Hi,

Welcome to our monthly update. Once again, all three Funds delivered positive returns in May. Links to the monthly fund reports are below.

Given the very good fund performance this financial year, it is likely all three of our funds will pay “special” distributions for the June period. That means, if you are invested with us, the amounts paid to you in July will be higher than normal. More information can be found here. We will update this information as we complete the various items. If you would like to adjust your preferences to turn distribution reinvestment on or off, you can either login via Boardroom’s Investorserve page, or contact us.

If you’d like to invest with us this month, applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 25 June.

If you have not yet invested in the Affluence LIC Fund, and wish to do so, your last chance closes on Wednesday 30 June. After that, only existing investors can add more. Want to know more? Go here.

Investments in all funds will be effective 1 July, with confirmations emailed about a week after that. As always, go to our website and click the “Invest Now” button to apply online or download application or withdrawal forms.

Among the things we found interesting this month, we look at energy neutrality by 2050, the ultimate SMSF end of financial year checklist and dinner at Bunnings.

If you have any questions or just want to give us some feedback, reply to this email or give us a call.

Regards, and thanks for reading.

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund returned 1.9% in May. Since commencing in 2014, returns have averaged 8.9% per annum, including monthly distributions of 6.6% per annum.

Following on from last month, it was the more value and cyclical orientated stocks that powered ahead, while expensive high growth equities lagged. We continue to position the portfolio more conservatively in the short term, through slightly higher cash levels and some hedging.

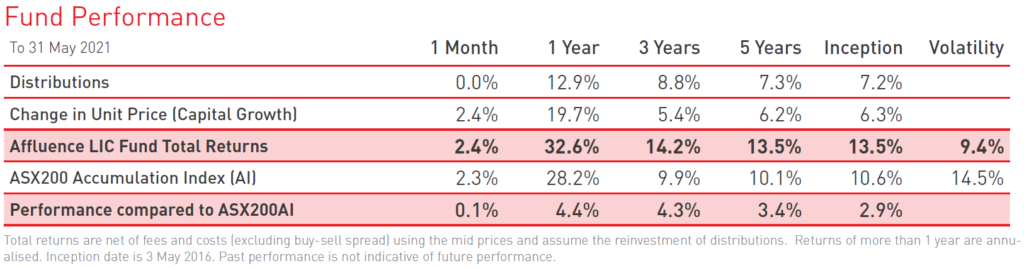

Affluence LIC Fund

The Affluence LIC Fund returned 2.4% in May. Since commencing in 2016, returns have averaged 13.5% per annum, including quarterly distributions of 7.2% per annum. The Fund will close to new investors on 30 June.

The average discount to NTA for the Fund portfolio at the end of the month was 16%. At the end of May, the Fund held investments in 21 LICs representing 79% of the Fund, 6% in portfolio hedges and 15% in cash.

Affluence Small Company Fund

The Affluence Small Company Fund returned 2.4% in May. The Fund now has a 5 year performance history. Since commencing in 2016, returns have averaged 10.0% per annum, including quarterly distributions of 5.8% per annum.

The Fund continues to be positioned mostly in small cap value opportunities. At the end of May the portfolio included six unlisted funds (55% of the portfolio), five LICs (17%) and seven ASX listed Small Companies (17%). The balance 11% was cash and hedges. The Fund is open to Wholesale and Sophisticated Investors.

Did LIC managers deliver when it mattered?

We believe the average LIC manager is vastly superior to the average unlisted fund manager. January 2020 to March 2021 took us from the pre-pandemic market high, through the low, and back to a new high. A short period, but still a complete market cycle.

It provided the perfect opportunity to assess whether LIC managers have done a good job. We took a look at those 14 months to see how the LIC managers went. Who made money, and who didn’t? Read on to find out whether LIC managers added value.

Invest in LICs the easy way

With a unique discount capture strategy, quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to portfolios. Learn more about the Fund

Things we found interesting

Chart of the month 1.

From the always insightful Vishal Khandelwal, it’s helpful to remember what you control…and what you don’t.

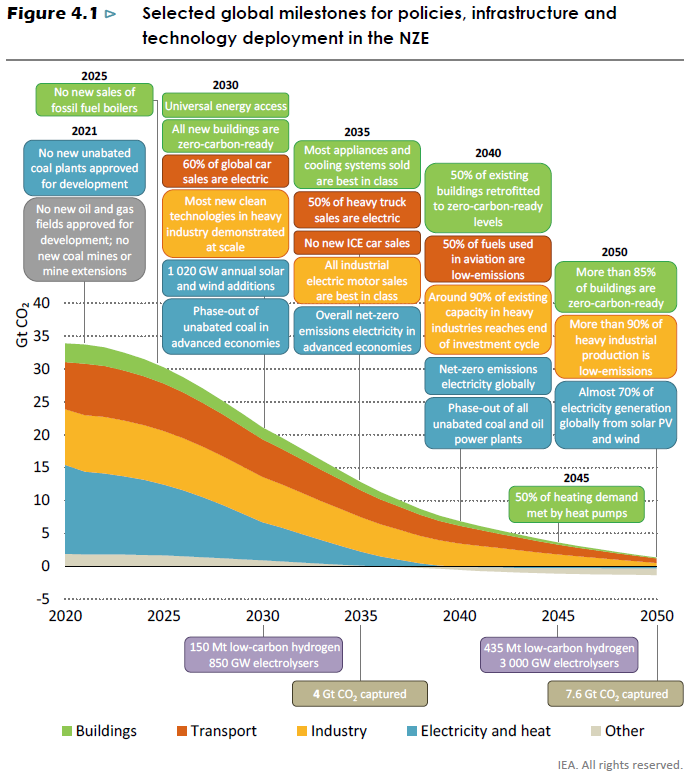

Chart of the month 2.

Net Zero by 2050.

The number of countries announcing pledges to achieve net-zero emissions over the coming decades continues to grow. But the pledges by governments to date – even if fully achieved – fall well short of what is required to bring global energy-related carbon dioxide emissions to net zero by 2050.

Below is a summary of what is required, taken from a recent report by the International Energy Agency. If you’re interested, the full report is here.

Helpful resources.

Got an SMSF? Here, courtesy of Firstlinks, is the ultimate SMSF EOFY checklist.

Worried about whether that investment manager is dodgy? ASIC helpfully publish a list of companies you should not deal with. It can be accessed here.

This month in (financial) history.King John of England signs the Magna Carta, including the principles of limited government, free trade, private property, and the liquidation of assets to pay debts. The year? 1215.

Five things to think about.

Why doesn’t Tarzan have a beard?

How come abbreviated is such a long word?

Why is there a light in the fridge and not in the freezer?

How is it that we put someone on the moon before we figured out it would be a good idea to put wheels on luggage?

Did you ever notice that when you blow in a dog’s face, he gets mad at you, but when you take him on a car ride, he sticks his head out the window?

And finally…

Timber prices have skyrocketed in the past few months. Which prompted some comedian on Twitter to make this.

Got a question?

If you would like to learn more about our Funds or invest with us, the buttons below will take you to the right places.If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM is not a recommendation by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.