Hi,

Welcome to a much later than usual monthly report. Holiday schedules have conspired to slow us down markedly this month. We will do better next month.

All three Affluence funds rose in March, to round out what has been a volatile quarter. For the 3 months, the ASX 200 Index increased 2.2%, while global markets decreased by 8.4% (in AUD).

On 5 April, our Reserve Bank met, and did not increase interest rates. The minutes of that meeting had this to say:

“The Board has wanted to see actual evidence that inflation is sustainably within the 2 to 3 per cent target range before it increases interest rates. Inflation has picked up and a further increase is expected, but growth in labour costs has been below rates that are likely to be consistent with inflation being sustainably at target. Over coming months, important additional evidence will be available to the Board on both inflation and the evolution of labour costs.”

We’re not sure what world our Reserve Bankers live in, that they are not yet sure whether inflation is sustainably 2-3%. Clearly, no-one from the RBA has filled up their car with petrol, gone grocery shopping, renovated, rented or bought a house or hired any new employees in the past 6 months. We don’t know anyone outside the RBA and the Australian Bureau of Statistics that still thinks inflation is lower than 3%. And it’s very clear that wage pressures are also increasing. Extreme lows in vacancies and an influx of foreign students and workers are likely to keep driving residential property rents higher.

We now have the ingredients in place for inflation to stay high for quite some time. The RBA cannot now raise rates in May (during an election campaign) and so the earliest they can get started is June. Delaying the inevitable may well force the RBA to raise interest rates much higher than if they would have, had they started earlier.

The good news is that while higher interest rates will have an impact, our resources and agriculture heavy economy means we may well turn out to be the lucky country once again over the next few years. We can’t think of anywhere else in the world we would rather live and invest right now.

If you want to apply online or download application or withdrawal forms for all our funds, go to our website and click “Invest Now”.

This month’s “things we found interesting” section includes profit margins, government debt, LICs, the weight of a cloud and where Sweden’s garbage goes.

If you have any questions or want to give us some feedback, reply to this email or give us a call.

Regards.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

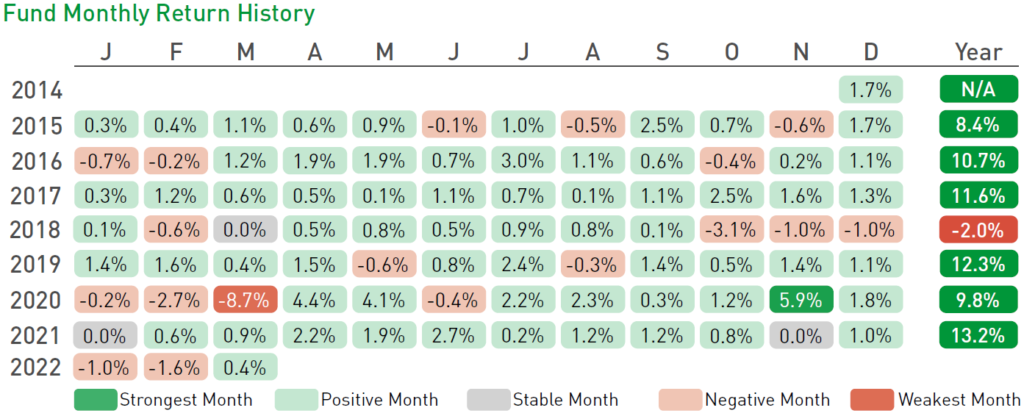

The Affluence Investment Fund returned 0.4% in March. Since commencing in 2014, returns have averaged 8.5% per annum, including distributions of 6.6% per annum.

At month end, 58% of the portfolio was invested in unlisted funds, 14% in the Affluence LIC Fund, 14% in listed investments, 1% in portfolio hedges and 13% in cash.

The cut-off for April monthly applications and withdrawals has passed.

Affluence LIC Fund

The Affluence LIC Fund returned 1.4% in March. Since commencing in 2016, returns have averaged 13.1% per annum, including quarterly distributions of 7.5% per annum.

The average discount to NTA for the portfolio at the end of the month was 13%. The Fund held investments in 29 LICs (75% of the Fund), 5% in portfolio hedges and 20% in cash.

The cut-off for monthly applications (existing clients only) and withdrawals is 29 April.

Affluence Small Company Fund

The Fund returned 1.0% in March. The Fund holds a range of value investments focused on smaller companies. Since commencing in 2016, returns have averaged 10.0% per annum.

The Fund held 8 unlisted funds (54% of the portfolio), 7 LICs (16%) and 6 ASX listed Small Companies (17%). The balance 13% was cash.

Available to existing wholesale clients only. The cut-off for April monthly applications and withdrawals has passed.

25+ talented fund managers in a single investment

The Affluence Investment Fund provides access to over 25 boutique fund managers in a single investment. These underlying managers all have several things in common. A lot of experience, an accomplished investment track record, and a specialised investment strategy. Plus, they all invest a significant portion of their own money in the strategies they manage.

