October was a quiet, but positive month for all our funds.

- +0.6% for the Affluence Income Trust (+7.3% over 1 year).

- +0.4% for the Affluence Investment Fund (+11.6% over 1 year).

- +0.3% for the Affluence LIC Fund (+12.0% over 1 year).

- +0.7% for the Affluence Small Company Fund (+18.0% over 1 year).

More details are in our monthly fund reports, which you can access below.

In other news this month, we completed our annual Affluence LIC Melbourne Cup for Livewire Markets and we were a guest on the Investment Markets podcast. You can access both from the links below. Further down, we also explain the “K-shaped economy” and provide our take on the Private Credit market, which is currently the subject of much debate.

As always, thanks for reading and for your continued interest in what we do. If you have any questions or feedback, reply to this email or give us a call.

Regards, Daryl, Greg and the Affluence Team.

Affluence Funds Returns

Affluence Income Trust

The Affluence Income Trust returned 0.6% in October and 7.7% per annum since commencing. The current distribution rate is 6.75% per annum paid monthly.

Affluence Income Trust October 2025 Report

Affluence Investment Fund

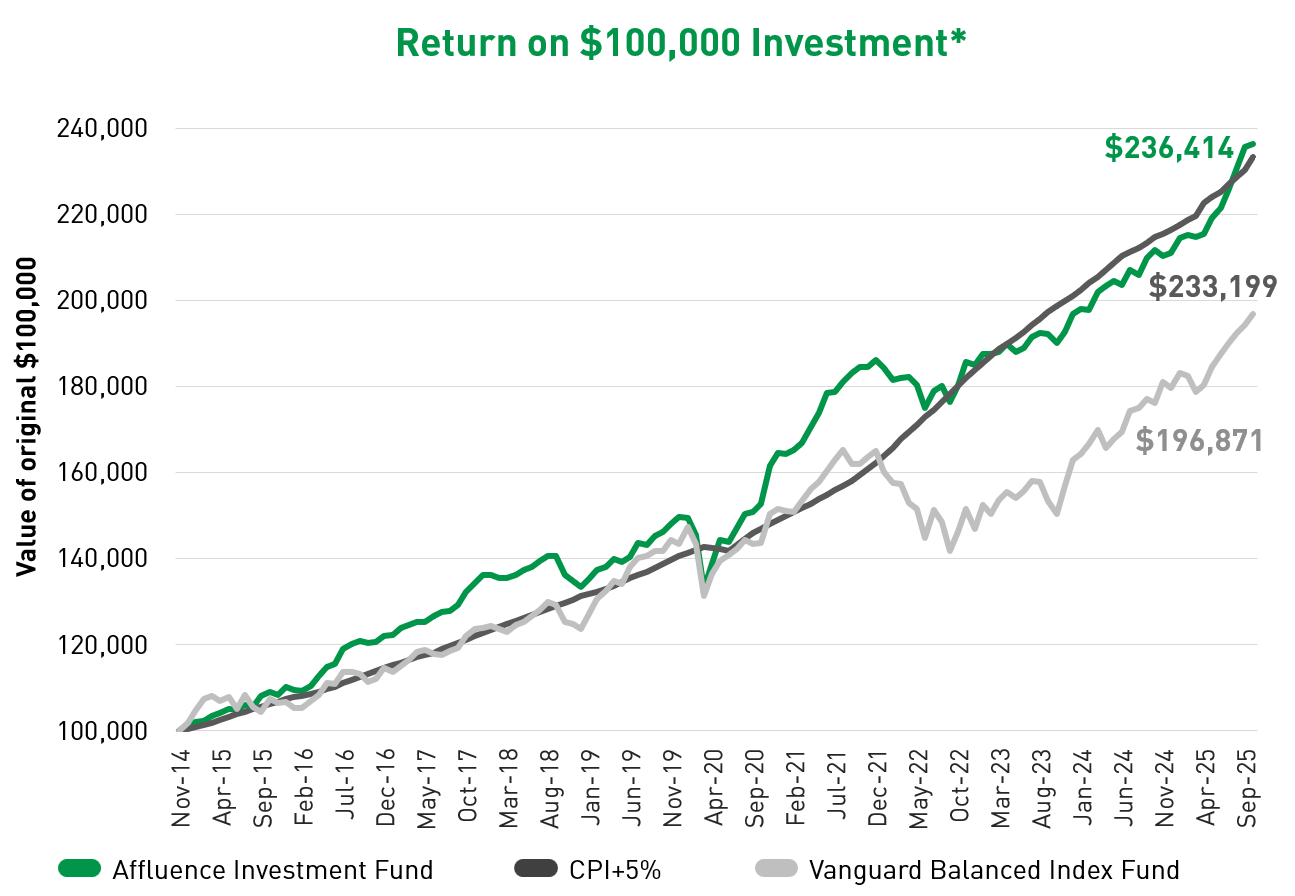

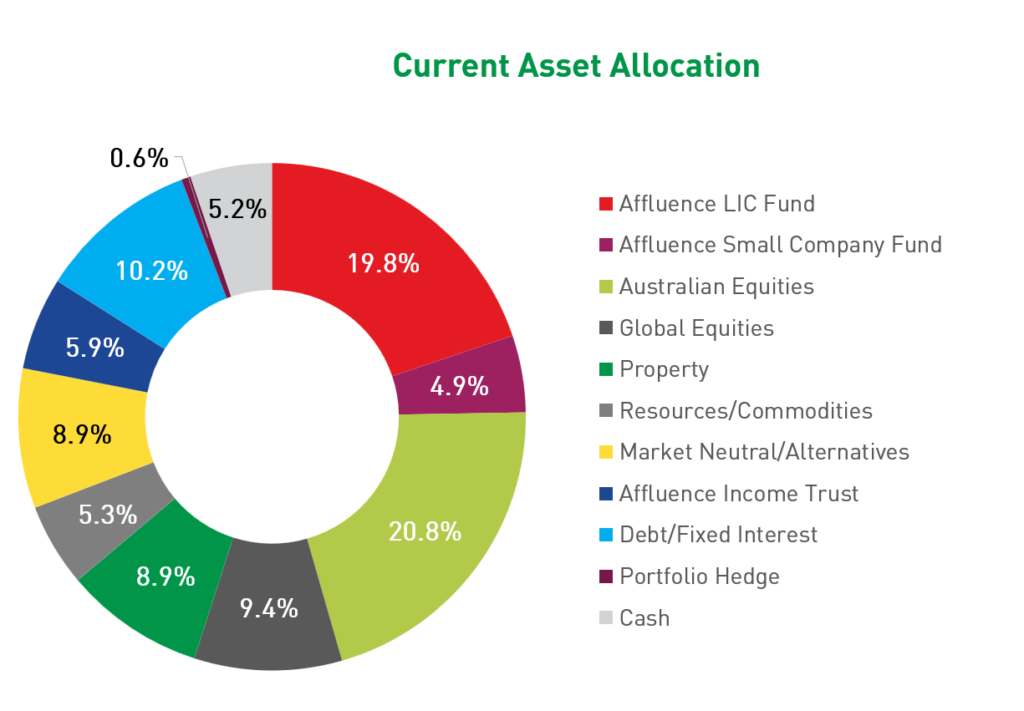

The Affluence Investment Fund returned 0.4% in October and 8.2% per annum since commencing. This diversified fund brings together our best ideas across all asset classes.

Affluence Investment Fund October 2025 Report

Affluence LIC Fund

The Affluence LIC Fund returned 0.3% in October and 11.5% per annum since commencing. At the end of the month, the average portfolio NTA discount remained near all time highs at almost 27%.

Affluence LIC Fund October 2025 Report

Affluence Small Company Fund

The Affluence Small Company Fund returned 0.7% in October and 10.2% per annum since commencing. There’s still exceptional value in many smaller companies.

