Hi,

All Affluence fund returns were stable last month (one up slightly, one flat, one down slightly), while the ASX 200 Index fell by 0.2%. Monthly fund reports can be accessed below.

We currently hold more cash in all three funds than at almost any time in our history. And yet, there is a growing range of attractive investment opportunities across quite a few asset classes. That would seem an unusual combination. The reason we’re positioned that way, is that we expect economic conditions to deteriorate further. The next year or so might be a long, slow grind. Patience is required.

This sort of investment environment suits our style just fine. We’re very comfortable with the existing portfolios of all three funds, which don’t necessarily rely on markets going up to make money. We’ll spend the extra cash over time, when we feel the risk/reward balance is right for individual opportunities. In the meantime, we’ll keep adding to the list of potential investments that excite us.

Monthly applications for the Affluence Investment Fund and Affluence Small Company Fund close on Monday 24 April. Applications for the Affluence LIC Fund close Friday 28 April. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.

If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund increased by 0.2% in March. Since commencing over eight years ago in November 2014, the Fund has returned 7.9% per annum, including monthly distributions of 6.5% per annum.

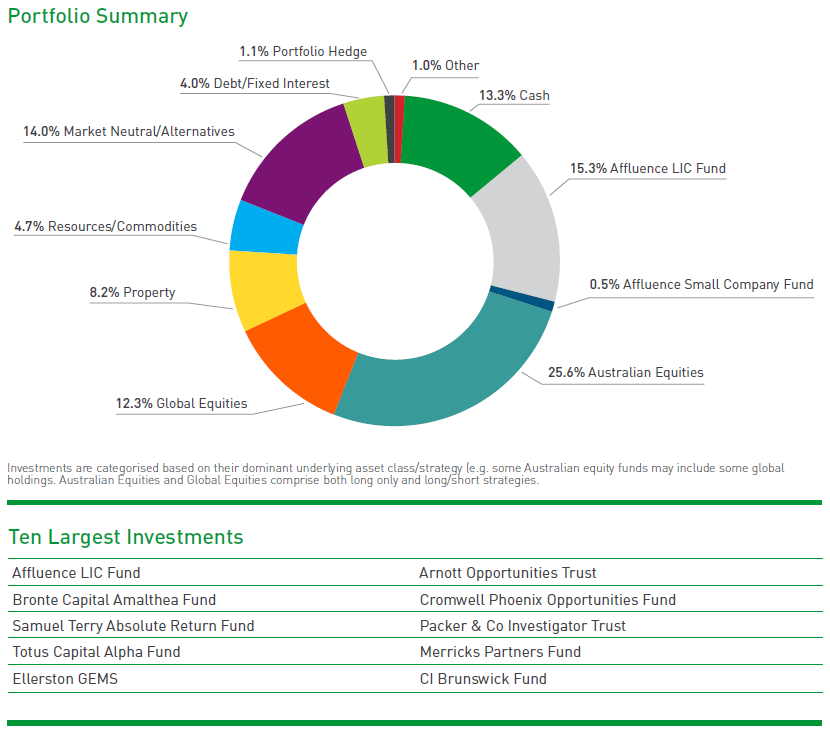

At month end, 62% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 9% in listed investments, 1% in portfolio hedges and 13% in cash.

The cut-off for monthly applications and withdrawals is Monday 24 April.

Affluence LIC Fund

The Affluence LIC Fund was flat in March, as the ASX 200 fell by 0.2%. Since the Fund commenced over six years ago, returns have averaged 11.5% per annum, including quarterly distributions of 8.2% per annum.

The average discount to NTA for the portfolio at the end of the month was approximately 18%. The Fund held investments in 29 LICs (68% of the Fund), 2% in portfolio hedges and 30% in cash.

The cut-off for monthly applications and withdrawals is Friday 28 April.

Affluence Small Company Fund

The Affluence Small Company Fund fell by 0.4% in March, slightly outperforming the ASX Small Ords which fell by 0.7%. Since commencing in 2016, returns have averaged 9.1% per annum, including quarterly distributions of 6.9% per annum.

The Fund held 8 unlisted funds (48% of the portfolio), 8 LICs (12%) and 7 ASX listed Small Companies (19%). The balance 21% was cash.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Monday 24 April.

Invest Differently

The Affluence Investment Fund provides you with access to a wide range of different investment strategies, combining our portfolio construction expertise, with access to over 30 talented boutique investment managers. A significant number of funds in the portfolio can only be accessed directly by wholesale investors, or existing clients of the manager.

We aim for the Affluence Investment Fund portfolio to have an all weather focus – prepared for whatever markets may do. We also tend to skew the portfolio towards the asset classes that we feel are cheapest, and to the themes we think are most likely to impact markets over the next few years. Returns since the Fund commenced have been similar to the Australian share market, with more consistency and significantly better outcomes in falling markets.

