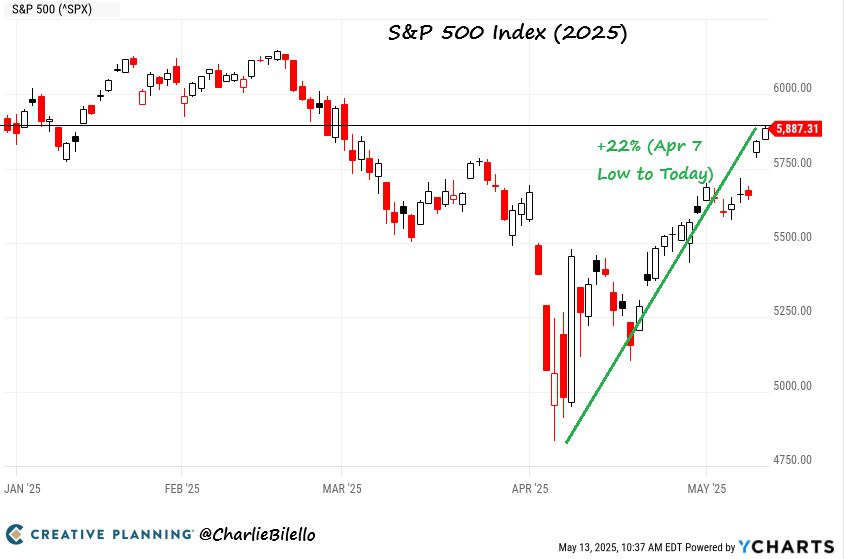

April was the most volatile month in financial markets since March 2020. The month was dominated by the ‘Liberation Day’ tariff announcement on April 2, which was much more severe than markets had expected. Australian and global markets sold off savagely, with the ASX200 Index falling to 13% below its February high, and in the US the S&P500 briefly entered a bear market after falling 20% below its recent highs. The US bond market also sold off on the announcement, with the 10 year bond rate hitting 4.50%. The Trump administration then performed a partial tariff backflip, sending markets rallying as investors went back to their usual playbook of ‘buying the dip.’

Our Funds all performed broadly as expected in April. You can access the latest fund reports below.

May, so far, has also been positive. While we are happy to see markets rising, we are not convinced this saga is over and find the market optimism somewhat perplexing. The outlook for the US economy is undeniably worse than it was two months ago, yet markets have shrugged it off. No one knows what the future impacts will be, but we believe that some caution is warranted, and we are positioned accordingly.

Should you wish to invest this month, head to our invest now page to apply online and access printable paper forms. Applications received by the cut-off dates will be effective from 1 June.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.5% in April and has delivered 7.7% per annum since commencing. The Fund pays monthly distributions. The current distribution rate is 7.25% per annum.

Affluence Investment Fund

The Affluence Investment Fund returned 0.3% in April. This diversified fund brings together our best ideas across all asset classes. Since commencing, the Fund has returned 7.6% per annum.

Affluence LIC Fund

The Affluence LIC Fund returned -0.3% in April and has delivered 10.5% per annum since commencement. At the end of the month, the average portfolio NTA discount made new all time highs at 27%.

Affluence Small Company Fund

The Affluence Small Company Fund returned -0.1% in April. The Fund has returned 8.6% per annum since inception in 2016, outperforming the ASX Small Ordinaries Index by 2.1% per annum.

Why Drawdowns Matter

The Affluence LIC Fund has been running for 107 months. For 68 of those months, the ASX200 has gone up. On average, the increase has been 3.0%. During those same months, our Affluence LIC Fund has had an average gain of just 1.7%. And yet, the Fund has outperformed the ASX200 over the long term.

How can that be? It’s all about how the Fund performs in the down months. In this article, we explain what’s happened and why we think it’s much better to outperform in the tough times.

Fund In Focus

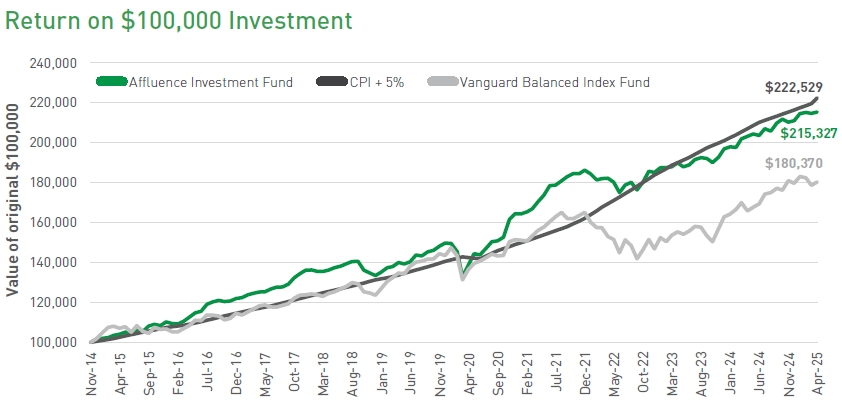

The Affluence Investment Fund is designed to deliver monthly income and capital growth over time. It targets returns of 5% above inflation. Despite choppy markets and inflation being much higher than usual, it has largely kept up with this benchmark in recent years.

