30% discount to their net asset value. We’ve recently hedged out a lot of the US market risk, but retain exposure to US dollars, improvement in the discounts and outperformance of underlying company investments.

If you’re interested, you can read more about SPACs here.

This month in (financial) history:

It’s early January 1973 and in one of economic forecasting’s finest moments, the US’s leading experts are unanimous: The bull market has only just begun. The financial editor of The New York Times, Thomas E. Mullaney said, “The United States is in the midst of a new economic boom that may prove to be unrivaled in scope, power and influence by any previous expansion in its history.” And a renowned forecaster is passionately optimistic:

“It’s very rare that you can be as unqualifiedly bullish as you can now,” declares Alan Greenspan, who runs the consulting firm of Townsend, Greenspan & Co. Yes, that Alan Greenspan.

It’s also very rare that anyone has ever been so unqualifiedly wrong. 1973 and 1974 turn out to be the worst years for US economic growth and the stock market since the Great Depression.

Also, we’re not sure unqualifiedly is actually a word…

And waaay back in 1793, the United States Mint became a significant enough institution to hire its first security staffer. It was a watchdog named Nero, which the Mint purchased for $3. No word on what breed of dog Nero was.

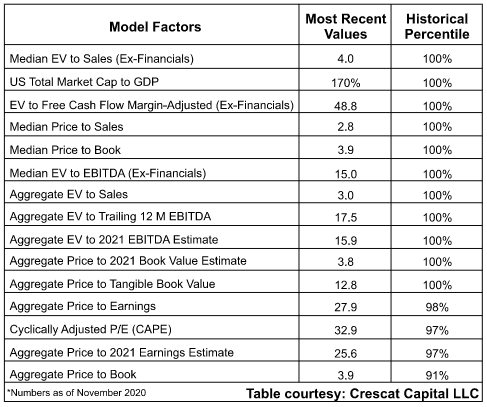

Chart of the month 2:

Fund manager Crescat Capital runs a valuation model on the US market. The table below shows their 15 key valuation indicators at November 2020, compared to historical data back to 1900.

As you can see, 11 of the 15 factors are at the 100th percentile, meaning they are in the top 1% of readings during the past 120 years. The rest aren’t far off.

If you’re interested, there’s a bunch more graphs in their latest presentation, which can be found here.

Quote of the month:

“I wish I could have stayed another year. At least I could have given shareholders the dessert they deserved after they had such a bad meal with me in 1998 and 1999.”

George Vanderheiden.

As technology stocks soared in 1999, George Vanderheiden, a veteran fund manager at Fidelity Investments, left a package of bulbs on the floor outside his office door. Above it, on a whiteboard, he had scribbled a message: “Tulip bulbs for sale.”

Mr. Vanderheiden was making a comment on stock-market excess. In his view, investors who piled into Internet stocks and other high-fliers were as foolish as 17th-century speculators who bought Dutch tulip bulbs — an investment bubble that ultimately burst. So Mr. Vanderheiden shunned tech shares and bought government bonds, hoping to protect his investors. He ended up being right, of course. Unfortunately, shareholders never profited from his insight.

In February 2000, a dispirited Mr. Vanderheiden, frustrated by lagging returns, retired after two decades as a money manager. Fidelity replaced him with two younger, up-and-coming managers of a more optimistic stripe. True to form, they piled into technology shares and other market favorites. They did so at exactly the worst time, just before the tech-dominated Nasdaq Stock Market collapsed.

George ran the Advisor Growth Opportunities and Destiny I funds for Fidelity and notched up annual returns of 19% for the 10 years to December 1999, despite underperforming substantially in his last two years. Not bad for a value manager in the midst of the dot com boom. Here are some of his abiding investment lessons:

- Manias often end with calendar years. The run-up in the Japanese stock market during the 1980’s, the biotechnology craze of 1991 and the rise of the Nifty 50 in 1972, all fizzled around the start of a new year.

- Eliminate your mistakes. George began the year with the knowledge that roughly 50% of his positions were mistakes, tried to carefully think about which of those mistakes would cost him the most money and eliminate those positions.

- Being too early is the same as being wrong. Timing does matter, as the price you pay determines the return you get.

- “Client alpha” really matters. “Client alpha” is the idea that having clients who are aligned with what you are trying to achieve as a fund manager is critically important. Otherwise investment capital is often taken away at exactly the wrong time.

Of these lessons, it’s the last one that resonates with us the strongest. We want more capital after a big market correction, and we’re never disappointed to see some withdrawals after a period of exceptionally strong performance.

Video of the month:

The best of 2020 internet, from Ryan Shirley. From this 13 minute video, we learned:

- Striped eel catfish and jellyfish swarms are mesmerising.

- Some people are silly.

- Jaden is broke (our favourite of them all).

- The heartbeat of an artificial heart sounds weird.

- The world record of stone skips is a lot.

- Wild animals should be approached with caution.

Did you know:

If Apple AirPods was a standalone business (founded 2016, $12bn revenue, 125% growth, 30–50% margin), it would probably be the most valuable startup in the world.

In the Thames Estuary, about 40 miles east of London, is a shipwreck from WW2 containing 14,000 unexploded bombs. If they blew up, it could send a five metre tsunami up the river.

When users download the Kenyan mobile loans app OKash, the T&Cs quietly give it permission to access their contacts. If they fall behind in repayments, the app starts to message all those contacts — family, colleagues, ex-partners — to shame the user into repaying the debt.

And finally:

We give you the Flatid Planthopper Nymph insect, also known as “walking popcorn”. The weirdest thing you’ve ever seen. Yes, it is real. More here.

Media and Presentations

We regularly present to investment groups on various topics including our Affluence Funds, how we choose great fund managers, LICs and the investment environment.If you would like to meet with us or have us speak with your investment group, get in touch.

Are you an Affluence Member?

We’ve spent hundreds of hours looking for Australia’s best Fund Managers and LICs.

Click below to register as an Affluence Member and see the results of all our hard work! Access our Affluence Fund portfolios and profiles of managers we invest with.

Thinking about Investing with us?

If you would like to learn more about our Funds, or invest with us, the buttons below will take you to the right places.

If you have a question, you can email or call using the details below. Alternatively, click on the ‘contact us’ button, fill out the contact form on our website and we will be in touch with you as soon as we can.

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors in any Affluence Fund should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering

units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contain important notices and disclaimers and important information about the relevant offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. The value of your investment will go up and down over time, returns from each fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that there is always the chance that you could lose money on an investment. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers and potential investors are encouraged to obtain independent expert advice before any investment decision.

The Morningstar Rating™ is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision. © 2019 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf.

You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.