With monthly distributions and a performance based fee structure, the Affluence Investment Fund may be a useful diversifier for your investment portfolio.

Things we found interesting

Chart of the month: Bigger Australia.

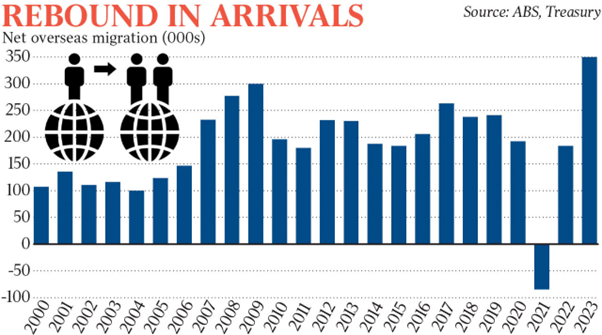

We are in the middle of what will likely be the biggest two-year population surge in Australia’s history.

An extra 900,000 residents are set to join us. In the September quarter of 2022, 106,000 migrants came into Australia. This is the largest quarterly addition since the data commenced in 1979. The influx is boosting spending and the tax take, helping to ease labour shortages and fuelling demand for services. All of which is good.

Chart of the month 2: What will house prices do next?

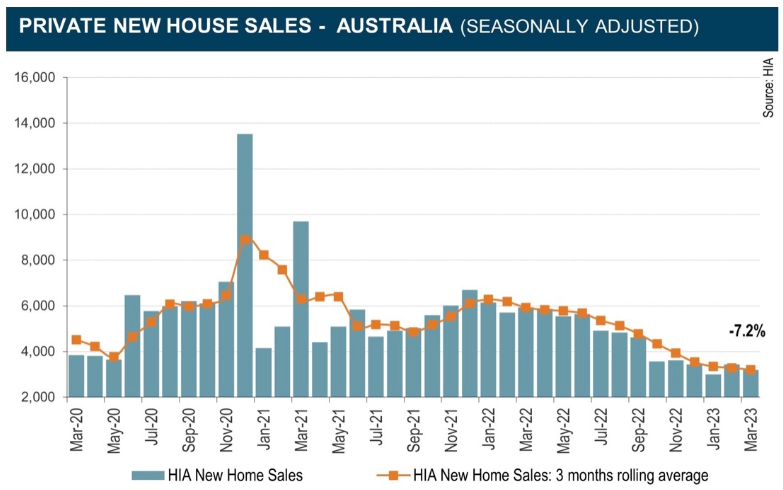

The raft of new entrants to Australia is putting severe strain on our already struggling housing sector. New home sales have plummeted in recent months, based on data from the largest volume home builders in the five largest states.

The continuing failure of builders, coupled with higher construction costs and difficulty getting finance, all mean it will probably get worse before it gets better. It’s a real issue for the nation, with no quick or easy solution in sight. In the short term, it’s led to a small rebound in existing home prices, despite the impact of the last years’ interest rate rises.

This month in history.

On April 23 1985, the Coca Cola Company committed what is widely considered to be one of the greatest marketing blunders of all time. On that day, they announced a change to the formula for the world’s most popular soft drink for the first time in 99 years. The move was intended to re-energize its Coca-Cola brand, following years of stagnating sales.

Despite being preferred in taste tests of nearly 200,000 consumers prior to launch, “New Coke” was a marketing disaster. What these tests didn’t show was the bond consumers felt with their Coca-Cola – something they didn’t want anyone tampering with! It provided a case study that is still commonly used in marketing courses to this day.

Coke chairman and chief executive officer Roberto Goizueta bore the brunt of the blame for the ill-advised move. There were protests, thousands of calls a day to the Coke consumer hotline, and widespread hoarding of “old coke”. One disgruntled customer sent a letter addressed only to “Chief Dodo, The Coca-Cola Company.” Bob Goizueta was most upset that it actually found it’s way to him! Another person wrote to him asking for his autograph — because, in years to come, the signature of “one of the dumbest executives in American business history” would be worth a fortune.

The firestorm ended four months later, with the return of the original formula, rebranded Coca-Cola Classic. The two brands were sold alongside each other for some time, and had distinctly different advertising campaigns. In 1990, the name of the new Coca-Cola was changed to Coke II. It was finally discontinued in 2002.

Incidentally, the whole fiasco didn’t hurt Coke’s share price at all. It rose by 37% during 1985. Suddenly everyone was talking about Coca-Cola, realising what an important role it played in their life, and it revitalised sales. So in the end, it wasn’t the marketing disaster it is widely assumed to be.

Vaguely interesting facts.

The average cumulus cloud weighs roughly half a tonne.

