March 2020 will go down as one of the crazier months in financial markets. March madness. Below, we explain what happened in March, how our funds performed, and how we are positioning our portfolios in this market.

What happened?

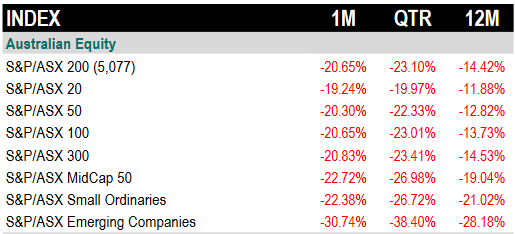

You’ve all heard the headlines about financial market meltdowns caused by the Coronavirus. Here’s how the major ASX stock market indices have fared over the past month, quarter and year to 31 March 2020. It doesn’t make for pretty reading.

It was the fastest market correction on record, even eclipsing the 1987 market crash. March 2020 was brutal. But this is a reminder of what can happen in the short term, and it is one of the prices to be paid for investing to achieve long term returns above most others.

It wasn’t just Australian and global equities that suffered. Fixed interest and debt credit markets suffered major declines (Australian bank hybrids, global high yield credit, leveraged loans). Listed property got hurt as well (the A-REIT index returned -35%). Unlisted assets such as direct property and infrastructure are a little more difficult to assess, given the infrequent nature of the transactions. However, several major super funds and property fund managers have started marking down the value of these assets to reflect the new reality.

It was a month in which there were very few places to hide other than cash and very high grade bonds. Both these asset classes are now expected to deliver yields well below 1% for the foreseeable future. The RBA is now actively targeting a yield of just 0.25% per annum for three year government bonds!

Most markets hit their lows in late March and bounced back up a little until the end of the month. They are up again in the first week of April. The final result of -20.65% for the ASX200 was actually a lot better than it was looking mid-month. At one point, the index was down more than 30% for the month, in conditions that could only be described as blind panic. Markets were somewhat comforted towards the end of March by governments around the world announcing unprecedented support packages (financed entirely by new debt). In addition, many central banks pledged, effectively, “to do whatever it takes”.

In a month of such turmoil, our funds did not escape unscathed. It brings us no joy to report negative returns, but we consider our results to be very good, given the environment in which we find ourselves. In March, the Affluence Investment Fund was down 8.7%. The Affluence LIC Fund was down 8.3%, both substantially outperforming the ASX200 index. Finally, our Affluence Small Company Fund fell 16.2%, compared to the Small Ordinaries Index, which fell 22.4% and the Emerging Companies Index, which fell by a whopping 30.7%.

Our job during these periods is straightforward, to preserve capital as best we can and avoid permanent losses. In this regard, we believe we performed well. As you would expect following such a significant market correction, each of our funds is set up to benefit from a recovery to a more normal environment, however long that may take. We’ve provided more detail about each Fund below.

Affluence Investment Fund performance

The Affluence Investment Fund ended the month down 8.7%. This month’s fall has meant the fund has temporarily slipped behind its CPI plus 5% benchmark. But it is now outperforming the ASX 200 Index over all time periods with substantially lower volatility.

Our holdings in small-cap equity funds negatively impacted the results in March. We also had some minor holdings in listed property and debt funds, which fell substantially. In both these areas, among others, we now see extraordinary value on offer and have increased our exposure.

Some good news in our results is that ultimately almost all of the investments we hold are valued based on current prices in actively traded markets. We have little exposure to unlisted property funds and no exposure to unlisted infrastructure or private equity. These types of investments will also be significantly impacted by recent events, but it may not be apparent in their valuations for some time. They can also be challenging to withdraw your money from in times of market stress. This can mean investors funds are trapped, in some cases for long periods, while underlying assets are sold down (often at less than what they were previously valued at). We purposely minimise our exposure to these types of investments later in the investment cycle.

Three things helped fund returns last month. Firstly we held more cash than usual at the start of the month, thereby providing a buffer to the falls. Secondly, we held some put options over the ASX. These became progressively more valuable as markets fell. And thirdly, we held some investments in assets and strategies which stayed steady or fell by only a small amount relative to listed markets.

