Hi,

May was a tough month for investment markets, with most areas suffering falls. The exception was large technology stocks, which rallied as investors rushed to get exposure to the artificial intelligence theme at (almost) any cost. All Affluence Funds were down for the month, though significantly less than market benchmarks. Fund reports can be accessed below.

Economically, in Australia and around the world, we believe we are at a tipping point. In the last month, hard evidence has started to emerge that interest rate rises are starting to bite. We have seen a range of retailers issue profit warnings, with the magnitude of falls surprising markets. For now, other areas of the economy continue to show resilience as medium and upper income households burn through surplus cash built up over the past three years. Nonetheless, we think further bad news will emerge as the year rolls on.

Given the importance of what is happening right now, we’ve recorded a 30 minute webinar outlining what we expect to occur over the balance of the year, and how each of our funds is positioned. Click the buttons below to view the webinar or the presentation.

The short version is that we’re finding a lot of value already, but we’re holding back cash in anticipation of buying more later in the year. Despite the tricky environment, our funds are on target to post respectable returns for the financial year. We’ll have more to say about that in next month’s report.

Applications for the Affluence Investment Fund and Affluence Small Company Fund close on Friday 23 June. Applications for the Affluence LIC Fund close Friday 30 June. Go to our website and click “Invest Now” to apply online or access application and other forms for any of our funds.If you have any questions or feedback, reply to this email or give us a call.

Regards,

Daryl, Greg and the Affluence Team.

Affluence Fund Reports

Affluence Investment Fund

The Affluence Investment Fund decreased by 1.1% in May. Since commencing over eight years ago in November 2014, the Fund has returned 7.7% per annum, including monthly distributions of 6.4% per annum.

At month end, 64% of the portfolio was invested in unlisted funds, 15% in the Affluence LIC Fund, 1% in the Affluence Small Company Fund, 11% in listed investments, 1% in portfolio hedges and 8% in cash.

The cut-off for monthly applications and withdrawals is Friday 23 June.

Affluence LIC Fund

The Affluence LIC Fund decreased by 0.9% in May. Since the Fund commenced over 6 years ago, returns have averaged 11.1% per annum, including quarterly distributions of 7.9% per annum.

The average discount to NTA for the portfolio at the end of the month was 18%. The Fund held investments in 31 LICs (70% of the Fund), 2% in portfolio hedges and 28% in cash.

The cut-off for monthly applications and withdrawals is Friday 30 June.

Affluence Small Company Fund

The Affluence Small Company Fund decreased by 0.8% in May. Since commencing in 2016, returns have averaged 9.1% per annum including quarterly distributions of 6.7% per annum.

The Fund held 8 unlisted funds (43% of the portfolio), 10 LICs (18%) and 9 ASX listed Small Companies (23%). The balance 17% was cash.

Available to wholesale investors only. The cut-off for monthly applications and withdrawals is Friday 23 June.

