The ASX200 index fell 3.6% in February. Australian and global markets got the shakes, as trade wars and global instability became too real for investors to ignore.

In the US the “Magnificent 7” showed some signs of weakness, with the NASDAQ ending the month down 4%.

The Reserve Bank of Australia finally reduced rates from their 13 year highs of 4.35% to 4.10%, but were at pains to point out that this is not necessarily the start of a downwards cycle in rates.

Our three largest funds delivered positive returns in February, an exceptional result given the environment. You can access the latest fund reports below. This market adjustment is also providing us with opportunities to top up existing holdings.

Should you wish to invest this month, head to our invest page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 April.

As always, thanks for reading and for your continued interest in what we do.

If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Fund Reports

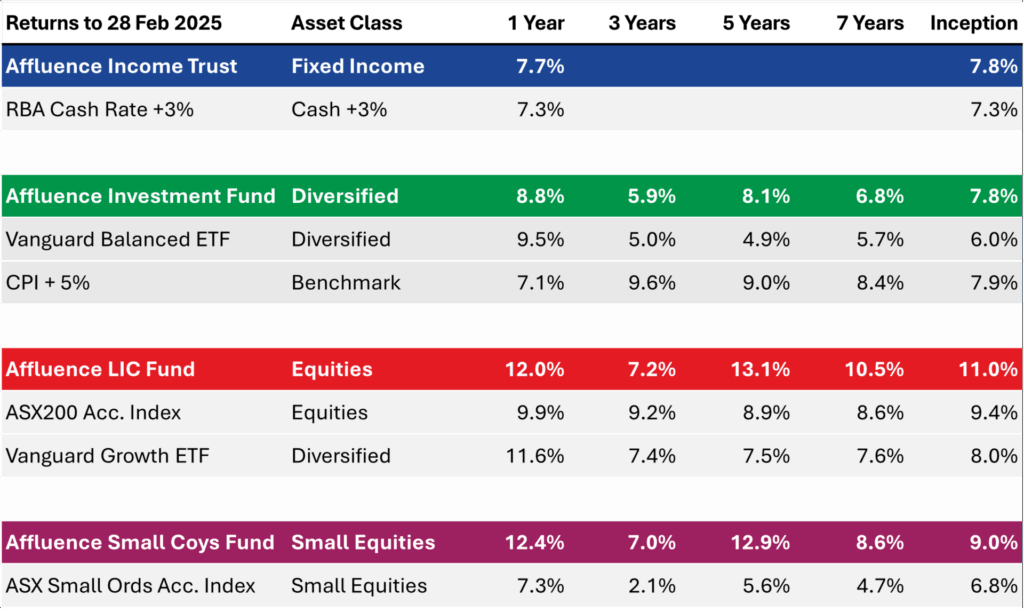

Performance records can change quickly – particularly in times of market stress. One of our key focus areas is generating smoother returns to help limit the impact of market downturns. For example, in February the Affluence LIC Fund generated 0.4% return, during a month in which the ASX200 fell by 3.6%. That’s 4% outperformance. The Fund continues to outperform the ASX200 index over almost all time periods, with significantly less ups and downs, and regular (quarterly) distributions.

February 2025 Reports

Affluence Income Trust Report

The Affluence Income Trust returned 0.6% in February and has delivered 7.8%per annum since commencing. The Fund pays monthly distributions, and the current distribution rate is 7.25% per annum.

Affluence Investment Fund Report

The Affluence Investment Fund returned 0.3% in February. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.8% per annum.

Affluence LIC Fund Report

The Affluence LIC Fund returned 0.4% in February and has delivered 11.0% per annum since commencement. At the end of the month, the average portfolio NTA discount remained close to all time highs at 25%.

Affluence Small Company Fund Report

The Affluence Small Company Fund returned -1.6% in February, as the portfolio took a breather after a relatively strong year in 2024. The Fund has beaten the ASX Small Ords Index by 2.1% per annum since inception.

Investment Profile

Each month we take a look at an underlying investment in one of our funds. This month, we profile the listed WAM Alternative Assets (ASX:WMA). It’s currently the largest holding in the Affluence LIC Fund, holds a diversified portfolio of alternative assets and is trading at an attractive discount. At current prices, we believe it provides potential for double digit returns, with a relatively low risk profile.