Frank Sinatra was offered the lead role in the Die Hard movie.

The Vatican bank is the only one in existence that allows ATM users to perform transactions in Latin.

According to a 2010 study, people fluent in multiple languages almost always swear in their native tongue.

The Antikythera mechanism was the world’s first analog computer. It was so advanced nothing surpassed it for almost 1500 years. *

Source: mentalfloss.com, wikipedia.com.

* The Antikythera mechanism was invented by Greek scientists. It is believed to have come into existence between 87 and 205 BC and was used to predict astronomical positions and eclipses decades in advance. It could also be used to track the four-year cycle of an Olympiad, the cycle of the ancient Olympic Games. It was discovered in 1901 by sponge divers wishing the wreckage of a sunken ship off the Greek island of Antikythera.

And finally…pillow tax

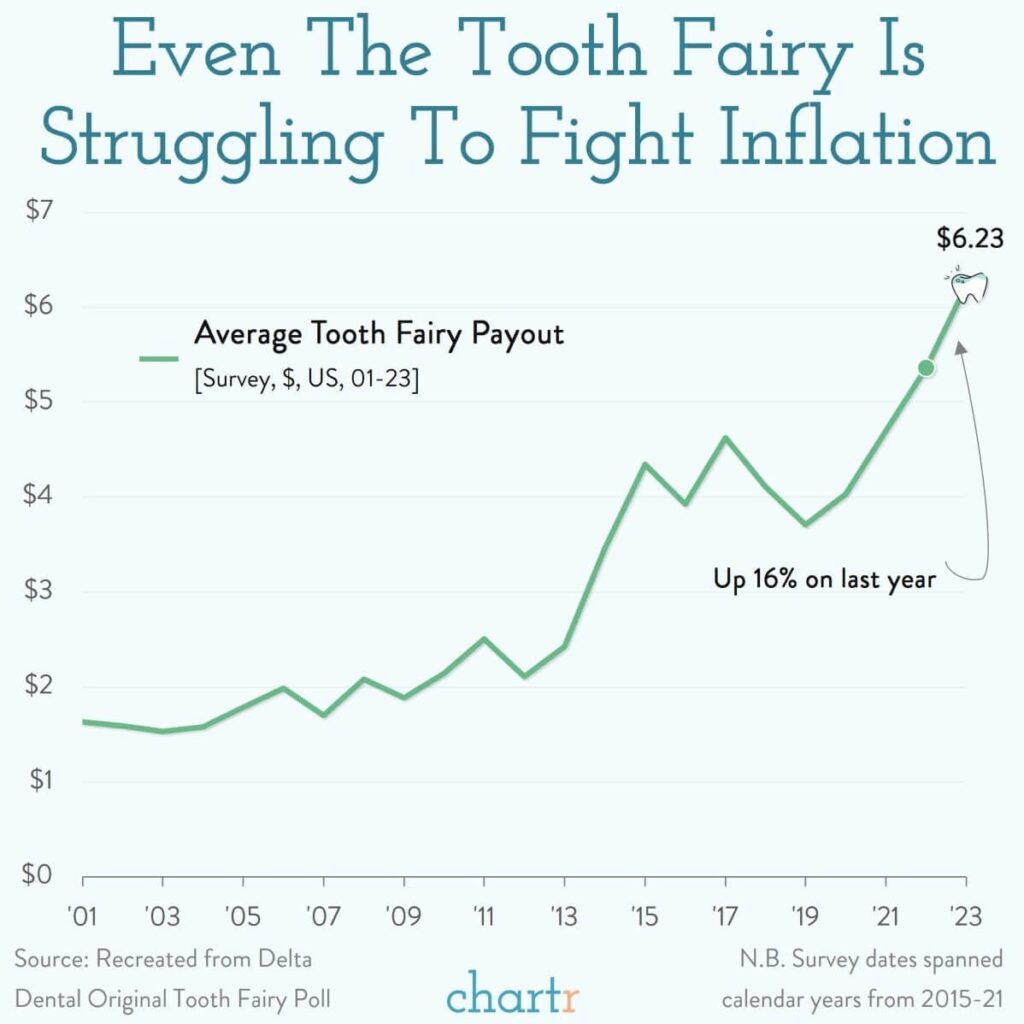

Compensating children for losing teeth just got a lot more costly, with the average payout up to $6.23 in 2023 according to the latest annual poll.

Delta Dental conducts its tooth fairy poll every year, asking 1,000 parents across the US how much their children are getting for each tooth. The 2023 figure is 16% higher than last year, confirming that not even the Tooth Fairy is escaping the impact of inflation. Given that children typically lose 20 teeth, parents will end up paying out $124.60 on average. Way back in 1998, each tooth was rewarded with just $1.30.

If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.