Affluence Small Company Fund October 2025 Report

Affluence LIC Cup

Here we go again, the ninth running of the Affluence LIC Melbourne Cup! For most of the year, we conduct our analysis of listed investment companies in secret. But on that special first Tuesday each November, we publish our LIC form guide for all to see.

Our top three picks from last year delivered an average 47% return, though individual results varied widely. Click below to see our recap of last year’s picks, our analysis of this year’s LIC field, and our three favourites for the coming 12 months. This year, we’re gone with two outsiders and a well known stayer.

InvestmentMarkets Podcast

Last month, Daryl was a guest on the InvestmentMarkets podcast. The topic?

Contrarian investing: finding value where others don’t.

Fund In Focus

Our Affluence Investment Fund has been quietly delivering results for over ten years.

- Source: Affluence, RBA, Vanguard. Data from commencement of Affluence Investment Fund in November 2014. Returns are not guaranteed. Past performance is not indicative of future performance.

Our investment mandate for the Fund is very wide. We combine a variable allocation to our three specialist funds, with a range of our best investment ideas across all asset classes. The result is an all-weather portfolio that can deliver in differing market conditions, including:

- A blend of defensive and growth assets, with a strong value bias.

- A focus on differentiated investment strategies.

Access to over 30 underlying managers and thousands of underlying investments.

With monthly distributions and a focus on differentiated investment strategies, the Affluence Investment Fund can be a very useful portfolio diversifier. To find out more, get in touch or head to the Fund page on our website to access all the latest information.

Things we found interesting

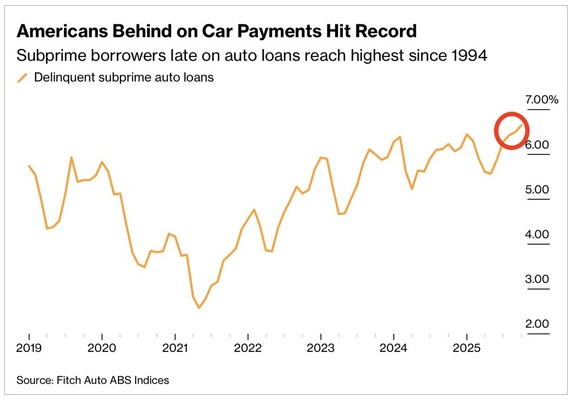

Chart of the month.

American subprime auto loan arrears just hit their highest level since 1994.

So why aren’t markets crashing? Well, mostly because of the “K-shaped” economy, prevalent in the US and, to a lesser extent, in Australia. A K-shaped economy means not everyone goes up together. Instead, one part of society shoots upward like the top stroke of the letter K. High earners, asset owners and people with strong job security are mostly doing very well. While for others, including lower-income households, renters, and anyone whose industry is wobbling, it’s tough out there. Their economic experience tilts downward more like the bottom stroke of the K. Same economy, completely different ride.

In the US, the split is basically normal now. White collar workers have seen rising wages, booming asset prices, and continued job openings. Meanwhile, large chunks of the population are getting smacked by rising living costs, higher borrowing rates, and continued rent increases. Consumer spending overall still looks fine. But dig deeper and you’ll find two Americas – one ordering $18 almond milk lattes, and one wondering if they can reuse a teabag five times. Australia hasn’t escaped the K either. Retirees with a decent nest egg and homeowners with low or no mortgages are mostly cruising. Their wealth is up, job security is decent, and their super balances haven’t been too shabby. Meanwhile, renters and heavily mortgaged households could be one interest rate hike or unexpected bill away from panic. It’s not a great long-term trend. Keeping inflation under control and improving productivity are two ways to help even the score. Sadly, neither looks like it will improve any time soon.

Why all the fuss about Private Credit?

What is private credit? Basically, it’s lending done outside the traditional banking system or public markets. Instead of buying a publicly traded bond (or bond fund), investors use specialist fund managers who lend directly to companies through privately negotiated loans. That means higher yields, bespoke terms, no daily market pricing and less liquidity.