You may not have heard of many of these funds. Quite a few are closed to new investors, or only available to wholesale clients. Almost all of them specifically cap the amount of money they manage, because they understand that one of the biggest barriers to exceptional performance is too much money.

Through the Affluence Investment Fund, you can access them all, plus more. With monthly distributions, a focus on investing differently and fees based only on performance, the Affluence Investment Fund is probably unlike anything else in your investment portfolio.

Things we found interesting

Chart of the month.

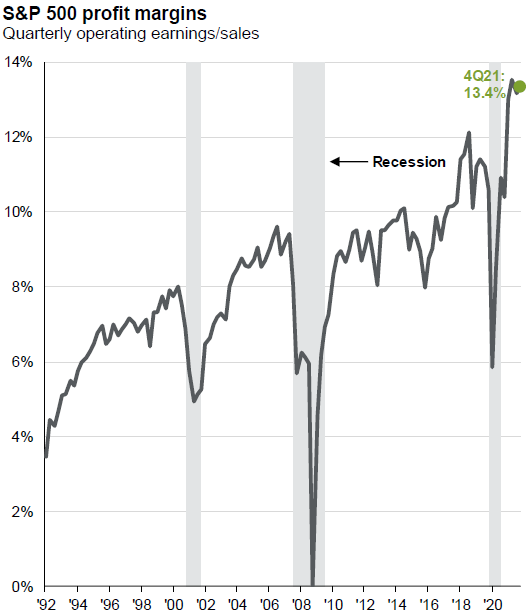

The US Cyclically Adjusted Price Earnings ratio (CAPE) is currently 35. This level is more than 40% above the long term average, even after the 2022 market fall. Bulls argue the market has fundamentally changed and todays tech companies justify these high valuations. We believe this demonstrates that US equities are still materially overvalued. The chart below goes some way to explaining the difference between the CAPE and standard forward-looking price earnings ratios, which seem far more reasonable.

You can see the dramatic improvement in profit margins compared to pre-GFC figures. The problem with this, is that we may be near a cyclical high in profitability for US listed companies. Our expectation over the next 12 months is that US inflation will drive interest rates, wage costs and other business inputs higher, and that these increases will be sustained to a degree. While headline inflation will probably fall this year, underlying inflation might remain stubbornly high. Most businesses are not going to be able to pass these higher costs on in full. This leads to a so-called “earnings recession”, where company profits fall without the broader economy falling into a recession.

This tends to have an outsized impact on markets, as it leads to PE ratios falling back to, or below average levels, as investors come to realise it’s no longer worth paying a premium for no/low/uncertain growth. The combination of a 10-15% fall in forecast earnings, coupled with a return to a more normal PE ratio, could easily see the US market fall by 25-40%. It could well end up worse if inflation sticks around.

Australia is much better placed in such an environment. The rest of the world is probably somewhere in between.

Chart of the month 2.

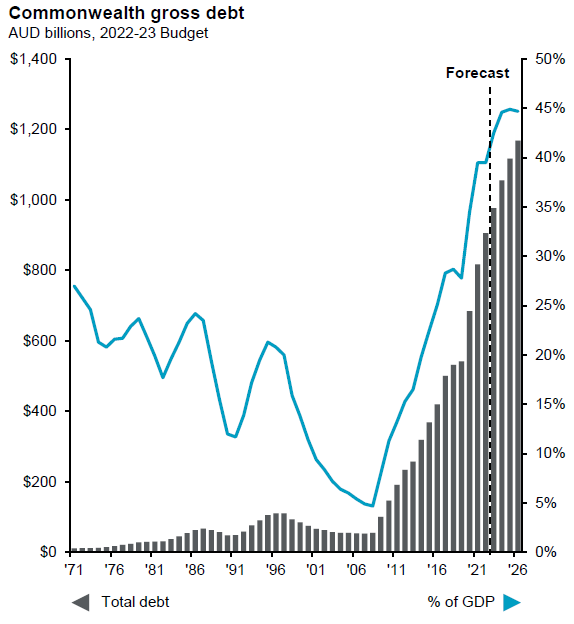

Here’s Australia’s Government debt. You can see just how huge the spendathon has been since the GFC back in 2008. Currently we’re at about $900 billion. That’s $36,000 for every one of us. Looked at another way, it’s around 40% of GDP (the value of all the finished goods and services produced in Australia each year). That debt is not expected to come down anytime soon.

The picture is similar for almost every developed nation on earth. And what’s the easiest way to get rid of this debt? Raise taxes for everyone and pay it back? We don’t think so. It’s much easier to let inflation do the heavy lifting. A few years of higher than average inflation means the debt as a percentage of GDP will reduce significantly. Much less painful, at least in theory. Unless that inflation also causes much higher interest rates on that debt. Then we might have to start raising taxes and paying it back…

Chart of the month 3.