Invest Differently

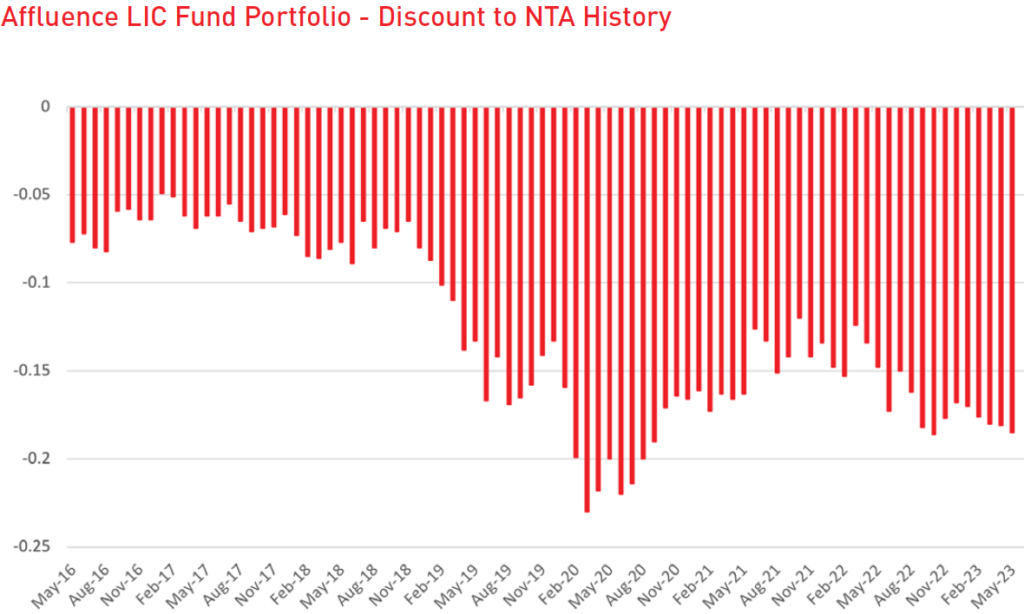

The current portfolio of the Affluence LIC Fund has an average discount to net asset value of over 18%. The only time it has been higher was during the COVID crunch of 2020.

The Affluence LIC Fund seeks to invest with some of the best LIC managers while simultaneously taking advantage of unusually large discounts and short term trading opportunities via our unique discount capture strategy.

With quarterly distributions and access to a wide range of quality LICs, the Affluence LIC Fund may be a useful addition to your investment portfolio. Learn More About the Fund

Things we found interesting

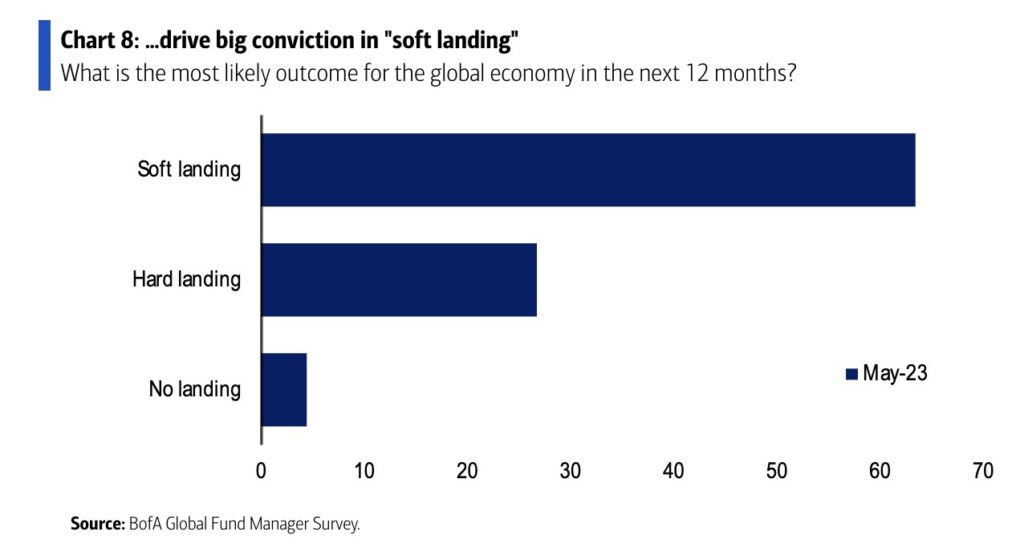

Chart of the month: Soft, hard, or something else?

The Bank of America Global Fund Manager Survey is a closely watched barometer of what professional investors are thinking and doing. The survey asks a range of questions, some of which vary over time. Last month included a question about the most likely outcome for the global economy in the next 12 months.

Around two thirds expect a soft landing. A quarter say a hard landing, and the balance think there will be no landing (no recession). Current prices suggest a (very) soft landing is priced in. We’re not so sure. Almost all leading indicators point to a worse outcome than that.

This month in history.

In June 1986, Standard & Poor’s began calculating the value of the S&P 500 stock index every 15 seconds. The jury is still out on whether the ability to check the market 1,559 times per day makes for better investment outcomes.

Tip of the month: Super health check

The ATO has introduced the ‘Super Health Check’ initiative. It consists of five steps you can do to get on top of your super.

- Check your contact details

- Check your super balance and employer contributions

- Check for lost and unclaimed super

- Check if you have multiple super accounts and consider consolidating

- Check your nominated beneficiary

The best way to perform these checks is via the ATO online services through myGov. You just need a myGov account linked to the ATO. Once you link your myGov account, you can also use the ATO app. More information on the ‘Super Health Check’, is available on the ATO website here.