Affluence Investment Fund portfolio changes

The changes we made to the portfolio in March mainly revolved around locking in some gains from strategies that helped returns. We sold the majority of our original put options during March as markets fell. This helped improve results for the month by around 3%, and increased cash levels further. We used some of these profits to re-hedge at lower amounts. This means that if markets do fall from here over the next 4-6 weeks, we will continue to have some protection. We also redeemed a number of our unlisted investments. These included two bond funds which had held up reasonably well and one property fund.

These actions, along with the cash we already had, allowed us to increase our investments in several areas that had fallen substantially during the last two weeks of March:

- We added to our investments in listed property, principally through the Phoenix Property Securities Fund. This fund did exceptionally well investing in ASX listed property funds after the GFC.

- We increased our investments in listed debt trusts, in particular to the higher-quality names. We bought these at 20-30% discounts to their underlying value.

- Our listed investment companies exposure was boosted, by adding to our investment in the Affluence LIC Fund. See below for more detail on this fund.

- We bought a small exposure to oil (via an ETF) around the lows in late March. We may well add to this in the next month or so if oil drops below its recent lows, but so far the oil price has bounced quite strongly.

Looking forward, given the continuing bounce back in April, it feels as if financial markets have rebounded a little too quickly from their lows. We believe the Affluence Investment Fund continues to have fantastic diversification and can handle whatever financial markets throw at us.

Affluence LIC Fund

The Affluence LIC Fund ended the month of March down 8.3%, substantially outperforming the index. The fund has outperformed the ASX 200 Accumulation Index over all periods with substantially lower volatility.

The average LIC discounts negatively impacted the results. Discounts across the portfolio expanded from around 20% at the start of the month to 24% at the end. This was a significant headwind, but one that our investment process enabled us to negotiate very well. We actively estimate current discounts and premiums in real time. This means we can regularly identify opportunities to sell more expensive LICs and buy relatively cheaper ones.

As with the Affluence Investment Fund, the extra cash and ASX put options we held in the Affluence LIC Fund assisted us to outperform the ASX 200 by a substantial amount. The put options added about 6% to monthly returns. Again, we have sold the original put options and rehedged at lower levels, providing some buffer if markets were to fall further in the next 4-6 weeks.

During the second half of March, we began deploying our surplus cash and increasing our LIC holdings. The fund now owns a portfolio of over 30 LICs. They are trading at an average discount of over 24% to the value of the underlying investments, which are themselves considerably cheaper than they were just six weeks ago.

Having avoided much of the considerable downside, we now see a wide range of opportunities to make good money within the LIC sector. We expect that over time the fund will be able to profit not only from the underlying returns of the LICs themselves, but also from a normalisation of the exceptionally large discounts.

Affluence Small Company Fund

The Affluence Small Company Fund ended the month of March down 16.2%. Results from our underlying managers ranged from -8.3% to -29.7%. The average result was -21.3%, slightly better than the fall in the Small Ordinaries index. As with our other funds, cash and the ASX put options helped cushion the results somewhat.

Investing in smaller companies requires an ability to stomach some hair-raising falls at times. Participating in the extraordinary value that is on offer once every decade or so is the reward for doing so. It appears that now is one of those times. But you should be prepared to commit to a minimum three year investment period. And to take the chance that things may well get worse before they get better. When things do start improving, smaller companies can re-rate to a much greater extent than other types of investments.

This Fund is only available to those who are able to qualify as a wholesale or sophisticated investor. If you have any interest, let us know.

What next?

We have no unique insights into where markets go in the short term. But whatever happens, we’re confident that we have a combination of both offence and defence in our portfolios. In addition, we are confident in the ability of the underlying fund and LIC managers that we invest with, to add value in the current turbulent market environment. This will help negotiate whatever ups and downs come along. This recent note from Howard Marks at Oaktree explains very well why we think this is an appropriate position for now.

As always, contact us at any time to discuss our funds and our views on the investment environment.

Want to know more?

See more of our articles.

Find out all about us.

Learn about the Funds we offer.

Subscribe to our free monthly Affluence newsletter or become an Affluence Member and get access to full details of our Affluence investment portfolios.

If you have any questions, please send us an email or give us a call.

Take care and all the best with your investing.