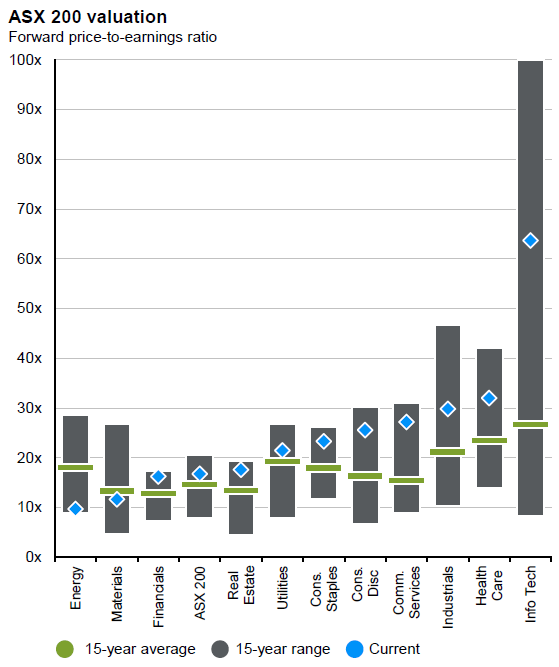

Is the ASX overvalued? Well, here’s one measure to gauge it. Price to Earnings Ratios by sector. You can see the range and average for the last 15 years, along with the current values. For the ASX200, PE Ratios are a little above average. Energy and resources look cheap, and they are making the overall market look not too bad. How about that technology sector! The best thing we can say about technology valuations it that they’re much less crazy that they were a year ago.

Discounts and premiums

Fund managers often give investors different ways to access the same (or a substantially similar) fund. In some cases, investors can buy a listed equivalent much cheaper than the unlisted version. It’s the entire reason our Affluence LIC Fund exists. In this excellent piece, Graham Hand at Firstlinks take a look at the arbitrage opportunity in listed vs unlisted funds.

By the way, the Affluence LIC Fund owns many of the stocks mentioned in the article, including MGF, PICOA, MFFOA, PMC and PAI. And the concept is not limited to LIC’s. The Affluence Investment Fund currently owns a handful of ASX listed REITs trading at decent discounts to the value of their property assets.

Quote of the month.

“Well, uh…thank you very much. We appreciate it. Asshole.”

Jeffrey Skilling, Enron CEO, on April 17th, 2001 – in response to analyst Richard Grubman after he asked why Enron does not produce a balance sheet or cash flow statement with their earnings.

On that day, Enron stock was trading around $60 per share, but had fallen from $90 just 6 months prior. After briefly closing above $60 in early May, Enron stock would never see a share price in the 60’s again. By December of that year, the company had filed for bankruptcy in one of the most famous business collapses of all time.

This month in (financial) history.

On 24 April 1901, volume on the New York Stock Exchange shattered records, mostly due to one stock in particular, Northern Pacific Railroad. In total, 662,000 shares of Union Pacific were traded – two thirds of all shares outstanding for the company.

The buyers (which would not be common knowledge for two weeks) were E.H. Harriman and J.P Morgan. The two were fighting for control of the railroad and attempting to corner the stock. E.H Harriman made a surprise raid and attempted to accumulate enough shares to gain control of Northern Pacific. However, J.P Morgan and fellow railroad tycoon and ally James Hill would quickly be tipped off of his efforts, and responded by purchasing as many Northern Pacific shares as could be found.

James Hill, set a new cross country speed record on his train to get back to New York from out west for the fight. Private trains were sent across the United States to buy the smallest of Northern Pacific lot sizes. The buying would culminated in one of the wildest days in NYSE history on May 9th, 1901 when Northern Pacific stock vaults from $160 to $1,000 in just a few hours.

Vaguely interesting facts.

Almonds and peaches are members of the same family.

Female bats give birth hanging upside down, catching the newborn with their wings.

Clouds are far from weightless. The average cumulus cloud weighs about 5,000 tonnes.

Flamingos aren’t naturally pink. They’re born gray. It’s their diet of brine shrimp and algae that turns them pink.

In Sweden, just 1% of garbage gets sent to landfill. And to answer your next question, 47% gets recycled, while a whopping 52% gets incinerated in power plants that convert garbage to energy.

The odds of giving birth to a baby at 12:01am on January 1 are around 1 in 526,000. *

Source: mentalfloss.com

And finally…should you play Powerball part 2?

As a follow up to last months post, if you must play Powerball (we don’t recommend it as an investment strategy), here’s the maths behind the best Powerball number to choose.

* Bonus vaguely interesting facts. The odds of getting struck by lightning in any given year are also about 1 in 526,000, the same as giving birth at 12:01 on 1 January. And as we learned last month, the odds of winning Powerball are 1 in 134 million. Which means you would need to buy 64 standard tickets (256 games) to have the same chance of winning the lottery as being struck by lightning.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.