Quote of the month:

“I’m known as a radical perma-bear. No, no, no. I’m an ideas guy, and I want my clients to stay out of trouble.””The business cycle is not dead.””You’ve got to focus on leading indicators.””A recession is like an odourless gas. It sneaks up on you.”

And this gem:

“I say to people, ‘we’re gonna have a recession’…and I’ve been through, probably, four cycles, and every time it’s the same thing. I look them in the eye, and I say ‘I think we’re gonna have a recession’, and the response I get…it’s as if I said your kid is ugly!”

David Rosenberg is an economist. He feels that he is unfairly branded as a perma-bear, though he is quite bearish right now, so he’s not really helping his argument right now. The quotes above come from this 55 minute interview. In it, he explains why he thinks a recession is coming to the US, why people don’t want to believe it, and the best asset classes to help weather the storm, including the case for Japanese stocks.

Vaguely interesting facts.

Floccinaucinihilipilification is one of the longest words in the English language. It is the act of estimating that something is worthless.

Peter Rabbit author Beatrix Potter kept a journal in a secret code that was so complex, it wasn’t cracked for over 50 years.

In Washington DC, there’s a basketball court above the Supreme Court. It’s known as the Highest Court in the Land.

The term “lawn mullet” means having a neatly manicured front yard and an unmowed mess in the back.

The national animal of Scotland is the unicorn. *

Source: mentalfloss.com, wikipedia.com.

* For thousands of years until the 1800s, many people worldwide believed that unicorns did exist. In medieval times, the tusk of the narwhal was sometimes sold as a unicorn horn. The unicorn was first introduced to the royal coat of arms of Scotland around the mid 1500s. Later that century, the coat of arms was expanded to include two unicorns. However, when King James VI of Scotland also became James I of England in 1603, he replaced one of the unicorns with the national animal of England, the lion, as a display of unity between the two countries. Though most people now accept that unicorns aren’t real, it hasn’t stopped the Scots continuing to honour them. In fact, 9 April in Scotland is National Unicorn Day.