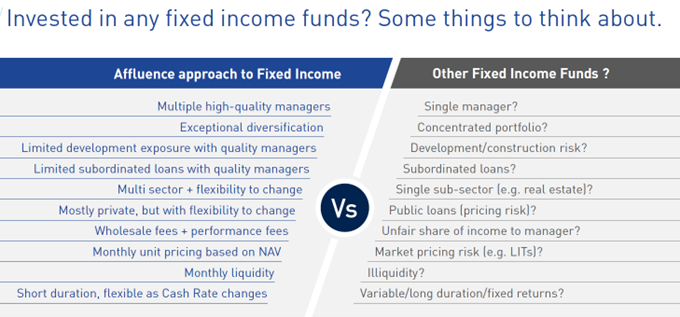

A lot of negative press, a twitchy regulator, and stories of problems unfolding in private credit have led to many people asking whether there is danger afoot. As part of our activities for the Affluence Income Trust, we talk to a wide range of fixed income managers, including many operating in the private credit space. Here is our view of what’s going on in the sector at the moment:

- ASIC’s recent report highlighted many of the potential problems the industry is already aware of. But problems usually don’t occur when everybody is looking for them.

- Much of the recent negativity is overdone. There will always be issues/defaults in any diversified fixed income portfolio. It’s how the manager handles those problems that is most important.

- Key loan defaults used as examples of “canaries in the coal mine” were generally caused either by fraud or very lax lending policies by individual managers. Overall loss levels are well within normal ranges across all sectors of fixed income.

- The correction in property assets from 2022 to 2025 was a relatively benign event, and very well handled by most private credit managers active in the real estate sector. Problems were most evident in very highly leveraged projects.

- The major risks in private credit (and fixed income generally) come from widespread relaxation of credit standards and major recessions. Australian lending standards remain very high. Globally, we have seen some deterioration. That’s why we have a limited allocation in our fixed income investments right now.

- Surviving a prolonged recession in fixed income comes down to manager and asset/loan quality. Our ability to buy discounted fixed income assets in recessions could help enormously in offsetting any credit losses.

We’ve included the following slide in our Affluence Income Trust presentation since the Fund’s launch. We’ve designed our fund around managing risk in fixed income through the cycle. If you have any fixed income investments, here are our top 10 things to think about.

Quote of the month.

“So here is the opportunity for this audience today.

- An economy already operating near full capacity.

- With extraordinary minerals resources, old & new.

- World-leading universities and human capital.

- A plumb geographical position in the Asia Pacific.

- A huge domestic savings pool:

- The second largest median wealth per capita in the world

- The fourth (in due course, second) largest pension system globally.

- One of the lowest public debt burdens in the G20.

- A strong banking system.

- Proven political and economic institutions.

- A long track record of welcoming foreign capital and labour.”

RBA Deputy Governor, Andrew Hauser, 10 Nov 2025.

Australia is, and remains, the lucky country.

Vaguely interesting facts.

Astound your friends with these morsels of knowledge:

- A deck of cards can be shuffled into more combinations than there are atoms on Earth.

- Your brain generates enough electricity to power a lightbulb.

- McDonald’s once made bubble gum flavoured broccoli.

- Africa is the only continent in all four hemispheres.

- Honey never spoils. *

* Honey’s long shelf life comes from its low water content, high acidity, and natural antibacterial properties. Honey is about 80% sugar and only 18% water, which is not nearly enough moisture for bacteria or mould to survive. When bees make honey, they add an enzyme called glucose oxidase, which converts sugars into hydrogen peroxide. This gives honey natural antibacterial powers. Honey is also mildly acidic, with a pH around 3.5 to 4.5 (similar to orange juice). Unless you introduce water into it, honey is basically eternal. It can crystallize or darken over time, but that doesn’t mean it’s gone bad. Archaeologists have found pots of edible honey in ancient Egyptian tombs, still preserved after over 3,000 years.

Thanks for reading. If you enjoyed this newsletter, forward it to a friend. If you are that friend, you can subscribe at the bottom of this page.