Things we found interesting

Chart of the Month

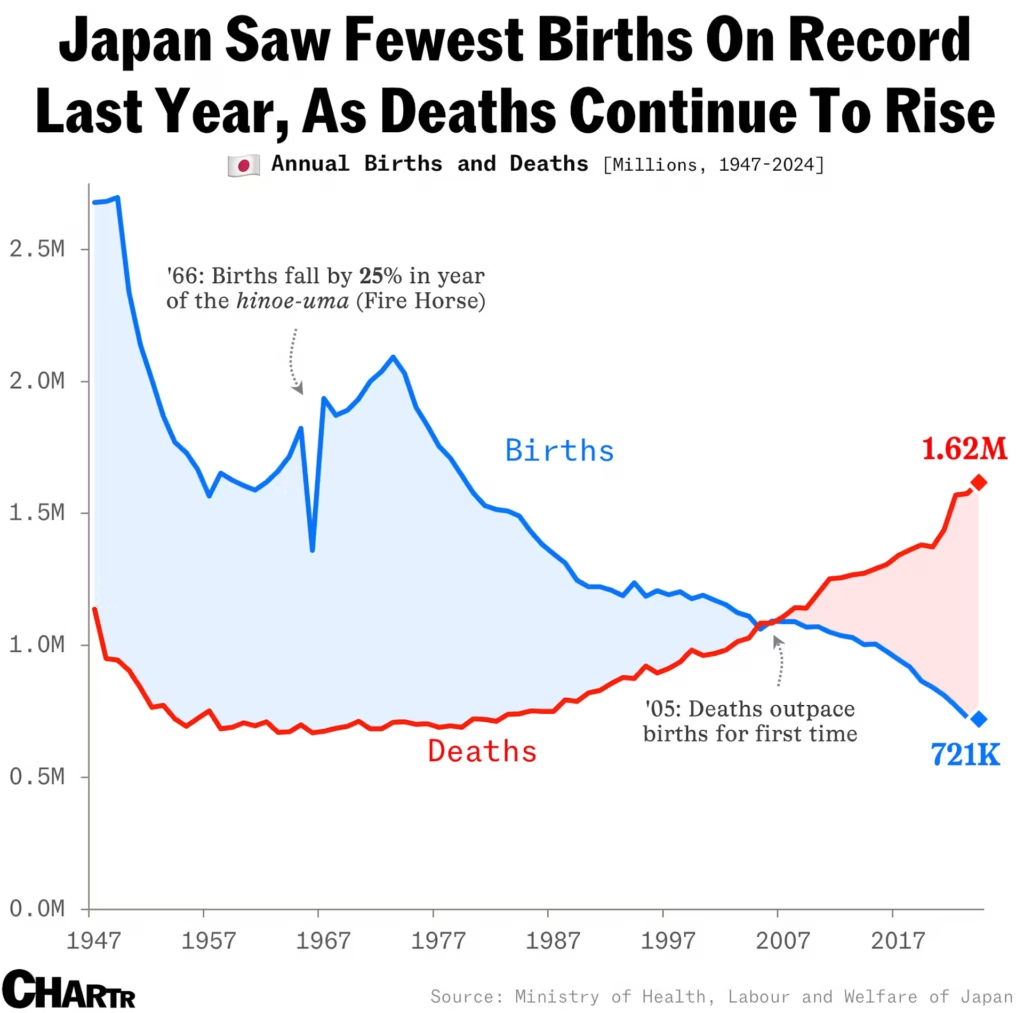

In Australia, above average population growth through immigration has been causing a squeeze on prices, fueling inflation. In Japan, they have a different problem.

Last year, there were just 720,988 babies born in Japan – the lowest figure since records began in 1899. Along with an increasing death rate, this means a natural population loss of almost 900,000 people last year. And the problem is getting worse, with almost one-third of the Japanese population now over 65 years old.

A declining population essentially creates the opposite problem to that which Australia has been dealing with over the past few years. In Japan, the issues are low growth, stagnation of asset values, and for many years (though not any more) outright deflation. Imagine your house price falling 2% every year!

The Government has been making efforts to encourage couples to have children. These include introducing a four day workweek in Tokyo and offering 1 million yen (about $10,000) per child to families who moved out of the city. But they are not improving the situation. Japan’s fertility rate (the average number of children a woman is expected to have in her lifetime) is just 1.26. This is a long way below the 2.1 needed for population replacement.

Japan’s population is projected to decline 30% by 2070, if nothing further is done. The aging population, coupled with the declining birth rate, is leading to a shrinking workforce and rising social security costs, as less working age (tax paying) citizens must support an ever growing retiree pool. It’s not clear how Japan will solve this problem. They have historically had low immigration rates for various reasons, but is now starting to consider more immigration to address labor shortages.

Quote (and article) of the month

“Key nations are now run by old men with big agendas and poor impulse control.”

This quote is from the best article we read last month – from Chris Richardson, writing in the AFR. Chris is an economist – quite a good one actually – and we don’t say that lightly. But right now, he’s angry about how Australian politicians on both sides have squandered the extreme good budgetary fortune that’s come our way in the past 10 years. It’s well worth a read.

Financial word of the month.

Restructuring.

The process by which a company that, only a few years before, had eagerly diversified into other businesses un-diversifies even more eagerly right back out of them. Analysts and investors, who had earlier hailed the expansion as essential for growth, will now applaud the contraction as essential for survival. The company’s management will earn big bonuses for adding to “Shareholder Value.” A few thousand employees will lose their jobs, but that strikes the other participants as a small price to pay for restoring the company to its former state of health. Source: “The Devil’s Financial Dictionary” by Jason Zweig.

Vaguely Interesting Facts

Astound your friends with these morsels of knowledge:

- Sharks have existed for longer than trees. *

- The record for the longest tire skid was set in 1964 at the Bonneville Salt Flats.

- Continental drift (movement of continents over time) happens as fast as fingernails grow.

- An estimated 1 million dogs in the U.S. have been named the beneficiary in their owners’ wills.

- An avocado never ripens on the tree, so farmers can use trees as a way to keep avocados fresh for up to seven months.

- Astronauts report that space has a distinct smell that’s been described as a mixture of diesel fumes, gunpowder, and barbecue. **

Source: Mentalfloss.

* The first sharks appeared around 450 million years ago. The first trees a mere 350 million years ago.

** Space is airless, so technically, you can’t smell anything. So where does the smell come from? Scientists have two good theories. One is that while an astronaut is on a spacewalk single atoms of oxygen adhere to their spacesuit. When they re-enter the airlock and repressurize, molecular oxygen (O2, or two atoms of oxygen) floods into the airlock and combines with the single oxygen atoms from the spacesuit to form ozone, which has a sour, metallic smell. So, what about the other odours? The second theory relates to polycyclic aromatic hydrocarbons, which are found in charred food like burnt toast and barbecued meat. They also occur in space, mostly originating from dying stars. They could also easily be picked up by astronauts and brought inside, and they’re probably the source of the burnt meat smell that astronauts report.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters on our Insights Page