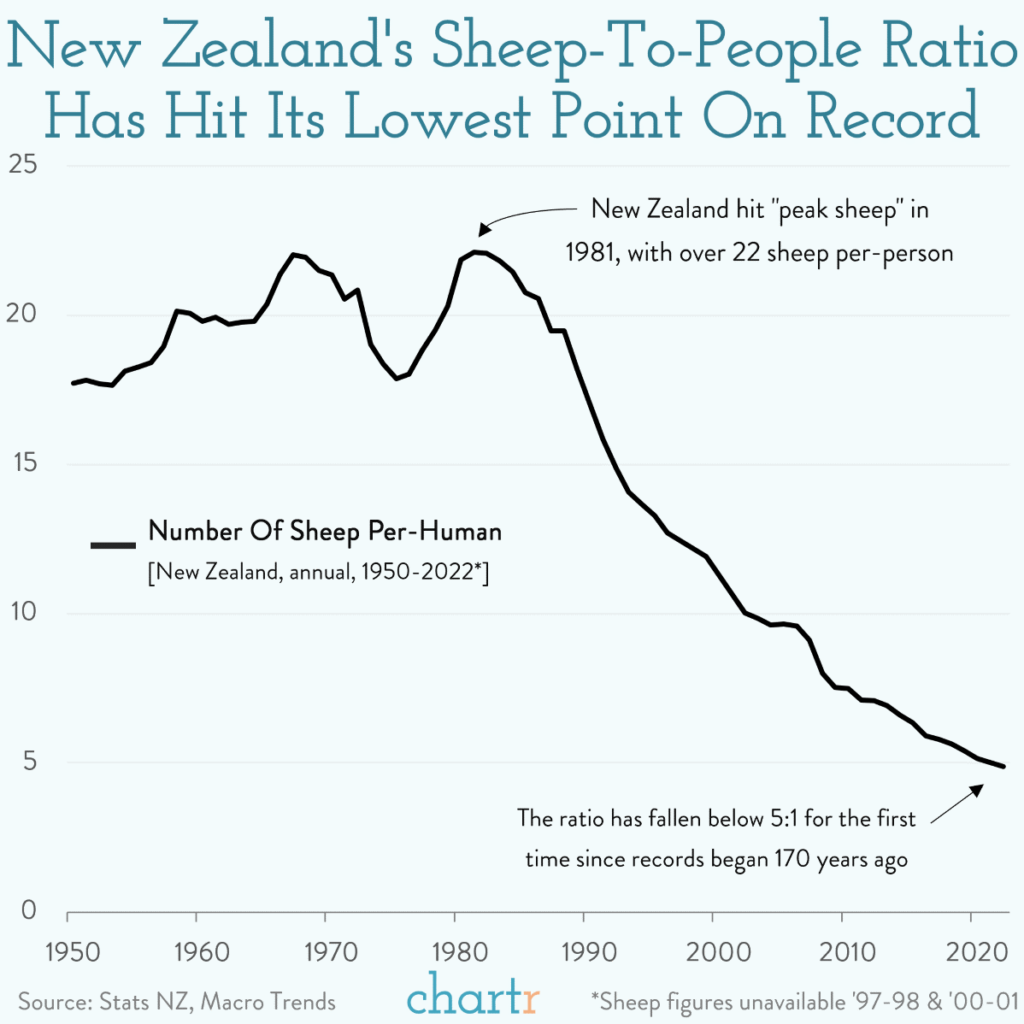

And finally…the Sheople Ratio

Something weird is going on in New Zealand. Back in 1981, there were 22 sheep for every person, a Sheople Ratio of 22:1. Since then, the number of humans in NZ has grown quite a lot. The number of sheep has shrunk.

With only 25 million sheep left in the land of the long white cloud, the Sheople Ratio has dropped alarmingly to only 5:1. It’s the lowest number recorded since the 1850s. That’s right, they’ve been counting the number of sheep in NZ for 170 years. Peak sheep was in the 1980s, with 70 million. One reason for the decline has been the fall in wool prices. At the same time, other forms of agriculture, such as dairy, deer, forestry and crop farming, have become more lucrative.

When announcing the numbers, Jason Attewell of Stats NZ felt compelled to mention that Australia has three times as many sheep as New Zealand, though the Aussie Sheople Ratio is only 3:1. We don’t think that will be enough to stop the sheep jokes for the kiwis.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend.

If you are that friend, you can subscribe and see previous newsletters here.

Got a question?

If you want to learn more about our Funds or invest with us, the buttons below will take you to the right places.

If you want to catch up on earlier versions of our monthly newsletter, you can view them here.

If you have a question, you can email or call using the details below, or simply reply to this email and we will be in touch with you as soon as we can.

Our Funds Invest Now Contact Us

P: 1300 233 583 | E: invest@affluencefunds.com.au | W: affluencefunds.com.au

This information has been prepared by Affluence Funds Management Limited ABN 68 604 406 297 AFS licence no. 475940 (Affluence) as general information only. It does not purport to be complete, and it does not take into account your investment objectives, financial situation or needs. Prospective investors should consider those matters and read the Product Disclosure Statement (PDS) or Information Memorandum (IM) offering units in the relevant Affluence Fund before making an investment decision. The PDS or IM for each Affluence Fund contains important notices and disclaimers and important information about each offer.

As with all investments, an investment in any Affluence Fund is subject to risks. If these risks eventuate, they may result in a reduction in the value of your investment and/or a reduction or cessation of distributions. Distributions are not guaranteed, nor is the return of your capital. Past performance is not indicative of future performance. It is important that you know that the value of your investment will go up and down over time, returns from each Fund will vary over time, future returns may differ from past returns, and returns are not guaranteed. All of this means that you could lose money on an investment in an Affluence Fund. As set out in the PDS or IM for each Affluence Fund, key risks include concentration risk, economic and market risk, legal and regulatory risk, manager and key person risk, liquidity risk, leverage risk and currency risk. Affluence aims, where possible, to actively manage risks. However, some risks are outside our control.

This information and the information in the PDS or IM are not recommendations by Affluence or any of its officers, employees, agents or advisers. Potential investors are encouraged to obtain independent expert advice before making any investment decision.