It is our most diversified investment opportunity, bringing all our best investment ideas together, including an allocation to each of our three specialist funds. You can learn more about this Fund from our latest updated presentation, which you can access by clicking below.

The Affluence Investment Fund is designed to deliver monthly income and capital growth over time. It targets returns of 5% above inflation. Despite choppy markets and inflation being much higher than usual, it has largely kept up with this benchmark in recent years.

It is our most diversified investment opportunity, bringing all our best investment ideas together, including an allocation to each of our three specialist funds. You can learn more about this Fund from our latest updated presentation, which you can access by clicking below.

Things we found interesting

Chart of the Month.

Quite unbelievably (to us, at least), the US S&P500 index recently moved into positive territory for the year, to complete one of the biggest short-term comebacks in market history.

A big reversal from the “Liberation Day” tariff announcement triggered the impressive recovery. Nonetheless, it seems the US will continue with an absolute minimum 10% tariff on all countries, with China currently at 30%. Retaliatory tariffs from China now, and other nations over time, plus the general volatility that follows the Trump administration, have not deterred investors. Nor have rising interest rates on US treasuries, as bond investors demand a higher premium for the structural deficits now entrenched in the US and other countries. The US Government now spends more on interest payments on the national debt ($1.11 trillion) than on defence ($1.10 trillion).

We expect a few more ups and downs may be on the way as the year progresses. The good news for Australia is that we may be a net beneficiary of the US determination to make its citizens pay more for stuff. In April, China’s decline in trade with the United States was mostly offset by strong exports to the rest of the world. This could mean cheaper imported goods for Australia. If inflation continues to moderate here, the RBA will be free to cut interest rates further as the year progresses.

Quote of the month.

“The interesting question, as I see it, is why so many pundits and reporters — and, it seems, small stock investors — have been sounding the all clear on Trump’s tariffs, when the reality is that all we’ve seen is a modest retreat from complete, destructive insanity to seriously harmful madness.”

US economist Paul Krugman. You can read his latest take on tariffs.

Financial word of the month.

Rating Agency. A company, such as Standard & Poor’s, Moody’s, or Fitch, that purports to be able to tell which bonds are safer than others on a scale from AAA at best to D at the worst. After a bond defaults, rating agencies will always downgrade it if they haven’t yet done so, thus forecasting with 100 percent accuracy what has already happened. History suggests that if the rating firms themselves were graded, they might well earn an F. Source: “The Devil’s Financial Dictionary” by Jason Zweig.

This month in financial history.

On May 17, 1792, 24 stockbrokers signed the Buttonwood Agreement, which marked the unofficial founding of what would become the New York Stock Exchange. The name comes from the buttonwood tree (a type of sycamore) where they used to meet on Wall Street. The agreement aimed to standardise commission rates and prevent undercutting. So, basically, a stockbroker cartel was formed under a tree.

In May 2008, Iran, one of the world’s top pistachio producers, saw hoarding of pistachios as commodity prices soared globally. Investors, reacting to inflation fears, bought everything from gold to nuts. Iranian authorities had to intervene to cap pistachio prices – one of the rare instances of central banks trying to deflate a nut bubble. On May 6, 2010, the Dow Jones Industrial Average plunged nearly 1,000 points in minutes, erasing about $1 trillion in market value before rebounding. This event, known as the “Flash Crash,” was triggered by high-frequency trading and a large sell order. One trader, Navinder Sarao, sitting in his bedroom in his parents’ home in London, was later blamed for contributing to the chaos using spoofing algorithms. He was jailed in the UK for 4 months, then extradited to the US, and eventually sentenced to another year of home detention.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- Bananas are berries, but strawberries are not.

- Humans share about 60% of their DNA with bananas.

- Water can boil and freeze simultaneously (called the triple point).

- Your taste buds have a lifespan of about 10–14 days before being replaced.

- The Immortal Jellyfish can essentially live forever by reverting to its juvenile form. *

* The Immortal Jellyfish is about the size of your smallest fingernail. When the adult is physically damaged or experiences stresses such as starvation, instead of dying, it shrinks in on itself, reabsorbs its tentacles and loses the ability to swim. It then settles on the seafloor as a blob-like cyst. This blob develops into a new polyp over the next 24-36 hours, reverting to the jellyfish’s previous life stage. Over time, that polyp will again transform into an adult jellyfish. This process behind the jellyfish’s remarkable rebirth is called transdifferentiation.

And finally.

Are we about to finally see investor demand more evenly spread among global markets, after 15 years of dominance by US tech companies?

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.